Author: cryptoHowe.eth Source: X, @weihaoming

Recently, a tweet by Brother Jian @jason_chen998 has sparked a discussion about Ethereum. After reading the opinions of Brother Haotian @tmel0211, Brother Chen Mo @cmdefi, etc., I would like to write about my own opinions and views. If you have any questions, you are welcome to point them out.

Brother Mo cited the example of building cars and roads. I will use another example that may not be appropriate to illustrate. Here we compare the Ethereum ecosystem to a real estate that can be speculated. Retail investors are investors who want to speculate on real estate, and the Ethereum Foundation is equivalent to the developer/property management of the real estate.

Looking back at the development of the Ethereum ecosystem, we can find that the construction route and process of the real estate are basically finalized and executed by the developer. This did not show too much impact in the early stages of the real estate. After all, it was originally a vacant land. The most important thing to do is to build the real estate first, have a brand, and start delivering it, so as to start attracting investment and attract more investors.

The current Ethereum ecosystem is similar to a real estate that has been delivered for a certain number of years. During this period, it has also experienced several good investment trends, and the Ethereum Foundation has also begun to shift to the role of property management. At this point, I believe that everyone has more or less experienced the scene of disagreements and conflicts between owners (investors) and properties. At present, the difference between the two lies in what property management does (decisions of the Ethereum Foundation) and meeting the needs of owners (demands of market users). This is like when an owner reports to the property management that the sewer pipe at home is blocked, the property management spends a few days to list a planning route, saying that we need to remove the drainage pipes of all buildings and replace them with larger ones. This is consistent with what Mr. Meng Yan @myanTokenGeek said in Space last night that the current practice of the Ethereum Foundation tends to pursue the best, not just right. But as I have always said, the first thing users care about when using a product is "whether it can meet their needs simply and quickly". They don't care whether the product they use is Web2 or Web3, nor do they care how much the product they use has improved in some aspects compared to other products. They only care whether the product can meet their needs simply and quickly.

That is, the owner only wants the property to quickly unclog his sewer pipe, and does not care whether other owners will have this problem or how much money the property will spend to hire someone to deal with this matter, etc. If the property chooses to ignore the direct needs of users and turns to a more long-term and time-consuming solution, this will lead to serious dissatisfaction and even loss of property owners. For external investors who are considering buying the property, when they see this scene, they will more or less worry about the appreciation potential of the property, and may even be attracted by the property next door with better service and greater potential.

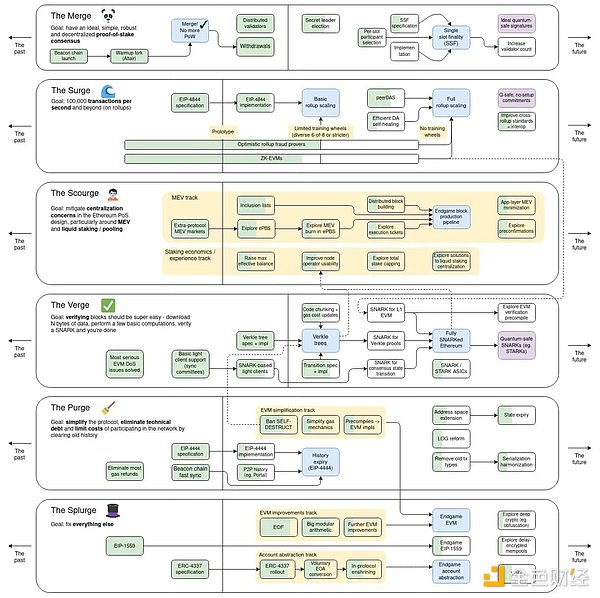

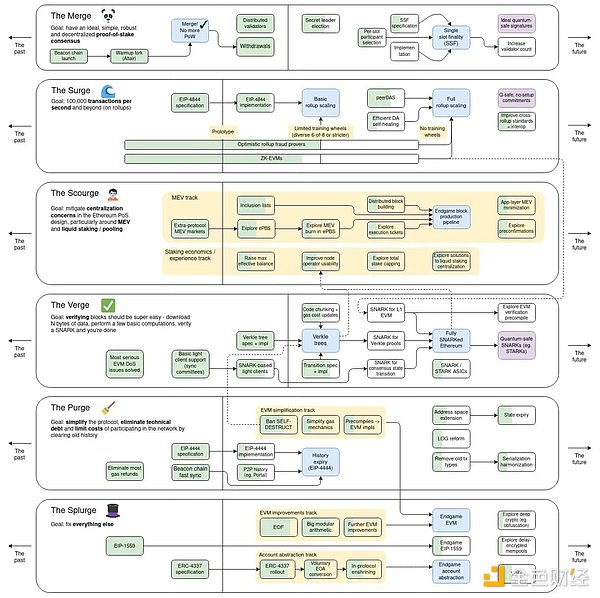

Therefore, in today's ecological development, the practice of the Ethereum Foundation is greatly decoupled from the needs of market users. After experiencing events such as the launch of thousands of chains, the blood-sucking of Layer2, and the prosperity of Solana next door, users inevitably expressed their concerns about the "calm" phenomenon of Ethereum. As one of the important roles in the development of Ethereum, the Ethereum Foundation undoubtedly needs to make comprehensive considerations in terms of technical research and development and market demand. Blindly burying oneself in technical research and ignoring the voice of the market will undoubtedly lead to the rapid loss of a large number of users. My personal opinion is that the Ethereum Foundation can find a suitable balance between the development path and market demand, but it is not the optimal solution. It is already remarkable that Ethereum can achieve what it has now. We cannot blindly deny its achievements because of a temporary crisis. The key to the price at which a property can be sold lies in whether investors can find good selling points, such as good decoration (complete infrastructure), good supporting services (mature ecological development), etc. These are not the most important things for developers/properties. They focus more on ensuring the safety of buildings and improving the quality of services. At the same time, we should not forget that if there had not been the efforts of the Ethereum Foundation, there would not have been a solid infrastructure that could support the vigorous development of upper-level applications. Their efforts are also worthy of recognition. Finally, I would like to end with a sentence.

Time and patience will be the best antidote.

Huang Bo

Huang Bo