Author: Greythorn Asset Management, compiled by: Plain Language Blockchain

As the earliest and largest blockchain by market value, Bitcoin has not only led the development of digital assets, but also continues to dominate the market in terms of market value. However, Bitcoin, which is currently regarded as "digital gold", is mainly recognized for its use as a means of storing value rather than its role in decentralized applications.

However, recent developments have shown that Bitcoin has greater potential in building an active decentralized finance (DeFi) ecosystem than previously expected. This change occurs against the backdrop of an unprecedented alignment between market interest in Bitcoin and the development of technological capabilities.

The SEC has approved a Bitcoin ETF for listing on all registered securities exchanges and will continue to regulate it to protect investors. Source: x.com

The next few years may be critical for Bitcoin as it has the potential to transform from a passive means of storing value to an active ecosystem full of innovation and investment opportunities. We believe this is an opportunity worth exploring, especially considering that most people have yet to invest in this emerging ecosystem and that some new features such as Runes are coming soon.

This will be the first bull run where people will be able to invest directly in protocols and assets on the Bitcoin blockchain. These assets are expected to gain as the price of Bitcoin rises, and profits will gradually become apparent when people sell Bitcoin. This article will focus on analyzing the potential opportunities that Bitcoin may bring in the future.

01 Bitcoin Ecosystem

The core code of the Bitcoin protocol has remained virtually unchanged for many years and is mainly used as a medium of transaction. In 2017, the Bitcoin protocol implemented the SegWit upgrade, which separated digital signatures ("witnesses") from transaction data. This separation effectively freed up space, allowing more transactions to be included in the blockchain.

Subsequently, in 2021, the Taproot upgrade was introduced. This improvement allows multiple signatures and transactions to be grouped together, facilitating the aggregation of signatures. Essentially, this means that multiple signatures can be grouped together for verification. Despite these upgrades, Bitcoin still faces challenges such as scalability, slow transaction speeds, and high costs.

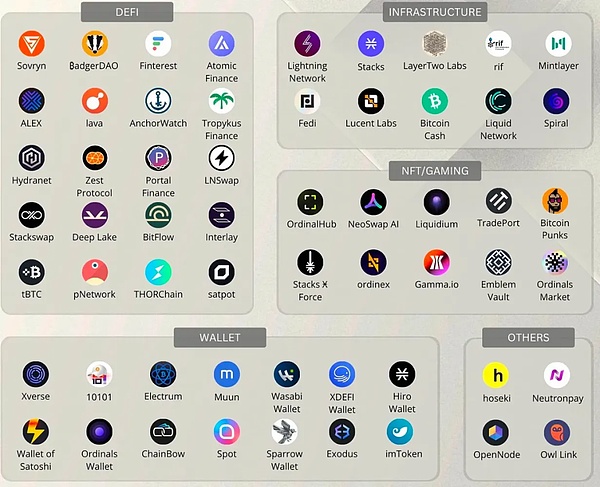

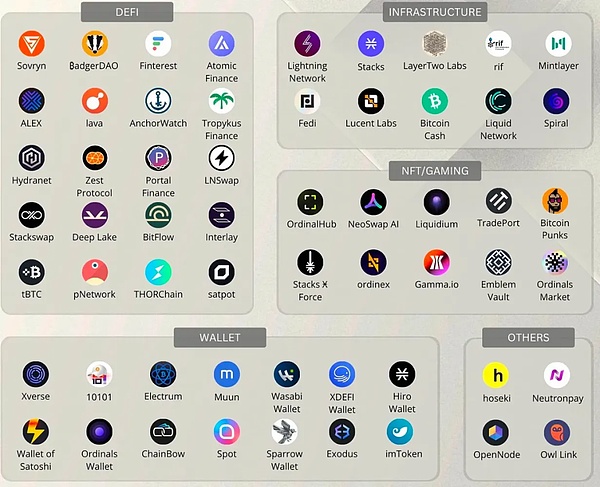

Currently, the Bitcoin network consists of miners, nodes, stakeholders, developers, and various second-layer solutions, sidechains, and DApps. Miners and nodes maintain the network by validating transactions and ensuring consensus, which is achieved through the Proof of Work mechanism (POW). The developer community contributes through expanding local ecosystems and occasional core protocol updates, which can be difficult to reach consensus and therefore have fewer changes. Here is a brief overview table of the Bitcoin ecosystem:

02 Layer2 Solutions

Multiple solutions have been proposed for Bitcoin's scalability issues, but the vast majority of Bitcoin users view the Proof of Work system (PoW) as a core part of Bitcoin's identity and are generally reluctant to support major changes to the protocol.

Nevertheless, Layer2 solutions offer a more practical approach as they do not involve major modifications to the core blockchain. These solutions are layered on top of the Bitcoin main network as independent blockchains, making them easier to implement and more realistic to address scalability issues.

Here are three major players:

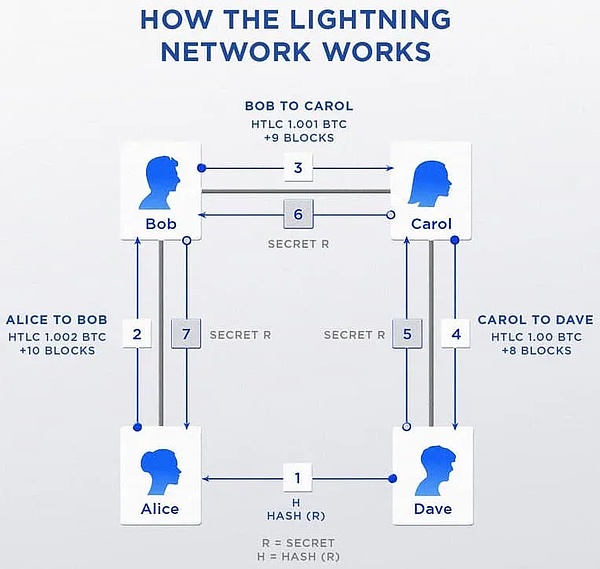

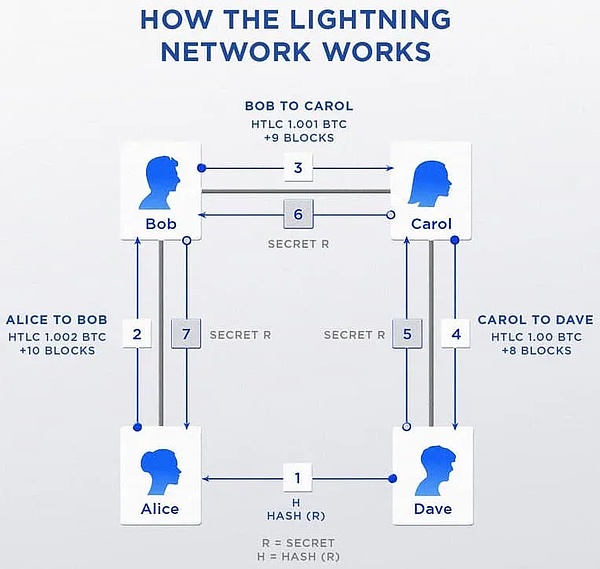

1) The Lightning Network

Launched in 2016, it is the first second-layer payment protocol developed on the Bitcoin blockchain, designed to increase transaction speeds and reduce costs, leveraging Bitcoin’s smart contract capabilities to achieve near-instant payments.While the Lightning Network has successfully improved transaction efficiency and attracted more than $347 million (as of July 31) in total locked value (TVL), it does not provide the advanced smart contract functionality needed to develop a diverse DApp ecosystem, but instead focuses on its peer-to-peer payment network capabilities.

Source: Lightning Network

Source: Lightning Network

2) Stacks

Stacks is the current market leader and has completed the Nakamoto upgrade on July 13, which significantly improves security and speed. Stacks was founded in Princeton in 2013 by computer scientist Muneeb Ali, who has been researching the technology for four years. In addition, the project has an extremely outstanding team and its technology has been peer-reviewed by experts from Stanford and Princeton.

Stacks enables smart contracts and Dapps to use Bitcoin as an asset and settle transactions on the Bitcoin blockchain. All transactions on the Stacks layer are automatically hashed and settled on Bitcoin.

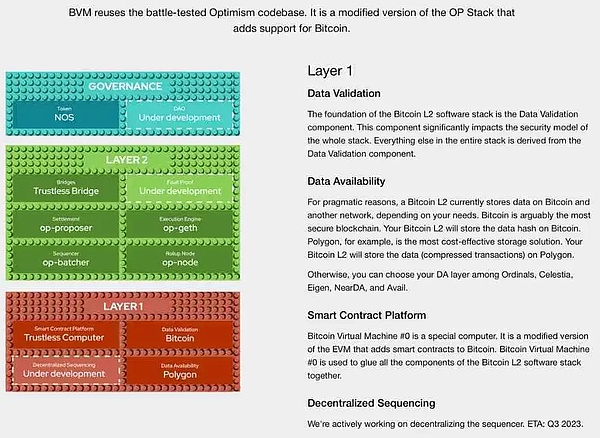

3) BVM Network

Through its Layer2 meta-protocol, Bitcoin’s smart contract and scalability limitations can be addressed. BVM supports the creation of DApps and smart contracts, and facilitates the expansion of Bitcoin’s Layer2 blockchain.Currently, BVM is emerging as a leading solution on the chain, especially during the recent market downturn. Its relatively strong performance shows potential growth, especially against the backdrop of rising interest in Bitcoin’s Layer2 solutions.

As a Rollup-as-a-Service (RaaS) protocol, BVM allows users to easily launch new Bitcoin L2 blockchains, with all value flowing back to BVM Token holders as new Layer2s continuously pay fees with BVM Tokens. Notable developments include the launch of Tuna Chain and Naka Chain using the BVM SDK. In addition, the planned integration of Runes functionality heralds further growth for BVM.

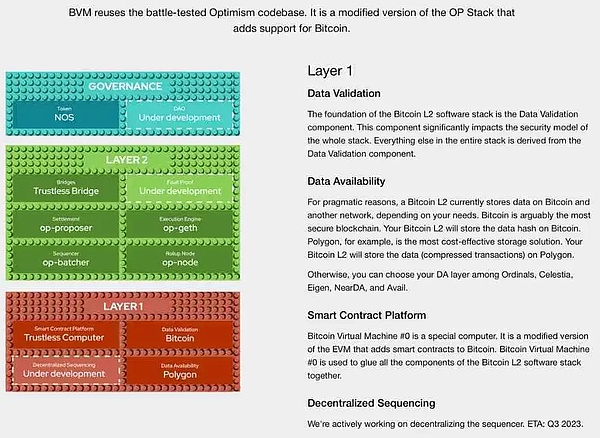

BVM reuses the battle-tested Optimism codebase. It is a modified version of the Op Stack with added support for Bitcoin. The software stack includes data validation, data storage options, a smart contract platform (Bitcoin Virtual Machine), and an upcoming decentralized sorter. Source: BVM

BVM reuses the battle-tested Optimism codebase. It is a modified version of the Op Stack with added support for Bitcoin. The software stack includes data validation, data storage options, a smart contract platform (Bitcoin Virtual Machine), and an upcoming decentralized sorter. Source: BVM

Several other scaling solutions have been developed to implement smart contracts on Bitcoin:

RGB:An off-chain layer that leverages Bitcoin’s UTXO to create digital assets such as tokens and NFTs, fully compatible with the Lightning Network.

Counterparty:Allows token creation and crowdfunding; has been revived through innovations like Ordinals.

Rootstock (RSK): A merged-mined sidechain that supports smart contracts compatible with the Ethereum Virtual Machine (EVM), using RBTC, which is pegged to Bitcoin.

Liquid Network:A sidechain launched by Blockstream that supports decentralized exchanges and asset issuance, including NFTs and stablecoins.

Omni Layer:Supports token minting and DEX; enhances the transaction speed of the Lightning Network through Omni Bolt.

Mintlayer:Combines Proof of Stake with Bitcoin's Proof of Work on a sidechain, supporting smart contracts and cross-blockchain transfers.

03 DeFi on Bitcoin

Ethereum has always been the preferred Layer1 blockchain for DeFi. However, recent developments may make Bitcoin a major player in mainstream DeFi adoption. With regulatory changes in the United States, expectations for the Bitcoin halving in 2024, and the introduction of Bitcoin Ordinals, Bitcoin is gradually gaining more possibilities.

The Bitcoin network is moving beyond simple trading capabilities, paving the way for a rich DeFi ecosystem through various scaling solutions. This development has spawned projects that support more complex financial applications, challenging Ethereum's dominance.

For example, Sovryn provides a non-custodial, permissionless environment for trading, borrowing, and lending Bitcoin and other select assets on RSK, a Layer2 EVM smart contract blockchain based on Bitcoin.

In addition, Zest Protocol, backed by Primal Capital, is pioneering peer-to-peer decentralized borrowing based on Bitcoin. Meanwhile, Bitcoin DEXs such as Bisq Network operate under a decentralized autonomous organization (DAO) and support peer-to-peer trading.

04 Ordinals and Runes

While the Runes protocol has received widespread attention, many people still don’t quite understand how it uses UTXO accounting to simplify Bitcoin transactions. Runes provide a more economical entry point compared to traditional methods such as the Unisat market. Before this, Bitcoin transactions were mainly managed through an account model, requiring specific transaction amounts, and providing a poor user experience compared to token transactions on Ethereum.

Created by the founders of Ordinals, Runes is intended to be the Bitcoin version of Ethereum ERC20, facilitating the issuance of fungible tokens. The protocol is scheduled to launch on April 19 after the Bitcoin halving, which may increase transaction fees on Bitcoin Layer1 and may promote activity on Bitcoin Layer2 solutions.

Ordinals stores data in transaction witnesses and attaches information to a single satoshi. Unlike Ordinals, Runes embeds token records into Bitcoin's unspent transaction outputs (UTXOs). This approach seamlessly integrates with Bitcoin's existing system, improves its functionality and blockchain integrity, and is specifically designed to be easily implemented on various Layer2 platforms such as Stacks.

Here are some key projects related to the Runes protocol:

PUPS / Rune Pups:This is an NFT series that will distribute 23% of the PUPS supply via Airdrop after Post-Runes activation.

WZRD:This is an early cultural token in the Ordinals ecosystem that has grown rapidly.

Runestones:This project will transform into a Runes Token after the Bitcoin halving. It has been Airdropped to multiple Ordinals collections, including Bitcoin Puppets.

When you buy BRC20 tokens, you are actually buying BRC20s that can be converted into Runes equivalent tokens after the halving. As the ecosystem is launched, there will be more similar projects, so stay tuned.

The bullish view of Runes is as follows:

Innovation in Bitcoin Fungibility:Runes introduces a new token standard on the Bitcoin blockchain that aims to improve the current BRC-20 fungible token standard. This innovation is considered sufficient to prompt a reassessment of Bitcoin's potential in the field of decentralized applications.

Efficiency and Design:The Runes Token standard is more efficient by using a UTXO-based design. This is different from the account-based design of Bitcoin's BRC-20 and Ethereum's ERC-20 tokens, which may reduce the bloat and high fees caused by the creation of "junk" UTXOs in the current process.

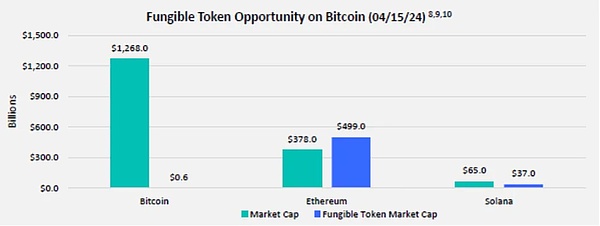

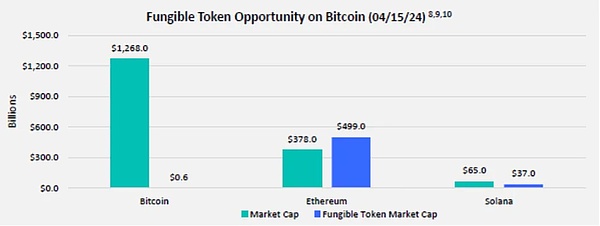

Market Positioning:The market capitalization of Bitcoin's fungible token market is relatively small, compared to Ethereum and Solana. Nonetheless, the introduction of more efficient token standards such as Runes may help close this gap.

Compatibility and Privacy:Runes is designed to be compatible with the Lightning Network and promises to provide higher privacy because data is hidden in UTXOs. This compatibility and privacy feature is seen as an important improvement over existing standards and may make Bitcoin a more attractive platform in the DeFi space.

Fungible tokens on Bitcoin have the greatest potential, source: Franklin Templeton

05 RGB++

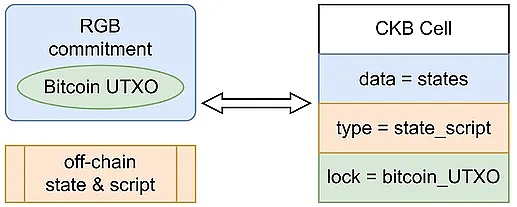

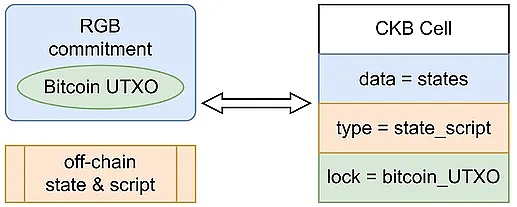

RGB++ enhances Bitcoin's functionality by integrating smart contracts onto the Nervos CKB blockchain. The highlight of RGB++ is its isomorphic binding, which enables asset management synchronization between Bitcoin and the CKB Nervos blockchain. In actual operation, each Bitcoin UTXO (unspent transaction output) is bound to the corresponding Cell (which can be understood as a "block") on the CKB blockchain. Therefore, when a Bitcoin transaction is made using UTXO, the transaction is automatically recorded on the CKB blockchain, and the corresponding Cell on CKB is updated.

Symbol of asset management synchronization between RGB Bitcoin and CKB Nervos blockchain

The system does not require a third-party multi-signature bridge, enabling trustless cross-chain transactions while ensuring accurate mapping of activities on both networks. RGB++ is considered a promising Bitcoin Layer2 solution.

In terms of investment, the token directly related to RGB++ is CKB, which has a market capitalization of $1.5 billion (as of July 31st) and more than 99% of the tokens are already in circulation. This reduces concerns about the impact that new token issuance may have on the market.

06 Conclusion

This is a lot of information and may be a bit complicated to understand. But the Bitcoin ecosystem is worth paying attention to because Bitcoin still has the highest adoption rate of all cryptocurrencies and is recognized by individual and institutional investors, which may bring more stability and growth potential.

Bitcoin is constantly improving and expanding its applications due to ongoing developments like the Lightning Network (which speeds up transactions) and initiatives like Runes (which improve the fungibility of tokens).

Anais

Anais