Over the past 48 hours, the world's two largest cryptocurrencies have experienced extreme market volatility.

Bitcoin experienced a flash crash after hitting a new high on Sunday, while Ethereum also took a sharp turn for the worse after hitting a record high. What exactly happened behind these two cryptocurrencies' "tremendous fluctuations"? According to reports, this round of sharp fluctuations in the cryptocurrency market was caused by a series of chain reactions: Federal Reserve Chairman Powell's dovish remarks at the Jackson Hole Economic Policy Symposium first pushed Bitcoin to a surge to nearly $117,200 on Friday. After Ethereum set a new high, it climbed further on Sunday, setting a new historical high of $4,954. However, a Bitcoin whale who had held the coins for more than five years suddenly sold 24,000 Bitcoins, triggering a stampede.

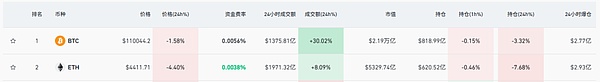

Bitcoin fell further to around $110,500 on Monday, and fell below its 100-day moving average for the first time since April. Ethereum plummeted from its all-time high to $4,400, and the sudden sell-off by whales resulted in forced liquidation of more than $570 million (about 4.082 billion yuan) in Bitcoin and Ethereum. Analysts point out that at the heart of the market turmoil lies a massive reallocation of funds, with signs that this capital is flowing into Ethereum, with approximately $2 billion in Bitcoin funds being reallocated to Ethereum. Furthermore, there are rumors that institutional investors BlackRock and high-frequency trading giant Jane Street are buying dips during this round of market turmoil, while ETFs like Fidelity have seen significant inflows. The actions of market makers like Jane Street are also believed to have exacerbated market volatility.

However, Joel Kruger, market strategist at LMAX Group, said that despite the short-term pullback, institutional conviction remains firm.

A Tale of Two Cities Over the Weekend: New Highs and Flash Crashes Coexist

Bitcoin and Ethereum have demonstrated very different market trends over the past 48 hours.

On Friday, Federal Reserve Chairman Powell's speech at the Jackson Hole Economic Policy Symposium opened the door to a possible interest rate cut, driving cryptocurrency prices sharply higher.

Bitcoin soared from about $112,000 to nearly $117,200. After Ethereum's big rise on Friday,it climbed further on Sunday, hitting an all-time high of $4,954, surpassing the previous peak of about $4,891 in November 2021. LMAX Group market strategist Joel Kruger said: "Powell's hint of a rate cut initially boosted market sentiment, but the nuances of his wording and his less-than-dovish tone made the market uneasy." In addition, the reversal of the cryptocurrency's rally was also due to the selling of whales. According to CoinDesk, a Bitcoin whale sold 24,000 Bitcoins on Sunday, triggering a "flash crash." This move triggered a chain reaction during the liquidity-thin weekend period. This caused the price of Bitcoin to fall by more than 2% within 10 minutes, hitting a low of $110,500. By Monday afternoon, Bitcoin had fallen further to around $110,500, and its gains since 2025 had narrowed to about 18%. Jacob King of WhaleWire pointed out that the actions of the whales triggered panic selling among other traders, exacerbating the downward spiral. This liquidity crunch was further exacerbated by the increase in leveraged long positions in the previous week. Compared to Bitcoin, although Ethereum has also retreated to $4,400, its year-to-date increase is still over 31%, significantly outperforming Bitcoin. Whale "Switching": A $2 Billion Strategic Shift At the heart of this round of market turmoil is a massive reallocation of funds. According to on-chain analysis, the whale account that sold 24,000 bitcoins still holds 152,874 bitcoins, worth over $17 billion. The investor has held these bitcoins for over five years. More critical is the flow of funds. Data shows that after the Bitcoin sell-off, a considerable amount of funds were reinvested in Ethereum. Two entities reallocated $2 billion worth of Bitcoin funds to Ethereum, of which 275,500 Ethereum (worth $1.3 billion) has been pledged. Analysts believe that this capital reallocation reflects a broader shift in market sentiment, with investors more optimistic about Ethereum's growing utility in stablecoins, tokenization, and smart contracts. BTSE's Jeff Mei and Hashdex's Samir Kerbage pointed out that compared to Bitcoin, Ethereum's smaller market capitalization may react more significantly to potential interest rate cuts by the Federal Reserve and increased systemic liquidity. According to CoinGlass data, in the past 24 hours, Bitcoin positions were forced to close $277 million and Ethereum positions were closed $293 million, totaling $570 million, and the total amount of cryptocurrency liquidations reached $878 million.

Wall Street "bottom-fishing" rumors: institutional funds are making reverse arrangements

Amid the sharp market fluctuations, there are rumors that Wall Street institutions are taking the opportunity to bottom-fish.

Financial blog zerohedge posted on social platform X that Fidelity, Bitwise, 21Shares and other institutions have seen significant capital inflows , and the market is closely watching the movements of large asset management companies such as BlackRock. According to rumors, Fidelity has seen net inflows of $87 million, Bitwise $9.7 million, and 21Shares $5.6 million, with the market still awaiting BlackRock's next move. While these figures haven't been officially confirmed, they suggest that institutional investors may be taking advantage of market corrections to increase their holdings of cryptocurrency assets. Another rumor that has garnered attention involves the operations of market maker Jane Street. Reports indicate that the company's "momentum spoofing" operation caused Ethereum to fall into a correction within 24 hours of reaching a new all-time high, a move described as one of the "most brutal" in history. However, overall ETF fund flows are diverging. According to Farside Investors data, spot Bitcoin ETFs had experienced net outflows for six consecutive trading days, totaling $1.19 billion, as of last Friday. The spot Ethereum ETF had previously experienced net outflows of $925.7 million for four consecutive trading days, but recorded net inflows of $625.3 million on Thursday and Friday. Despite significant short-term volatility, analysts remain cautiously optimistic about the medium- to long-term outlook. LMAX's Kruger stated, "As long as Bitcoin remains above $110,000 on a weekly basis, we expect the market to remain resilient during declines." Alex Krüger of Aike Capital noted that Bitcoin could regain upward momentum once short-term volatility subsides and the price breaks through the key resistance level of $113,500-114,000. Options data also suggests continued bullish sentiment. Sean Dawson of on-chain options platform Derive stated that the market has not been shaken by the pullback and that fundamentals remain intact. The current 7-day relative strength index (RSI) shows oversold conditions, but there is no clear reversal signal yet.

Brian

Brian

Brian

Brian Joy

Joy Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Brian

Brian Alex

Alex Brian

Brian Brian

Brian