Recently, there have been many controversial voices in the industry surrounding the development and current status of Ethereum. The focus of doubts is mainly on the following aspects:

Question 1:The Ethereum Foundation account frequently transfers ETH, the financial planning is not transparent, and the assets held may be difficult to maintain subsequent operations and development.

Related events:

1. On August 24, 2024, the Ethereum Foundation deposited 35,000 ETH into Kraken, and the market value of ETH fell by 13% in the following 6 days.

2. At 16:10 on September 5, 2024, according to @ai_9684xtpa’s monitoring, the Ethereum Foundation transferred another 100 ETH. This address has transferred a total of 2,616 ETH on the chain in the past 8 months.

3. At 14:07 on September 6, 2024, according to Lookonchain’s monitoring, the Ethereum Foundation transferred 1,000 ETH to a multi-signature address starting with 0xbC9a 15 minutes ago. According to previous transaction patterns, this multi-signature wallet account may transfer ETH to a wallet address starting with 0xd779 and convert it into DAI assets.

Response and discussion:

Justin Drake of the Ethereum Foundation expressed his personal opinion at the 12th open question and answer event (hereinafter referred to as AMA) held on the Raddit platform on September 5, 2024: The financial report of the Ethereum Foundation will be released soon. It is estimated that the Ethereum Foundation holds about 10 years of funds as a whole, and the funds will change significantly due to the fluctuation of the Ethereum price.

Based on the current market value of assets, the Ethereum Foundation spends about $100 million per year. The Ethereum wallet mainly used by the Ethereum Foundation currently holds assets worth about $650 million. At the same time, the Ethereum Foundation also has currency reserves that can cover the operational needs of the next few years.

Ethereum founder Vitalik Buterin said in the 12th AMA:Currently, the Ethereum Foundation's budget strategy is to spend 15% of the remaining funds each year, which means that the Ethereum Foundation can continue to operate, but its influence in the ecosystem will decrease over time.

According to media reports, AyaMiyaguchi, executive director of the Ethereum Foundation, once posted on social media:The Ethereum Foundation has an annual budget of approximately US$100 million, which is mainly composed of grants and salaries, and some recipients can only accept legal currency payments. Since 2024, the Ethereum Foundation has been told not to conduct any funding activities for complex regulatory reasons and is currently unable to share plans in advance. The Ethereum Foundation's ETH transfer transactions are not sales.

Question 2:The Ethereum roadmap planning is overly focused on Layer2 solutions (mainly Rollups), ignoring the attention to the development and improvement of Ethereum mainnet Layer 1.The roadmapneeds to be revised.

Response and discussion:

Ethereum researcher Dankrad Feist said in his personal opinion at the 12th AMA:Many people believe that a roadmap centered on Rollups will weaken Ethereum's fee income and MEV, and Rollups may eventually become parasites. I don't think this is correct.

Today's highest-value transactions will still occur on Ethereum mainnet Layer1, and Rollups will expand the entire ecosystem by providing users with a large amount of transaction space. This relationship is symbiotic:Ethereum provides cheap data availability for Rollups, and Rollups make Ethereum Layer1 a natural hub for high-value transactions.

In the process of advancing the Ethereum roadmap centered on Rollup, I believe that expanding Layer1's execution capabilities should also be a goal, which is not necessarily in conflict with the roadmap, which is reflected in:

Data availability is almost infinitely scalable - the ultimate limit that cannot be expanded essentially comes from the user's interest in participating in Ethereum, that is, how many people are willing to run full nodes seriously and record all data.

Execution capabilities will inevitably be subject to objective limitations, but the ultimate limiting bottleneck is the single-threaded limitation. At present, state access is the direct limitation to expanding Ethereum Layer1's execution capabilities.

Through zkEVM and parallelization technology, Ethereum Layer1's scalability can be increased by 10 times to 1000 times. Rollups will provide the remaining scalability to meet Ethereum's need for "world-class scale".

The Ethereum Foundation's long-term sustainable plan is to use SNARK to expand the EVM execution capabilities of Ethereum Mainnet Layer1. In addition to the vertical scaling advantages brought by significantly improving the Layer1 EVM Gas limit, there is also the opportunity to use EVM-in-EVM precompilation for arbitrary horizontal expansion to verify EVM execution within the EVM at low cost.

This precompilation will allow developers to programmatically launch new Layer1 EVM instances, thereby unlocking a supercharged version of execution sharding, where the number of shards is unlimited and a single shard is a programmable Rollup, i.e., "native Rollup".

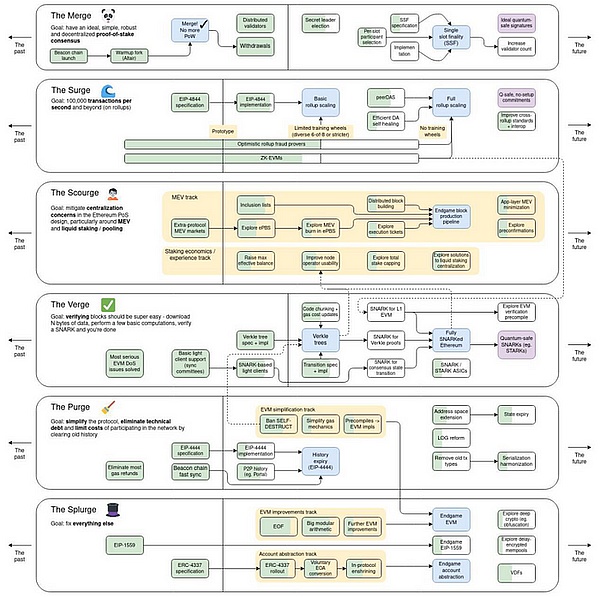

△ The Ethereum 2024 roadmap consists of the following 6 parts:

The Merge, The Surge, The Scourge, The Verge, The Purge and The Splurge

Question 3:The ecosystem is developing well, but the market value of ETH has not increased significantly.

Response and discussion:

Anders Elowsson of the Ethereum Foundation expressed his personal opinion at the 12th AMA:In the long run, Ethereum's facilitation of sustainable economic activities is directly related to the appreciation of ETH's market value. If you design a system for sustainable economic activity, you are designing for ETH price growth. Vice versa, when designing ETH appreciation, you must ensure that Ethereum facilitates sustainable economic activity.

Focusing only on "price growth" in the short term without considering its source may lead to reduced value in the long term. Personally, I think the current roadmap is actually a "price growth roadmap". If Ethereum succeeds, but ETH does not grow in price, I will be surprised and even a little disappointed, but this may be an opportunity to buy ETH because the market will eventually realize this theory of price growth.

Justin Drake of the Ethereum Foundation said in the 12th AMA: I personally think that whether ETH price grows or not comes down to liquidity and premium. The key indicator for liquidity is total fees, not fees per transaction. The key indicator for premium is the proportion of ETH used as a pledged asset. In the future, Ethereum's goal of success is to reach 10 million transactions per second, which can bring billions of dollars in revenue per day even if the fee per transaction is less than 1 cent.

Question 4:Optimistic Rollups are actually cheaper than ZK Rollups, and ZK is a superior technology.

Response and discussion:

George Kadianakis said in the 12th AMA:The Ethereum Foundation is currently working on different zero-knowledge (ZK) projects in multiple stages.

Justin Drake of the Ethereum Foundation said in the 12th AMA:I am very excited about bringing SNARKs to the Layer1 EVM. We have made great progress in the past few months. According to recent data from Uma (from Succinct), the cost of proving all Layer1 EVM blocks is currently around $1 million per year, and future optimizations will reduce this cost further.

It is expected that by the 2025 period, the cost of proving all Layer1 EVM blocks may be only $100,000 per year, thanks to SNARK ASICs and optimizations at all levels of the stack. The Ethereum Foundation is also accelerating formal verification of zkEVM, a project led by Alex Hicks with a budget of $20 million.

For the Beacon Chain, our recent benchmark accelerated the timeline for the convergence of hash-based signatures with SNARKs. This is key to achieving post-quantum security for the Beacon Chain.

Max Resnick, Ethereum researcher at the Special Mechanisms Group (SMG), said in an interview with the Bankless podcast:ZK is the only technology that can really make a breakthrough in bandwidth limitations, and Optimistic Rollups can't do it...

What to do next? I think we should start optimizing the functions required for ZK Rollups.

If you want to continue to go the Rollups route, you need to turn immediately to make the cost of verifying ZK proofs on the chain lower, rather than continuing to lower data costs, because now the data on the chain is almost free.

In addition, I think the fees on Ethereum Layer1 have reached a balanced level, but if you want to launch an application, the key consideration is:What will the fees become when the application achieves explosive growth?

If I were an application developer and developed a killer application that could achieve 100x growth and bring in a large number of users, I would not choose to release it on Ethereum at this stage - because in the best case, if I succeed, it would clog the chain and the fees would become so high that it would be unusable. So, based on this consideration, the really important development facing Ethereum now is not to maintain the current equilibrium state, but to create how strong the expansion capability can be, strong enough to attract top application developers who want to bring 100x user growth into the Ethereum ecosystem.

How should we view the dilemma and doubts of Ethereum?

Tracing back to the original intention, firmly optimistic about the value development of Ethereum

Compared to the doubts about Ethereum in the market, Ethereum founder Vitalik Buterin is still firmly optimistic about the future of Ethereum and believes it is full of hope. At the ETHTAIPEI event in 2024, Ethereum founder Vitalik Buterin once said in a group interview with the media: "I think the next five years will be critical for the development of Ethereum. Because before that, many applications that are still in the theoretical stage or on a smaller scale will be ready to enter the real world from now on. Many ideas generated in the blockchain field have penetrated into the wider world in many ways that have not yet been fully recognized. Non-financial applications are also expected to begin to have a greater impact. The special benefit that decentralization brings to these projects is that almost everyone can write a new client, and when you have a new client, you can access and write the same content without having to build your network effect from scratch. At the same time, I expect the Ethereum-based identity space to grow rapidly. The technology is improving rapidly, and I really hope that it will soon see more mainstream use cases introduced. Many people are worried about the issue of account identity, but currently when people want to solve it, the first consideration is to use centralized solutions. I hope that the Ethereum space can create truly decentralized identity alternatives and make them accessible. In addition, Stable Coins may have a significant impact in the future, and Ethereum can help Stable Coins become more open, decentralized, and do not need to rely on third parties with weak trust foundations. You can already see the efforts of Layer2 projects such as Base. "Looking forward to the future, the market still needs to give Ethereum some time. 1. Looking forward to Pectra upgrade. After the Dencun upgrade, 2025 In the first quarter of 2019, Ethereum will usher in another major technical update - Pectra upgrade. This upgrade will further simplify and improve the process of creating and maintaining on-chain smart contracts, which means that developers can develop more powerful applications more efficiently, and users can also experience faster transaction speeds, lower transaction fees and safer on-chain use cases.

Pectra upgrade has direct benefits for projects and users such as modular blockchains, abstract accounts, and abstract account wallets. In addition, Pectra upgrade also has technical improvement proposals that are beneficial to ZK Prover network, which is also an effort to enhance ZK technology.

2. Outlook for PoS mechanism, ecological innovation and strong community power

Whether the PoS consensus mechanism will lead to centralized risks is a concern for many blockchain users.

Ethereum founder Vitalik Buterin once said in an interview with the media: The risk of centralization of the PoS consensus mechanism is the main challenge at present. The situations that may bring centralization risks and attract high attention include the growth of MEV censorship risks and staking activities.

Compared with other influential industry figures in the blockchain world, Ethereum founder Vitalik Buterin and the core team of Ethereum have always been highly vigilant about various centralized situations that have appeared on Ethereum, and have insisted on actively speaking out for the concept of decentralization, which is also the core strength of Ethereum that is worth looking forward to firmly.

In addition, although Ethereum's use case innovation and growth seem to have entered a development bottleneck period, in the blockchain world, thanks to the continuous upgrading of Ethereum infrastructure and technical improvement, Ethereum's ecological power is still strong, and its most unique value lies in its strong community power - this is the necessary foundation for the possibility of disruptive innovation, and it is also a firm support for Ethereum's future development to achieve strong development.

4. Outlook on ZK Technology

In the Layer2 ecosystem that improves the scalability of Ethereum, there is a certain consensus on the development and applicability of Optimistic Rollups and ZK Rollups: in the short term, the development of Optimistic Rollups with better compatibility will be faster than the development of the ecosystem based on ZK technology. But in the long run, ZK Rollups that can ensure the validity of real-time transactions and provide privacy protection will inevitably be more actively developed.

Privacy is the key point to promote a new chapter in the future narrative of Ethereum. Ethereum founder Vitalik Buterin once said in a blog post discussing the three technical transformations that Ethereum needs: If there is no excessive technical transformation of privacy, Ethereum may lose most of its users and Ethereum may fail.

The privacy protection scenario provided by ZK technology is its main application scenario in the blockchain field. As Vitalik Buterin once emphasized at the Ethereum community's annual meeting: "In the next 10 years, ZK-SNARK will be as important as blockchain."

As the technology matures, the narratives related to ZK technology will be more diverse and more attractive in the next development of Ethereum.

5. Outlook for ETH

In the second quarter partner letter published on the social platform X on August 24, 2024, Nick Tomaino, founder of 1confirmation, expressed his strong optimism about the development trend of digital assets: ETH market value may exceed BTC in the next 5 years. Currently, BTC's market value is about 4 times higher than Ethereum's market value. Both will continue to grow, but ETH will eventually surpass BTC.

The value accumulation of ETH is crucial to the success of Ethereum, which is still a relatively common consensus. As the members of the Ethereum Foundation said in the 12th AMA: the value accumulation of ETH will be achieved through total fees and asset premiums. The value growth of ETH will support the security and economic activities of the Ethereum ecosystem, thereby promoting Ethereum to become a global financial platform.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Xu Lin

Xu Lin Edmund

Edmund Edmund

Edmund JinseFinance

JinseFinance