DePIN: The new industrial revolution

The Decentralized Physical Infrastructure Network (DePIN) promises to usher in a new era of productivity, but this era will be driven not by centralized forces but by decentralized forces.

JinseFinance

JinseFinance

Author: EO@codeboymadif, Lisa@lisal1l1, Ryan@Ryan0xfmg, Kelv@KelvinYuan13, Simon Source: FutureMoney Group

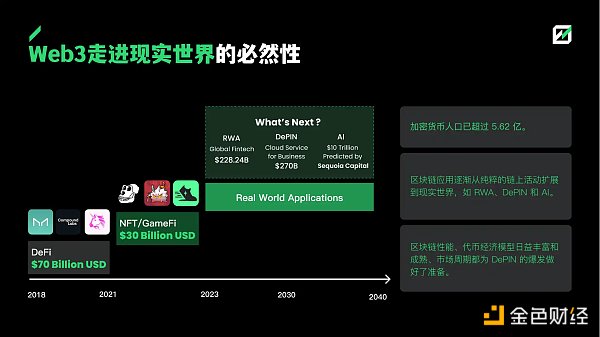

The use of crypto-economy to deploy real-world physical infrastructure has a long history. Some typical projects were established as early as 2013. They have conducted very valuable explorations in the fields of communication, storage, and computing. Until today, this model has expanded to more fields, such as AI, energy, data collection, etc., and the ecology has also ushered in a phased prosperity.

DePIN represents a paradigm of decentralized applications: node economy, miner model, and transformation of the real world.

· Compared with centralized infrastructure, DePIN has a higher unit economic effect. DePIN's smart contracts, equipment standardization, and economic models will replace CePIN hardware deployment, operation, and management, which will bring 75%-90% cost savings.

· Token economy is the key to expanding the node network and forming network effects. When the token price rises, economic incentives make the node scale grow rapidly.

· If Web2.0 allows humans to interact with the Internet through various input devices, Web3.0 allows physical hardware to interact with the blockchain through DePIN.

We have experienced DeFi Summer, NFT, and Metaverse craze. Will the next wave of craze turn to DePIN? Between 2020 and 2021, the market value of DeFi increased nearly 100 times, from US$1.75 billion to a maximum of US$172.2 billion. Assuming that in this bull market, the total market value of DeFi increases 10 times, and the total market value of DePIN reaches 50% of DeFi, then the total market value of DePIN will reach 500 billion US dollars, and there is at least 20 times of growth space. According to Messari's estimate that the market value of DePIN will reach 3.5 trillion US dollars in 2028, DePIN has a potential growth space of 120 times.

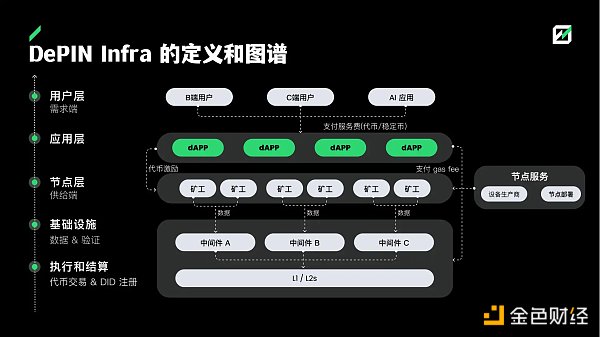

We believe that the DePIN architecture has the following 5 opportunities from bottom to top:

1.DePIN blockchain underlying infrastructure.The DePIN blockchain underlying infrastructure acts as the settlement layer of the DePIN application, providing support for transactions and token economic models.

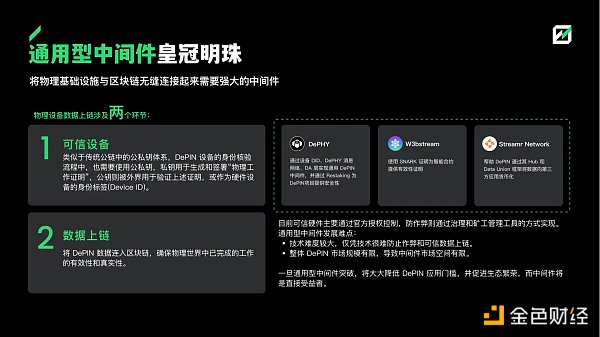

2. DePIN middleware. DePIN middleware is the middleware layer that connects the underlying infrastructure and upper-layer applications, providing standardized interfaces and tools. This layer is the key hub of the DePIN ecosystem.

3. DePIN upper-layer applications. DePIN upper-layer applications are various applications built on the DePIN infrastructure and middleware layers, providing users with actual services and value. This is the front-end and landing scenario of the DePIN ecosystem.

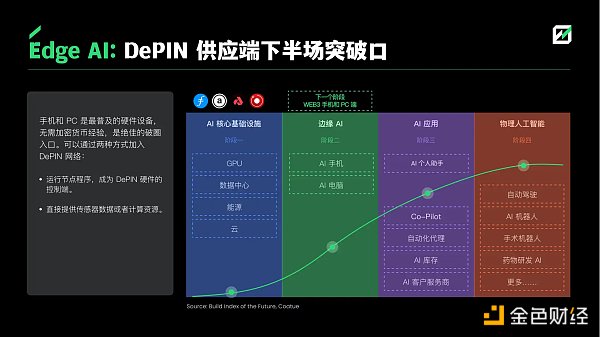

4. Derivative opportunities: Edge AI. Edge AI is an important extension direction of the DePIN ecosystem, using the DePIN network to deploy edge computing and AI applications, process data locally and provide intelligent services.

5. Derivative opportunities: RWA. Combine DePIN with real world assets (RWA) to create new financial products and services.

· DePIN is the main track of the Solana OPOS (Only Possible On Solana) concept. Benefiting from this positioning, Solana has fought back from the shadow of FTX, and its market value has increased from a minimum of US$3.6 billion to US$89.8 billion, an increase of 25 times. In the future, DePIN will still be an important narrative of Solana. The choice of head projects often represents a trend. Helium's migration of the main network to Solana has played an obvious demonstration effect. According to this logic, Polygon and Arbitrum are both underlying chains that may benefit from the growth of DePIN in the future.

· Proprietary chains that provide DePIN modular infrastructure will benefit from the growth of ecology and head applications, such as IoTeX and Peaq.

· Public chains that are closely integrated with the concept of AI will inevitably extend their ecology to the upstream DePIN sector. For example, Near has developed a public chain narrative around AI, and Aptos has cooperated with Microsoft to try to combine AI with Web3 products.

Seamlessly connecting physical infrastructure with blockchain requires powerful middleware. At present, trusted hardware is mainly controlled by official authorization, and anti-cheating is achieved through governance and miner management tools.

Difficulties in the development of general middleware:

· The technical difficulty is relatively high, and it is difficult to prevent cheating and trusted data from being uploaded to the chain by technology alone.

· The overall DePIN market size is limited, resulting in limited middleware market space.

Once the general middleware breaks through, it will greatly reduce the threshold for DePIN applications and promote ecological prosperity, and the middleware will be the direct beneficiary.

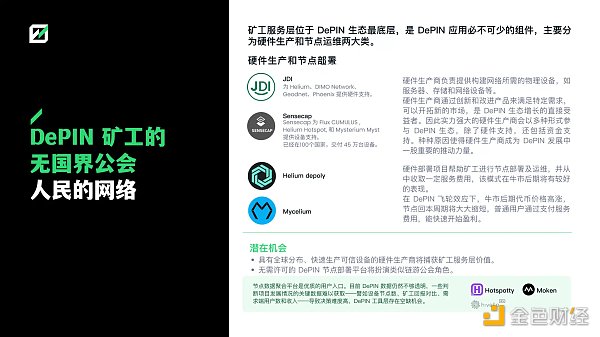

The miner service layer is located at the bottom of the DePIN ecosystem and is an indispensable component of DePIN applications. It is mainly divided into two categories: hardware production and node operation and maintenance:

· Hardware manufacturers are responsible for providing the physical equipment required to build the network, such as servers, storage, and network equipment. Hardware manufacturers can open up new markets by innovating and improving products to meet specific needs, and are direct beneficiaries of the growth of the DePIN ecosystem. Therefore, powerful hardware manufacturers will participate in the DePIN ecosystem in various forms, including hardware support and financial support. For various reasons, hardware manufacturers have become an important driving force in the development of DePIN.

· Hardware operation and maintenance projects help nodes to deploy and operate, and charge a certain service fee. This model will perform well in the later stage of the bull market. Under the DePIN flywheel effect, the token price will rise in the later stage of the bull market, and the node payback period will be very fast. Ordinary users can quickly start to make profits by paying service fees.

1. Hardware manufacturers with global distribution and rapid production of trusted devices.

2. The permissionless DePIN node deployment platform will play a role similar to the chain game guild.

3. Look forward to the emergence of better DePIN tool layer projects and capture value. The device data aggregation platform is a high-quality user entrance. At present, DePIN data is still not transparent enough, and some key data for judging the development of the project are difficult to obtain, such as the number of device nodes, miner return comparison, the number of demand-side users and income, which makes decision-making difficult and there are vacancies in the DePIN tool layer.

DePIN Protocol is a bilateral market, where the supply side provides services and the demand side contributes to income, so value evaluation should be carried out from both the supply and demand sides.

Compared with the division from the concept, industry and supply side, we believe that the judgment on the demand market is more important, so we pay special attention to projects facing the C-end market.

Two judgments on the demand side:

· For applications facing the C-end, there are more high-profit scenarios and greater imagination space.

· Applications facing AI data needs are still in a very early stage.

Bold guess on the end of demand: Web3 mobile phones and new sharing economy

1. Encrypted mobile phones will be the key to breaking through the C-end market

Through customized mobile phones, mobile phones can have built-in DePIN applications, and through airdrop incentives, rapid growth can be achieved. Subsidies are often needed to acquire the market for the C-end. Taking Helium Mobile as an example, the revenue is the $20 package paid by users. Due to the need to pay cooperation fees to T-mobile, when 70-80% of the download services are provided by Helium's own network, it is just at the profit point (Messari, as of December 2023, the proportion in Miami is 55%). Once it exceeds the profit point, the project will achieve self-sustaining blood, and the DePIN flywheel will run better.

2. Build a Web3 version of the shared economy network

Relying on Web3 mobile applications, through effective token incentives, large-scale shared economy/social networks can be realized in the future.

In the past two decades, the price of hardware equipment has dropped sharply, enabling individuals to act as infrastructure service providers.

Our judgment criteria for the supply market:

· Is the product easy to standardize? The more standardized the product, the easier it is to financialize. For example, computing power is priced according to duration, and different configurations have different prices.

· Is the equipment cost low enough? The lower the cost, the larger the potential supply scale and the more decentralized it is.

Supply-side end: focus on projects that can be quickly scaled and standardized

· The node equipment costs of the 6 tracks are mostly medium ($300-$1000), which can reach consumer level. Among them, high-end GPUs (A100, H100) in computing power are more expensive, and AI requires professionalism, which we also define as high cost. Some equipment in energy costs more than $1000.

· In terms of product standardization, there is a general problem of low standardization. Bandwidth in Wireless is a standardized product, and other sub-segments such as 5G and WiFi are non-standard products.

According to Messari statistics, by 2023, there will be more than 650 DePIN application projects, covering six sub-tracks: computing, AI, wireless networks, sensors, energy and services.

Computing (computing power + storage) is the largest track in TAM, and enterprise cloud service revenue will reach US$270 billion in 2023 (Synery Research).

· Demand side: The demand for computing comes from small and medium-sized enterprises and individuals, among which GPU demand is the strongest due to the growth of AI.

· Supply side: Akash has a diverse hardware network including CPU, GPU and storage, and Render has a large number of GPUs. io.net obtains a large number of GPUs from its own network and other platforms.

1. The GPU computing power market is currently the most promising segment. We believe that there are more secondary market opportunities in this field, and that it will move towards head concentration and horizontal integration in the future.

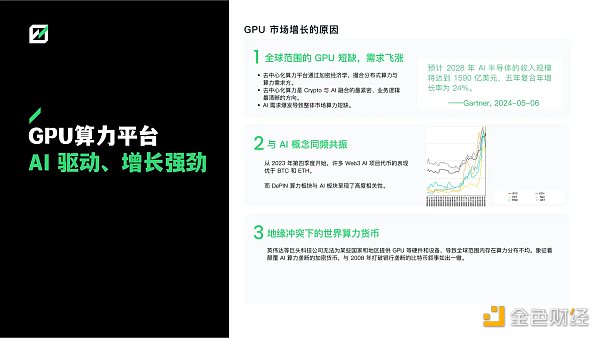

GPU computing power platform growth logic:

1. Global GPU shortage and soaring demand

2. Resonance with AI concept

3. World computing power currency under geopolitical conflict

The development trend of decentralized GPU platform is to attract computing power head projects through token incentives and horizontal integration of resources. At present, it faces the risk of failure in matching demand and supply, and needs demand growth or model innovation to support the current market value. In the future, the growth point of decentralized GPU platform is that the supply side will bypass the B-end, expand computing power to the C-end, and build an edge computing network, and the demand side will be closely integrated with the downstream demand side or self-built application scenarios.

2. The storage sector will move towards storage and computing integration, becoming a unique Layer1.

After superimposed computing, some large-scale storage DePINs will become unique Layer1s - blockchains that can provide decentralized storage and computing capabilities. Compared with the current blockchain, this unique Layer1 can greatly reduce the storage and computing costs on the chain. Some applications that require large-scale storage and complex logic can be implemented here, such as content platforms, social networking, games, etc.

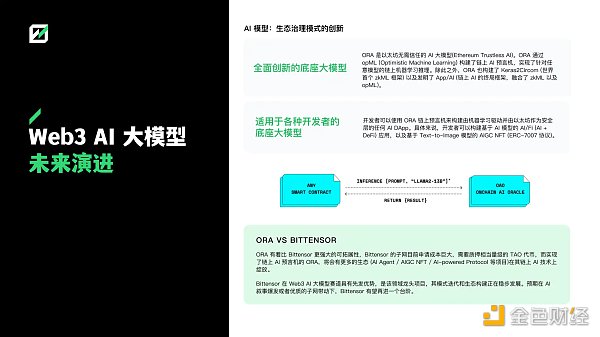

Bittensor is a typical model of DePIN AI. It creates a decentralized machine learning (ML) network to stimulate the development and decentralization of artificial intelligence. Bittensor has a first-mover advantage in the Web3 AI large model track and is a leading project in this field. Its model iteration and ecological construction are developing steadily. It is expected that Bittensor will be able to take another step forward driven by the outbreak of AI narratives or high-quality subnets. ORA has stronger scalability than Bittensor. The application cost of Bittensor's subnet is currently huge, and it is necessary to pledge a considerable amount of TAO tokens. ORA, which has realized the on-chain AI oracle, will have more ecosystems (AI Agent / AIGC NFT / AI-powered Protocol and other projects) blooming on its on-chain AI technology.

Currently, there are fewer sensor projects, especially those focusing on data, which means more opportunities in the primary market.

Value analysis of the sensor sector:

Is the market space large enough? The scale of the downstream demand market determines the ceiling of the project.

Is the data value high enough? The uniqueness and application scenarios of the data determine the value of sensor-based DePIN applications.

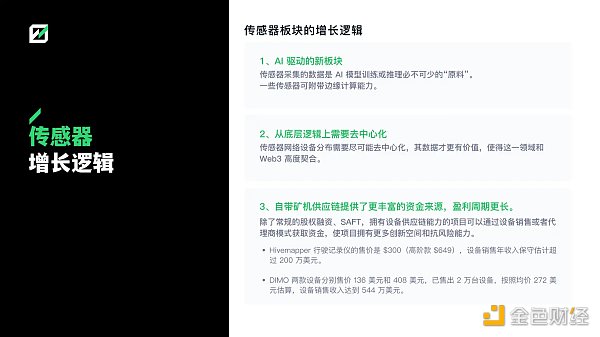

Growth logic of the sensor sector:

1. A new sector driven by AI

2. Decentralization is needed from the underlying logic

3. The built-in mining machine supply chain provides a richer source of funds and a longer profit cycle.

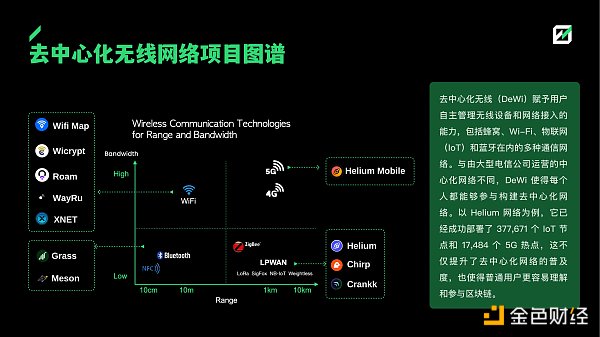

DePIN provides information transmission services for the Internet of Things and end users through decentralized base stations, routers and other physical devices. The main difficulty is that the demand is scattered and decentralized networks are difficult to meet the demand. It is necessary to rely on the power of traditional operator networks to expand the market, such as DePIN as a supplement to traditional operators or provide them with data. Therefore, the core competitiveness in the field of wireless communications lies in cooperation with traditional operators. (Helium Mobile relied on the power of T-mobile in the market cold start stage).

DePIN energy network reduces energy transmission through distributed power supply, improves energy utilization efficiency, and ultimately realizes VPP virtual power plant. With the development of energy collection and storage technology, individuals can become energy suppliers, but transmission faces high costs. Smart grids can guide the construction of power supply networks through the collection of electricity consumption data, and the construction is relatively easy. Therefore, the fastest-growing segment of DePIN energy will be smart grids. Similar to wireless communication networks, power generation projects need to cooperate with centralized power grids to achieve mode operation.

Our judgment on DePIN energy:

· VPP (Virtual Power Plant, VPP) virtual power plant is the end of DePIN energy: through the DePIN incentive model, small power supply networks and demand sides are connected to form a virtuous circle, and finally realize VPP virtual power plants.

· At present, the DePIN energy project is gradually realizing some links of VPP, such as data, electricity meters or power generation.

Since the DePIN track became popular in October last year, a large number of DePIN consumer products have emerged in the market, including watches, rings, e-cigarettes, power banks, game consoles, etc., which promote the sales and high-frequency use of equipment through DePIN incentives.

Features of DePIN + Consumer Products:

· High market size ceiling: The market space for consumer-grade devices is huge, estimated to be between trillions and hundreds of trillions of dollars in the Web2 world, including various consumer products.

· Reach C-end users: Most Web3 users are transactional users, with relatively few connections with the real world and lack of close connection with user lives. However, the business model and operation mode of DePIN consumer products can integrate Web3 applications into real life, establish connections with users and increase user stickiness, so that they can truly integrate into the real world.

· High return expectations promote the transformation of traditional brands to Web3: The new Web3 marketing model makes the products not only have use value, but also have profit attributes. This model helps products quickly occupy the market, thereby significantly improving profitability.

Potential risks and shortcomings of consumer-grade DePIN hardware:

Subject to a single token incentive, most users buy hardware for free, rather than users with real needs. Similar to the verification problem between the current DePIN hardware devices and software, more anti-cheating solutions are needed to overcome it.

Mobile phones and PCs are the most popular hardware devices. They do not require cryptocurrency experience and are an excellent entry point. There are two ways to join the DePIN network:

· Run the node program and become the control end of the DePIN hardware.

· Directly provide sensor data or computing resources.

· Mobile encrypted apps. The encrypted application market built into encrypted phones is an excellent user entrance for dAPP. As the most commonly used device in people's daily lives, mobile phones provide a platform for the popularization of encrypted applications.

· Edge computing. Edge computing is a clear development trend. Data processing and analysis tasks are transferred from centralized data centers to places closer to data sources, thereby improving efficiency and reducing costs. Token economic incentives combined with encrypted phones can accelerate the development of edge computing.

· Token airdrops. For mobile phone buyers, airdrops can bring economic returns. For the project side, airdropping to encrypted mobile phones makes the token holding highly decentralized, which is conducive to the spread of Meme or the cold start of consumer applications.

· DePIN mining. For DePIN projects, the sensors and computing modules of encrypted mobile phones are natural supply ends. As DePIN devices, mobile phones can participate in the DePIN economy and receive rewards.

· The production barriers of mobile phone hardware are relatively small, the mobile phone production supply chain is mature, the production cycle is short, and the cost is controllable, which makes the price low. The current encrypted mobile phones are priced between US$100 and US$1,000.

· The difficulty of mobile phone delivery lies in the sales network. Projects with Internet sales and offline promotion networks will be more likely to gain market access.

· The application ecosystem is the key to the formation of barriers for encrypted mobile phones. Once the network is formed, there will be an opportunity to become the traffic entrance of Web3.

· Other tests: Hardware iteration, testing the project's financial strength and operational capabilities.

In the Web2 era, through the Internet, personal cars and houses are gathered to form a huge service market, which enables personal assets to be realized.

In the Web3 era, through the token economy, idle and scattered personal hardware devices are organized to form productivity, which enables personal hardware devices to be realized. The software based on Web3 mobile phones will also build Web3 service infrastructure, innovate the Web2 sharing economy model, and cover various aspects such as catering, travel, and accommodation. The mobile Web3 application has the following characteristics: marketing innovation, token airdrops, high-frequency social interaction, and consumer-grade products through crypto-economy.

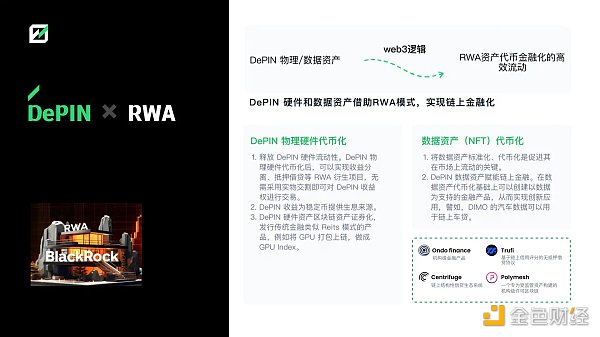

Tokenization of DePIN physical hardware:

· Release DePIN hardware liquidity. After the DePIN physical hardware is tokenized, RWA derivative projects such as income separation and mortgage lending can be realized, and the DePIN income rights can be traded without physical delivery.

· DePIN income provides a source of interest for stablecoins.

· DePIN hardware assets are securitized on blockchain assets, issuing traditional financial products similar to the Reits model, such as packaging GPUs on the chain to make GPU Index.

Data asset (NFT) tokenization:

· Standardizing and tokenizing data assets is the key to promoting their flow in the market.

· DePIN data assets enable on-chain finance. Based on the tokenization of data assets, data-supported financial products can be created to achieve innovative applications. For example, DIMO's car data can be used for on-chain car loans.

· The expansion of blockchain into the real world is an inevitable trend. DePIN represents a paradigm of decentralized applications: node economy, miner model, and transformation of the real world. According to Messari's estimate last year, the market value of DePIN will reach 3.5 trillion US dollars in 2028. According to the current scale of 30 billion US dollars of the DePIN category on Coingecko, it can be concluded that the potential growth space is 20-120 times.

· Layer1/2 is the most certain and stable beneficiary of ecological growth. The public chain that supports the DePIN ecology in this cycle will reap the greatest dividends.

· At present, the middleware is mainly an important component of DePIN's dedicated Layer1. Although the general middleware technology is difficult, we still look forward to breakthroughs, which will greatly promote the prosperity of DePIN applications, and the middleware will be the direct beneficiary of the prosperity.

· Similar to the game guild, the DePIN miner service layer is expected to develop a borderless hardware miner guild. The current potential opportunities are the global hardware supply chain and node deployment services. There are also vacancies in the DePIN data aggregation tool layer.

· In the computing sector, GPU is the fastest-growing and most mature segment. In the future, the GPU platform will move towards horizontal integration and vertical integration; in addition, "computing and storage integration" based on storage superposition computing will be a new narrative, and traditional storage such as Filecoin and Arweave will be rejuvenated.

· Current status of DePIN AI development: AI large language models headed by Bittensor have gradually absorbed many leading projects in the track by taking advantage of their first-mover advantage. At the same time, other large models like Fetch.ai are also actively deploying. The competition is fierce and the pattern is unclear. In the future, it will usher in a thousand-model war like the Internet explosion in 2000, and everyone will have a chance.

· Sensors are a potential sector activated by AI. The sales revenue of proprietary equipment will provide sensor projects with more innovation space and risk resistance.

· The model logic of wireless networks and energy networks is similar. The end of wireless networks is to bind large operators, and it is more likely to break through from the third world; the end of energy networks is virtual power plants (VPPs). At present, the project is exploring from all aspects of VPP, and the track is still in the early stages of development.

· Edge AI based on mobile phones and PCs is the next trend of DePIN development. Universal Web3 terminal devices will also give birth to a new Web3 sharing economy, and more high-frequency consumer-grade Web3 applications for the C-end will gradually emerge.

· DePIN is a new way to issue RWA assets. Combining it with on-chain DeFi will release the liquidity of DePIN hardware and data.

Original report: https://docsend.com/v/x2zdt/futureofdepincn

Thanks for the support: DePhy, Exabits, Ora, EthStorage, Hotspotty, IoTeX, DePIN Hub for their guidance and suggestions on this report.

Reference:

https://messari.io/report/state-of-depin-2023

https://public.bnbstatic.com/static/files/research/depin-an-emerging-narrative.pdf

https://mirror.xyz/sevenxventures.eth/Hx4AScWLZf4HrCl1IoumFTq1L20e3SzF-9XEkgWmrG4

https://www.galaxy.com/insights/research/understanding-intersection-crypto-ai/

https://gpus.llm-utils.org/nvidia-h100-gpus-supply-and-demand/

https://messari.io/report/the-depin-sector-map

The Decentralized Physical Infrastructure Network (DePIN) promises to usher in a new era of productivity, but this era will be driven not by centralized forces but by decentralized forces.

JinseFinance

JinseFinanceWith the rise of blockchain and the growing interest in decentralized solutions, DePIN has become a hot topic currently.

JinseFinance

JinseFinanceWho is the spine and nerves of the distributed system? How do we build the spine and nerves? In this article, we will start with the small lessons learned from the development of the Internet of Things, build a Depin development strategy, and help builders better land.

JinseFinance

JinseFinanceThis report explores the rapidly evolving DePIN space and its strategic composability with other ecosystems, positioned to transform economic systems through data integrity and scalable solutions.

JinseFinance

JinseFinanceIf improving resource utilization through decentralization is not prominent in the practice of most projects, then what is the real significance and comparative advantage of the DePIN project?

JinseFinance

JinseFinanceThis article explores the exciting possibilities and potential challenges facing DePIN, and their implications for policy development, regulation and governance.

JinseFinance

JinseFinance Coinlive

Coinlive Exploring the potential of AI & Web3 rewards in revolutionizing language models like ChatGPT, enabling real-time data access & enhancing performance.

CryptoSlate

CryptoSlateWeb3 startup Spatial Labs has raised $10 million in its seed funding round.

decrypt

decryptHardware wallet-based staking offers more security and freedom than staking via software wallets and crypto exchanges, according to the head of Ledger Enterprise.

Cointelegraph

Cointelegraph