Author: Jaleel, BlockBeats

The four-year development history of the coin circle's wool industry is also the four years when cryptocurrencies have grown most wildly.

In 2020, due to the money-making effect of new stocks of star companies such as Nongfu Spring, Smoore, and Kuaishou, Hong Kong stocks were once popular and became a hot spot for many investors. Although the Hong Kong Stock Exchange requires KYC, the regulatory approach of turning a blind eye has given investors the opportunity to exploit loopholes.

During that time, many investors known as "hundred households" appeared in the Hong Kong stock market. They increase their chances of winning new stocks by opening multiple brokerage accounts, and some people even have hundreds of accounts. It is not a problem for a family, relatives and friends to open thousands of accounts together, which increases the probability of winning new stocks.

2020 Hong Kong stock IPO income, source: Futu

Behind the feast of Hong Kong stock IPO is actually the art of account management. Through the operation of a large number of accounts, the winning rate is increased, thereby obtaining a higher return on investment. This mode of operation allows many ordinary investors to feel a simple and effective arbitrage opportunity. As the saying goes: "Learn three or two more tricks, and leeks will become sickles." In that wave of Hong Kong stock IPOs, account management and arbitrage were one of the two or three tricks.

And the same gameplay was copied in the currency circle and iterated to the extreme. Here, this operation is called "rubbing the wool".

Unlike the fixed platform for participating in the new stock issuance, in Crypto, if you want to obtain new cryptocurrencies, you need to interact with the products of each project party. Obtaining the token airdrop of the project party is the only goal of rubbing the wool. To give an inappropriate and unrealistic example, it is like buying and selling things on Pinduoduo when it was just established, in order to obtain the stocks that Pinduoduo will issue later. The tokens airdropped by the project party can be circulated and exchanged for money, and the rubbing wool people will have actual benefits.

This is not the native industry of cryptocurrency. Compared with investment institutions and retail investors, the history of rubbing wool people has only been 4 years since 2020. Unlike investment or speculation, rubbing wool is more like doing business. Basically, there is no need to understand the so-called new concept of Crypto, and only focus on costs and benefits.

In the past four years, the scale and voice of the business of Lumao have been growing. From individual iteration to studio and even company, it has become an extremely important part of the cryptocurrency industry. Of course, crowded tracks mean considerable profits. It is not uncommon to see examples of Lumao getting rich just like speculating in cryptocurrencies, and the returns are even more amazing than those from speculating in cryptocurrencies.

However, the cryptocurrency cycle is four years, and the Lumao industry, which has already experienced a cycle, is facing its own dilemma: the returns given by the project parties to Lumao people are no longer as generous as in the early days, and there are more and more conditions, and the costs and benefits are not growing in direct proportion.

Especially in recent times, the benefits brought to Lumao people by several superstar projects have reached the extreme, and the time and money costs are completely disproportionate to the benefits. I don’t know if the four-year development of Lumao will go downhill this year. BlockBeats wants to use this article to record the development of Lumao, which may be the four years when cryptocurrency has grown the most.

Uniswap airdrop, the origin of the luma industry is the Uniswap airdrop in 2020.

As the world's largest decentralized exchange, Uniswap's addresses that have interacted with the platform before September 1, 2020 are eligible, and each address has received at least 400 UNI tokens. By the beginning of 2021, the value of these 400 UNI tokens once climbed to about US$12,000.

"Money is not earned, it is blown by the wind." Because of the UNI airdrop, such voices have also increased.

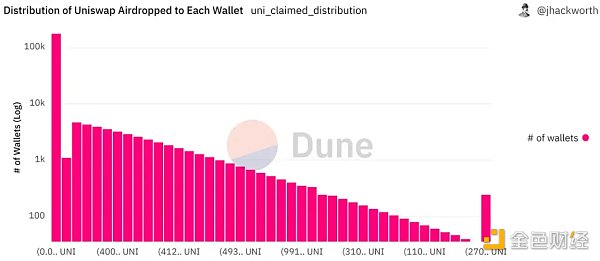

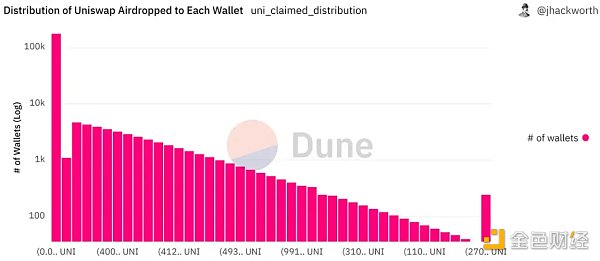

The vast majority of addresses airdropped that year had 400 UNI tokens, data source: DUNE

This airdrop of Uniswap made everyone realize the importance of multiple numbers and batch addresses, which is also the essence of wool. There is no KYC (identity verification) in the world of coin circle chain. A person can have countless addresses and use these addresses to earn more income. It is this point that makes wool a relatively stable and high-yield way, which is more certain than currency speculation.

It was also from Uniswap that the trend of wool-pulling began. In those years, everyone was a "wool-pulling party", and everyone had dozens or even hundreds of wallet addresses, wanting to replicate the next "wool-pulling rich" like UNI.

Studio equipment, source: Internet

2021 and 2022 are the sweet period for wool-pulling people, and the wave of encrypted airdrops continues to push up a group of new rich people. dYdX and Ethereum Domain Name System (ENS) conducted large-scale airdrops in September and November 2021, respectively. The success of these projects has created many legendary stories of overnight wealth. For example, a college student received 46,000 ENS tokens directly for his contribution to ENS, which was equivalent to more than $620,000 at the price of $13.63 per token at the time.

The most common "origins" of the past few batches of freed-up studios are Uniswap, dYdX, and ENS.

However, with the advent of the crypto bear market, the number and size of airdrops began to decrease. During the bear market, many studios could only barely make ends meet by relying on the monthly unlocked token share, but most studios were not so lucky and disappeared from the cryptocurrency circle because they could not operate.

It was not until 2023 that some studios survived the "winter" and ushered in a brief recovery thanks to the issuance of several major projects, Arbitrum (ARB), Celestia (TIA) and Blur.

With the development over the years, Lu Mao Studio has also gone through many tests and the survival of the fittest. Those who remain have been tempered and reached an unprecedented level of maturity.

And this year may be the most glorious year for Lu Mao Studio after 2020.

With the passage of the Bitcoin ETF, Bitcoin broke through $72,000, setting a record high. The arrival of the bull market has led to the issuance of more projects and brought new vitality to Lu Mao Studio. In recent months, Merlin, Unisat, ionet and ZKsync and other well-known projects have successively issued coins. Although the market value is slightly inferior to the airdrops in previous years, these airdrop projects still attracted widespread attention.

Unlike the past, the wool-pulling industry has also experienced many evolutions and new challenges. Today, the wool-pulling business is more competitive, professional and commercial than ever before. The threshold for newcomers to enter this industry is getting higher and higher, and the competition is becoming more and more fierce. "Low wool" used to be a place where every grassroots hero could make a living, but now it is more like a high-threshold commercial game.

Grassroots heroes play commercial games

In addition to daily operating costs, such as utilities, rent and other expenses, a typical wool-pulling studio also needs to pay the salaries of executive employees. "These have to be settled every month, about hundreds of thousands. So basically all the studios are in second- and third-tier cities to reduce staff consumption and venue rental costs." Xiao Zhi (@shut_nice1) is in a Lumao studio team, he revealed to BlockBeats.

In order to obtain more resource support and liquidity support, some studios will also register for business licenses and apply for some government subsidies and subsidies.

With the development of the cryptocurrency circle, Lumao, a once free and undisciplined grassroots industry, has gradually become industrialized, networked and corporatized. Now it operates like a small startup company. It is no longer a grassroots hero era where a few people get together, but a professional system. These studios have a clear organizational structure and division of labor. Through refined management and operation, they can maximize the use of resources and steadily increase their profits.

Startup company configuration

"In terms of studio configuration, different teams have different genes, but there is no doubt that the most critical parts of the team are investment research and execution." Damon (@Damon_btc) is the manager of SohaDao Studio. Their current focus is mostly on the Bitcoin ecosystem.

As the think tank behind the SohaDao studio, investment research colleagues are responsible for analyzing market trends and project data, identifying the most promising projects, and formulating the best investment plans. Investment research also needs to do cost control and strategy optimization.

In strategy formulation, Damon's team usually starts from the results and works backwards to the steps needed in the middle. "Suppose we have a project with the goal of acquiring 1% to 10% of the market share. We will first study the token model, predict the number of addresses in the market, and then work backwards to calculate how much money and resources are needed to achieve this goal." Damon said that such backward calculations can help the team determine the cost of the initial investment and make adjustments every month to ensure the balance between the investment cost and the output benefit.

"But I think the role of investment research will gradually weaken in the future. First of all, the information gap in the entire market will become less and less. The content transferred between KOLs or paid groups is now very homogeneous. So execution is a way to make differentiation. It may be 70% investment research and 30% execution in the past, but in the future, execution will gradually be greater than investment research, forming a 50-50 split." Damon said.

Looking at the execution section again, the execution team is divided into two parts: program development and manual operation.

The program development team is a technical support, similar to the technical development team in a startup company, responsible for developing and maintaining the tools for making money, such as automated scripts and data crawling programs, to ensure the stable operation of the system and improve the efficiency of making money. Programmers must not only be proficient in code, but also understand the relevant technologies of blockchain and cryptocurrency, quickly develop tools that meet market needs, and enhance the competitiveness of the studio.

The manual operation members are like frontline fighters, who specifically implement the strategy for making money, ensuring that each airdrop project can participate in time and maximize the benefits. They are responsible for daily operations and maintenance of various accounts, handling transactions and transfers, etc. The execution team needs a high degree of execution and responsibility to ensure that every step of the operation is accurate and correct, and to maximize the benefits of making money. Qi Fite is currently a self-employed person, but he also knows many studio friends. After communicating with them, he has some insights: "The standard for recruiting manual execution members is not to recruit too smart, nor to recruit not smart at all." Like startups, some mature studios also accept investment from investors. "Profit sharing is a common cooperation model. The studio is responsible for execution, and the investor provides funds. After the airdrop, the profit sharing is divided according to the proportion." The specific profit sharing ratio depends on the negotiation of both parties. If the execution is difficult or fundraising is difficult, the profit sharing ratio will increase. The profit sharing ratio must also consider the risks that both parties can bear. The party with higher risks may share more, Qi Fite mentioned. In addition to investment research and execution, the CEO of this "small startup company" is generally called the "manager", who coordinates the overall situation, is responsible for the overall operation and strategic planning of the team, decision-making and execution, and ensures the achievement of team goals and long-term development planning.

According to BlockBeats, the current LuMao studio still needs KOL as an external spokesperson to expand the influence of the studio through social media and community activities, establish connections with other project parties, investors and media, increase the right to speak, and also get more "insider information" opportunities.

In the currency circle, the role of KOL is similar to that of Internet celebrities or reviewers in traditional industries, and can use their influence to help promote projects.

"The influence can be expanded, but the team should not be expanded. This is one of my demands." Damon said that he hopes to improve efficiency and professionalism by streamlining the team. At present, his studio is in its infancy, and social media such as Twitter have just started operating, and the influence needs to be further improved.

"I think it's enough for a serious executive team to have 10 people, because a large team may not make money." Damon explained that his experience working in a large company made him find that a team that is too large will lead to internal competition and reduced efficiency. But he stressed the importance of influence, believing that expanding the influence of the studio is more valuable than expanding the size of the team. By increasing influence, more resources and information can be obtained, thereby enhancing the competitiveness of the studio.

The sideline business derived from rubbing hair, the road to industrialization of the studio

The industrial structuring of the rubbing hair studio is no longer limited to the single rubbing hair business. In order to reduce costs and increase profits, they have explored and opened up more channels and paths, thus deriving multiple profit models.

Damon explained that due to his work experience in Web2 Internet, "reducing costs and increasing efficiency" is like a gene engraved in his bones. People with a financial background, especially actuarial background, can calculate and control costs more accurately.

"The three-piece set of Lumao" can be said to be the "jargon" of Lumao people in the currency circle, referring to three basic tools: virtual private network, multi-account management tool, virtual machine/fingerprint browser (there is also a three-piece set saying Twitter, DC and Gmail account).

Account multi-opening tool, source: Lumao diary

Multi-account management tools can help Lumao party manage multiple accounts, including batch registration, login, automated operations, etc. Common tools include browser extensions, scripts, etc., to reduce the time and error rate of manual operations. Fingerprint browsers can simulate different browser environments to prevent the platform from detecting that the same device is operating multiple accounts. Virtual machines can create independent operating system environments to further isolate operations of different accounts.

When choosing these hair-pulling tools, studios usually "shop around" in terms of price and function. Damon mentioned: "Although investing more money can also make money, through careful calculations, costs can be greatly reduced." This means that through actuarial calculations, half of the costs can be saved, and the odds will be completely different.

In order to ensure the lowest cost in every link, some studios will try to find the most advanced "source of goods". "For example, when buying a Twitter account, someone may pay two dollars, but we may only pay two cents. These trivial accounts are actually very important in the long run."

After finding the cheapest purchase channel in the market, it also means that another profit model has been opened up - selling sources. In this way, they have derived scalper resources in multiple channels, such as selling Google accounts, hardware, and cloud servers, forming a complete industrial chain.

In terms of revenue channels, the LuMao studio will also earn some "recommendation rewards". In this case, the role of KOL can be reflected. When KOLs have greater influence in recommendation tasks, they can get more points and cashback.

In addition, some studios may also get involved in OTC over-the-counter transactions. Xiao Zhi is a typical example. Everyone in his team also has their own responsibilities, and his focus is on over-the-counter business.

Due to the need for these channel resources, in the LuMao industry, scalpers are like people "born in Rome" and have a unique advantage in running a studio. "My boss started out as a scalper before, and he can use the scalper's thinking to operate Web3, which can be said to be a master." Xiao Zhi told BlockBeats.

Capital preservation and payback period

Like all traditional businesses, "capital preservation" is very important for studios.

For studios, the most important thing is to keep the funds safe and try not to lose the invested funds. "Every step of our studio is taken step by step. It is not easy to accumulate funds, but a wrong decision may make all the wealth disappear." Xiao Zhi went on to explain their strategy: "In the cryptocurrency circle, the most important thing is to protect the principal. We only need to play the role of a porter and ensure the basic docking of the project. We do not pursue subsequent profits. It is also a good result if there is no profit withdrawal or capital loss."

Coin circle payback picture, source: Internet

In the process of communicating with the LuMao studio in the cryptocurrency circle, BlockBeats found that "payback period" is a frequently mentioned keyword.

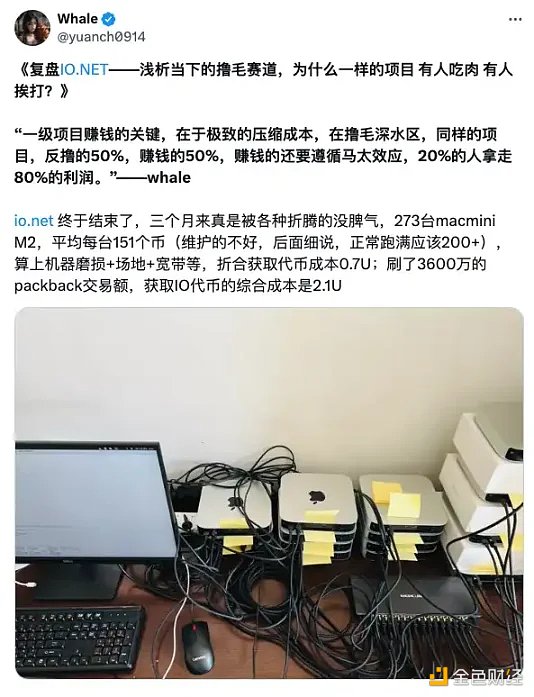

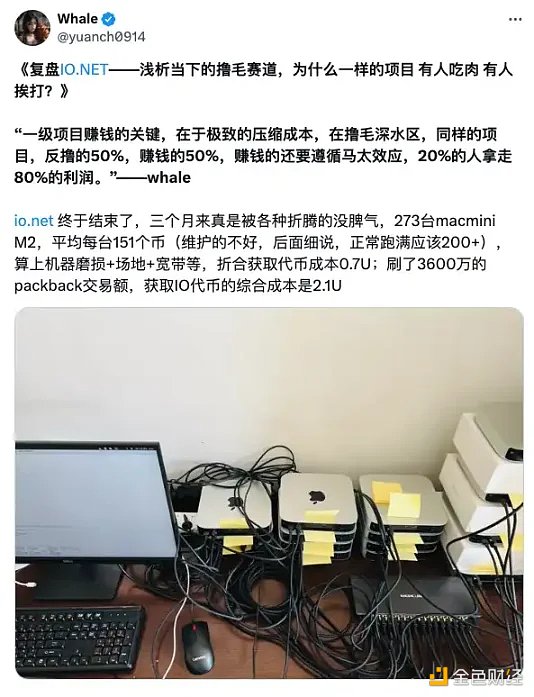

After leaving the big company, Whale (@yuanch0914) also has his own studio. In the past two months, he has continued to follow up on ionet and prepared 273 macmini M2s. While many people have lost money, he still made hundreds of thousands of dollars. This review article about ionet has received nearly 300,000 views.

In Whale's review, he also mentioned that long-term projects such as ZKsync have potential, but the time node is uncertain and it may take several years to take effect. Short-term projects, such as ionet and Merlin, have a cycle of only one or two months, with fast capital recovery and rapid profit realization. "My preference is for short-term, flat and fast projects, which means that the expected returns, coin issuance time and cash-out time are relatively clear. After the capital is invested, it can be recovered quickly, and then invested in the next project. In this way, the income will be more stable and the mentality will be easier to maintain."

It's like flipping a coin. The result of flipping it once or twice may not be one head and one tail, but if you flip it 1,000 times in a row, the probability is 500 heads and 500 tails. "So when the winning rate is relatively high, the more projects you do, the more stable your income will be." Whale continued to explain to us.

Damon also mentioned their choice of projects, which is somewhat similar to Whale. "We don't choose projects based solely on long-term standards, but choose the projects that can get results the fastest."

For a studio, the winning rate is the key to promoting its healthy development. Many studios may have existed two years ago, but because they only focused on long-term projects like ZKsync, they dragged on for two years and ended up doing only this one thing, which obviously doesn't work. Therefore, the studio needs to accumulate income in the short term, and then slowly do some long-term projects.

Behind the million-dollar annual income of post-95s: the secrets of LuMao Studio

In the cryptocurrency circle, the low threshold and high return of the LuMao business have attracted a large number of young people to participate. BlockBeats found that most of the members of LuMao Studio were born after 1995, and there are even many born after 2000, who have basically achieved an annual income of one million this year.

Although there are top players (called A8 in the cryptocurrency jargon) with an income of tens of millions, this situation is relatively rare. These people often choose not to continue LuMao, but sell the studio and become shareholders or investor consultants to enjoy more stable income.

With flexible strategies and high execution capabilities, young people have risen rapidly in this emerging market and achieved incomes that ordinary white-collar workers can hardly achieve in traditional industries. What are the secrets to wealth for these young people who are thriving in the wool-pulling business?

"If I were the project party"

"Think about the problem from the perspective of the project party" This is a sentence that many studios know, but only a few can really do it.

When the project party formulates the rules, it must not only ensure the rationality of these rules, but also consider how to send more tokens to their own hands, which is the so-called "rat warehouse". However, they must ensure that these rules appear fair and reasonable on the surface, and cannot be easily found out by community members. Whale said: "The project team will not just throw money at everyone, they will design some rules to screen out the best users."

"For example, why ZKsync was criticized so much this time, because some addresses were found to have obvious signs of witches, with exactly the same amount of money, but in the end all these addresses were airdropped. I think this kind of rule-making is a failure, because it cannot convince the public, and then it will affect the token consensus, and no one is willing to take over." Whale cited the recent example of ZKsync being criticized.

Most project teams want to make money and not be criticized. In order to achieve this goal, they must be extremely cautious and outstanding in formulating airdrop rules and strategies to prevent witch attacks. Project teams need to select 100,000 high-quality addresses from 1 million addresses, just like selecting admission places to top universities in prestigious schools. In this case, they must carefully design rules to ensure that only truly valuable users can get airdrops, while avoiding large-scale arbitrage by the Mao Mao Party.

“This actually involves a lot of so-called resources or information gaps. In Web3, information gaps are everywhere,” Xiao Zhi explained: “This information gap allows some people to get relatively first-hand information, thereby gaining an absolute advantage in the competition.”

Just like wanting to enter a top university like Peking University or Tsinghua University, if there is an information gap, you will know that there are many ways, which is much easier than the thousands of people in the college entrance examination, but the key to the problem is how you get this information gap. In the currency circle, having connections and resources is sometimes even more useful than in traditional industries.

Xiao Zhi also pointed out that in projects represented by ZKsync, account balance and pledge requirements have become new screening criteria: "The balance requirement of ZKsync is 50 US dollars. For those bulk accounts, 10 US dollars in one account is already a lot. If one account has to put 100 US dollars, then 10,000 accounts have to put 1 million US dollars, which is very risky for them."

The wool-pulling industry is shifting from POW (proof of work) to POS (proof of stake). This fund retention requirement makes batch operations more difficult and raises the threshold for wool-pulling work. Although there are many bulk accounts, they cannot bear the risk of large amounts of funds, especially in an environment where hacker attacks are frequent. The pledge and retention of high amounts of funds have become a "barrier" for the studio.

ZKsync online airdrop rules diagram, source: Yiwuyu

Many people hate rat warehouses and think that all good projects should be distributed to real users, but Whale believes that the reason why coin trading has excess profits is because of the existence of rat warehouses. If there were no rat warehouses, the project party and even the investors behind it would never be able to distribute such lucrative profits in the form of airdrops. "Objectively speaking, it is actually the investment institutions and project parties who are eating meat, and the coin traders are drinking soup in the back, but there are often some meat scraps falling into the soup." Whale's view on the coin trading industry is more sober than most people. In order to cope with the screening rules of the project party, users also need to think in reverse.

While the wool industry is becoming more and more professional, the studio must also find its own position in this process. The tutorials on the market are all teaching TX and large-scale interactions. Either you roll more than others, or you do differentiated things and make full use of one of your own advantages, so as to increase the chance of getting airdrops.

Qi Fite said: "Airdrops are like dividing cakes. How to get more shares? You have to keep adding and expand the number of addresses. Of course, the standard for adding must comply with the airdrop rules of the project party. If the rules are unclear, you can only think about how the project party may draw the line. If there is a rat warehouse, how can your address "mix into" the rat warehouse standard. "

The wool industry has also begun to pay attention to the "craftsman spirit"

Worms are like fishing. The waiting time is always the longest. What is needed in the wool process is not only technology, but also patience and determination. "The most suitable person to do the wool-pulling is actually a person who can keep calm in character. Such people can go further." Damon said.

When she just resigned from Web2 last year, Qi Fite was indeed a little anxious. When she was doing wool-pulling alone, her life and work schedule were very irregular, and she often went to bed late and got up late. But fortunately, she and her friends got the Sui project. The shares unlocked and sold every month were equivalent to the "monthly salary", which greatly alleviated her anxiety. "But I can't just live on this salary. After all, the token is unlocked once a month, and it will be gone after a year. I have to find a way to make a living."

So in that year, in addition to wool-pulling, Qi Fite kept calm and studied hard. For example, he learned option trading, and also had a deep understanding of the Bitcoin ecosystem and seized some opportunities in the second half of the year.

Three years later, wool-pulling people were slowly polished out of the "craftsman spirit" and adjusted their operating strategies. From the early days when random interactions could get airdrops to now running code group studios, the wool industry has gradually developed a more delicate and sophisticated way of operation while pursuing efficiency, emphasizing that "high-quality accounts are the best", and high-quality account addresses are regarded as a kind of "gold mine" and "mine".

Qifite told BlockBeats: "I don't agree with everyone using synchronizers when using fingerprint browsers. Although synchronizers are indeed very convenient and can operate multiple addresses at the same time, doubling efficiency, it is easy to make the behavior tracks of addresses the same, increasing the risk of being identified as a witch."

Damon also emphasized the importance of manual operation: "Now many studios have lazy thinking, and they are smart enough to use scripts or automation. From the perspective of ZKsync, this path has a high probability of being "killed". So some room for error tolerance should be left, such as 20% of the work depends on code and synchronizers, and the remaining 80% depends on pure manual operation. "

Whale's point of view is similar. For example, on ZKsync and Starknet, the machine brushing is basically annihilated, because Starknet uses AI to find witch clusters with similar behaviors (including withdrawal time, amount, interaction path, interaction order, etc.). ZKsync uses the amount retention. If you run it in batches with scripts, you will instinctively ignore the above two points in pursuit of efficiency. Therefore, due to the randomness of manual operation (not efficient enough) and the consideration of operation cost (no frequent movement of LP funds), there are almost no witches on these two projects.

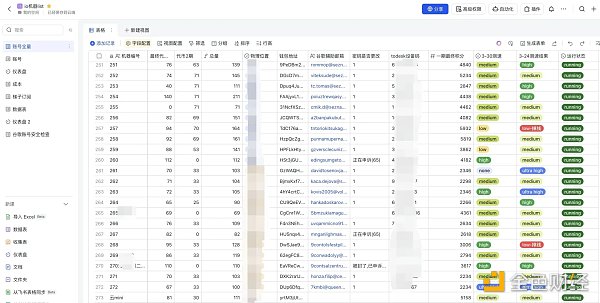

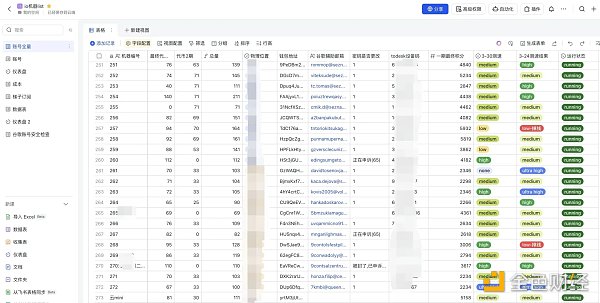

In addition to manual operation becoming mainstream again, refined data analysis has also become the core competitiveness of many successful studios. Whale emphasized that in the currency circle, the market value and distribution of tokens for each project need to be estimated in detail. Although this estimation seems simple, it is very complicated and time-consuming in practice. "There are too many projects, and it is very tiring to calculate the cost, income and input-output ratio of each one. But I have always adhered to this habit to ensure that the input and income of each project have a rough estimate," Whale explained.

Multi-dimensional table example diagram that Whale is good at

In order to ensure the accuracy of the estimate, Whale not only relies on public information, but also digs into non-public data, such as the TVL of the protocol, the number of interactions, and the number of independent addresses. "Many people only look at public information, but I will do further analysis, such as checking the data of the contract address through the block browser to estimate the expected return of the project." For example, the expected market value of a project invested by Binance is usually not less than 1 billion. Whale explained: "If a project is invested by Binance, and the amount is not small, then the probability of listing on Binance is very high." Then, Whale will further analyze the project's activities, such as the token distribution ratio and the number of participating addresses, and use these data to estimate the potential return of each user.

The philosophy of coin-mining: the art of surviving and thriving in the cryptocurrency world

During the process of coin-mining, Whale slowly formed his own philosophy of "subtraction". He believes that "choosing what not to do" is more important than "choosing what to do", "so that I can guarantee my winning rate."

Whale wrote in his Twitter signature: "Learning increases day by day, and the way decreases day by day." He explained that this means that the acquisition of knowledge and information should continue to increase, while the pursuit of things should be less and less. Reducing useless information and unnecessary pursuits is the key to success. For him, a project must have a clear reason to do it, rather than doing it because there is no reason not to do it.

Coin-mining is also an industry that becomes more popular as it gets older. "Everything can be reused", this is Xiaozhi's belief. By reusing successful strategies and experiences in different projects, the cost of trial and error can be reduced and the execution efficiency can be improved.

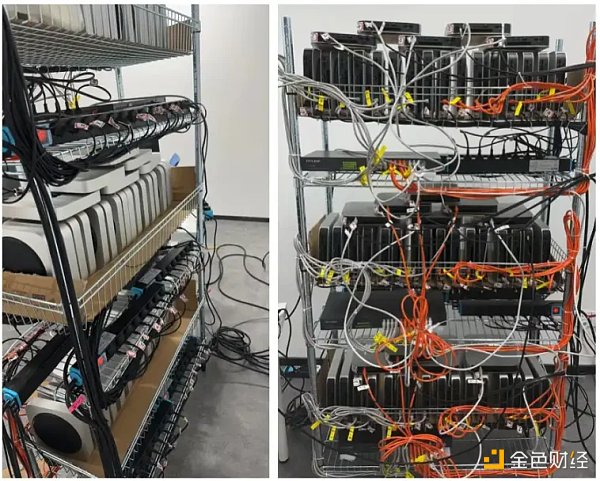

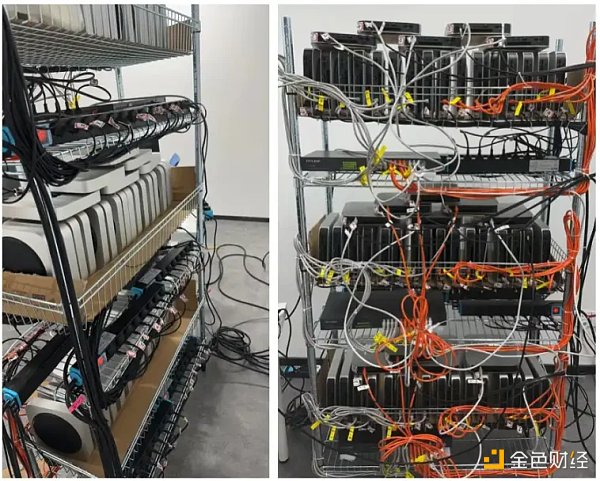

The hardware used by Xiaozhi's team to mine CHIA three years ago

"In 2021, we did the CHIA project, which also required us to install the machine and configure the network ourselves. We had a lot of trial and error experience, which was well reused when mining ionet, so we got started quickly."

The rise of CHIA coins that year attracted many "miners" and studios to buy large-capacity hard drives to mine coins to get rewards. This caused many people to speculate on hard drives and hoard goods, causing large-capacity mechanical hard drives and solid-state drives to be out of stock and increase in price for a while.

Ionet machine configuration of Xiaozhi's team

Xiaozhi also mentioned that before entering Web3, his team had also participated in the new listing of Hong Kong stocks. As mentioned at the beginning of the article, Xiaozhi's team is one of the Hong Kong stock hundred households. "We decide whether to buy new shares, mainly based on the situation of the investment institutions and their winning rate. These logics can also be reused in Web3." "At that time, the cost of subscribing to new shares in Hong Kong stocks was 10,000 to 20,000 Hong Kong dollars, which is a bit like the gas fee on the chain now." Xiao Zhi remembered that in the most glorious week, their income from new share subscriptions could reach between 700,000 and 800,000. In the process of making money, everyone's strategy is different. Xiao Zhi explained: "Each project has different strategic dimensions, such as which protocols you interact with, how your monthly, weekly and daily active users can be maintained, how much your account funds and on-chain funds can reach, your mortgage and loan amounts, etc. These are all uncertain factors." The formulation of strategies needs to be based on experience, which boils down to the management of multiple accounts. Xiao Zhi said: "If one account transfers money to 100 accounts, it will be easily detected and banned." Although it is impossible to hit the target every time, it is very important to formulate a reasonable strategy, and the most important thing is to ensure the strict implementation of the strategy, and the strategy is unchanged. This is like playing Texas Hold'em. Strictly follow the strategy. Even if a certain game is lost and the local optimum is not achieved, it is the overall optimum from the overall and long-term perspective. In the process of contacting the studio, we also found some interesting observations. The currency circle has always been an industry with very serious polarization. Those who do projects are usually elites from the world's top universities, while most of the people who speculate in coins and make money are more like talented people doing market business in the market. English is an extreme point of this polarization. Talented people from grassroots backgrounds, after making money, want respect the most, and don't want to be called "upstarts." Learning English has become a kind of "respectability", and its symbolic meaning is stronger than its practical meaning. Just like the businessmen who came out of the "small county town" in 2000 began to wear suits and go abroad to do business, they are using language and behavior to shape their new identity, seeking higher social recognition and respect.

Today, the wool-pulling studios, like KOLs, are also experiencing the replacement of generations. After making a big profit, some people choose to leave, and new studios take over the old ones and continue to pursue wealth in this market.

"My friend has become financially free after this wave of rubbing, and he is ready to close the studio and retire. I am discussing with him that I will take over, so that the price is the most suitable for both of us." This inheritance after getting rich has also added some special continuity to the wool-pulling industry.

As time goes by, the studios have also begun to form a "brotherly" relationship, forming a wool-pulling alliance and a wool-pulling matrix.

The voice of the Lumao Studio has been continuously improved with this organization and alliance. From the beginning, the Lumao Party was sometimes despised by the project party and the community, and even self-deprecatingly called "black slave losers". Nowadays, the project party actively cooperates with the Lumao Studio, and sometimes the studio even gives suggestions to the project party in return.

These changes are not only superficial. The "voice" of the Lumao Party can now have a huge impact on the entire industry. Their opinions can change the attitude of venture capital (VC), affect the price of the currency, and even influence whether the trading platform will list the currency. This influence comes not only from their number and funds, but also from their gradually accumulated professional knowledge and operational experience in the industry. It can be said that the Lumao Studio has evolved from a simple business model to a highly organized and influential currency industry force today.

For the future of the Lumao industry, many people will also speculate whether it will disappear like the "Hong Kong stock IPO" business because IPOs are no longer profitable.

In fact, as more and more projects fail to meet expectations after issuing coins, the income from airdrops gradually decreases, and the winning rate of studios has begun to decline. The previous article mentioned many profitable studios, but in fact, many studios have long disappeared in the torrent of competition.

The survival time of the wool-pulling industry depends on market trends. The bear market is more like a season of cultivation, and the bull market is a time of harvest. The coin circle industry is still in its early stages, which means that the entire wool-pulling industry may have a longer vitality. However, as competition intensifies, whether or not the "art of wool-pulling" can be found will become the key to success or failure.

The coin circle wool-pulling industry is gradually moving towards the "28 rule", and only 20% of people make money. How to become the 20% that make money is a huge challenge that all wool-pulling people are facing now. For them, this is not just a game about technology and strategy, but also a business field about wisdom and patience.

This article thanks the interviewees: Whale, Xiaozhi, Xianyu, Damon, Qifite, Lambert Lin.

JinseFinance

JinseFinance