Author: Clem Chambers Source: Forbes Translation: Shan Ouba, Golden Finance

When the prices of two correlated assets diverge, there is a simple call to make. The assets will continue to diverge, perhaps even further, or they will regain correlation at some time in the future. These relationships can be used to try to profit from price reversions, or even to maintain a market neutral position using long-short strategies.

Most people expect prices to resynchronize to past ratios, but this does not necessarily happen.

Gold and silver are a good example. Throughout history, the price of gold has been 5 times, 10 times, 20 times, and even as of today, 80 times the price of silver.

While there are still legions of precious metals believers who yearn for the era of silver and gold money, the good old days of the recent 20:1 gold to silver ratio are gone, although some do dream of its return.

But that is not the case.

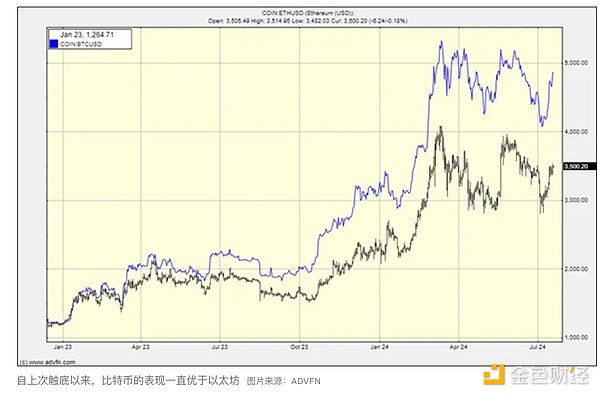

In cryptocurrencies, a similar situation is Bitcoin (BTC) and Ethereum (ETH). Bitcoin has been performing well since the crypto winter bottomed out.

Here is the chart:

I invest in cryptocurrencies through Ethereum because historically it has run longer and more persistently than Bitcoin, but as of now, it has underperformed.

If you want to explain this, you might say that Ethereum developers are constantly tinkering with the blockchain, regularly injecting their new ideas into the system, which may or may not fix the blockchain problem they want to fix, and that this tinkering reduces the value of Ethereum because it injects uncertainty. A bunch of geniuses tinkering with the crypto-financial system is, in a way, exactly what governments do with fiat currencies, and why people who hate fiat currencies and love crypto want to get rid of them. Therefore, Ethereum developers playing the role of a central bank may be a drag on its valuation. "Code is law" is less compelling when some young unknown programmer can handle your crypto bag like Judge Dredd.

This kind of intervention is almost non-existent in Bitcoin, and the system is not subverted every time some developer thinks there is something wrong with the system. The concept of decentralization is still popular in Bitcoin, it is simply incredibly difficult to modify the system, and its structure is almost as decentralized as it can be. Unfortunately, Ethereum's recent proof-of-stake structure, while good for the environment, leaves various risk surfaces, while Bitcoin continues to move forward, seemingly without much human influence.

These are just theoretical nitpicks, however.

If Bitcoin achieves its next much-anticipated rally, then Ether will follow suit and will most likely catch up to Bitcoin in percentage terms, and may even continue to rise, as it did during the last crypto rally in 2021. One investor who is “all-in” on Ether also believes that Ether will replace Bitcoin in the future, which could mean Ether prices reaching $25,000 if Bitcoin prices exceed $100,000. I’m not an avid Ether fan, but you can understand my reasoning, however optimistic it may be. If Bitcoin breaks $100,000 again, Ether could easily reach $8,000.

If Bitcoin performs well, it will also perform well, and if we see a repeat of past performance in the last leg of this cryptocurrency cycle, it does have a chance to catch up.

Meanwhile, an Ethereum ETF is on the horizon that will absorb a lot of Ethereum, which should boost prices. The ETF begins trading today, even though the SEC isn’t exactly keen on cryptocurrency ETFs.

So the question isn’t whether Ethereum will catch up to Bitcoin, but whether cryptocurrencies will rise again before this cycle is over? If you think so, then Ethereum will certainly outperform, and there’s a good chance it will surpass Bitcoin at the end.

Cryptocurrency isn’t for the faint of heart, but it’s a great diversifier that can add a little spice to a balanced portfolio. It’s also the only game in town for speculators hungry for action – which, of course, is why many come to the market to enjoy it. There will be no shortage of fireworks displays before Christmas.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist 链向资讯

链向资讯 Ftftx

Ftftx Bitcoinist

Bitcoinist 链向资讯

链向资讯 Cointelegraph

Cointelegraph