Former US Treasury Secretary Lawrence Summers has raised concerns over a potentially alarming inflation situation that may have been overlooked by official reports.

Summers' Paper Challenges Traditional Inflation Measures, Suggesting Actual Rates Are Far Higher Than Official Figures

Summers, along with co-authors, has released a paper revisiting traditional inflation measurement methods, shedding light on what he believes to be a more accurate representation of the economic challenges facing Americans.

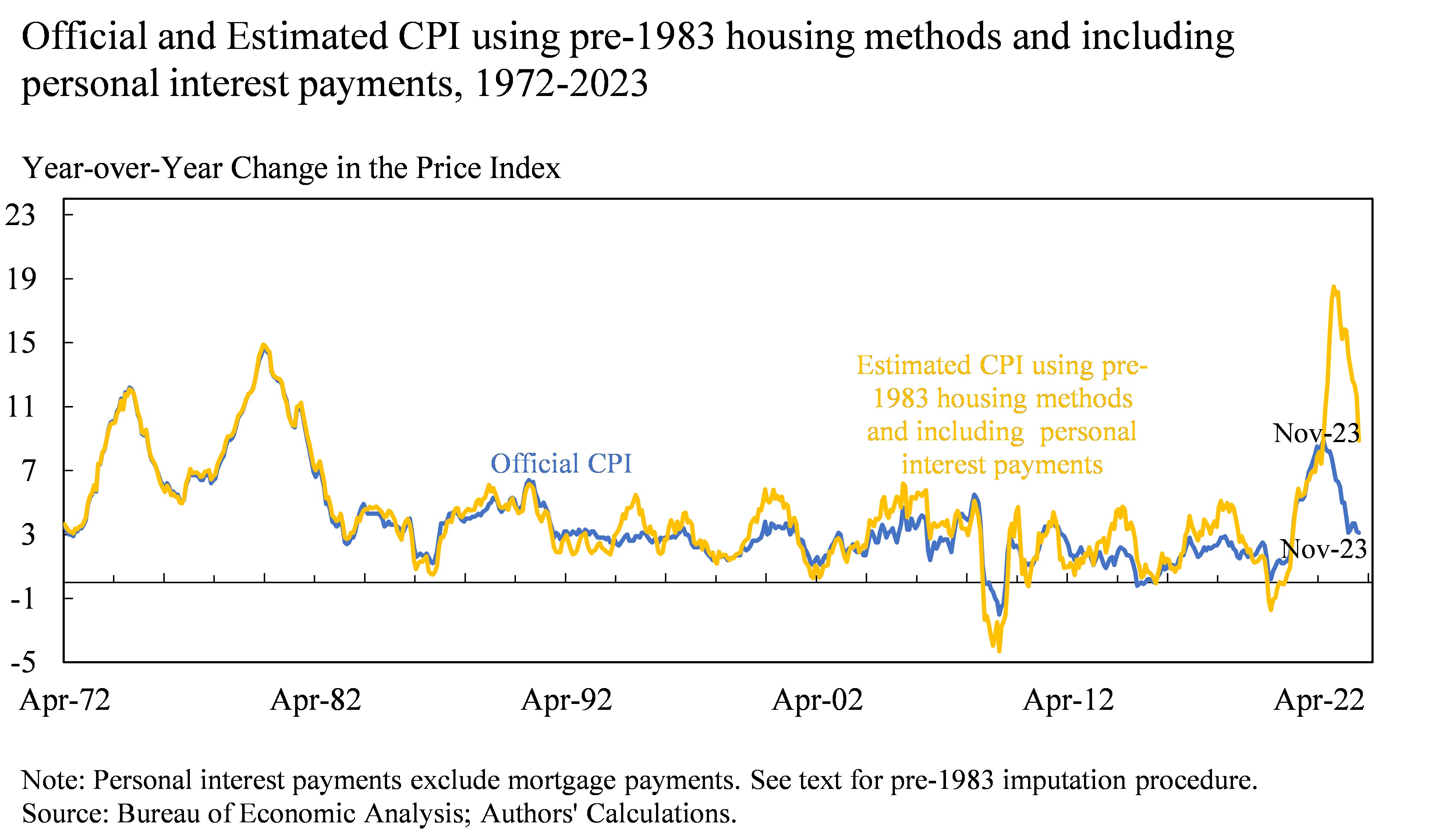

By reintroducing metrics such as personal interest rates and housing financing costs into the analysis, the report suggests a significant inflation spike unseen in official data. In November 2022, inflation could have surged by 18%, a stark contrast to the government's reported 4.1%.

Summers argues that excluding certain costs from the Consumer Price Index (CPI) distorts the true impact of inflation. Particularly, the omission of borrowing costs from modern CPI calculations paints an incomplete picture, failing to reflect the financial strain felt by consumers.

Summers Emphasizes Inflation-Interest Rate Relationship on Twitter, Reevaluates CPI Indicator to Highlight Economic Challenges

Twitter served as a platform for Summers to highlight the discrepancies, emphasizing the link between interest rate hikes and consumer well-being. The reconstruction of pre-1983 CPI metrics, according to Summers, could explain up to 70% of the observed gap in consumer sentiment.

The revelation challenges perceptions of economic stability, suggesting that inflation may be far more pronounced than officially acknowledged. With personal interest payments surging by over 50% in 2023, the financial burden on individuals becomes increasingly evident.

Lawrence Summers discusses how inflation triggers a chain reaction in the housing market

Summers points out the ripple effects of inflation on the housing market, where rising mortgage rates hinder mobility and dampen market activity. The discrepancy between high mortgage rates and stagnant house prices contributes to a sense of stagnation and disappointment among homeowners and potential buyers alike.

Miyuki

Miyuki