Author: Digital Asset Research Source: substack Translation: Shan Ouba, Golden Finance

"What is the difference between a hero and a coward? There is no difference. They both feel the same fear inside. What the hero does makes him a hero" - Cus D'Amato

The above is a famous quote from the late great boxing coach Cus D'Amato, who is famous for training Mike Tyson. Cus was known as the Master of Fear. He taught his boxers to be the best friend of fear and made them understand that it is a normal and healthy part of life. If we don't have any fear, we will die. Everyone feels fear, but the difference lies in how we deal with it.

I have always believed that the psychological qualities required to be a high-level fighter are almost the same as those required to be a high-level trader. Everyone knows the old saying on Wall Street: "Buy when there is blood flowing." But what they don't tell you is that it's actually very difficult to do this, even if you're an elite investor. They would have you think that the professionals have no emotions and can trade at any time. The truth is, as Cus says, they feel fear just like the rest of the market participants, but it's what they do that matters.

There are a lot of fears running rampant in the markets right now. Whether it's World War III, riots, elections, an impending recession, or something else, tensions are certainly feeling high. All of these external factors make up a lot of scenarios we might be worried about. However, we have to remember that it's true that 90% of the things we worry about will never come true.

Remember the threat of World War III in 2022? Or the banking crisis trough in March 2023? How about the talk of a recession that continued throughout 2023 and much of 2024? How about the Israel-Hamas conflict that led to the trough in October 2023? Or the threat of an Iranian attack on Israel on April 13th and 14th?

I am not saying there are no problems in the world, but as far as I know, the market has not crashed in response to any so-called "doomsday" event. In fact, all of these events have caused mini-panics, which gives us a buying opportunity.

Fear and Greed

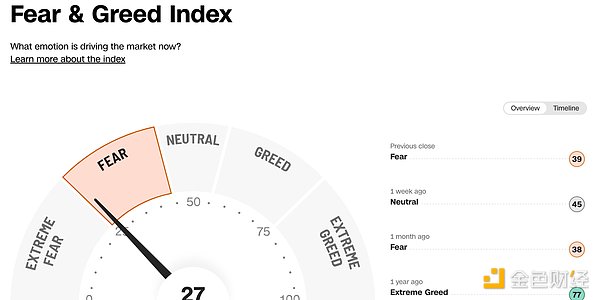

For a market that has just come out of its historical highs, there is overwhelming panic in the market. Whether it is the stock market or the cryptocurrency market, the index readings are close to extreme panic.

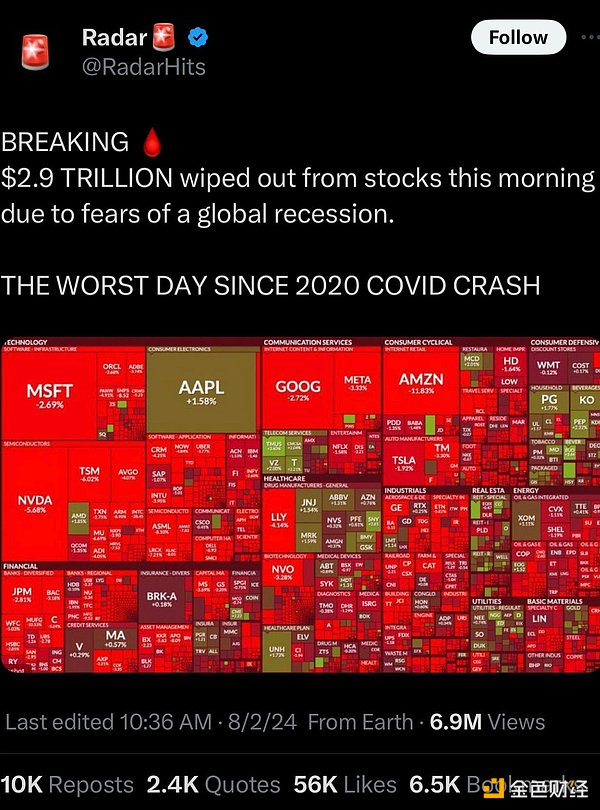

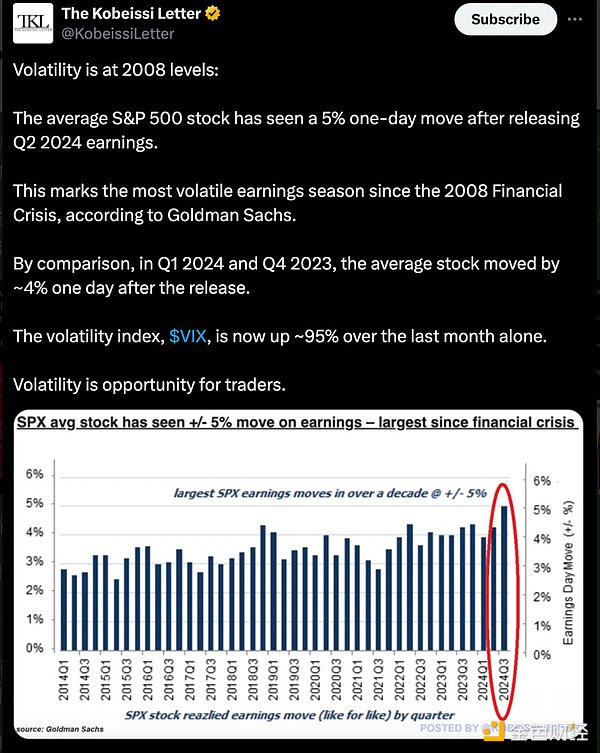

I have lost count of how many posts I have seen that talk about market statistics that have historically indicated great buying opportunities. Please see the pictures below, only a few of which I shared.

Worst day since the pandemic crash? Volatility at levels not seen since the regional banking crisis of 2023? Most volatile earnings season since 2008?

To me, this sounds like total panic, but if we look at the charts and the cycles, we see that prices are just below all-time highs. That doesn't seem to make sense.

Everyone gets scared at times like this, but we have our jobs backing us up then. All the analysis we did when those emotions weren't there told us to look for a major August low. Now that we're here and everyone is panicking, we're not going to throw all that out the window. That's the foundation that allows us to see the facts when others are panicking.

I have been going back and forth through the cycles trying to figure out where we could be wrong or wrong but I can't seem to make the case for a total meltdown here. Let's look at the charts to see what I mean.

Stocks

I'll try to keep this relatively simple. If it ain't broke don't fix it. That's what our 60 year cycle is telling us. It has worked well all year and we'll continue to track it.

August 5th, today, is the day 60 years ago when the market made a new low after a 50% retracement. I have been saying since the 17th that this correction has more room to go down. Even after the historic 6% or 7% gains, I wrote to premium subscribers and told them that this market would make a new low. On Friday, the market did make a new low.

However, now we are at the stage where time is running out to panic. Here is the plan I laid out in last week’s Market Outlook and how it actually played out.

This is a very typical correction window for the stock market in an election year. That is, a rebound is possible in September and further declines are possible in October. But we'll talk about that then. For now, I at least expect the stock market to start to bottom. It may not fully cooperate until later this month, so don't go all long, but what I mean is to start looking for our typical bottom signals. Reversal candles, bullish RSI reversals, 3-day reversals, etc. Let the market tell us that a bottom has been formed.

This is the weekly view since the same period last year. This is the third three-week correction that has caused us to fall 6%. As you can see, what I am saying is that it remains to be seen how strong the rebound from here is. This will determine whether this is the low or whether we will experience a longer correction in October like we did a year ago.

Finally, the dates I want to focus on here are August 8th, which is a Gann natural date. Then there is August 16th, which is 120 degrees from the April low (the lowest low this year).

Bitcoin

Bitcoin is firing on all cylinders trying to catch everyone offside. Fortunately, we have been looking at this moment as a buying opportunity since the beginning of May. I have had a plan in place for weeks.

As I said, when things start to get messy, we have to stick to the plans we have in place and not get emotional. While this is a very hard move, I will tell you why I believe this will mark a major cycle low for BTC.

These daily time dates by degree have always been strong indicators of trend changes, and when we have so many time dates clustered together, it can be a strong signal. When you pair this with the higher timeframes we listed in our previous report, you get a major change in trend. In this case, we have the 90 week and 20 month windows combined with our daily timeframe analysis.

The dates to watch this week are specifically around the 6-9th. Remember, the Gann Natural Date is also in there, August 8th.

Conclusion

These environments are not easy, but the best have learned how to thrive in this fear. We have predicted every major low in this market so far, and I believe time and our analysis will prove correct once again. Remember, we have been planning for this low for over 3 months, and now is the time to step up and execute. I am not telling you to be a hero and do something extremely risky, I am telling you to ignore the 95% of participants who are always on the wrong side of a trade.

As for the specifics, I think even with a low this week, it will be hard for stocks to find their footing in the coming weeks. The same goes for crypto. I expect the likelihood of a major low to be confirmed in the coming days, but markets generally take some time to sort out after such a big drop. We will then have strong seasonality coming into October. I believe that in 3 months we will look back at these prices in crypto and think it was an absolute steal. Moments like these can make or break your entire year, so learn to let fear be your best friend.

YouQuan

YouQuan

YouQuan

YouQuan YouQuan

YouQuan Brian

Brian Joy

Joy Joy

Joy Brian

Brian Jixu

Jixu Jixu

Jixu Jixu

Jixu Jixu

Jixu