Author: [email protected]

In February, the cryptocurrency market showed strong upward momentum, mainly due to Bitcoin and Ethereum The value surged by more than 45%. This optimism has also affected other coins, with the top ten coins all seeing over 25% growth in value.

Remarkable progress has been made in the field of blockchain data storage, and at the same time, there are many sub-fields in the blockchain field, such as AI, DePin, Web3 games and Meme. The trend of rotation is obvious, especially in the DeFi sector, where projects represented by Uniswap and EigenLayer are leading the innovation in the industry.

In addition, Ethereum’s Layer 2 solutions, including Blast and Starknet, as well as the Bitcoin Layer 2 ecosystem led by Merlin Chain, have made breakthroughs .

The data in this report comes from the public chain research page of Footprint Analytics. This page provides an easy-to-use dashboard containing the most critical statistics and indicators for understanding the public chain field, updated in real time.

Crypto market overview

The significant rise in the cryptocurrency market in February was due to multiple factors factors combined. Among them, the U.S. Spot Bitcoin ETF attracted a whopping $6 billion in capital inflows in February, a figure that highlights investors’ strong confidence in cryptocurrencies as an effective store of value. In addition, market expectations for the Ethereum Cancun upgrade in March and the Bitcoin halving event in April have further pushed prices higher. Together, these factors have provided strong support for the rise in the cryptocurrency market.

However, broader market dynamics, such as inflation concerns and Federal Reserve policy, may pose challenges to continued growth. The increase in inflation in February means that the expected interest rate cut in the United States may be postponed until later this year or even later, which undoubtedly creates uncertainty for the continued growth of the cryptocurrency market.

Overview of public chains

As February comes to an end, the development of public chain cryptocurrencies The total market value soared to US$1.9 trillion, an increase of 42% compared to January. In this wave of growth, Bitcoin, Ethereum, BNB chain and Solana have undoubtedly played a leading role, with their market shares reaching 64.0%, 21.4%, 3.3% and 3.0% respectively.

Data source: Public chain token market value share - Footprint Analytics

Bitcoin and Ethereum both showed significant showing growth trend. Among them, Bitcoin rose strongly, rising by as much as 46.5%, closing at $62,404 at the end of the month, breaking the $60,000 mark for the first time since the fourth quarter of 2021, and only 9% away from its all-time high. Ethereum performed even more impressively, slightly outperforming Bitcoin with a gain of 48.1%, closing at $3,383 at the end of the month.

Data source: Bitcoin and Ethereum prices - Footprint Analytics

In Bitcoin and Ethereum token values Led by growth of more than 45%, other tokens also showed strong performance. The average value of the top ten coins increased by more than 25%. In addition, Arweave (AR) saw a particularly significant increase of 205.8%, while Stacks (STX) and Filecoin (FIL) also achieved increases of 88.3% and 57.1% respectively.

Data source: Market value and price of public chain tokens - Footprint Analytics

Over the past month, significant progress has been made in the field of blockchain data storage. On February 14, the distributed data storage solution Arweave officially launched Arweave AO and plans to launch a test network by February 27. Arweave AO will improve the scalability of the blockchain through a modular architecture, thereby promoting higher transaction throughput and parallel processing capabilities.

In addition, the distributed storage network Filecoin announced the completion of integration with Solana on February 16. The partnership aims to increase the accessibility of Solana’s historical data using Filecoin’s infrastructure.

In terms of TVL, the public chain industry ended February at $97.7 billion. Among them, Bitcoin’s TVL soared to $2.05 billion, a 600% increase from January. This significant growth is mainly due to the advancement of Bitcoin Layer 2 technology and the boom in staking activity, especially the Merlin's Seal project.

Data source: Public chain TVL - Footprint Analytics

In February, the blockchain industry showed a strong upward trend, with sections such as AI, DePin, Web3 games, Meme and DeFi rotating. The DeFi sector has finally made a strong recovery, with projects such as Uniswap and EigenLayer performing well.

On February 23, the Uniswap Foundation proposed a proposal to adjust its fee mechanism to support UNI token holders, which is called a "fee switch" Although the move was somewhat controversial, it still triggered a positive response from the market, boosted the value of UNI tokens, and boosted the overall performance of the DeFi industry.

In addition, the Ethereum project EigenLayer has attracted much attention for introducing a re-staking function and received a US$100 million investment from a16z Crypto. This capital infusion helped EigenLayer’s TVL jump to over $10 billion, placing it among the top three DeFi projects.

Layer 2

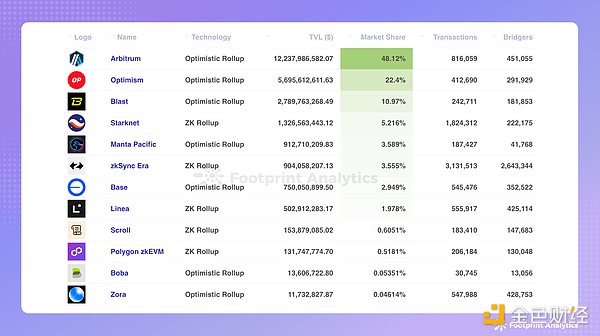

As the cryptocurrency market booms and expectations for a potential Ethereum ETF , the TVL of Ethereum Layer 2 solutions has achieved significant growth. Among them, Arbitrum and Optimism continued to lead, with their TVL increasing by 31.1% and 22.1% respectively.

Blast's TVL also saw impressive growth, surging 106.4% to $2.8 billion. The platform’s Big Bang dApp competition was a huge success, significantly boosting network activity and prompting some dApps to migrate to Blast from other blockchains. Additionally, Blast has confirmed that its mainnet will be officially launched on March 1st.

Starknet has launched its Provisions Program, the largest token airdrop in the crypto space to date, giving the network a huge boost and bringing it to TVL increased by nearly 900%.

Data source: Ethereum Layer 2 Overview - Footprint Analytics< /span>

The Bitcoin Layer 2 ecosystem cannot be ignored. In February, Merlin Chain’s rapid expansion successfully pushed Bitcoin’s DeFi TVL past the $2 billion mark. This significant growth is largely driven by the popularity of Merlin Chain’s fair launch event, Merlin’s Seal. At the same time, Lightning Network, Stacks and Rootstock are also emerging as Bitcoin Layer 2 solutions.

In addition, a new wave of projects are making significant progress within Bitcoin's Layer 2 space, all of which emphasize compatibility with EVM smart contracts. This development trend will greatly expand the use of Bitcoin, making it no longer limited to payment functions. Projects like Conflux, Bitfinity, and Botanix are leading this change, working to diversify applications and functionality on the Bitcoin network.

Blockchain games

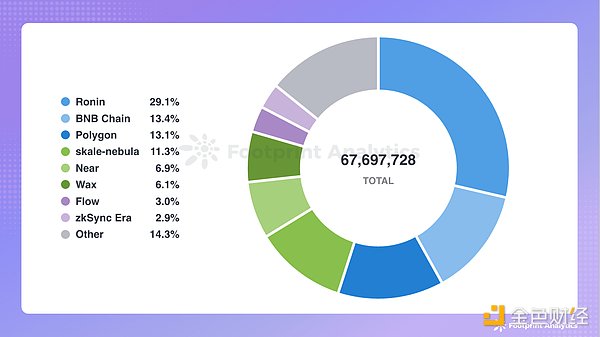

The February game rankings show that Ronin, BNB chain and Polygon performed well in terms of user activity, occupying 29.1%, 13.4% and 13.1% of the market share respectively. In terms of transaction volume, Ethereum, BNB chain and Ronin are at the forefront, showing strong market performance.

Data source: Proportion of active game players on the public chain - Footprint Analytics

Public chains are seizing growth opportunities through in-depth cooperation with content creators. Facing local regulatory challenges, South Korea's Web3 game developers are actively looking to the global market to find broader development space for their blockchain games. As a leader in this trend, Oasys not only provides Layer 1 networks, but also launches Layer 2 networks based on Ethereum to provide game developers with diversified technical support. Recently, Oasys announced a strategic cooperation with Com2uS, a well-known Korean game developer, and later joined forces with Metabora SG, the Web3 game division of Korean Internet giant Kakao.

In addition, expanding the ecosystem through mutual growth between games and blockchain platforms is another measure for public chains to gain growth. Web3 game pixels will be migrated from Polygon to Ronin at the end of October 2023, taking full advantage of Ronin's excellent interoperability and marketing support. This shift has significantly increased the game’s popularity and on-chain activity. In February alone, Pixels achieved more than 1.5 million on-chain interactions and approached the 1 million user milestone. This growth trend has undoubtedly had a positive impact on Ronin as well, highlighting the mutual benefits brought about by the cooperation between the two parties.

NFT

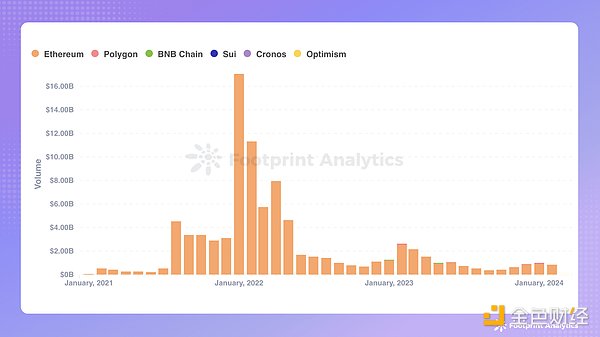

In February, Ethereum continued to hold the top spot in the NFT market , its trading volume reached US$810 million, accounting for 97.1% of the entire market trading volume. Although this number is down from January, Ethereum’s market share has increased slightly. At the same time, Polygon's performance was not satisfactory. Its trading volume fell sharply to $20.4 million from $110 million in January, and its market share shrank sharply from 10.4% to 2.4%.

Data source: Public chain monthly NFT transaction volume - Footprint Analytics

The number of unique users of Ethereum (i.e. the number of wallets) dropped from 163,000 in January to 150,000 in February. Despite this, its The market share increased from 42.7% to 46.9%. Polygon's user base also declined, falling to 129,000, causing its market share to drop to 40.4%. At the same time, the BNB chain’s market share grew modestly by 9.7%, with its number of users reaching 31,000.

Public chain investment and financing situation

In February, a total of 11 incidents occurred in the public chain industry financing event, successfully raising US$150 million. Compared with January, both the number and scale of investments showed significant growth.

Public chain financing events in February 2024

In the Layer 1 field, Flare is led by Kenetic and Aves Lair. Received US$35 million in private equity funding. Flare positions itself as a data-centric network focused on promoting the development of smart contract protocols and pricing oracles.

In the field of Ethereum Layer 2, Karak performed particularly well, with its Series A financing amounting to US$48 million, becoming the largest financing event of the month. Karak launches a cutting-edge risk management framework for blockchain, Web3, and the global financial ecosystem. Additionally, Ethereum Layer 2 solutions like AltLayer and LightLink have also successfully received funding.

This momentum also extends to Bitcoin Layer 2 platforms, with QED Protocol, Citrea and Merlin Chain all receiving new investments in February. This shows the market’s growing interest in Bitcoin scaling solutions.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld Coinlive

Coinlive  Coindesk

Coindesk Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph