Crypto Leaders Counter Elizabeth Warren's Oversight Push

Crypto leaders oppose Senator Warren's increased oversight efforts, highlighting political strategies and indirect influence.

Cheng Yuan

Cheng Yuan

Author: First.VIP Source: medium

Merit Circle (MC) is a decentralized DAO chain game guild built on Ethereum and BSC. Different from traditional chain game guilds, Merit Circle invests in the primary market of chain games, cooperates in game development, and builds The chain game market distribution channel platform, infrastructure construction and other methods have gradually expanded to the upper and middle reaches of the chain game industry. In summary, this project deserves attention.

Merit Circle (MC) is an investment platform built on Ethereum and The decentralized DAO chain game guild on BSC. Initially, Merit Circle was a scholarship guild similar to YGG. It also had scholarship business, SubDao model, etc. However, considering the sustainability and limitations of the scholarship business, and almost all of these businesses were YGG suppressed it and began to transform the structure and positioning of DAO in March 2022, hoping to build it into a game DAO. Merit Circle divides DAO into multiple sectors (vertical fields). Currently, its main sectors are investment, studio (building and incubating new projects), games (chain game market distribution channel platform) and infrastructure (Beam based on Avalanche Game Chain, the mainnet was launched on August 18 this year), and the game NFT platform Sphere, which is still in the research and development stage, was once one of the four major sectors. Due to market factors, the release was delayed and replaced by the infrastructure sector.

Merit Circle, formerly known as Axie 420, is an Axie infinity "scholarship" organization. It was founded in July 2021. The original purpose was to make low-wage countries of players can play Axie infinity. Axie 420 received US$200,000 in incubation investment from Flow Ventures in August 2021, and raised US$1.25 million from other channels. It was renamed Merit Circle in September 2021, expanding the project positioning from just focusing on Axie infinity to more of popular games and metaverses.

The advantages of Merit Circle are:

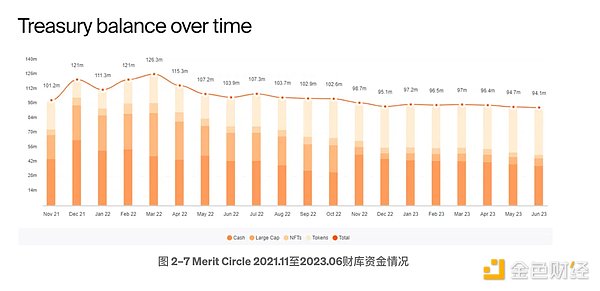

1) The treasury is abundant and information disclosure is transparent , the allocation of funds is relatively reasonable (according to official treasury data, as of June 23 this year: cash accounts for 40%; high-liquidity blue-chip tokens account for 8%; NFT assets account for 4%; chain game track-related tokens/equities Accounting for 48%, of which the primary market equity accounts for the majority. Most of the investment targets are traditional game studios that combine blockchain technology. The overall game style is more biased towards game playability). The treasury funds are approximately US$94.1 million, of which $MC is not included in treasury calculations, and treasury funds have decreased by approximately 7% compared to the end of 2021. In a bear market, Merit Circle ensures sufficient cash flow through reasonable treasury allocation, and has the theoretical ability to cope with the bear market in terms of funds.

2) Compared with traditional chain game guilds, Merit Circle’s development route is quite different. Merit Circle abandoned the scholarship model and invested in chain game The primary market, cooperative game development, building game market distribution channel platforms, and infrastructure construction have gradually expanded to the upper and middle reaches of the chain game industry.

The risks of Merit Circle are:

1) From the perspective of investment situation, Merit Circle Most of the investment targets are the primary market of chain games, accounting for about 80% of the token/equity investment related to the chain game track. Merit Circle's income method is relatively single, mainly relying on the investment sector. Most of the gamefis invested by Merit Circle are small games, and the market value of the investment part is relatively large. The survival rate of this type of chain games in the bear market is low, and the risks and uncertainties are Greater certainty. Merit Circle's short- and medium-term revenue situation is difficult to improve due to market conditions. The follow-up depends on the development of the chain game track and whether the games invested can have good returns, as well as whether the constructed Beam game chain and the soon-to-be-released game NFT market Sphere can have good returns. good development.

2) The market value of $MC has a strong correlation with the market value of treasury assets under management, and ceiling expectations appear to be relatively limited for the time being.

3) Due to the lack of attractive gold mining business and community activities, Merit Circle's community foundation is relatively weak.

1.1 Project Introduction

Merit Circle (MC) is a decentralized DAO chain game association built on Ethereum and BSC. Its main sections are divided into investment, studio (construction and Incubating new projects), games and infrastructure (Beam game chain based on Avalanche, the mainnet was launched on August 18 this year). In addition, Merit Circle has also launched its own NFT collection Edenhorde, and the game NFT platform Sphere, which is in the research and development stage. .

1.2 Basic information

2.1 Team

According to LinkedIn data, the Merit Circle team There are 33 members in total. From the perspective of team background, team members generally have a blockchain working background. The core members have been deeply involved in Axie Infinity and have a background in web3 investment institutions.

Marco van den Heuvel —— Co-founder, graduated from Arnhem Business School in 2019 with a major in International Business and Languages. From 2017.09 to 2018.10, he co-founded a blockchain company called Happy Mod, focusing on providing community management and marketing services for blockchain startups; in 2021.07, he founded the Axie 420 "scholarship" organization, which was renamed Merit Circle in 2021.09.

Tommy Quite — Co-founder, graduated from Beijing University of Technology majoring in Contemporary Chinese Business and Language, Utrecht, the Netherlands in Entrepreneurship and Small Business Operations at the University of Applied Sciences. From 2014.04 to 2018.09, he was a member of the Bitcoin Foundation, committed to advocating and publicizing Bitcoin and blockchain technology; from 2017.07 to 2019.08, he worked at Civic, a Web3 identity management tool provider, as a community administrator; in 2020.12, he co-founded a company called Flow Ventures web3 venture capital institution; co-founded Merit Circle in 2021.08.

Mark Borsten — Co-founder (Twitter @meritcirclorr, profile not published on LinkedIn), of Flow Ventures Chief Operating Officer and Co-Founder, joins Merit Circle with Tommy Quite.

Thale Sonnemans — COO Chief Operating Officer, graduated from San Francisco State University in Marketing Management and Hann Applied Technology in the Netherlands University major in business administration. From 2012.07 to 2013.07, he worked as a junior producer and junior sales representative at HALAL (a film production company and photography agency) from 2016.01 to 2018.12; from 2019.04 to 2021.10, he co-founded a gambling subsidiary company called Chaser; and joined Merit Circle in 2021.08.

Brandon Aaskov — — CTO Chief Technology Officer, graduated from the New England Institute of Art with a major in interactive media design. From 2006.02 to 2013.03, he worked at a streaming media technology company called Brightcove as a senior solution engineer; from 2015.06 to 2023.02, he worked at a software product agency called DEPT®, serving as software engineer, network director, cryptocurrency department manager and web3 deputy President and other positions; joined Merit Circle in 2023.02.

2.2 Funding

2.2.1 Financing

Merit Circle has received a total of 3 rounds of financing (the predecessor Axie 420 received US$200,000 from Flow Ventures incubation investment in August 2021, and raised US$1.25 million from other channels).

2.2.2 Treasury

Merit Circle's treasury is divided into four parts (excluding those held $MC), which are respectively cash, blue chip coins, NFT assets, and tokens/equities related to the chain game track. The treasury value is approximately US$94.1 million. In addition, according to official treasury address statistics, Merit Circle’s treasury addresses on Ethereum and BSC hold a total of approximately 42.49 million $MC, which is approximately US$12.83 million based on the current currency price, accounting for approximately the current total circulation. 9.17%.

2.3 code

Merit Circle's code is open source on GitHub, with a total of 4578 code submissions by code contributors The average is 10 people. Among them, the time periods for more frequent code submissions are from March 2022 to June 2022, and from July 2023 to September 2023. These two periods correspond to the development of the game NFT market Sphere (not yet released, news was revealed in February Will be released this year) and develop the Beam game chain based on Avalanche Subnet.

2.4 Products

2.4.1 Product Introduction

Merit Circle (MC) is a decentralized DAO chain game guild built on Ethereum and BSC. Initially, Merit Circle was a scholarship guild similar to YGG. There are scholarship business, SubDao model, etc. Taking into account the sustainability and limitations of the scholarship business, we began to transform the structure and positioning of DAO in March 2022, hoping to build a game DAO and divide the DAO into multiple sections (vertical field). At present, its main sectors are divided into investment, studio (building and incubating new projects), games (chain game market distribution channel platform) and infrastructure (Beam game chain based on Avalanche, mainnet launched on August 18 this year), in addition The game NFT platform Sphere, which is still in the research and development stage, was once one of the four major sectors. Due to market factors, its release was delayed and replaced by the infrastructure sector.

2.4.2 Merit Circle Investment

1) Initial investment funds and sources;

1 p>

Merit Circle’s investment funds come from the US$100 million USDC previously raised on the Copper platform. According to the MIP-2 proposal, an investment committee was formed to be responsible for the investment. The specific members are: Flow Ventures LP, Sergei Chan, CitizenX and Maven11.

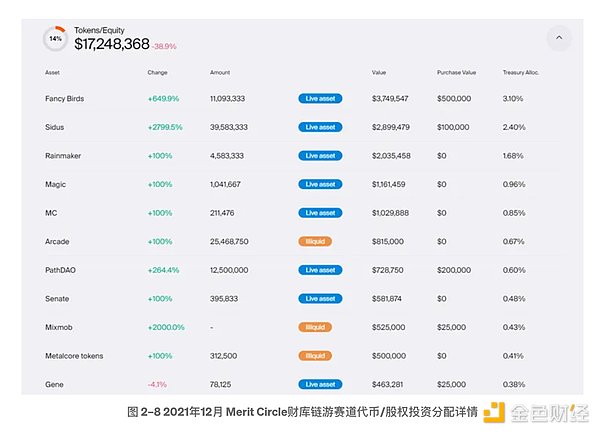

2) Investment details;

Merit Circle’s investment sector details are reflected in the treasury allocation superior. According to the data from the treasury as of June 23: cash distribution is mainly USDC; blue chip coins are mainly WBTC, Uni V2 pledge and WETH; NFT assets are mainly Bigtime Land ($1 million), Axies NFT and Cyball NFT; chain game competition Dao-related tokens/equities have invested in a total of 79 projects (61 non-circulating, 18 circulating), among which are mainly the primary market of chain games, accounting for about 80% of the chain game track-related tokens/equity investments. These The style of the game is more playable.

According to official data, the purchase of NFT assets cost US$4,834,000, and the current valuation is US$3,404,852, with a loss of US$1,429,148 (-29.6%); Lianyousai The money spent on Dow-related token/equity investment was US$28,045,486, and the current valuation is US$45,471,587, with a profit of US$17,426,101 (+62.1%). The above data is not accurate. Due to liquidity of NFT assets, the actual valuation will be lower. The valuation calculation of tokens/equities related to the chain game track is based on market valuation, and most assets are not circulated, so there is a certain degree of error.

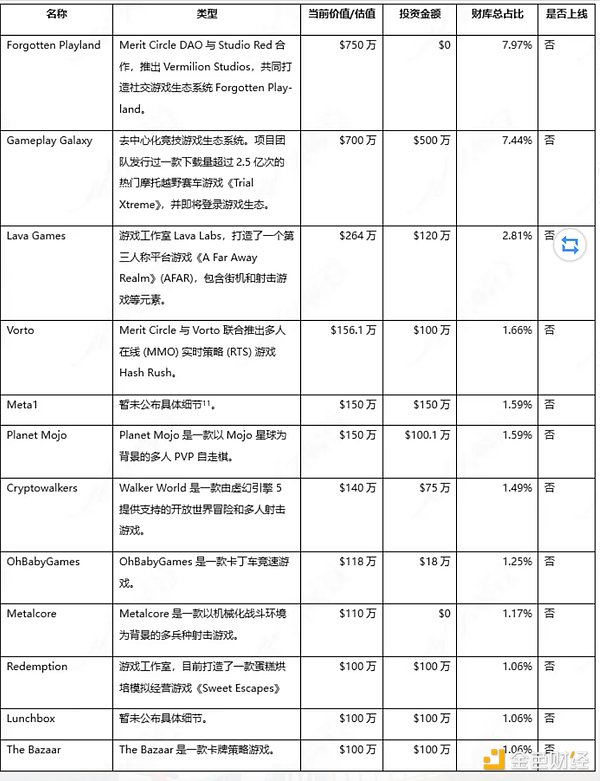

Since the investment sector is the main source of income for Merit Circle, and there is a strong correlation between the market value of $MC and the market value of the treasury assets under management, it is necessary to focus on analyzing it. Regarding the health of the invested projects, the current situation of projects accounting for more than 1% of the treasury is listed below:

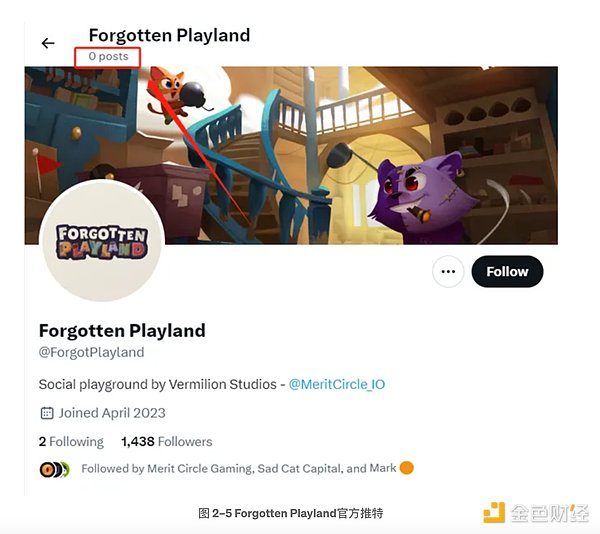

① Forgotten Playland, with a current valuation of $7.5 million, accounting for 7.97% of the total treasury

Merit Circle announced on April 25 this year that it would join hands with Studio Red to launch Vermilion Studios to create the social game ecosystem Forgotten Playland. Two mini-games have been revealed so far, one of which is called "Bomb Pitchers". The content of the game is roughly that players throw bombs at each other in an attempt to blow up their opponents while avoiding themselves from being blown up. Power-ups are scattered throughout the game, allowing players to make bombs more deadly with bigger explosions and other enhancements; another game, Toy Limb Golf, is a golf game where players must run to equipment warehouses and find Weird items like toy limbs, baseball bats, and even a science fiction teleporter gun to use as their "golf clubs." Officials stated that 20 mini-games will be launched in the future. According to the disclosed information, Forgotten Playland’s game economy is mainly the sale of customizable skin NFTs, such as cosmetics, skins, etc. Judging from the official Twitter of Forgotten Playland, there have been no tweets or related progress disclosures since Merit Circle was announced on April 25. Therefore, the author believes that the game’s current valuation of $7.5 million has a lot of water, poor health, and Most of the games developed are small games, and the economic models are relatively general. The possibility of future development is currently not high.

Judging from Forgotten Playland’s official Twitter, there has been no Twitter release or related progress disclosure since Merit Circle was announced on April 25, so the author believes that the game is currently The valuation of $7.5 million has a lot of water content and poor health. Most of the games developed are small games. The economic model is relatively average. The possibility of future development is currently not high.

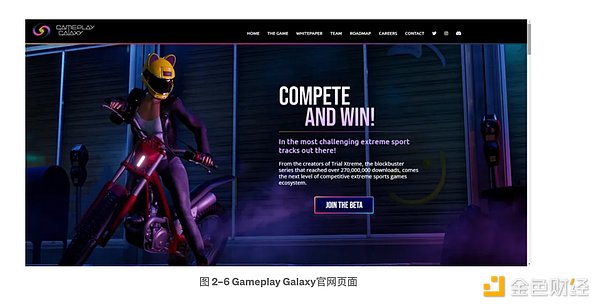

② Gameplay Galaxy, currently valued at $7 million, accounting for 7.44% of the total treasury

Gameplay Galaxy is a decentralized competitive gaming ecosystem powered by Web3, developed by the creators of the web2 game series Trial Xtreme, whose various bike racing games have been downloaded over 250 million times on Google Play and App The ratings on the Store are 4 stars and 4.2 stars respectively (out of 5 stars). Gameplay Galaxy raised $12.8 million on September 7, 2022, led by Blockchain Capital, with participation from Merit Circle (investing $5 million), Mysten Labs, Solana Ventures, Com2uS, Yield Guild Games and Hustle Fund.

According to LinkedIn data, the team behind Gameplay Galaxy currently has 41 employees. Co-founders Doron Kagan, Maya Gurevich and Dmitry Burlakov all have more than 15 years of experience. Game entrepreneurship and work experience.

Gameplay Galaxy has migrated its web2 game "Trial Xtreme" to web3. It is currently in beta test version. You can apply for test qualifications through email. Gameplay Galaxy has not yet issued coins, and the project white paper has not yet introduced details. According to the project roadmap, regular game updates such as the rarity and practical mechanism of NFT, opening of early access versions, security reviews, localization in different regions, official release of the game, and the launch of the NFT owner community will be announced in the future.

Gameplay Galaxy's official Twitter (@TrialXtreme) has 17,577 Followers and is still actively tweeting updates. The official Medium of Gameplay Galaxy has not released any new content since the announcement on May 30.

As far as the game project background is concerned, Gameplay Galaxy's game "Trial Xtreme" has a certain degree of popularity and influence. Since its release in 2009, the game has had With a history of more than ten years, it is one of the early well-known motorcycle racing games. It belongs to a niche direction in the game type and has a stable player base, but there is still a certain gap between it and the mainstream popular games; in terms of team background, Gameplay The co-founders of Galaxy have more than 15 years of experience in game entrepreneurship and work; in terms of funding, $12.8 million is still enough to support this small game, because the game has been maturely running in web2 for many years. Based on the above information, the author believes that the health of this project is pretty good. Although the probability of it becoming a popular hit is low, it has a relatively solid foundation.

③ Lava Games, currently valued at $2.64 million, accounting for 2.81% of the total treasury

Lava Games is a game studio that has created a third-person platform game "A Far Away Realm" (AFAR), which includes arcade and shooting game elements. Merit Circle announced its cooperation with "A Far Away Realm" (AFAR) on March 21, 2022, and invested $1.2 million in it.

The game started pre-registration soft launch on Google Play on June 30 this year, but it is not yet online. Its project NFT collection AFAR — RAFA Genesis has only a trading volume of 90 ETH on OpenSea, and the current floor price is 0.0099 ETH, which is basically uninterested. In addition, the game's official Twitter (@playafar) has 46,451 followers, but its tweeting activity is low. Based on the above information, the author believes that the health of the project is poor, and the current valuation of $2.64 million is quite flawed.

④ Vorto, currently valued at $1.561 million, accounting for 1.66% of the total treasury

Merit Circle announced on August 25, 2022 that it would jointly launch the multiplayer online (MMO) real-time strategy (RTS) game "Hash Rush" with Vorto and invest $1 million in it. The game is currently in the development stage, and the official website states that it will be released on the Beam chain later. According to the officially revealed game animations and graphics, the production is relatively average. It is worth noting that the project has been in progress since July 2017, with intermittent progress and frequent changes in direction. In addition, the official Twitter (@PlayHashRush) has only 9,117 Followers. Based on the above information, the author believes that the health of the project is poor, and the current valuation of $2.64 million is quite flawed.

⑤ Others

Looking at other projects overall, we found that the gamefi invested by Merit Circle is large Most of them are small games. This type of chain games have a low survival rate in a bear market. At present, nearly half of the assets of the treasury are used to invest in gamefi projects. If you fail to invest in a hot money, it will be a potential risk for the project as a whole.

As shown in Figure 2–7, Merit Circle’s overall treasury shrinkage was not obvious during the market down cycle from 2021.11 to 2023.06. Compared with November 2021, it decreased by approximately 7%. %. According to analysis, the main reasons are as follows:

① Cash distribution has been maintained at around US$40 million, accounting for 40%-50% of the treasury;< /p>

② NFT assets with large fluctuations and poor liquidity have remained at a low level, around 5%;

③ According to the risk avoidance authorization in the early stage of the proposal MIP-6, a series of stop-profit and stop-loss requirements are proposed;

④ Chain game track generation The currency/equity risk assets will mostly invest in the secondary market at the end of 2021 and the beginning of 2022 (as shown in Figure 2-8). In the early stages of the down cycle, they intentionally reduce their positions in this part of the asset and turn to investment in the chain game track. The primary market, and the proportion of investment is increasing month by month. In addition, it is worth noting that the quality of the projects invested in this part of investment assets is relatively average, most of them are small games and almost none of them are online, and their valuations are relatively high.

It can be seen from the above that Merit Circle is more conservative in its investment style and has a strong risk awareness, but the valuation of its investment projects is relatively high.

3) Investment income distribution.

Based on the MIP-7 sustainable future vision proposal, the investment income distribution framework is formulated as shown in Figure 2–7, specifically:

① 20% of the proceeds will be returned to the treasury in the form of USDC;

② 5% of the proceeds will be transferred to crypto assets (mainly (ETH and WBTC) return to the treasury;

③ 60% of the proceeds are used to repurchase $MC, and limit buy orders (lower than the market 10%-35% of the price), the repurchased $MC will gradually become the main source of MC pledge dividends (due to the cancellation of V2 and V3 pledges in the MIP-26 proposal, the remaining undistributed approximately 9.5 million $MC will be destroyed, This part of the funds may be used for Beam chain rewards in the future), in addition it can be sold to strategic investors that are locked or destroyed for a long time, and are governed by DAO;

④ 15% of the proceeds are used to destroy $MC.

2.4.3 Merit Circle Studio

The main function of Merit Circle Studio is DAO Other parts of the ecosystem bring value and are the home for creative projects within the Merit Circle DAO, collaborating with existing projects and projects from non-web3 companies. Merit Circle studio currently provides three services and products:

1) Merit Circle grant;

;">Grants are divided into research grants and development grants.

u Research Grants, of up to $10,000 per applicant, are designed to support research projects and contribute to a larger community-voted The proposal lays the foundation. This grant is available for proposals that exceed this grant limit.

u Development Grant, up to US$25,000 per applicant, the purpose of this grant is to provide developers with expenses incurred during project development compensate.

Applicants can apply in Wonderverse, and a committee composed of DAO community members will review and vote.

2) Merit Circle NFT collection Edenhorde;

Edenhorde NFT collection is Merit Circle DAO The first creative project (the total amount is 8800, the current floor price on OpenSea is 0.059 ETH, the total transaction volume is 10,103 ETH, the current floor price has shrunk by nearly 93.4 compared to the high average selling price of 0.9 ETH in March 2022 %, since the launch of OpenSea, there has been a downward trend in both volume and price, with no obvious rebound during this period. In addition, the transaction situation has been bleak in the past two months, with only a few sporadic transactions occurring every three or four days on average). The Edenhorde NFT collection is the original NFT artwork by Emmy Award-winning illustrator Andy Ristaino. The IP story behind the NFT is written by Celia Blythe, the author and historian of "Edenhorde". A total of eight episodes have been released so far.

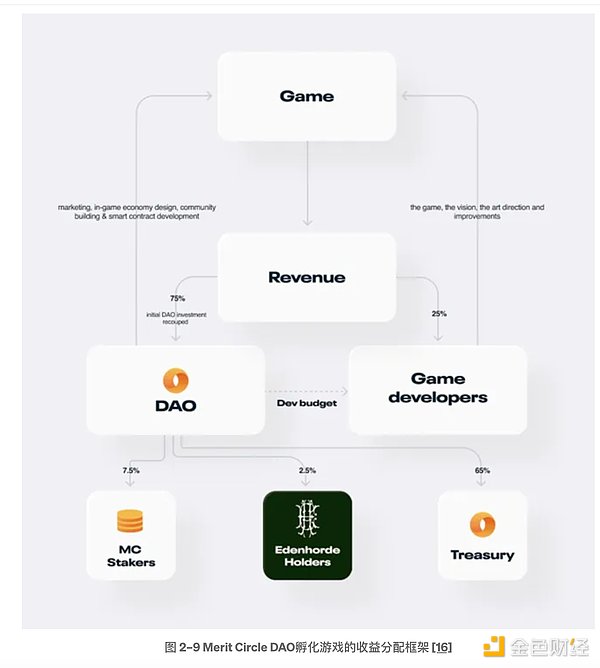

Merit Circle wants to build Edenhorde into an IP to enter the multimedia field, such as merchandise, animation and games. Edenhorde can interact with the creative incubation projects and cooperation projects of Merit Circle DAO (for example, the board game Canverse can use Edenhorde characters as game pieces in the game). In addition, Edenhorde holders can also benefit from incubation-developed projects. 2.5% of the revenue obtained from the project (as shown in Figure 2–9. The distribution details are a rough framework and may be revised later. For specific details, please view the proposal MIP-10). A card game called Edenhorde Eclipse was released on August 21 this year. It is in the Alpha testing stage and will be released on the Beam game chain. In addition, according to official news, there is another project called Project Amginea under development, and Edenhorde NFT staking will be launched in the future.

3) Merit Circle Tactile.

According to proposal MIP-22, Merit Circle Tactile is a set of 650 merchandise boxes specially provided to the community, which contains seven wearable items (T-shirts, Hoodies, scarves and hats), you can get these product boxes by holding the Merit Circle Tactile NFT. The NFT is distributed in two stages and is distributed to proposal creators, contributors, Edenhorde NFT holders, etc.

2.4.4 Merit Circle Game

At first Merit Circle also had gold mining business, that is Scholarship model, but considering the sustainability and limitations of the scholarship business, Merit Circle decided to transform into the current gaming sector. The main functions of the current game section are: to promote cooperative games to obtain game users; to provide players with learning tutorials for major popular blockchain games; to provide early access games to Merit Circle game community users, and players receive rewards by completing tasks ( NFT, lottery, etc.).

The game interface introduces popular games on the market, games available for early access, games partnered with Merit Circle, upcoming competitions, free-to-play games and game tournaments .

The academy provides players with introductory learning tutorials for web3, as well as learning tutorials for major popular chain games.

Players can obtain experience points by registering an account and logging in every day. The rewards are mainly lottery draws and corresponding game-related NFTs. As the level increases, more tasks and rewards can be obtained. . For example, the game that Level 1 can currently get rewards for is CropBytes. Completing these tasks within the deadline can get lottery opportunities for game NFT props.

2.4.5 Merit Circle Infrastructure

Merit Circle’s infrastructure is built around the game. The infrastructure product that has been released so far is the Beam game chain based on Avalanche, which was launched on the mainnet on August 18 this year. According to proposal MIP-27, 75 million $MC is allocated from the treasury (worth approximately $22.5 million based on current currency prices) to inject liquidity, provide funding to games/game developers (to pay gas fees), and verify and Securing the Beam network. In addition, 2.7 million USDC has been allocated from the treasury to develop Beam and ecosystem products (of which $200,000 is used for AMM liquidity on Beam).

Beam Game Chain adopts POS consensus mechanism. You can become a verification node by pledging $AVAX or $MC, use $MC as gas fee, and use LayerZero as the official cross-chain Bridge, which uses Openfort to provide account abstraction wallet and integration services.

It is worth noting that according to the MIP-28 proposal, $MC may be migrated to $BEAM at a ratio of 1:100 by the end of this year (before the migration, $MC Still the platform token of the project), but the Merit Circle name will continue to be used as the overarching brand associated with the Beam network and $BEAM. After the migration, $MC is associated with outdated information from the initial stage of Merit Circle, and subsequently $BEAM will be used as Beam. The gas consumption of the chain and node pledge tokens. After the migration is completed, you need to pay attention to whether there will be any major changes in the economic model.

According to official disclosures, the ecological games that will be released on the chain include: Trial, a popular motocross racing game created by Gameplay Galaxy that has been downloaded more than 250 million times. Xtreme"; social deduction game "Castle of Blackwater"; "Megaweapon" a multiplayer melee shooter; "Walker World" an open world adventure and multiplayer shooter powered by Unreal Engine 5; Merit Circle DAO and Vorto Jointly launch the multiplayer online (MMO) real-time strategy (RTS) game "Hash Rush"; "Edenhorde Eclipse", a card game incubated by Merit Circle, can be played using Edenhorde NFT; in addition, the game NFT trading market Sphere will also be launched later .

Summary:

From a development perspective, Merit Circle has transformed into a game DAO. It is quite different from the traditional decentralized chain game association. The main product business no longer relies on the scholarship model, but through investing in the primary market of chain games, cooperatively developing games, building chain game market distribution channel platforms, building infrastructure, etc. The approach has gradually expanded to the upper and middle reaches of the chain gaming industry.

From the perspective of Merit Circle's four major business sectors, the investment sector is currently the main source of income and the core of the business, requiring focus. Merit Circle's investment style is more conservative and has a strong sense of risk. Currently, it mainly invests in the primary market of the chain game track. Most of the games it invests in are small games, and its current valuation has a lot of moisture. Such projects The probability of survival in the bear market is not high, but the cash and highly liquid blue-chip coins in the treasury still have 45 million US dollars, accounting for 48% of the treasury, and the funds are relatively abundant; the studio sector can bring other sectors in the DAO ecosystem It is the birthplace of creative projects within Merit Circle DAO. At present, the development of the studio sector is still in its infancy. There is no obvious profit benefit at present, and the quality of the innovative projects developed and incubated is relatively average; currently, the game sector Its function is similar to the distribution channel of the blockchain game market. It promotes games for game developers to acquire users, provides learning tutorials for major popular blockchain games to players in the Merit Circle game community, provides early access to games and opportunities to obtain rewards (NFT, lottery, etc.) , but for now, the game sector has no profit-making benefits and is less attractive to users; the infrastructure sector has increased the application scenarios of $MC, which may increase expectations and project ceilings. Many of the invested projects have claimed It will be released on the Beam chain, and we need to observe the implementation of the game ecology on the chain in the future.

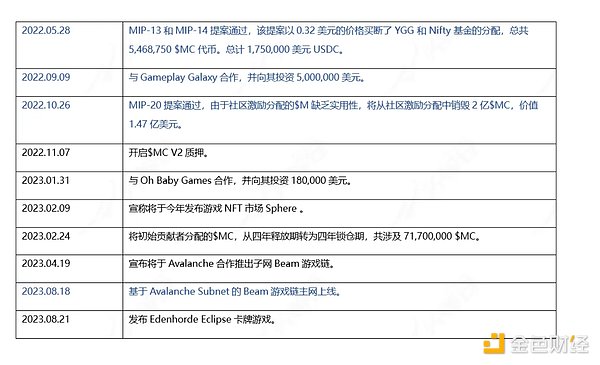

3.1 History

3.2 Current situation

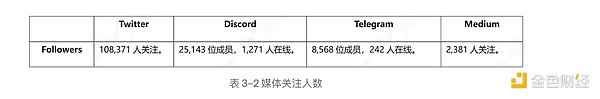

3.2.1 Number of media followers

3.2 .2 Operational data

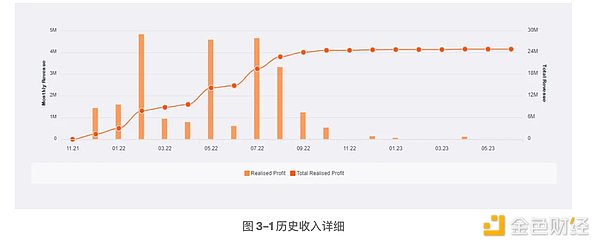

Merit Circle as of June 23, 2023, has accumulated revenue of US$24.09 million, of which the main revenue comes from 2022. In the first half of this year, revenue was only US$18. Ten thousand U.S. dollars.

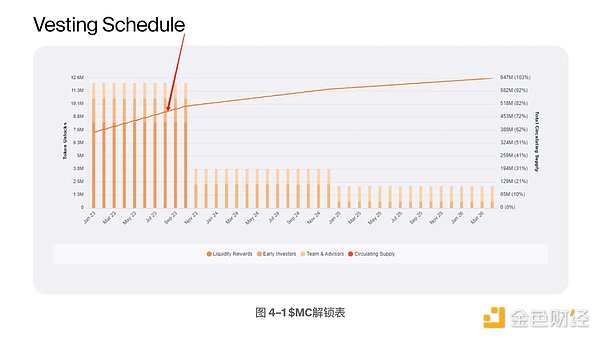

As of June 23, 2023, Merit Circle has repurchased a total of 5,485,270 $MC, spending a total of $9,443,937, accounting for approximately 39.2% of the revenue for the same period. The main repurchase period is Same for 2022.

Merit Circle As of September 23, 2023, a total of 368,707,273 $MC has been destroyed, with a cumulative value of $316,430,488, reduced from a total of 1 billion to 631,292,726. The main sources of destruction are : According to the MIP7 proposal, 75% of unused tokens will be destroyed from the community incentive distribution every month, and 15% of the investment income will be used to destroy $MC; according to the MIP-20 proposal, 75% of the unused tokens will be destroyed from the community incentive distribution on October 26, 2022 During distribution (294 million $MC), 200 million $MC will be destroyed, worth $147 million;

Merit Circle's overall treasury shrank during the market decline cycle from 2021.11 to 2023.06 The situation is not obvious, with a decrease of about 7% compared to November 2021.

According to the MIP-19 proposal, from November 8, 2022 to November 2023, 30,000,000 MC will be used for V2 staking rewards. Before the end of the year, a new staking policy vote will be held to determine rewards for the coming year. The single-coin pool obtains 20% of the liquidity mining reward distribution, and the MC/ETH pool obtains 80% of the liquidity mining reward distribution. The $MC income obtained from staking has a custom locking period, and different reward weights are allocated according to the locked time. , specific examples are: the non-locked option weight is 1; the 12-month locked option weight is 1.65; the 24-month locked option weight is 2.5; the 48-month locked option weight is 6. In addition, the $MC repurchased from investment income is also used for staking rewards.

However, according to the MIP-26 proposal on June 30 this year, Merit Circle will cancel the remaining V2 staking plan four months in advance, and the positions of all pledgers will Once unlocked, the accumulated $MC rewards from staking can be claimed, and the remaining undistributed approximately 9.5 million $MC will be destroyed. The project team stated that although the current staking plan was canceled and further rewards were stopped, it did not rule out the possibility of implementing new staking plans or exploring alternatives in the future.

3.3 Future

The official has not announced the latest roadmap.

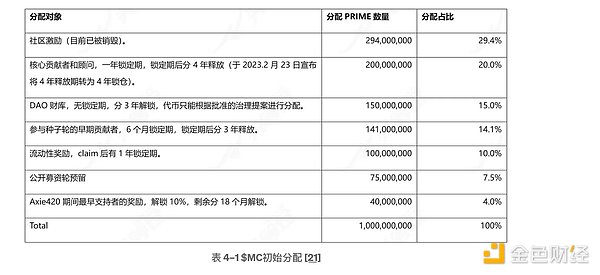

4.1.1 Token Allocation

The initial total amount of $MC is 1 billion, and the specific distribution is as shown in Table 4-1. After that, as the community voted to destroy it and part of the income was used for destruction, nearly 1/3 was destroyed. As of The total number at the time of writing was 631,292,726 on September 18.

It is worth noting that according to the MIP-28 proposal, $MC may be migrated to $BEAM at a ratio of 1:100 by the end of this year (before the migration, $MC Still the platform token of the project), but the Merit Circle name will continue to be used as the overarching brand associated with the Beam network and $BEAM. After the migration, $MC is associated with outdated information from the initial stage of Merit Circle, and subsequently $BEAM will be used as Beam. The gas consumption of the chain and node pledge tokens. After the migration is completed, you need to pay attention to whether there will be any major changes in the economic model.

4.1.2 Analysis of currency holding addresses

According to Ethereum browser and Nansen data, as of 2023.09. 22. The total number of $MC currency-holding addresses is 11,995. The top 100 $MC currency-holding addresses hold a total of 91.99%, and the top 10 addresses hold 75.63%. The top 10 addresses are mainly unlocked by contract addresses, multi-signature address contracts, and team consultants. Contracts, Binance hot wallets and pledge pool contracts, etc., do not have personal wallet addresses, and the overall positions are relatively scattered.

Judging from the changes in currency-holding addresses, the number of currency-holding addresses has increased significantly after October 29, 2022.

4.1.3 Governance

Major important decisions of Merit Circle are basically determined by governance proposals , there are 27 proposals so far, here are a few important proposals: MIP-1 is publicly sold through the Balancer Labs Liquidity Bootstrapping Pool on the Copper platform, MIP-6 proposes a series of stop-profit and stop-loss requirements for early-stage risk aversion authorization, MIP -7 Formulate investment allocation and destruction measures, MIP-13 and 14 buy out the distribution of YGG and Nifty funds for US$1.75 million, MIP-17 DAO structure reorganization, MIP-20 destroy $200 million MC in community incentive distribution, MIP- 27 Beam development grant, etc.

Merit Circle’s governance proposal terms are clear and transparent, and a governance forum has been specially created for discussion. However, the main proposals are currently proposed by the project team.

4.1.4 Token requirements

1) As the Gas of Beam game, and verification Node staking;

2) Staking $MC can earn income from pre-allocated rewards and part of the income from the investment sector;

3) Governance voting.

The track where Merit Circle is located is the chain game guild track. However, it is significantly different from the traditional chain game association in its development route. Merit Circle abandoned the scholarship model and gradually invested in the chain game primary market, cooperated in game development, built a chain game market distribution channel platform, and built infrastructure. Expand to the upper and middle reaches of the chain gaming industry.

5.1 Track Overview

In traditional games In the field, game guilds are formed so that players can gather and cooperate to conquer dungeons or jointly kill big bosses. For example, in "World of Warcraft", top guilds often strive for the first clearance of each dungeon or the first monster. Kill; in addition to such cooperative guilds, traditional game guilds will also focus on socializing between players or sharing game content, becoming the location of game communities.

In Web3, due to the rise of the Gamefi track in 2021, the popularity of Axie Infinity has triggered a gold-making frenzy among blockchain players. For most game players in low-income countries, the configuration cost of a 600-dollar pet, which often requires three to start a battle, is unaffordable for many players. In this environment, the emergence of chain game guilds has greatly affected the game industry. It has lowered the threshold for players to enter P2E games. Among them, the scholarship model pioneered by Yield Guild Games has led to the rise of chain game guilds.

The scholarship model is one of the core businesses of the chain game guild in the last round of Gamefi Summer bull market. Its operating logic is that the game guild provides the game props required by Gamefi and Recruit community managers, who recruit and train gold players (scholars). Qualified players rent the game props required by Gamefi from the game guild to make gold, and the gold profits obtained are proportional to the game guild and the community manager. distribute.

With the development of the chain game association in the past two years, it has gradually begun to show the following characteristics:

1. Limitations of the scholarship mechanism: The scholarship mechanism essentially helps Gamefi bring more players who focus on gold farming. This group can help the game attract popularity and expand the game community in the early stage. However, once it enters the middle and late stages, At present, the design of the common token model in the chain game circuit is immature, and death spiral dilemmas abound. The huge number of gold users and chain game guilds that focus on game assets (NFT game props) have caused damage to the game itself. It is extremely serious and will accelerate the collapse of the Gamefi economic model.

This means that the operation of the scholarship system cannot last long in a single Gamefi. Guilds need to constantly look for profitable Gamefis to gain profits, and During the bear market, there are not many profitable Gamefis, which will lead to obvious cyclical changes in the guild's income;

In addition At present, the ordinary scholarship mechanism of the chain game guild is only applicable to P2E mode games, and P2E mode games, without exception, are currently entering the recession stage. In the long run, it is difficult to see whether P2E mode chain games will continue to exist or die out. definite.

As the Gamefi track gradually matures, more and more Gamefis have begun to have their own rental systems, such as Starshark and Pegaxy; rental systems The emergence of guilds will also squeeze the players who are the audience of the scholarship system. Once more players choose to use the rental system instead of using the shared scholarship system like YGG, the income of this type of guild will drop significantly.

2. The regional nature of guilds is serious: the current mainstream guilds are mainly distributed in Southeast Asia, such as YGG, the largest guild on the track, and its main community players Distributed in the Philippines, the main GuildFi community dedicated to developing Gaas (Guild-As-a-Service) is located in Thailand, and the largest chain game guild in Vietnam is Ancient8.

3. Future development will be funded and functional: After the success of the scholarship model, guilds began to look for the next "Axie Infinity", so the current guilds Generally, they will participate in the early NFT pre-sale of chain game projects, and are committed to obtaining a certain amount of NFT through cooperation in the early stage to prepare for the later launch of the game;

In addition to NFT, the Guild will even serve as an early venture investor in many chain game projects, transforming its role from an NFT leasing agency and player community to a venture capital fund for the chain game track; in addition to the direction of funding , and some guilds are trying to explore other development directions, such as developing infrastructure, incubating and developing games, providing data services, community services, diversion services for cooperative projects, and providing systematic management services for the guild's scholarship system and income system. Develop in the direction of functional end.

4. Highly dependent on the development of the chain game track: The income of the chain game association depends on whether it relies on the commission from the scholarship mechanism or the rate of return on investment in Gamefi. Both are based on the development of the chain game track. The chain game track is still in its early stages and there is a lot of room for growth in the future. As a game guild, can it grow with the track and ensure its success? It is crucial that the portfolio value is consistently profitable.

5.2 Comparison of competing products

1) Yield Guild Games (YGG)

YGG is a decentralized chain game guild built on ETH and Polygon. It pioneered a scholarship model to drive However, due to the current desertedness of the chain game guild track, the limitations of the scholarship model have gradually been revealed. YGG has begun to invest in high-quality games rather than pure P2E game development on its development path. At first, Merit Circle was a scholarship guild similar to YGG. It also had scholarship business, SubDao model, etc. However, considering the sustainability and limitations of the scholarship business, and the fact that these businesses were almost all suppressed by YGG, it began to transform in March 2022. The structure and positioning of DAO hope to build Merit Circle into a game DAO.

2) GuildFi (GF)

GF is a chain game built on Ethereum Guild and guild service platform, the project is currently trying to develop in the direction of funding and functionality, providing early financing for the game community and guild-related services after going online.

5.2.1 Competitive product business development

YGG's current focus is on popular games and related projects Cooperating, investing and incubating track-related games, guilds and infrastructure, holding web3 micro-sports competitions and activities, etc., continue to expand the scale of the community, while the once core scholarship business has shrunk every quarter in 22 years, and this year Neither the Q1 nor Q2 community reports released scholarship business-related data.

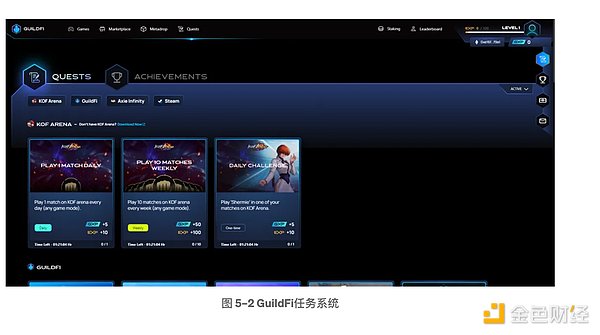

At present, the main way of operating the YGG community is the Quest game task system. Currently, it is mainly through launching the GAP plan (Guild Advancement Program) to expand the community and enhance community cohesion. To promote collaboration between community members and cooperative games, participants need to complete achievement tasks officially released by YGG, such as participating in cooperative games for a corresponding length of time; recruiting a corresponding number of players to join YGG, hosting high-quality streaming content, etc. to receive YGG tokens Coin rewards and corresponding NFT. This plan is one of the key directions of YGG's current development, and GAP Season 4 is currently underway. As shown in Figure 5-1 below, GAP Season 4 provides a total of 14 mission sets, with a total of more than 150 missions. However, these missions need to be completed with higher difficulty. For players who can complete these missions, the income is low and they are all $YGG. Bonus, overall appeal is weak. But compared to the NFT rewards and draws provided by Merit Circle’s game section, YGG’s Quest rewards will be more generous.

GuildFi's current community operation method is mainly through the task system and reward market. Players complete the provided tasks to obtain certain GXP points, which can be used to exchange for game whitelist qualifications, game NFT, game tickets, in-game items and gift cards (mainly Axie Infinity) have fewer categories that can be redeemed and have lower value.

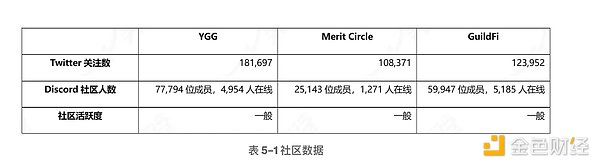

From the perspective of community scale and community operations, the community foundations of Merit Circle and GuildFi are relatively weak due to the lack of attractive gold mining business and community activities. YGG has a first-mover advantage and has accumulated a certain community foundation with its previous scholarship model and SubDAO mechanism. But for now, all three are lacking in their ability to attract new users and retain old ones.

5.1.2 Comparison of financial data

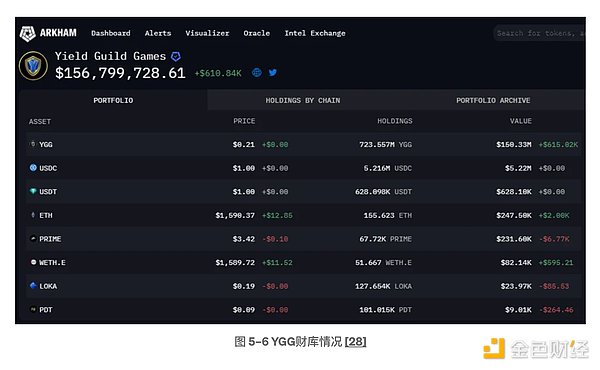

YGG disclosed financial information in the 2023Q2 community update document. Since the establishment of YGG As of 2023Q2, a total of 83 projects related to the chain game track have been invested, of which the investment objects are 41 game tokens, 35 game NFT assets, 57 games, 9 chain game guilds and 17 P2E infrastructure. The cost of investment in these projects is US$18.37 million. As of June 30, 2023, the value of these investments is approximately US$2,725, with a profit of approximately 32.58%. In addition to its own treasury investment, YGG also raised US$75 million on February 18 this year to establish a venture capital fund called YGG Ventures Fund I, which is used to invest in web3, game studios and infrastructure to support industry development. of early token and equity transactions.

As of June 23, 2023, Merit Circle’s treasury size is US$94.1 million, which is divided into four parts, as follows: cash accounts for 40% , the allocation is mainly USDC; blue chip coins account for 8%, mainly WBTC, Uni V2 pledge and WETH; NFT assets account for 4%, mainly Bigtime Land (USD 1 million), Axies NFT and Cyball NFT; chain game track related tokens Tokens/equity accounts for 48%, and a total of 79 projects have been invested (61 non-circulating, 18 circulating), mainly in the primary market of chain games, accounting for approximately 80% of the token/equity investments related to the chain game track.

In terms of investment performance, compared with YGG and GuildFi, Merit Circle looks better on the surface, but in fact, most of the projects invested by Merit Circle are unfinished. The valuation of circulating equity is generally relatively high based on the quality of the projects currently invested in, which means that Merit Circle's actual investment is likely to lose more, although the specific losses are difficult to calculate. However, Merit Circle does have better risk control capabilities and larger capital scale, as well as relatively transparent financial information disclosure (monthly updates, public billboards). Looking back at GuildFi, its overall investment and participation in the chain game market is low, its competitiveness is also weak, and it is quite a situation of sitting flat on interest; in terms of cooperation and investment objects, compared with Merit Circle and GuildFi, YGG has The quality of games invested and cooperated with is more advantageous and has better brand effect.

YGG's treasury currently holds tokens worth $157 million, of which approximately $724 million YGG is held, with a current value of $150 million, accounting for 95.54% , the current value of stablecoins and other circulating tokens is US$7 million, accounting for 4.46%.

Merit Circle disclosed that its treasury size was US$94.1 million as of June 23, 2023, of which stablecoins and blue-chip coins are worth approximately US$45 million. According to the official treasury wallet address, Merit Circle's treasury addresses on Ethereum and BSC hold a total of approximately 42.49 million $MC, which is approximately 12.83 million US dollars based on the current currency price, accounting for approximately 9.17% of the current total circulation. .

GuildFi stated in its mid-year report released on July 26 this year that its total treasury funds were approximately US$92.68 million, divided into three parts, stablecoin , BTC, ETH and LP are approximately US$71.89 million, the tokens and primary market invested are approximately US$15.91 million, and the NFT assets held are US$4.89 million. But in fact, based on the current announced address holdings on the five treasury chains, it was found that its total funds are approximately US$42.26 million, of which $GF tokens are worth approximately US$7.35 million, and most of the rest are stablecoins, ETH and LP. . In addition, there were two transfers from the main treasury address to Binance, with amounts of 8 million USDT and 2.97 million USDT respectively. According to the official statement, these funds are mainly used to support daily operations and repurchase tokens from investors. .

Judging from the treasury situation, YGG holds a large amount of $YGG in the treasury, accounting for 95.54% of the stablecoins and other liquids. The tokens are only 7 million US dollars, accounting for only 4.46%. On the other hand, the treasury distribution of Merit Circle and GuildFi is more reasonable. The former’s stable and blue-chip coins account for nearly 50%, with a value of approximately US$45 million. The latter holds approximately 71.9% of stable and blue-chip coins, worth approximately US$53.23 million. In addition, Merit Circle’s token $MC has a higher unlocked circulation ratio, about 73.32% ($YGG is 18.51%, $GF is 42.56%). It also has a token destruction and repurchase mechanism, with a total of 368,707,273 $ destroyed so far. MC, repurchasing 5,485,270 $MC, and $MC can also be used as Beam’s gas consumption and node pledge. However, YGG and GuildFi currently have no token destruction and repurchase mechanisms, and their token empowerment is weaker than $MC. .

The market values of cash plus high-liquidity tokens in the treasury of Merit Circle and GuildFi are similar, but the market value of the two is quite different. The current liquid market value of $GF is approximately US$20.38 million, and the fully circulated market value is approximately US$47.86 million, both of which are lower than the current total amount of funds in its treasury of US$74 million (5323+ mid-year reported NFT and investment project value). The circulating market value of $MC is approximately US$140 million, and the fully circulated market value is approximately US$195 million, both of which are higher than the current total amount of funds in its treasury this year, which is US$94.1 million. The reasons may be inferred as follows:

① Although the cash flows of Merit Circle and GuildFi are close and the quality of the projects invested by both is relatively average, the investment scale of Merit Circle Larger, indicating that it is more actively deploying and participating in the industry, while GuildFi has a tendency to stay away from the track and lie flat to earn interest. When the heat of the track comes, GF may find it difficult to get on board, and if the bear market continues for a long time, it will be difficult for GuildFi Might be an advantage.

② Merit Circle is actively developing chain gaming infrastructure. Although MC’s infrastructure development is still in its infancy, this change in positioning reflects its The company is willing to expand its track business scope, but considering that its development is still in its early stages, it cannot be ruled out that its high market value may be overly optimistic and hyped. Over time, if Merit Circle’s investment business and infrastructure do not develop as expected, its valuation advantage compared to GuildFi may be reduced.

③ $MC has a destruction and repurchase mechanism, as well as Gas consumption and node pledge as a Beam chain, and the overall token empowerment is better than $GF.

Summary:

The current scale of the chain game guild track is not large, and the community size is Even less than the user scale of popular chain games, the scale of the entire track still has a lot of room for growth;

YGG expands the community and cooperates with popular games It has maintained a high level of growth and is the first choice for the more prestigious guilds in the circuit. Merit Circle is actively expanding its business scope and exploring more possibilities through transformation and multi-faceted layout in the upstream and midstream of chain games, but it is still in its infancy and needs time to be verified. However, GF's development is relatively flat and somewhat off-track. Its investment scale is limited and it mainly focuses on earning interest, so its influence in the industry is weak.

1) From the perspective of investment situation, Merit Circle Investment Most of the targets are the primary market of chain games, accounting for about 80% of the token/equity investment related to the chain game track. Merit Circle's income method is relatively single, mainly relying on the investment sector. Most of the gamefis invested by Merit Circle are small games, and the market value of the investment part is relatively large. The survival rate of this type of chain games in the bear market is low, and the risks and uncertainties are Greater certainty. Merit Circle's short- and medium-term revenue situation is difficult to improve due to market conditions. The follow-up depends on the development of the chain game track and whether the games invested can have good returns, as well as whether the constructed Beam game chain and the soon-to-be-released game NFT market Sphere can have good returns. good development.

2) The market value of $MC has a strong correlation with the market value of treasury assets under management, and the ceiling expectations appear to be relatively limited for the time being.

3) Due to the lack of attractive gold mining business and community activities, Merit Circle’s community foundation is relatively weak.

Crypto leaders oppose Senator Warren's increased oversight efforts, highlighting political strategies and indirect influence.

Cheng Yuan

Cheng YuanMerit Circle DAO's Beam blockchain expands to Immutable's zkEVM, enhancing compatibility and functionality. The move aligns with the broader trend of blockchain gaming embracing multi-chain strategies. However, the industry witnesses increasing competition, necessitating continuous innovation and adaptability.

Xu Lin

Xu LinAdditionally, their jointly operated Centre Consortium will be shut down.

Clement

ClementCircle denied that it has received a Wells notice.

CryptoSlate

CryptoSlateThe firm ends SPAC deal under which it would have become a listed company.

Others

OthersThe USDC issuer has started investing funds into its CRF (Circle Reserve Fund) to ensure that holders can redeem their coins when they want.

Bitcoinist

BitcoinistThe passing of an investment proposal brought into question a legal agreement between the organizations and the Merit Circle DAO agreed to a counterproposal that would ensure a settlement.

Cointelegraph

CointelegraphFor Merit Circle Ltd and Yield Guild Games (YGG), looking for a neutral settlement for their differences is a more ...

Bitcoinist

BitcoinistDAOs can be thought of as online organizations of like-minded individuals that are owned and managed fairly by group members.

链向资讯

链向资讯I still love you very much, DAO, and I intend to spend the rest of my life growing with you. But for now, I'm going to focus more on the DAO that I call home.

Ftftx

Ftftx