The market is bleak, but there is quite a lot of news about Ethereum.

There are many good news about Ethereum spot ETF. First, Consenys announced that the SEC stopped investigating Ethereum securities issues, and then there was market news that the Ethereum spot ETF is expected to be approved and launched on July 2. Standard Chartered Bank also joined in the fun and was recently rumored to build a trading platform for Bitcoin and Ethereum.

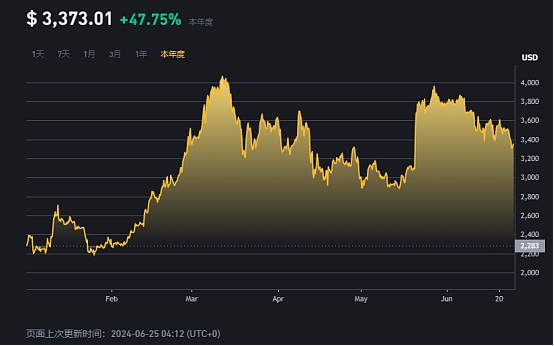

Despite the large amount of news, the market is still not good because most of them are expected. As Bitcoin once fell below the $60,000 mark, Ethereum also returned to below $3,400. However, if we compare Ethereum, which fell to $2,900 at the end of May due to insufficient narrative, and then compare the downward elasticity of mainstream currencies in the past week, we can see that the expectation of spot ETF still provides strong price support for ETH.

At the current point of view, the long-awaited Ethereum spot ETF is about to be launched. Its performance after listing has begun to become the focus of industry discussion. Will it sell off the fact and fall rapidly, or will it turn the tide with the capital of institutions? The market has completely different views on this.

The trend of Ethereum this year can be described as twists and turns, but from the main narrative, it is nothing more than the hype of Cancun upgrade and E spot ETF.

On March 13, the Cancun upgrade was completed, and ETH reached a high of $3,981. Since then, it has rotated with the news of ETFs. When the ETF was declared hopeless, the price fell all the way. After the extreme reversal, it rose to 3,600 overnight, and then continued to fluctuate at a high level in conjunction with the market.

After the "618" dump, the crypto market has entered a cooling-off period again. Due to insufficient liquidity, prices are easily affected by emotions. Under the recent outflow of ETF funds and the panic of selling pressure in Mentougou, mainstream value coins continue to slide, but compared with Bitcoin's 7.72% drop from 65,000 in a week, Ethereum's resilience is stronger (-3.18%), showing relatively strong support. Back to the market itself, in fact, Ethereum has also had a lot of positive fundamentals recently.

First, the non-securities attribute is clear. Consensys announced on the social platform last week that the U.S. Securities and Exchange Commission decided to end its 14-month investigation into Ethereum. Although the lawsuit between the two surrounding ETH is still ongoing, this fact is undoubtedly a milestone in crypto regulation.

Giving up the investigation of Ethereum means that the SEC will not accuse the sale of ETH of securities trading in the future. This point echoes the approval of Ethereum ETF19b-4. The potential meaning of passing 19b-4 is to eliminate the securities attribute of Ethereum. But before this news, there were still rumors that the US SEC would make a fuss about this, because the SEC chairman repeatedly avoided talking about the attributes of Ethereum, even after the ETF was approved.

On the other hand, if Ethereum is no longer a security, then the POS mechanism and pledge mining in the mechanism are also unlikely to be securities, and Ethereum spot ETF applicants are expected to add this function. Previously, due to the US SEC's aversion to pledge, all applicants deleted "pledge" in the S-1 form, which aroused market suspicion about the competitiveness of ETFs. For investors, there is no pledge income and additional management fees, and the yield is bound to be worse than directly buying ETH. Of course, this speculation lacks the consideration that large institutions such as banks are not allowed to directly purchase virtual currencies under current US regulations.

The second big positive is the approaching time of ETF. Although the chairman of the SEC mentioned in an interview that he would announce the approval of the Ethereum spot ETF application this summer, the unclear time point also made the market anxious. Just recently, the date finally had an estimated timetable. On June 21, Bloomberg ETF analyst Eric Balchunas announced on social media that the issuer of the Ethereum spot ETF is expected to submit a revised S-1 form in the late afternoon. After that, the SEC will notify the issuer of the final modification and validity, and the spot ETF is expected to be launched on July 2. Considering its previous accurate prediction of the listing of the Bitcoin ETF and the reversal of the Ethereum ETF, this time point has a certain degree of credibility.

In addition, Standard Chartered Bank also announced that it is building a trading platform for Bitcoin and Ethereum. If the news is true, the trading channels will be further broadened and the threshold for investors will continue to be lowered. However, judging from the current situation, traditional institutions still face great challenges in terms of regulatory feasibility and infrastructure in order to engage in trading business.

There are many positive news, but the actual price performance can only be said to be unsatisfactory. There are also different opinions in the market about the upcoming ETF.

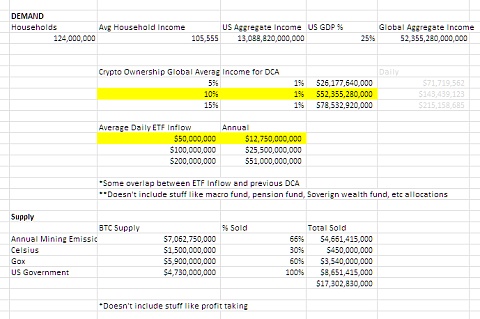

In terms of market size, Bitcoin ETF provides an excellent example. According to Farside Investors, since its launch in January, the net flow of BTC-related products has reached US$14 billion, and the assets under management (AUM) have exceeded US$50 billion, but the scale of Ethereum ETF cannot help but make people worry.

The vast majority of analysts believe that Ethereum ETH can only account for 15-20% of Bitcoin's share. Analysts at JPMorgan Chase believe that by the second half of 2024, the Ethereum ETF will only attract about US$1 billion to US$3 billion in net inflows. Andrew Kang, co-founder of Mechanism Capital, also holds a similar view and wrote a detailed article analyzing the impact of Ethereum spot ETF on the market.

In his opinion, excluding hedging transactions and spot rotation, the real net inflow of Bitcoin ETF is $5 billion. According to Eric Balchunas's estimate, the flow of ETH may be 10% of BTC, which means that the real net purchase flow in the first 6 months after the ETF is passed may be $500 million, and the optimistic estimate is around $1.5 billion.

He emphasized that Ethereum is not popular for ETFs that target traditional institutions such as pensions, endowment funds, and sovereign wealth funds. First, the institutional market holdings of Ethereum itself are smaller than those of Bitcoin. Before the ETF was approved, the CME's Ethereum holdings accounted for only 0.3% of the supply, while BTC accounted for 0.6% of the supply. However, before the launch of the ETF, ETH had risen 4 times from its low point, while BTC only rose 2.75 times, reflecting the limited room for ETH to rise. Second, from the perspective of quantitative data, Ethereum also performed poorly, with an annualized revenue of $1.5 billion in 30 days and a price-to-earnings ratio of 300 times, and a negative price-to-earnings ratio after deducting inflation.

The more realistic reason is that due to the suddenness of the approval, the issuer did not spend a lot of time persuading holders to convert ETH into ETF form, and choosing ETF also bears the opportunity cost of ETH staking income. Andrew expects that before the launch of the ETF, ETH will trade at $3,000 to $3,800. After the launch of the ETF, it is expected to be $2,400 to $3,000. If BTC rises to $100,000 by the end of Q4/Q1 of 2025, it may drag down the rise of Ethereum and altcoins, and ETH/BTC will be lower, with the ratio between 0.035 and 0.06 in the next year.

There are bearish voices, and naturally there are bullish arguments.

In response to Andrew Kang's analysis, Degentrading countered and believed that Ethereum could reach $6,000 by September. He emphasized that in discussions with traditional financial people, the market's enthusiasm for ETH and even SOL is higher than BTC. At the same time, although Ethereum is about one-third of Bitcoin's size, its liquidity is only about 10% of BTC, which means that an inflow of $3-4 billion will have a substantial impact on ETH, and Grayscale's ETH trust inventory also gives Ethereum lower selling pressure than Bitcoin. A recent report from Deribit Insights also gave a bullish signal, with the premium for the September ETH 4000 call option exceeding $12 million, indicating rising optimism in the medium-term market.

Regardless of external controversy, ETF issuers have already sounded the drumbeat for fee wars. Last week, several spot Ethereum ETF issuers subsequently submitted revised S-1 forms. From the perspective of fees, in order to seize the market, Ethereum's fees are generally lower than Bitcoin's. VanEck disclosed that its fees are as low as 0.20%, which is very close to Franklin's 0.19%. Against this background, other institutions such as BlackRock will be forced to keep fees below 30 basis points.

Before this, Cathie Wood's Ark Investment Management withdrew from the competition for Ethereum ETFs due to lack of profit. She mentioned that the Bitcoin spot ETF did not earn any profit for the company because the fee charged to investors was too low, at only 0.21%. Although this is similar to the fees charged by other Bitcoin ETF issuers, it is still significantly lower than the fees charged by other non-cryptocurrency ETFs.

In this context, allowing pledges may increase the competitiveness of Ethereum ETFs. Although no ETF issuer has yet to modify its caliber to support pledges, it is likely that the issuer will make changes to this in the face of profit pressure in the future. However, it is worth noting that if pledges are used, for security and efficiency reasons, the issuer may build its own nodes to become a validator, which will dilute the market share of other Ethereum ecological projects.

Back to Ethereum itself, as the largest application platform in the encryption field, the price of ETH actually represents the development of the entire encryption ecology. However, in recent years, as the application and ecological development has entered a bottleneck period, the Ethereum hype cycle has begun to focus on upgrading. In addition to the vitality brought by pledges, it exists as a symbol of mainstream currency.

Compared to the consensus on the value of Bitcoin, Ethereum's position in the eyes of institutions is quite ambiguous. On the one hand, it is a blue chip stock among technology stocks and an absolute leader in the blockchain world, but on the other hand, it is also an existence that is more easily replaced among investment products. Its value is not as strong as Bitcoin, and sometimes it even follows the decline but not the rise, and the increase is not as good as some US stocks. Especially in the context of limited application innovation, Ethereum's ecological growth has slowed down, and the MEME cycle has also rotated accordingly. From time to time, there will be arguments that Solana has surpassed Ethereum.

Although there are many controversies about whether Ethereum is an investment product that is better than Bitcoin in terms of investment value, no one will deny Ethereum's status and network effect. This is also the reason why the market pays close attention to Ethereum ETFs. It is possible that Ethereum's funds will flow into the altcoin market through the transmission of pledges, but Bitcoin's funds will not.

Looking at various price views, it is also a high probability event that Ethereum will usher in high volatility after passing the ETF. Pay attention to the selling facts. Short-term bearishness and long-term bullishness are also in line with the market's price expectations. Before the passage, the speculation of various currencies in the ecosystem has already begun. Perhaps this is also one of the alternative ways to make profits.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin