Previously, the US market was mired in the tensions of interest rate cut expectations, a soft or hard landing for the US economy, Q3 earnings reports, and the repo season. The temporary absence of economic and employment data during the US government shutdown left the market feeling vulnerable amidst its continuous climb to new heights. This week, the US-China tariff war, which had been simmering for months, suddenly resurfaced, instantly becoming the most significant factor, disrupting the established rhythm of almost every trading market. As a result, BTC, which had reached a record high on October 6th, experienced another correction, falling as much as 15.28% from its peak. Beyond BTC, the altcoin market, due to near-exhaustion of liquidity and the emergence of black swan events, experienced a shocking single-day "waterfall" drop of 30%. Over 1.6 million positions in the crypto futures market were liquidated, resulting in a historic liquidation exceeding $10 billion.

After half a year, the US-China tariff war has once again become the core market factor determining the trend of BTC and the crypto market; as the cycle is coming to an end, the liquidity dilemma within the crypto market is also plaguing the market.

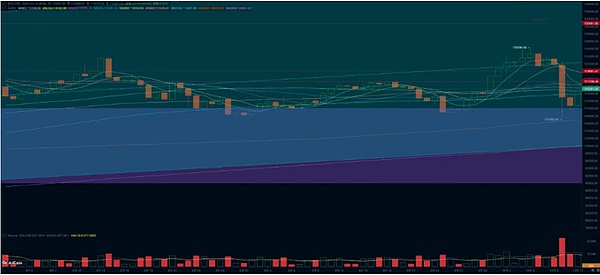

BTC Daily Chart

Policies, Macro-Financial and Economic Data

In the first half of the year, the United States declared war on the world with reciprocal tariffs. After several months, the agreement ended with the signing of agreements by various countries. However, an agreement with China, its most important trading partner, has yet to be signed. Since then, delegations from both sides have met several times, but no real progress has been made. As October began, this unfavorable situation quickly escalated into a back-and-forth of targeted sanctions. On October 9th, China's Ministry of Commerce tightened exports of rare earth and magnetic materials, announcing expanded export restrictions on these materials, affecting key products in the military and high-tech supply chains. This move was seen as a hedge against long-standing US export controls and the "Entity List," and would directly impact key industrial chains in the US and its allies. On October 10th, Trump announced via social media that he would impose a 100% tariff on all Chinese imports starting November 1st (or earlier) and hinted at new export restrictions on key software and technology. He also emphasized that a meeting with China was still possible, but "depending on China's response." The market viewed this as a "risk of a new round of escalation in the trade war." After the Chinese measures were announced on the 9th, A-shares rose, while Hong Kong stocks fell. The Nasdaq fell slightly after reaching a record high. Before Trump announced the 100% tariff increase on the 10th, A-shares fell and Hong Kong stocks plummeted. Following the announcement, the Nasdaq, which had hit a new all-time high, began a sharp decline, ultimately plummeting 3.56% below its 30-day moving average, its largest single-day drop since June. BTC experienced a waterfall trend, with an amplitude of 12.87 points and a sharp drop of 7.18%. The renewed conflict has sent the market into a risk-off mode. The US dollar index closed down 0.57% to 98.843. Short-term and long-term US Treasury yields plummeted by 1.89% and over 2%, respectively. London gold rose 1.02%, returning to the $4,000 mark. The renewed US-China tariff conflict has reshaped the dynamics of many markets. Later, Trump stated in a television interview that the November 1st implementation date would allow time for negotiations, and he also stated that he would continue his trip to South Korea (for the APEC summit), but whether he would meet with China would depend on the circumstances. On the 12th, a spokesperson for China's Ministry of Commerce stated that China's export controls do not constitute a ban, and that applications that meet the requirements will be approved. Before the measures were announced, China had informed all relevant countries and regions through the bilateral export control dialogue mechanism. China is willing to strengthen dialogue and exchanges on export controls with all countries to better safeguard the security and stability of the global industrial and supply chains. Media outlets believe that while both sides are implementing concrete measures, they are also sending signals of easing tensions, and that their actions can be seen as an attempt to "use force to promote negotiations." This is because previous negotiations between the two sides had indeed been difficult. Based on current market data and information, market risks have not yet accumulated to the point of a major correction. However, if the conflict escalates, the probability of a medium-sized correction in markets such as the US stock market will increase. As for BTC, we believe the downward adjustment in risk appetite triggered by the tariff conflict has been initially completed during the sharp drop. BTC, especially altcoins, has reacted far more strongly than other markets. This is not only due to BTC's inherent high-risk nature, but also because BTC is currently nearing the top of its previous cycle, a crucial "curse period" that has already created a mix of selling pressure and uncertainty in the market. In our September monthly report, we noted that based on past cyclical patterns, BTC prices would peak in the fourth quarter. In this cycle, with retail investors retreating, only two major sellers remain: the BTC Spot ETF channel and DATs. Long-term investors continue to sell heavily, significantly absorbing market liquidity. This week, long-term investors sold over 11,926 BTC, while short-term investors sold 176,648 at a loss, marking two consecutive weeks of high selling levels. After two consecutive weeks of significant outflows, outflows from centralized exchanges slowed significantly this week, forcing BTC prices to seek equilibrium downward. Regarding buying power, the BTC Spot ETF channel maintained a healthy inflow (though still lower than last week) over the first four trading days, but saw outflows on Friday. In short, the current market presents a persistent threat of selling pressure coupled with insufficient buying power, a typical pre-cyclical peak scenario and warrants high vigilance. Furthermore, the fragility of the crypto futures market's internal structure also played a significant role in the overreaction. After BTC prices hit a new high on the 6th, open interest reached a record high of over $94 billion. The sharp price drop triggered a series of long position liquidations, exacerbating the decline.

Bulls were slaughtered, and the size of BTC open interest fell by nearly US$25 billion.

In addition, the USDe launched by the stablecoin project Ethena deviated from the USDT anchor on Binance by more than 35%, triggering the liquidation of market makers using USDe, causing the prices of many Altcoins to plummet by more than 30% in a short period of time. According to media reports, over 1.6 million accounts were liquidated that day, resulting in losses exceeding $19 billion. October 10th was arguably the single largest day of losses in the history of the crypto futures market. Technical indicators show that BTC prices stabilized above the 200-day bull-bear line at the end of the weekend, remaining above the upper limit of the "Trump bottom" (US$90,000-110,000). Following the intense trading on Friday and Saturday, trading volume returned to normal levels over the weekend. We believe that pricing in the US-China trade conflict has been initially completed, and further escalation is uncertain. However, the risks in the US may not have been fully resolved, which may hinder funding for BTC ETFs. However, we should not be overly pessimistic. Market risks have been fully resolved, and the US-China trade war is likely to return to a more rational state, with its impact expected to be far less than in April. Whether the medium-term trend can reach new highs depends primarily on whether the US-China trade conflict, the US stock market's performance, and whether capital inflows driven by long-term investors can be slowed. Cycle Metrics: According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, indicating a peak.

Anais

Anais