As a narrative that goes beyond Web3, AI's business scale is far more than that. The violent shocks caused by the market are the best time to re-position.

On January 5 this year, we at FMG launched the index watch list for DePIN and AI. In the past six months, the index has expanded to include RWA, DeFi, GameFi and Memecoin. In the AI index, after careful tracking and investigation, 23 projects were selected for real-time buying and trend tracking. At the same time, through several rounds of market cycles and shocks, we selected three projects with outstanding performance.

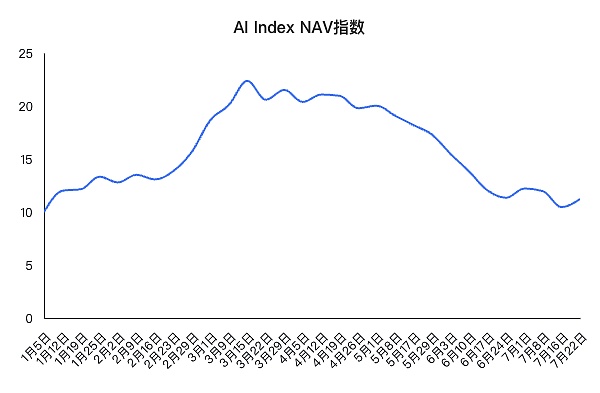

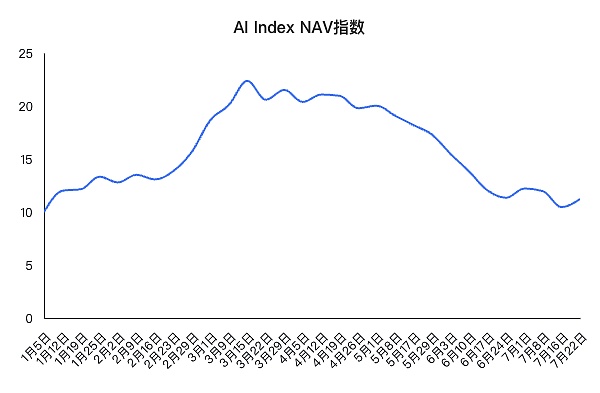

AI Index Performance Analysis

The AI index uses the NAV (net asset value) method to track profitability, with a starting value of 10. When the actual position increases, the NAV value rises, and vice versa.

The AI index profit in the past six months can be divided into three stages:

Bottoming stage (January to March): The index is in the bottoming stage.

High sideways stage (March to mid-May): The index is sideways at a high level.

Downward stage (mid-May to present): The index has experienced a downward trend.

Starting from an initial NAV value of 10, the AI index reached a peak of 22.38 on March 15, which means a profit of 138%. For about ten weeks thereafter, the NAV value remained stable at around 20, reflecting a continuous profit of 100%. However, starting from May 17, the NAV value dropped significantly, and as of July 24, it fell back to 11.22, with a floating profit of about 12% and no loss of principal.

It is worth noting that among the 23 tokens in the AI Index, 7 tokens have a yield of more than 50%, among which AGI and AIOZ have the highest yields, both exceeding 200%; while OLAS, COMAI, ASTO, and HEART tokens performed poorly, with a decline of more than 50% in half a year. The average increase of the entire AI Index is 37.6%.

Highlights in the AI Index

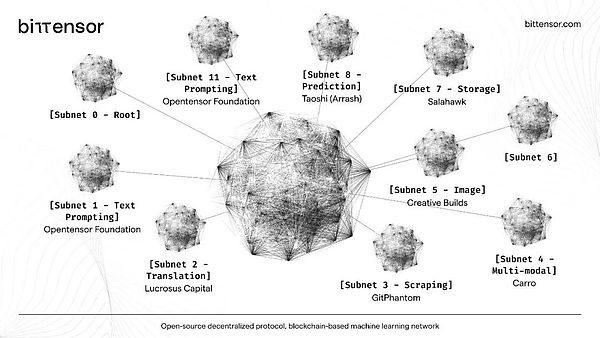

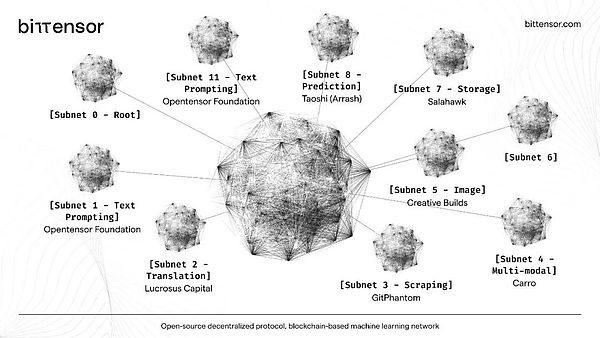

1. BitTensor (TAO)

Overview: BitTensor is a special project in the AI Index. It does not directly contribute data or computing power, but manages and selects various AI algorithms through blockchain networks and incentive mechanisms to form a competitive and knowledge-sharing AI model market.

Performance: The price was $256 when it joined the index, and it rose to $728 on March 8, with a return rate of 184%. The current price is $350, with a return rate of 25%.

Market Position: BitTensor's FDV is $7.1 billion, ranking 46th in the world, and ranking first in the Web3 AI sector.

Development: Plans to expand to 1024 slots to enhance the ecosystem. Recently, the personal data network Masa launched an LLM-based AI data subnet on BitTensor, strengthening the ecosystem and cooperation.

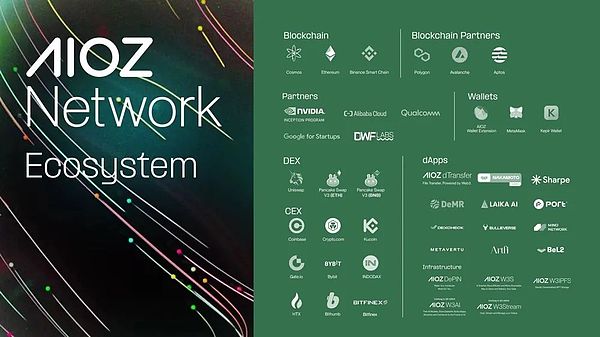

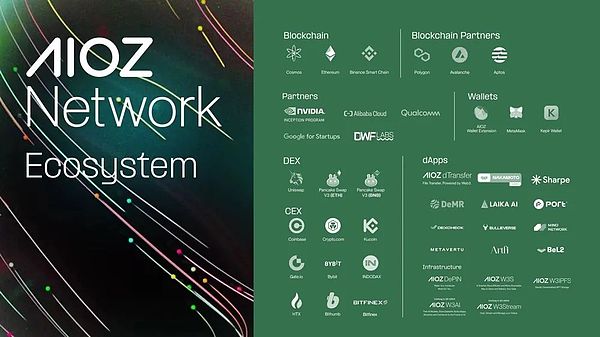

2. AIOZ Network

Overview: AIOZ Network is a global AI+DePIN infrastructure that integrates decentralized storage, AI computing, and streaming services. Supported by 180,000 global edge nodes, it provides efficient distributed computing and data processing.

Performance: The initial price was $0.15, and it rose to $1.03 on March 27, an increase of nearly 600%. The current price is $0.5, an increase of 250%.

Token Economics: AIOZ adopts an inflation model with an initial inflation rate of 9%, which will decrease by 1% to 5% each year. Tokens are used for transaction fees, node rewards, and infrastructure income to promote node participation and user growth.

Market Position: Listed on Bybit, Crypto.com, and Bithumb, with a market value of $570 million and Coinmarketcap ranking 117. The goal is to enter Binance and OKX and rank among the top 100.

Recognition: On May 22, AIOZ became the first Web3 solution to be included in the Nvidia Accelerated Application Catalog, narrowing the gap with leading Web3 AI projects RNDR and Akash Network.

3. FET

Overview: Originally from the Fetch.ai machine learning platform, it merged with Ocean Protocol and SingularityNET on June 28 this year to form the Artificial Intelligence Super Alliance (ASI).

Performance: The price was $0.66 when the position was established, and it rose to $3.27 at its highest, an increase of 400%. The current price is $1.5, an increase of 100%.

Market position: After the merger, the FDV is $4 billion, and Coinmarketcap ranks 26th.

Significance: This is the first merger case of different AI products in the Web3 AI sector. The integration of liquidity and users and business complementarity may become an important competitive method in the future Web3 AI track.

Outlook and Expectations

Overall, AI Index reflects the current trend of Web3+AI track in a more concrete way:

1. Application-based AI projects are less resistant to market fluctuations and are prone to violent fluctuations;

2. AI projects with computing power scenarios, data scenarios, and algorithm scenarios perform more strongly;

3. BitTensor is showing its dominance among the top AIs. OLAS and COMAI, which were previously comparable to it, did not perform as steadily as TAO during the bull-bear transition;

4. As a narrative that transcends Web3, AI's commercial scale is far more than this. The violent fluctuations caused by the current market are the best time to re-bottom-out.

JinseFinance

JinseFinance