Summary

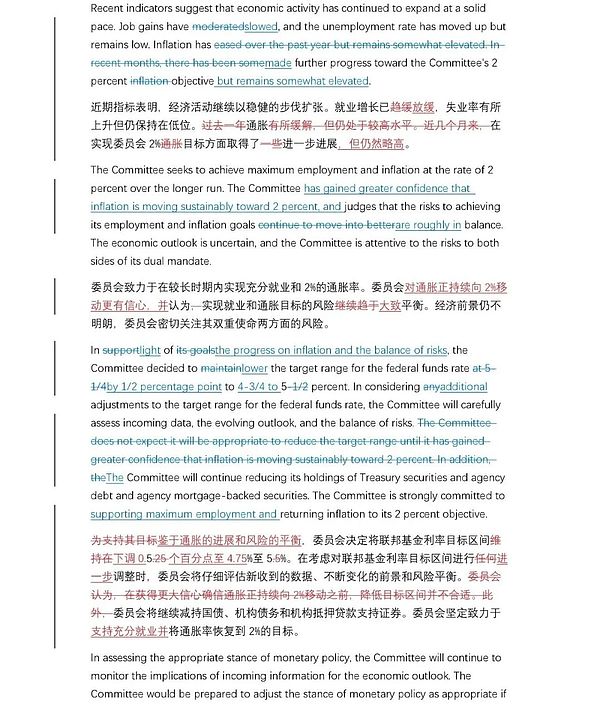

At this meeting, the Fed cut interest rates for the first time to start a new cycle, with a range of 50 basis points to 4.75%-5.0%.

The wording of the meeting statement has changed significantly, emphasizing that it has gained greater confidence in the continued decline in inflation to 2%.

Regarding the job market, the statement pointed out that employment growth has "slowed" and the unemployment rate has risen but remains low.

Regarding the risk management stance, the statement announced that the risks of achieving the dual goals of employment and inflation are "roughly in balance".

The committee is firmly committed to adding "supporting maximum employment" and listing it alongside "restoring inflation to the 2% target," and bringing the employment target forward.

For the first time since September 2005, there was a dissenting vote in the FOMC interest rate decision: Michelle W. Bowman, who favored a 25 basis point cut at this meeting.

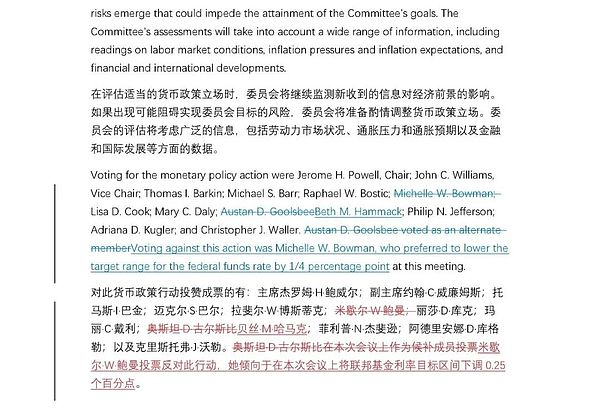

The main change in the economic forecast is reflected in the upward revision of the unemployment rate forecast, which is expected to remain unchanged at 4.4% in 2024 and 2025 (4.0% and 4.2% respectively in June), and 4.3% in 2026 (4.1% in June), reflecting that the new information provided by QCEW has been digested. Inflation forecasts were slightly lowered, with core PCE expected to be 2.6% in 2024 (2.8% in June), 2.2% in 2025 (2.3% in June), and unchanged at 2.0% in 2026.

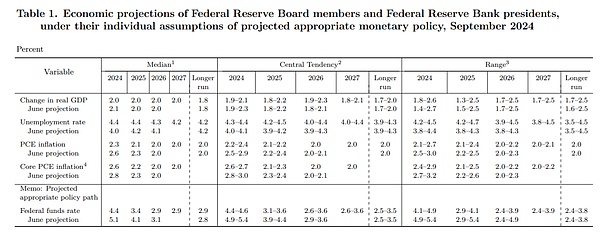

Most of the interest rate dot plots predict that there is still room for a 50 basis point rate cut this year. Considering the remaining two meetings in 2024, November 6-7 and December 17-18 (including dot plots and economic forecasts), it reflects that the Fed's decision this time is a pre-emptive rate cut.

At the press conference, Powell sent out a more significant hawkish signal, repeatedly emphasizing that the committee is "in no rush" and will gradually "recalibrate" the Fed's monetary policy stance.

As the market digested the Fed's meeting statement and Powell's press conference information, the three major U.S. stock indexes all gave up their intraday gains and eventually closed slightly lower; U.S. Treasury yields rose (bearish steep); the U.S. dollar index bottomed out and rebounded. Gold prices hit a record high and then plummeted, with an intraday range of more than $50.

Original statement

Wording deleted from the June statement is in blue with a strikethrough

Wording added in the September statement is in blue with an underline

Red text is the corresponding Chinese translation

Dot plot and economic forecast

No more rate cuts this year (2 digits)

Another 25bps cut this year (7 digits) vs. another 50bps cut this year (9 digits)

Another 75bps cut this year (1 digit)

Conference highlights

With inflation declining and the labor market cooling, upside risks to inflation have diminished and downside risks to employment have increased. We now view the risks to achieving our employment and inflation goals as roughly balanced, and we closely monitor risks to both ends of the dual mandate.

We do not have a preset path and will continue to make decisions on a meeting by meeting basis.

Q&A Session

CNBC: What has changed that led the committee to choose to cut by 50bps? Will there be another 50bps rate cut next? How should the market judge?

A: We have received a lot of data since the last meeting. We received two employment reports for July and August. We also received two inflation reports, one of which was released during the quiet period. We also received the Quarterly Census of Employment and Wages (QCEW), which showed that the non-farm payrolls data we already had may be false and will be revised down in the future, which everyone knows. We also saw anecdotal data, including the Beige Book. We collected all this data, entered the quiet period, and thought about what actions to take. We concluded that (pre-emptive rate cuts) was the right thing to do for the US economy and the people we serve, and we made a decision on this.

A good starting point for judging the pace of subsequent rate cuts is the economic forecast (SEP). We will make decisions meeting by meeting based on new data, the changing economic outlook, and the balance of risks. If you look at the SEP, it's a process of recalibrating our policy stance from where it was a year ago when inflation was high and unemployment was low to a stance that is more consistent with where we are today and where we expect to achieve our goals. That recalibration will be gradual. There is nothing in the SEP to suggest that the Committee is in a "no rush." That recalibration will evolve over time.

Of course, the SEP is a forecast, a baseline forecast. I talked about in my remarks that the actions we actually take will depend on the direction the economy evolves. We can speed up, we can slow down, we can pause, it's all "if appropriate," but that's what we're thinking about. Again, I encourage you to think of this SEP as just an assessment of the Committee's thinking today, but the thinking of each member of the Committee is based on the assumption that their forecasts will be realized.

AP: The SEP shows that the federal funds rate will remain above the long-term neutral rate estimate by the end of next year. Does this reflect that the interest rate level is restrictive? Does this threaten continued weakness in the job market, or does it mean that people think the short-term neutral rate is too high?

A: In the baseline case, we expect to continue to remove restrictive policies and watch how the economy responds to them. Looking back, the policy stance we took in July 2023 was based on an unemployment rate of 3.5% and an inflation rate of 4.2%. Today, the unemployment rate has risen to 4.2% and the inflation rate has fallen to just above 2%.

Now is the time to recalibrate our policy stance to make it more consistent with the progress made in inflation and employment toward more sustainable levels. The balance of risks is now even. The direction of the adjustment process is to move towards the neutral rate, and the speed of our pace will be determined in real time.

Reuters: For the first time since 2005, a member voted against it. Was the decision of 25bps vs. 50bps very entangled? Will the pace set this time guide each subsequent meeting until next year?

A: The decision made by the committee vote has broad support.

We will make decisions meeting by meeting. The committee is not in a hurry. We have made a good start, and frankly, it is really a sign of our confidence. We are confident that inflation will continue to fall to 2%. To me, the logic (of the front-end rate cut) is clear from an economic perspective and a risk management perspective. We will proceed cautiously from meeting to meeting and make decisions in real time.

New York Times: SEP shows that the unemployment rate will remain at 4.4% after climbing to that level, but historical experience shows that once the unemployment rate rises for a period of time, it will not stop midway, but continue to rise. Why do you think the labor market will stabilize?

Answer: The labor market is in good condition. The policy actions we take today are aimed at maintaining this state. The same is true for the entire economy. The U.S. economy is in good condition, growing steadily, and inflation is falling. The labor market is strong. We hope to maintain this state. This is what we are doing.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang Bernice

Bernice JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph