Author: Ryan Yoon Source: Tiger Research Translation: Shan Ouba, Golden Finance

Abstract

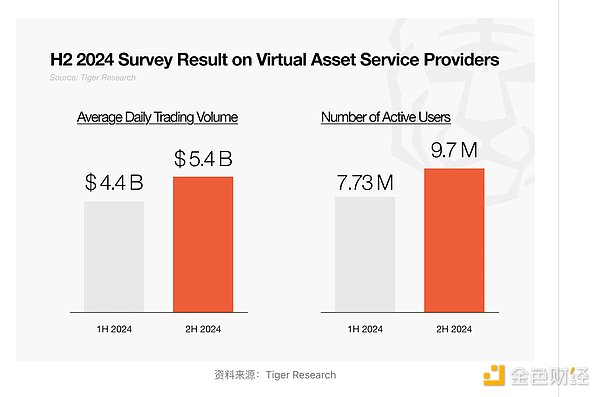

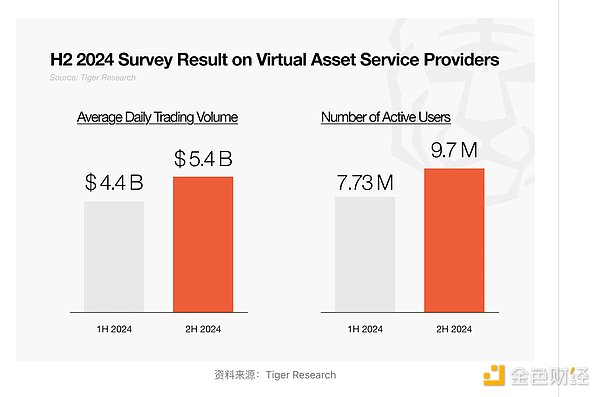

South Korea becomes the core hub of Web3: South Korea's average daily crypto trading volume reaches US$5.4 billion, with 9.7 million active users, making it the world's third largest crypto market after the United States and China. It has important reference value for global projects to expand into the Asian market.

Tax increase time may be advanced, transaction volume may decline: Although the implementation of crypto tax has been postponed to 2027, the new government may advance the policy ahead of schedule. Referring to international cases, transaction volume may drop by more than 20%.

Bitcoin ETF is expected to be approved, other reforms will still lag behind: All major candidates support the launch of a Bitcoin spot ETF, increasing the possibility of its implementation. In contrast, reforms to the regulation of Korean won stablecoins and the "one exchange-one bank" policy are expected to be long-term issues.

1. Is South Korea's June presidential election just a local political event?

South Korea will hold a presidential election on June 3. Although it appears to be a domestic political event, its significance has long transcended national borders due to South Korea's influence in the global crypto market.

South Korea is widely regarded as the third key market for global Web3 projects after the United States and China. This position is not just based on marketing strategies. According to a 2024 report by the Financial Services Commission (FSC) of South Korea, the average daily crypto trading volume in South Korea is as high as 7.3 trillion won (about US$5.4 billion), with more than 20 million registered accounts and 9.7 million active users.

Investor behavior further consolidates this position. South Korean users have always been interested in "altcoins" other than Bitcoin and Ethereum; on-chain activities are also very active, making South Korea a key weathervane for global projects to test market reactions.

Therefore, South Korea has become an important entry point for many global projects to enter the Asian market. The core issues involved in this election include cryptocurrency taxation, won stablecoin regulation and ETF approval.

These changes not only affect local participants. Global investors and project owners also need to pay close attention to the election results. Both tightening and relaxing regulations are possible, and projects with a high proportion of South Korean users will be particularly sensitive.

2. What changes will happen after the South Korean presidential election?

2.1 End of Crypto Tax Delay

According to the Financial Services Commission's virtual asset market enterprise participation roadmap, enterprises are being allowed to enter the crypto market in stages. This gradual opening of the market must also be accompanied by the reconstruction of the tax system.

Currently, South Korea's virtual asset-related taxation has been postponed to 2027. Originally scheduled to start in January 2025, a 20% capital gains tax will be levied on individuals with annual income exceeding approximately US$1,850. However, the plan has been delayed for two years.

An increasingly controversial issue is that both individuals and companies are enjoying tax deferrals despite the gains they have made from crypto trading. According to the roadmap, from the second half of 2025, listed companies and registered investment companies will be allowed to invest in virtual assets through corporate accounts.

Given this shift, it is unlikely that the government will delay the tax again. Instead, it may push for legislative changes to abolish the current deferral policy and collect taxes in advance.

The positions of the political parties have historically differed. The Democratic Party initially preferred to increase the tax exemption threshold rather than postpone the tax, although it also supported the deferral policy in the end. Therefore, the election results may change direction again and resume the issue of increasing the deduction.

Once the tax is implemented, local trading volume may decline significantly, which has been a precedent in other countries. In 2022, India imposed a 30% tax on crypto gains and added a 1% withholding tax on all transactions, resulting in a 10% to 70% drop in trading volume on major platforms such as WazirX and CoinDCX. Similarly, after Indonesia implemented a high tax rate in 2023, annual trading volume fell by about 60% year-on-year.

Although South Korea's proposed tax rate is relatively mild, these precedents suggest that local exchange trading volumes may fall by more than 20%, accompanied by a trend of capital outflows to overseas platforms.

2.2 Launch of Cryptocurrency ETF

Lee Jae-myung (Democratic Party): On May 6, Lee Jae-myung expressed support for the launch of a spot cryptocurrency ETF through Facebook as part of his broad plan to support youth asset accumulation. He also proposed lowering investment fees to improve accessibility.

Kim Moon-soo (People Power Party): On April 27, he expressed his openness to allowing public institutions to invest in the crypto market. Among his ten major policy promises under the slogan of "middle-class wealth expansion", he included the launch of a spot crypto ETF.

Lee Joon-seok (Reform Party): On May 20, Lee Joon-seok suggested through his YouTube channel that the government hold Bitcoin as a national strategic reserve asset through ETFs and other means.

The spot crypto ETF is the only policy proposal among all major candidates that has reached a cross-party consensus, making it one of the most likely policies to be implemented in the short term. It is expected that relevant policy discussions will quickly unfold after the election.

Once spot ETFs are launched, they are expected to trigger fee competition with existing exchanges, driving a healthier market structure and higher quality of service. For investors, especially small investors, lower fees will lower the entry barrier and increase willingness to participate.

In the long run, the launch of spot ETFs may also become a catalyst for further financial innovation. It may open up new paths for the integration of traditional finance and cryptocurrencies, such as derivatives, index funds, and hybrid investment products.

2.3 Re-examining the "one exchange – one bank" model

In order to control the anti-money laundering (AML) risks in the crypto industry, South Korea has been implementing an implicit system: "one exchange – one bank". That is, each licensed exchange can only cooperate with one commercial bank to provide users with real-name verified deposit accounts. For example, Upbit only works with K-Bank, while Bithumb only works with KB Kookmin Bank.

This model contrasts with regions such as the United States, where platforms such as Coinbase can integrate Apple Pay, Google Pay and multiple banks.

The discussion around dismantling the rule began when Woori Bank President Jung Jin-wan raised questions during a policy discussion with lawmakers from the People's Power Party. He pointed out that the model brings systemic risks, limits consumer choices, and imposes unnecessary restrictions on corporate customers. He called for a shift to a "one exchange - multiple banks" model.

As the election progresses, political parties have also begun to express their views:

On April 28, the National Power Party included the abolition of "one exchange - one bank" as one of its "seven commitments for digital assets";

The Democratic Party is also conducting relevant assessments internally, but it has recently become more cautious and has not yet confirmed whether to include this issue in the official campaign platform.

Financial regulators are also cautious, saying that any changes require long-term evaluation.

Although prudence is necessary, continuing to maintain this model on the grounds of market concentration and money laundering risks is being challenged. After all, Upbit and Bithumb already occupy 97% of the domestic market share. If multiple banks are allowed to cooperate, it will increase competition, help exchanges expand user coverage, and bring lower fees and more service innovations to individual and institutional investors.

Concerns about AML risks should also be evaluated more carefully. In fact, the greater risk comes from the transfer of funds to overseas platforms. With the implementation of the Travel Rule and the improvement of compliance infrastructure, South Korea is now subject to stricter international supervision. In this context, the claim that multi-bank partnerships will bring systemic risks appears exaggerated.

2.4 Korean Won Stablecoin

For a long time, South Korea has preferred to develop a central bank digital currency (CBDC) rather than a stablecoin. The Bank of Korea is conducting a CBDC test project "Project Han-Gang" to evaluate CBDC-based payment and settlement systems.

However, as the global trend shifts to stablecoins, domestic demand for stablecoins anchored to the Korean won is gradually heating up.

Lee Jae-myung:

On May 8, he said in a YouTube economic interview that the Korean won stablecoin can prevent capital outflows by providing a local alternative;

On May 18, he emphasized in a TV debate that the Korean won stablecoin will be backed by collateralized reserves to ensure stability.

Lee Jun-seok:

Kim Moon-soo:

The first presidential debate on May 18 officially brought stablecoins into public political discussion, mainly between Lee Jae-myung and Lee Joon-seok. Although the discussion showed that the support direction was basically consistent, it also exposed the lack of a specific policy framework, especially in terms of risk management and compliance.

Currently, the Korean won stablecoin is still in the "concept" stage and it is difficult to achieve in the short term. However, considering regional trends, especially Singapore and Hong Kong are actively promoting local currency stablecoins, South Korea will inevitably follow suit in the future to maintain its financial competitiveness.

Real progress will depend on the establishment of a legal and regulatory system. Key issues include:

Who is eligible to issue stablecoins;

How to ensure the transparency of reserve assets;

How to set up AML procedures;

How to define the relationship between stablecoins and CBDCs.

Given the complexity of these issues, stablecoin-related policies are expected to be promoted in stages over the medium and long term rather than implemented immediately after the election.

3. Gradual but inevitable transformation

Although the above policy changes have far-reaching impacts on the industry, most of them are unlikely to be realized in the short term. Currently, among the main candidates, only Kim Moon-soo has included Web3 issues in his top ten core policies. This suggests that, despite its high industry relevance, Web3 has not yet become a national policy priority.

Therefore, regulatory changes will be progressive in an incremental manner, and related discussions will be held in parallel with more pressing policy issues. But the overall direction is very clear: transformation is inevitable.

As mentioned earlier, it is only a matter of time before crypto taxation is finally implemented. In addition, legislative discussions on security token issuance (STO) are also expected to restart.

For investors and market participants, these changes cannot be underestimated. All parties should prepare for a more regulated and compliant policy environment as soon as possible.

Anais

Anais