Author: Ulrich Bindseil, Jürgen Schaaf, European Central Bank; Compiler: Deng Tong, Golden Finance

January 10 , the U.S. Securities and Exchange Commission (SEC) approved a Bitcoin spot exchange-traded fund (ETF). For followers, the official approval confirms that Bitcoin investments are safe, with the previous rally proving an unstoppable victory. We disagree with both statements and reiterateBitcoin’s fair value remains zero. For society, The prospect of a new boom-bust cycle for Bitcoin is scary, strong>The collateral damage will be enormous, including environmental damage and ultimately a renewed wealth at the expense of less mature people distribute.

In November 2022, an article on the European Central Bank’s blog debunked Bitcoin’s false promises and warned that if it is not effectively resolved, it will lead to Danger to society.

We believe that Bitcoin has failed to fulfill its original promise of becoming a global decentralized digital currency. We also believe that the second promise of Bitcoin as a financial asset, whose value will inevitably continue to rise, is equally false. We warn of the risks to society and the environment if the Bitcoin lobby reignites the bubble with the unintended help of lawmakers, who may impose explicit bans where bans are needed Supervision.

All of these risks have become a reality.

Today, Bitcoin transactions remain inconvenient, slow and expensive. Beyond the dark web, a hidden part of the internet used for criminal activity and barely used for payments, regulatory initiatives to combat criminals' large-scale use of the Bitcoin network Not yet successful. Even with the full support of the government of El Salvador, granting it legal tender status and efforts to kick-start network effects by giving away $30 in free Bitcoin to citizens, it has not been able to establish it as a successful payment method.

Similarly, Bitcoin is still not suitable as an investment. It does not generate any cash flow (unlike real estate) or dividends (stocks), cannot be used efficiently (commodities), and does not provide social benefits (gold jewelry) or subjective appreciation based on outstanding abilities ( artwork). Retail investors with less financial literacy are attracted by the fear of missing out, leading to the possibility of losing their money.

Using proof-of-workMining Bitcoin continues to take a toll on the environment and the entire country For the same scale of pollution, rising Bitcoin prices mean higher energy consumptionbecause miners can afford higher costs.

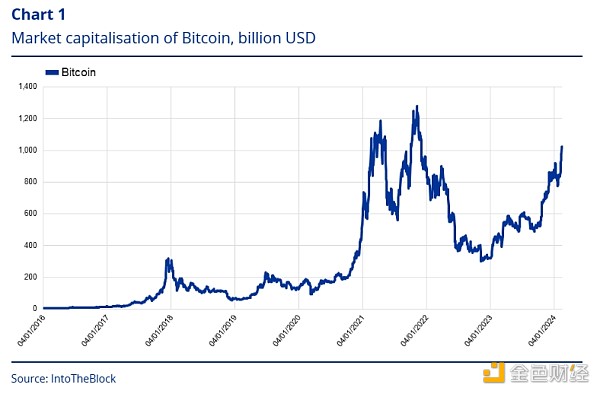

However, while all this is well known, and the reputation of the entire cryptocurrency space has been tarnished by a long and growing list of scandals,[ 1] Bitcoin has rebounded significantly since late December 2022, rising from just under $17,000 to over $52,000. Small investors are slowly returning to cryptocurrencies, although not yet diving in like they did three years ago (Bloomberg, 2024).

So why Bitcoin Will it rebound so high?

For many, the fall 2023 rally was triggered by the prospect of an impending shift in Federal Reserve interest rate policy, the BTC mining reward halving in the spring, and the subsequent SEC approval of a Bitcoin spot ETF.

Lower interest rates will increase investors’ risk appetite[2], and the approval of spot ETFs will Bitcoin opens the door to Wall Street. Both promise massive capital inflows—the only effective fuel for speculative bubbles.

Still, this may be just a blip. While in the short term, inflows can have a significant impact on prices regardless of fundamentals, in the long term, prices will eventually return to their fundamental value (Gabaix and Koijen, 2022). If there are no cash flows or other returns, the fair value of an asset is zero. Separated from economic fundamentals, every price is equally (un)reasonable.

Similarly, using an ETF as a financing vehicle does not change the fair value of the underlying assets. ETFs that include only one asset subvert their actual financial logic (although there are others in the US). ETFs generally aim to spread risk by holding many individual securities in the market. Why would anyone pay an asset management company for the custody service of just one asset, instead of using the custodian directly (which in most cases is a huge cryptocurrency exchange) or even holding it for free without any intermediary? Token? Additionally, there are already other easy ways to gain exposure to Bitcoin or buy Bitcoin without any intermediaries. The problem has never been the lack of possibility to speculate with Bitcoin, but rather that it is just speculation (Cohan, 2024). Finally, It is extremely ironic that cryptocurrencies aim to overcome the demonization of the established financial system However, units need traditional intermediaries to spread to a wider investor base.

The halving of BTC mining rewards will take place in mid-April. Roughly every four years, the block reward given to Bitcoin miners for processing transactions is cut in half after the Bitcoin network mines 210,000 blocks. The current daily limit of 900 BTC will be reduced to 450 BTC. The halving reduces Bitcoin mining rewards, although mining costs remain high. In the past, prices have risen after halvings. But if this is a reliable pattern, then the upside is fully priced in (and some say this is the case).

While the current rally is driven by temporary factors, there are three structural reasons that explain its apparent The rally on: "continued manipulation of 'prices' in unregulated markets with no fair value, growing demand for 'criminal currency'" and flaws in the authorities' judgment and measures.

Price manipulation since the birth of Bitcoin

Bitcoin’s history has been marked by price manipulation and other types of fraud. Characteristics. This may not be surprising for an asset that has no fair value. As a result of scams in the first cycle, cryptocurrency exchanges were shut down and operators sued.[3] During last year’s rally, pricing remained Suspicious. An analysis of 157 cryptocurrency exchanges (Forbes, 2022) found that 51% of the daily Bitcoin trading volume reported by these exchanges may be fake. [4]

During the recent pronounced downturn known as the “Crypto Winter”, as trading volumes decreased significantly, manipulation may have become more effective, as market intervention has a greater impact when liquidity is lower . According to one estimate, the average Bitcoin transaction volume from 2019 to 2021 is about 2 million Bitcoins, compared with only 500,000 Bitcoins in 2023 (Athanassakos and Seeman, 2024).

Crime Currency: Financing Evil

As critics often point out: A key use that cryptocurrencies serve is in the financing of terrorism and criminal activities such as money laundering and ransomware. The demand is large and growing. p>

Despite the market downturn, illegal trading volumes continue to rise. The range of possible applications is wide.

Bitcoin remains the preferred choice for money laundering in the digital world, with the amount of cryptocurrency transferred from illegal addresses reaching $23.8 billion in 2022, a 68.0% increase from the previous year. About half of these funds were transferred through mainstream exchanges Yes, despite the compliance measures in place on mainstream exchanges, they still serve as conduits for converting illegal cryptocurrencies into cash. (Chainalysis, 2023). [5]

Additionally, cryptocurrencies remain the preferred method of payment for ransomware, with attacks on hospitals, schools and government offices expected to generate $1.1 billion in 2023, That compares with $567 million in 2022.

A misjudgment by the authorities?

The international community initially acknowledged that Bitcoin lacked positive social benefits. Lawmakers have been hesitant to crystallize regulations because of the abstract nature of the guidelines and concerns about Bitcoin's divergence from traditional financial assets. However, pressure from well-funded lobbyists and social media campaigns prompted a compromise, which was understood to be a partial approval of Bitcoin investment (The Economist, 2021).

In Europe, the June 2023 Market Regulation in Crypto-Assets (MiCA) aims to curb the spread of cryptocurrency units Fraudulent issuers and traders, although the original intention is genuine crypto assets, the ultimate focus is on stablecoins and service providersAlthough there is no regulation and supervision at the same time, a well-informed outsider may Create the wrong impression that with MiCA, Bitcoin will also be regulated and safe.

In the United States, the SEC’s approach to Bitcoin ETFs initially involved compromise in favor of futures ETFs , because futures ETFs are believed to be less volatile and carry less risk of price manipulation. However, a court ruling in August 2023 forced the SEC to approve spot ETFs, causing the market to surge. [6]

Despite evidence that Bitcoin has a huge negative impact on the environment, neither the United States nor the European Union has taken any effective measures to address Bitcoin’s energy consumption so far.

The decentralized nature of Bitcoin creates challenges for authorities, sometimes leading to unnecessary regulatory fatalism. But Bitcoin transactions provide pseudonymity rather than complete anonymity because each transaction is linked to a unique address on the public blockchain. Therefore, Bitcoin has been a cursed anonymity tool that facilitates illegal activities and leads to legal action against offenders by tracing transactions (Greenberg, 2024).

Furthermore, it seems wrong that Bitcoin should not be subject to strong regulatory intervention, or even a virtual ban. Even for decentralized autonomous organizations (DAOs), it is easy to accept the belief that people are protected from effective intervention by law enforcement agencies. DAO is a member-owned digital community with no central leadership and is based on blockchain technology. A recent case involves BarnBridge DAO, which was fined more than $1.7 million by the SEC for failing to register the offer and sale of cryptocurrency securities. Despite claiming autonomy, The DAO settled after the SEC pressured its founders. When administrators of decentralized infrastructure are discovered, authorities can effectively prosecute them, highlighting the limits of claimed autonomy.

This principle also applies to Bitcoin. The Bitcoin network has a governance structure in which roles are assigned to identified individuals. Given the large-scale illegal payments being made using Bitcoin, authorities may decide to prosecute these individuals. Lawmakers can impose strong regulations on decentralized finance if they deem necessary.

Recent developments such as increased fines for lax regulation (Noonan and Smith, 2024). and the EU’s agreement to strengthen anti-money laundering rules for crypto-assets[7], indicating a growing recognition of the need for stricter regulation in the cryptocurrency unit space.

Conclusion

Bitcoin’s price level is not an indicator of its sustainability. Without fundamental economic data, there is no fair value from which to derive serious predictions. There is no "price evidence" in a speculative bubble. On the contrary, the reflation of the speculative bubble shows the effectiveness of the Bitcoin lobby. “Market” capital quantifies the total social damage that will occur when the house of cards collapses. Authorities must remain vigilant to protect society from money laundering, cyber and other crime, economic losses among people with less financial education, and widespread environmental damage. The work is not done yet.

Notes

[1] Prominent recent examples include the collapse of cryptocurrency exchange FTX and the criminal conviction of its founder Sam Bankman-Fried, the An was fined $4.3 billion for money laundering and sanctions violations, Luna/TerraUSD collapsed, and Three Arrows Capital closed or liquidated.

[2] The contradictions in the initial narrative are obvious: Like gold, Bitcoin is supposed to be a hedge against financial market fluctuations and act as a safe haven in bear markets, rather than being positively correlated with the riskiest speculative investments. Despite BlackRock CEO Larry Fink’s approval of ETFs, it’s hard to see why ETFs would be a “stepping stone to tokenization” despite being a recourse to traditional financial products from the pre-crypto era (Rosen 2014).

[3] Dunn (2021) attributes the first Bitcoin bubble in 2013 to the Mt Gox exchange. Its bankruptcy resulted in the loss of 650,000 Bitcoins as it hosted 70% of all Bitcoin transactions. (2021) show that the initial boom, from $100 to $1,000 in two months, was also manipulated through trading software. Griffin (2020) links the second and third waves to the launch and rise of Tether. Tether is a stablecoin designed to maintain a stable value backed by fiat currency. Griffin’s findings on the 2017 boom suggested that 50% of the price increase was caused by Tether manipulation.

[4] In the cryptocurrency space, many manipulation techniques can be seen: 1) Wash trading requires the same owner to repeatedly buy and sell cryptocurrency units, inflating trading volumes and deceiving investors about supply and demand, thereby affecting prices Discover. A study based on a sample of nearly 30 large cryptocurrency exchanges, including Bitcoin, found that wash trades accounted for 77.5% of total trading volume on unregulated exchanges (Cong 2023). 2) Pump and dump schemes involve manipulators using disinformation (often via algorithmically enhanced social media) to artificially increase prices and attract buyers so they can sell at a profit. On January 9, the official account of the US SEC on X (formerly Twitter) was included. Hackers posted false news about the SEC’s expected approval of a spot ETF containing Bitcoin. When the SEC removed the post approximately 30 minutes later, the price of Bitcoin surged and fell sharply (Reuters 2024). 3) “Whale manipulation” occurs when large holders influence the price of a cryptocurrency to strategically buy or sell large amounts of money.

[5] Recently, the giant cryptocurrency platform Tether has become one of the main payment methods for money launderers in Southeast Asia (UNODC 2024). But just because Tether is increasingly used for money laundering, that doesn’t mean Bitcoin’s use is declining.

[6] It is worth noting that U.S. Securities and Exchange Commission Chairman Gary Gensler stated that the agency’s approval does not mean an endorsement of Bitcoin, calling Bitcoin “primarily a speculation. volatile, volatile assets and have also been used for illegal activities, including ransomware, money laundering, sanctions evasion and terrorist financing.” In addition, Democratic Commissioner Caroline Crenshaw, who voted to deny approval, said in her dissent The opinion listed a range of investor safety concerns, ranging from insufficient market regulation to wash trading (New York Times 2024).

[7] Cryptoasset service providers must screen customers who make transactions worth €1,000 or more and report suspicious activity. Cross-border cryptoasset companies must undergo additional checks (Reuters 2024a).

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph