Narrative is not a crime Crypto lives on because of narrative

Instead of suffering in the "desert" of faith, it is better to work in the "oasis" of narrative.

JinseFinance

JinseFinance

Article author: Siddhant Kejriwal

Article compilation: Block unicorn

As 2024 approaches, cryptocurrency The sector is making a groundbreaking comeback, with big rewards for those who weather the latest bear market storm. This recovery is more than just a rebound in value; it is a testament to the resilient and evolving nature of the crypto ecosystem. Determined investors, enthusiasts, and innovators are now at the forefront of the revitalized space, witnessing breakthrough ideas being born and cryptocurrency’s potential blossoming into something substantial and innovative The application goes far beyond mere speculative assets.

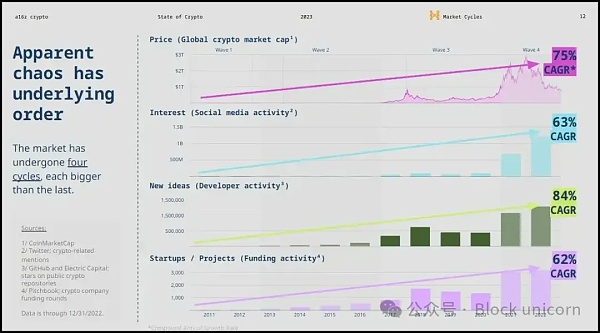

a16z’s Cryptocurrency Report 2023 supports this vibrant resurgence with a compelling infographic that showcases the burgeoning global interest in cryptocurrencies. It’s not just prices that are rising; an influx of new ideas, an increase in startups, and a growing user base have driven a compound annual growth rate (CAGR) of between 63% and 84% since 2012. This strong growth narrative highlights the dynamic evolution of the cryptocurrency industry and its ability to rebound and push the boundaries of what is possible, while ushering in a new era of innovation and opportunity.

This article takes a deep dive into some of the most compelling new stories shaping the cryptocurrency space in 2024. From the transformative potential of decentralized finance (DeFi) to groundbreaking advances in the tokenization of real-world assets, the breadth of innovation is staggering. However, as we explore these frontiers, it is crucial to look at them with caution. Many of these concepts, while promising, are still in their infancy and their practical applications have yet to be fully realized and tested. In addition, the changing regulatory environment creates additional complexities and potential headwinds.

As we begin to explore the top cryptocurrency narratives, we must remain vigilant, recognizing the endless possibilities while also being aware of the uncertainties and challenges ahead .

Liquid Staking Tokens: Reshaping the Staking Dynamic

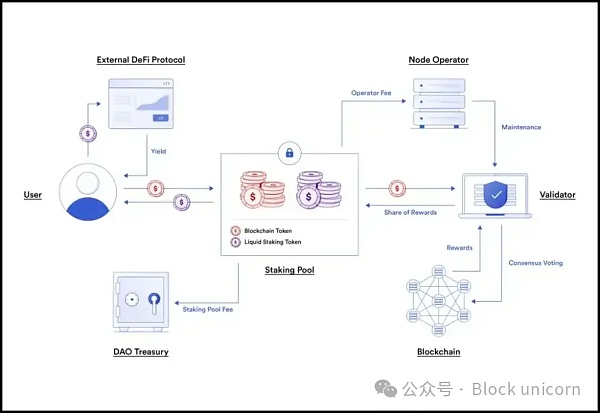

In the traditional staking model, participants lock assets to support network operations and face liquidity constraints as a trade-off for earning rewards. Liquidity staking emerged as a game-changing innovation that solves this fundamental problem by allowing stakers to maintain liquidity while staking their assets. This approach is increasingly in demand as it reconciles the benefits of staking with the flexibility of liquid assets, allowing participants to maximize operational efficiencies and financial opportunities within the blockchain ecosystem.

Chainlink explains liquidity staking mechanism

< strong>Benefits and Risks of Liquidity Staking

Liquidity staking brings several benefits that enhance the staking experience:

Enhanced Liquidity: Pledgers receive liquidity tokens representing their pledged assets, Allowing them to use them in a variety of DeFi applications without giving up staking rewards.

Increase engagement:Liquidity staking encourages wider participation in cybersecurity by lowering barriers to entry and increasing decentralization.

Flexibility and efficiency:

strong>Participants can respond quickly to market changes and use their liquidity tokens for trading and lending, thereby optimizing the utility of their assets.However, these advantages come with associated risks:

Smart contract vulnerabilities: Reliance on smart contracts brings a layer of risk, where flaws or vulnerabilities can lead to the loss of funds .

Market Volatility:The value of liquid tokens may fluctuate, introducing a market risk component that is not typically present in traditional staking.

Complexity and interdependencies: Integrating various DeFi protocols increases complexity and interdependence, potentially exacerbating systemic risks in the blockchain ecosystem.

Famous liquidity propertiesDeposit projects:

Several well-known projects are at the forefront of the liquidity staking movement, having a significant impact on the Web3 landscape:

Lido:As a leader in liquidity staking, Lido provides solutions across multiple blockchains, facilitating Stake without locking assets, enhancing liquidity and participation.

Rocket Pool: Rocket Pool provides a decentralized, trustless staking service for Ethereum, promoting accessibility and network health.

These projects and others are leading the shift to a more fluid, dynamic and inclusive staking environment, fostering a robust Web3 Ecosystem allows participants to participate more freely, safely and profitably. As liquidity staking continues to develop, it is expected to redefine the staking paradigm, providing a powerful combination of security, liquidity and opportunity, in line with the basic principles of decentralization and user empowerment in the blockchain field.

The Red-Staking Revolution: A New Paradigm for Cryptocurrency Yields

The groundbreaking concept known as “restaking” redefines the mechanics of blockchain security and token economics. Re-staking is a complex mechanism, and new blockchain networks entrust their economic security to a strong, professional security layer. This is achieved by accumulating liquid staking tokens and distributing them to the staking layer, ensuring enhanced protection and efficiency.

The "re" in restaking represents layered commitment: resources are initially pledged to secure major protocols such as Ethereum, and then Assigned to another protocol, thus benefiting both layers. This innovative approach simplifies security and fosters a more connected and collaborative blockchain ecosystem.

RequalificationThe impact of staking on the crypto economy

Restaking is a game changer for the crypto economy, especially for emerging layer 1 networks. By eliminating the need for these networks to independently recruit validators and accumulate staking resources, restaking significantly lowers barriers to entry and operational overhead. This model promotes more efficient utilization of resources as staked assets can be leveraged across multiple protocols, thereby enhancing the overall security and vitality of the Web3 space.

Furthermore, the additional revenue stream generated through re-staking will incentivize new participants to join the ecosystem. The influx of stakeholders helps create a more secure, robust, and decentralized Web3 environment, highlighting the transformative potential of restaking.

Ethereum staked on the network | Chart from CryptoQuant

How to participate in re-staking

Participating in re-staking requires a strategic approach and a deep understanding of the underlying platform and mechanisms . Potential participants should first familiarize themselves with platforms like EigenLayer and EtherFi, which are at the forefront of the restaking movement.

General steps include obtaining liquid staking tokens (LSTs) from platforms such as Lido Finance and staking these assets to the re-staking layer of choice. By following this process, individuals and entities can contribute to the security and efficiency of multiple blockchain networks while also leveraging new channels to earn revenue and participate in the digital asset space.

BRC-20 Token: Making Bitcoin Smarter

The BRC-20 token represents a major innovation that brings a new layer of utility to the Bitcoin blockchain. Unlike satoshis, which are the traditional basic unit of Bitcoin, the BRC-20 token introduces a novel concept by burning a JSON file onto a single satoshi. This process is similar to attaching a unique digital annotation to each satoshi, giving them unique properties and identity. These inscriptions can detail a variety of properties, including the token’s name, token symbol, and total supply, turning ordinary satoshis into versatile digital assets.

The serial number inscription is also a BRC-20 token

Overview of the comparison between BRC-20 tokens and ERC-20 tokens

The creation and development of BRC-20 (such as Ordinals) tokens The established ERC-20 standard on the Ethereum blockchain is significantly different. ERC-20 tokens utilize smart contracts to introduce new assets with properties independent of Ethereum, while BRC-20 tokens use an inscription approach. To create a BRC-20 token, a specific amount of Bitcoin must be deposited into the ordinal registry. These deposited Bitcoins will then serve as the backbone of BRC-20 tokens, with the token supply corresponding to the amount deposited.

An interesting aspect of BRC-20 tokens is their operating framework, which allows them to run in parallel with the main Bitcoin blockchain. Therefore, transactions can be verified on the Bitcoin network if they fail to meet predefined inscription conditions, while transactions can be rejected on the BRC-20 protocol.

The advantages of the BRC-20 token include its simplicity and strong security inherited from the Bitcoin blockchain. However, they also have some limitations. Their versatility is limited by the lack of smart contract functionality, and their interoperability with other blockchain systems is relatively limited.

Future prospects of BRC 20 tokens

Looking ahead , the BRC-20 token is expected to usher in a new era for the Bitcoin network. From enabling direct peer-to-peer transfers to facilitating the creation of Bitcoin-based DeFi applications and tokenizing real-world assets such as gold and real estate, BRC-20 could significantly broaden Bitcoin’s use cases, opening new doors for its legendary evolution. chapter.

ERC 7621: Basket of Tokens Standard

ERC -7621 is a new token standard developed by Alvara Protocol It is designed to create and manage on-chain multi-token asset portfolios and investment portfolios. It provides a framework for deploying token basket standards on the Ethereum blockchain. A single BTS token can encapsulate any combination of ERC-20 tokens, similar to mutual funds in traditional finance, thus facilitating on-chain fund management.

Alvara protocol creates a basket of token standards | Image from Alvara Litepaper

Key Features and Innovations

< strong>Basket Token Standard (BTS):A revolutionary approach that allows the creation of tokens containing a variety of underlying ERC20 tokens.

Transferability and Liquidity: By integrating with the ERC721 standard for ownership representation, BTS becomes transferable, thereby enhancing liquidity and management rights.

Fungible BTS LP Token:< These are ERC-7621 LP tokens that represent holdings in a basket and can be used in a variety of DeFi applications, increasing their utility beyond traditional fund holdings.

Dynamic donations and withdrawals:

strong>The protocol allows LP tokens to be minted and destroyed with every donation or withdrawal, consistent with fund dynamics.Management fees and rebalancing:< /strong>ERC-7621 simplifies fund management by automatically allocating management fees and facilitating portfolio adjustments.

Alvara Protocol: Utilizing ERC-7621

The Alvara protocol leverages the ERC-7621 standard to provide a decentralized framework for creating and managing investment funds on the blockchain. Leveraging the Fund Factory and Marketplace, Alvara drives ecosystem participation and governance by enhancing BTS visibility and performance tracking, powered by its native ALVA and veALVA tokens. The protocol democratizes money management, ensuring an accessible and efficient elite environment.

Note: ERC-7621 is an experimental token standard and has not yet been formally proposed as an Ethereum improvement proposal. As such, it has not yet been reviewed by the Ethereum community, so readers planning to explore this new standard must take it seriously.

ERC-404: Semi-fungible tokens

ERC-404 is another experimental token standard independently developed by Pandora Labs. Ethereum supports the ERC-20 standard for creating fungible tokens and the ERC-721 standard for NFTs. Pandora Labs merged these concepts to create semi-fungible tokens, a solution that is very similar to fragmented NFTs.

The idea of semi-fungible tokens has been floating around in Web3 almost since the advent of NFTs. The idea provides for a situation where NFTs need to be jointly owned on-chain. Standard NFT tokens can only have one official owner at a time, while ERC-404 defines a standard that preserves both the “non-fungibility” of NFTs and the liquidity of ERC-20 tokens.

How ERC-404 works:

ERC- 404 Tokens are both divisible and unique. When a newly minted ERC-404 token represents ownership of a virtual asset, the entire unit from a single address will mint the NFT in your wallet. That address can then sell a portion of that token. Once the ERC-404 is split, the protocol destroys the NFT. When an address collects enough portions of a specific ERC-404 token to form a whole again, the protocol re-mints the NFT in the associated address.

Comparison of ERC-404 and other token standards | Picture from Pandora website

The potential of ERC-404 tokens

Pandora’s innovation has many potential applications that could expand the reach of NFTs Practicality. First, one can use fragmented NFTs as a source of liquidity to power liquidity pools, or have a diversified basket of NFTs rather than purchasing entire NFT units individually.

However, users must understand that ERC-404 is experimental and not a standard Ethereum improvement proposal. Pandora is being developed independently and has not yet been reviewed by the Ethereum developer community. As a result, this innovation may be riddled with bugs and vulnerabilities, and may be prone to development bottlenecks.

Universal Data Availability Layer: The Frontier of Modularity

Data availability is crucial as it ensures that sufficient transaction data is accessible during the consensus process. This accessibility is crucial for validators or nodes to verify the validity of transactions in proposed blocks. Data availability is fundamental to maintaining chain liveness, i.e. the network continues to agree on transaction sequences and ensures that invalid transactions are consistently identified and rejected.

However, creating a dedicated data availability (DA) layer is a resource-intensive effort. It requires strong hardware capabilities and staking requirements to ensure robustness and security. To alleviate these challenges, the blockchain industry is witnessing the rise of universal DA layers. These layers provide a shared infrastructure that new or emerging blockchain networks can simply "subscribe" to, thereby alleviating the need for each chain to build its own expensive data availability solution.

Outstanding data availability solution

EigenDA:EigenDA provides a unique approach to data availability by using liquidity staking tokens , thus improving the efficiency of the blockchain network.

Polygon Avail: As part of the Polygon suite, Avail is designed to serve as a powerful and decentralized Data availability layer that supports various blockchain architectures and enhances their performance and security.

Benefits of the Dedicated Data Availability (DA) layer

The emergence of a dedicated DA layer brings various advantages to the blockchain ecosystem:

Reduce the overhead of new chains: By leveraging the existing DA layer, new blockchain projects can significantly reduce their startup and operation cost.

Efficient utilization of resources: The dedicated DA layer optimizes the resource usage of the entire ecosystem and prevents redundancy. and promote eco-friendly blockchain operations.

Enhanced decentralization: With accessible DA services, smaller chains can implement other A level of security and decentralization that cannot be achieved with other methods.

Basics of application chains: These layers facilitate application-specific chains or "app chains ” development, enabling customized blockchain solutions that meet unique needs without compromising data integrity or availability.

Essentially, the dedicated data availability layer is changing the blockchain landscape, providing support for the growth and diversification of the Web3 ecosystem infrastructure. They demonstrate the continued development and maturation of blockchain technology, paving the way for more resilient, scalable and application-centric networks.

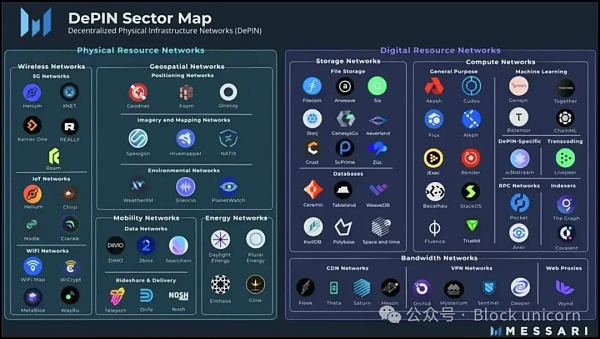

DePIN: Decentralized Physical Infrastructure Network

The Decentralized Physical Infrastructure Network (DePIN) represents a groundbreaking movement in the crypto space, combining blockchain technology with real-world physical infrastructure. The DePIN project leverages the decentralization and tokenization of blockchain to innovate in areas such as data storage, energy and connectivity, changing the way physical services are provided and managed. Notable examples such as The Graph Protocol, Theta Network, and Arweave illustrate the potential of DePIN, demonstrating how blockchain can extend its utility beyond the digital realm to impact tangible, real-world infrastructure.

The Graph Protocol Uses blockchain to index and query network data, effectively Created a decentralized service for information retrieval.

Theta Network Decentralizes video streaming by allocating bandwidth to users, thereby increasing the efficiency of streaming services Quality and coverage.

Arweave provides a novel data storage solution that allows information to be permanently stored on a decentralized network.

These initiatives fully demonstrate how DePIN is redefining infrastructure and leveraging crowdsourced contributions to improve service efficiency and accessibility. .

Advantages of DePIN over traditional systems

With traditional DePIN has many advantages over infrastructure models:

Decentralization: By distributing control and ownership, DePIN ensures that no single entity can monopolize services, fostering a more democratic infrastructure ecosystem.

Transparency:The inherent transparency of blockchain allows all network participants to view and verify transactions and operations process.

Incentives:DePIN uses cryptocurrency rewards to incentivize participation, ensuring the infrastructure is powered by a voluntary community Maintenance and enhancement.

Accessibility: DePIN lowers the barrier to entry and enables a wider range of participants to Contribute to and benefit from physical infrastructure services.

< /p>

< /p>

DePIN’s zoning map | Image from X

Challenges Facing DePIN

Despite its potential, DePIN still faces some challenges: p>

Integrate with physical infrastructure: Integrate digital blockchain systems with Connecting physical infrastructure requires innovative solutions and powerful middleware to ensure seamless operation.

Scalability:As these networks grow, it is critical to ensure they can scale efficiently while maintaining quality of service and network security.

Regulatory Compliance:

strong>Understanding the regulatory environment, especially in areas such as energy and transportation, will be critical to DePIN’s adoption and success.In summary, DePIN is poised to transform physical infrastructure and make it more decentralized, transparent and user-centric. By taking an innovative and collaborative approach to solving relevant challenges, DePIN can have a significant impact on various industries and usher in a new era of blockchain-integrated physical services.

Decentralized Science: Revolutionizing Research and Innovation

Decentralized Science (DeSci) is an innovative movement using blockchain technology to change the landscape of scientific research, collaboration, and publishing. Decentralized science (DeSci) solves several long-standing problems in traditional science, such as inaccessibility of data, lack of transparency in research funding and publishing processes, and the monopoly of knowledge by a few gatekeepers. Leveraging the inherent transparency, immutability, and decentralization properties of blockchain, Decentralized Science (DeSci) promotes open collaboration, democratizes access to scientific data, and simplifies financing mechanisms.

The role of decentralized science (DeSci) in data sharing, research publishing and funding

Decentralized Science (DeSci) revolutionizes data sharing by enabling transparent, immutable records of scientific data, facilitating peer verification, and encouraging collaborative research efforts across borders. Decentralized Science (DeSci) challenges the traditional research publishing model, providing a decentralized platform where research results can be published without excessive control, ensuring that scientific discoveries can be disseminated and recognized faster .

In addition, DeSci has introduced innovative funding models such as Decentralized Autonomous Organizations (DAO), allowing community members to directly fund projects they believe in Invention project. This model speeds up the funding process and democratizes decision-making, aligning research incentives with the interests of the community rather than pandering to the interests of a few.

Famous projects of DeSci

VitaDAO:VitaDAO is focused on funding longevity research. By leveraging blockchain technology, community members can have a say in the research projects they fund, facilitating direct connections between researchers and the public.

Athena DAO: Athena DAO focuses on biomedical research and uses blockchain to promote the field of medical research funding and collaboration to ensure research results are shared broadly and transparently.

Vallet DAO: Vallet DAO is another important player in the DeSci space and aims to decentralize Streamline the funding and publishing process for scientific research, making it more accessible and efficient.

In short, DeSci will redefine scientific research and publishing paradigms, break down barriers to information access, and ensure more greater transparency and promote more inclusive, collaborative approaches to scientific inquiry. Through projects like VitaDAO, Athena DAO, and Vallet DAO, decentralized science (DeSci) is not just a concept, but an evolving reality with the potential to have a significant impact on how scientific research is conducted and shared around the world.

Tokenized Real World Assets (RWA)

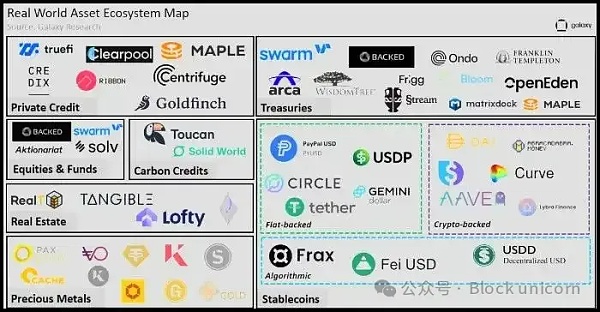

Tokenization of Real World Assets (RWA) is an emerging niche in the cryptocurrency space in 2024, gaining momentum due to its innovative approach of blending the physical and digital realms. RWA is a blockchain token that represents ownership or equity in physical and traditional financial assets. The industry is expanding rapidly, with various projects tokenizing a range of assets including cash, commodities, real estate, and more, thereby bringing these assets to the blockchain to enhance liquidity, accessibility, and efficiency.

How asset tokenization works

Asset Tokens ization involves converting the rights to an asset into digital tokens on the blockchain. The process begins by validating and valuing the asset, then creating a digital representation (i.e. a token) that reflects ownership or the asset’s value proposition. These tokens can then be bought, sold or traded on digital platforms, allowing for fractional ownership and wider access to investment opportunities that were previously inaccessible due to high barriers to entry or lack of liquidity.

RWA Industry | Picture from Galaxy Digital

Benefits of RWA

Accessibility & Inclusion:Tokenization democratizes access to investment opportunities, allowing more people to invest in high-value assets through fractional ownership.

Liquidity: Tokenizing real-world assets can enhance their liquidity, thereby making Trading these assets becomes easier without the need for traditional intermediaries.

Transparency and Efficiency:Blockchain technology ensures transparency with a clear understanding of the ownership and ownership of assets. transaction history, thereby reducing fraud and speeding up transactions.

Risks of RWA

Regulatory Uncertainty: The tokenization of real-world assets navigates a complex regulatory environment where clarity and compliance Still evolving.

Market Risk:The value of a token may fluctuate, affected by the performance of the underlying asset and the broader Impact of crypto market dynamics.

Operational Risk: The process involves various stakeholders, including legal entities, custodians and A token issuer whose operational integrity is critical to the tokenization and ongoing management of the asset.

Project construction of RWA section

ONDO:ONDO focuses on democratizing financial assets and providing an access to real-world assets through blockchain technology. A platform for segmentation and investment of diversified portfolios.

Polymesh: Polymesh is a blockchain designed for regulated assets to facilitate compliance It provides a framework for issuing and managing securities on the blockchain.

MANTRA: MANTRA operates in the DeFi space, extending its offerings to tokens for real-world assets ization, aiming to bridge the gap between traditional finance and DeFi.

In summary, the tokenization of real-world assets represents a major leap in the integration of the physical and digital worlds, providing countless benefits, but also brings unique challenges.

Summary

When we look at the future of cryptocurrency in 2024 When looking at the dynamics of the landscape, it's clear that we can clearly see that the industry isn't just rebounding; it's evolving, diversifying, and maturing. Underlying this renaissance is a wave of innovation that expands the boundaries of possibility in the blockchain and crypto space. From liquidity-enhancing mechanisms for liquid staking tokens to groundbreaking integration of blockchain with the physical world through a network of decentralized physical infrastructure, each narrative we explore marks a move toward a more connected, efficient, and trustworthy world. A step forward for the digital future of access.

The emergence of tokenized real-world assets heralds a new era of integration of traditional asset markets and blockchain technology, providing unprecedented investment and asset management opportunities. At the same time, decentralized science (DeSci) promises to revolutionize the foundations of scientific research and publishing, fostering a more collaborative, transparent, and inclusive global research community.

However, as we marvel at these advances, it is crucial to view this new frontier with a balanced perspective. Many of these innovations are in their nascent stage, meaning they are still being tested against the challenges of real-world application and market acceptance. In addition, the regulatory environment continues to evolve, creating potential challenges and shaping the trajectory of these emerging industries.

The cryptocurrency environment of 2024 is a testament to the resilience and relentless innovation of the blockchain community. As we embark on this promising but unpredictable journey, staying informed, adaptable and insightful will be key to leveraging the opportunities and navigating the challenges of this new digital era.

The future of cryptocurrency is unfolding before us, full of potential and possibilities waiting for us to seize.

In the currency circle, you must learn to look at the general trend and the progress of the entire market. Only by being clear and clear about each current stage , in order to better grasp the subsequent entry opportunities! Learn more about the industry, no threshold, no fees, no promotion of exchanges, no recommendation links , For the latest news in the circle, please follow me and check out my homepagethe QR code of the official account! ! !

Instead of suffering in the "desert" of faith, it is better to work in the "oasis" of narrative.

JinseFinance

JinseFinanceIn the third quarter of 2024, the cryptocurrency market experienced significant fluctuations due to macroeconomic factors, with a significant decline in early August. So, what is the situation in the exchange market? Let’s find out together.

JinseFinance

JinseFinancea16z CSX invests at least $500,000 in each company that is accepted.

JinseFinance

JinseFinanceIn Q2 2024, the overall Crypto market showed a volatile downward trend, and the price of Bitcoin also hit a low of $55,000. So, what is the situation of the exchange market?

JinseFinance

JinseFinanceTokenInsight selected 9 centralized exchanges that are influential in the Crypto industry and conducted a comprehensive comparison across three key dimensions: products, transactions, and user experience.

JinseFinance

JinseFinanceMemecoin is the most profitable cryptocurrency so far in Q1 2024, with the highest average return among the top coins at 1,312.6%.

JinseFinance

JinseFinanceNFT, project, let’s talk about the “IP narrative” of PFP NFT: Tired of hearing it, too many failures = worthless, wrong path? Golden Finance, the excessive pursuit of NFT “narrative” is destroying the industry

JinseFinance

JinseFinanceAs 2024 approaches, we will enter a new era in cryptocurrency and blockchain.

JinseFinance

JinseFinanceParallel EVM is a way to make the Ethereum network faster and more efficient by running multiple transactions simultaneously.

JinseFinance

JinseFinanceVanEck advisor Gabor Gurbacs highlights the evolving narrative in the blockchain industry in 2024, emphasizing the underestimated potential of crypto, shifting from generic blockchain discussions to impactful efforts.

Huang Bo

Huang Bo