Written by: Ignas, DeFi Research; Compiled by: J1N, Techub News

There are now good reasons for the market to be bearish on Ethereum. Because SOL has gained 6.8 times more than Ethereum since the market lows in early 2023, the ETH/BTC trading pair has declined 47% over the past two years.

Is now the time for Ethereum to rebound?

Bearish reasons for Ethereum

There are many reasons for Ethereum’s underperformance. But I think some of the important reasons are as follows:

Bitcoin is "digital gold", and this concept is easy to understand for retail investors and institutions. In contrast, Ethereum’s story is more complicated. The market’s term “digital oil” is neither attractive nor accurate.

Solana is catching up to or even surpassing Ethereum in terms of active users, transaction volume, and awareness.

When investors choose to invest in cryptocurrency varieties, Bitcoin will be a safer choice, and Solana is a choice with potential and a relatively low market value. Ethereum is sandwiched between the two.

Ethereum’s modularity and L2 separate capital liquidity and complicate user experience.

The modular system requires investors to spread their funds across various derivative tokens of Ethereum, such as multiple L2, LRT tokens and DA tokens. In contrast, under the same circumstances, on Solana users only need to purchase SOL.

I believe that Ethereum will perform better than Bitcoin because the market realizes the high returns of the POS mining mechanism. Based solely on the airdrop proceeds from the re-pledge protocol, I believe that the current price of Ethereum is seriously undervalued.

However, this did not bring a FOMO effect to Ethereum. This may be due to the over-exposure and traffic the Ethereum ecosystem received during the past bear market. Many people believed that Ethereum would not fail and bought heavily. .

In contrast, few Crypto Natives hold SOL. When SOL rebounds, these people will transfer more funds from Ethereum to SOL. In the absence of significant retail inflows, Ethereum’s price has stagnated.

Another problem is the decline in Ethereum’s staking revenue and destruction rate.

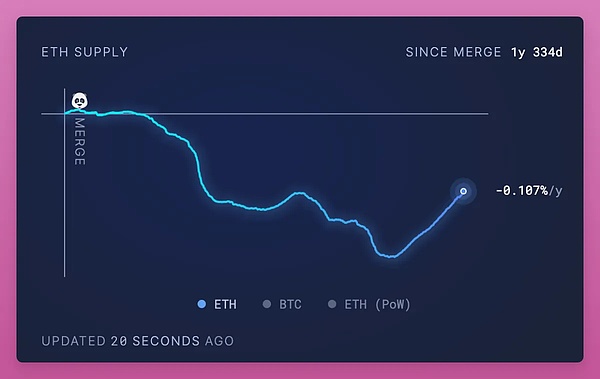

After the EIP-4884 Proto-danksharding upgrade, the gas fee of L2 dropped, resulting in a reduction in the destruction rate of Ethereum. Although Ethereum’s inflation rate is still less than 1%, the situation is not optimistic for those who are optimistic about Ethereum as “ultrasound money”.

It can be clearly seen that after the release of EIP-4844 in March, the destruction trend of Ethereum has reversed

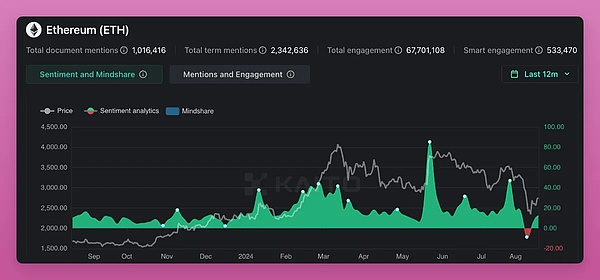

Currently Twitter There are very few "ultrasound money" Memecoins on the Internet. Bearish talk flooded Twitter, but bullish sentiment on Ethereum remained, albeit not as strong as on Bitcoin.

Instead, let’s discuss the bullish side of Ethereum argument.

The Bullish Thesis for Ethereum

There are many reasons to be bullish on Ethereum, and I asked my followers on Twitter to share their views.

Before sharing, I will summarize everyone’s views for the following 10 points.

If the gas price remains around 20 Gwei, Ethereum is deflationary, making it an attractive and efficient network. It’s worth noting that Ethereum’s gas price has been below 20 Gwei since March.

Retail investors can now pledge Ethereum at home, which attracts individual investors in consumer-grade hardware and increases the degree of network decentralization.

The technically strong developer community in the Ethereum ecosystem and the constant emergence of new ideas support continued innovation and network robustness.

Ethereum is the leading smart contract platform. It ensures decentralization while ensuring reliability, and has no real competitors.

Ongoing developments such as L2 and interoperability improvements are major positives, while the community is working to optimize fragmentation and improve network efficiency.

Increasing regulatory transparency, especially in the United States and the European Union, has increased market confidence in Ethereum, enabling institutions such as BlackRock to adopt Ethereum.

Various LSD protocols enable all Ethereum holders to participate in securing the network without technical knowledge or resources.

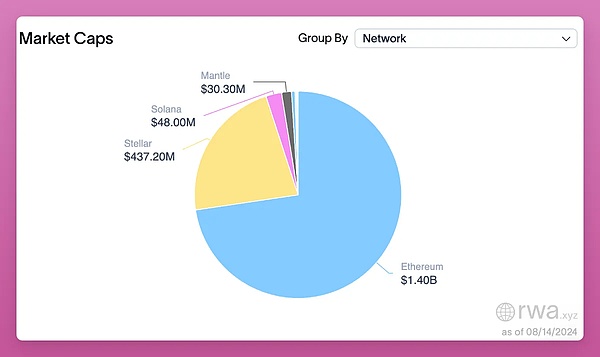

Large institutions such as Coinbase and BlackRock have stated that tokenized applications of RWA on Ethereum will become increasingly popular.

There is huge room for growth in DeFi services and large stablecoin pools on Ethereum.

Ethereum holders and users have regained their enthusiasm and collective pride and contributed to blockchain evangelism and market education.

I also asked several well-known Ethereum holders and users why they are optimistic about Ethereum. Among others, Camila Russo (Founder of The Defiant) and Christine Kim (Galaxy Researcher) responded.

Here are the reasons why Camila Russo is bullish on Ethereum:

Mature DeFi ecosystem: Ethereum and its The second-layer network has the most mature DeFi ecosystem in the entire cryptocurrency field. This liquidity and DApp concentration will attract more users, so that the impact of DeFi activity can be reflected on L1, driving up gas fees and consuming more Ethereum. DeFi is key because finance is currently one of the few cryptocurrency application scenarios that has practical significance.

Decentralization and security: Ethereum’s decentralization and security have attracted the world’s largest asset managers, such as BlackRock’s BUIDL Fund, PayPal’s PYUSD, JPMorgan Chase, Santander and other major banks are testing features such as blockchain settlement and tokenization on Ethereum. Large institutions cannot afford the risk of blockchain downtime or validator/miner attacks and breaches and will continue to choose Ethereum. This will drive activity and price growth.

Christine Kim highlights Ethereum’s network effects:

I think one of the main advantages of Ethereum over its competitors It's the network effect. Ethereum is the earliest general-purpose blockchain and has first-mover advantages and the largest developer community, both of which I believe will help increase the value of the network.

In fact, I prefer to store long-term assets on Ethereum. Solana has had multiple outages, while Ethereum has been reliable for years.

In addition, I am very optimistic about Ethereum as a risk-weighted asset chain for tokenization of RWA assets. For example, 52% of stablecoins and 73% of U.S. Treasuries are tokenized on Ethereum.

Tokenization of US Treasury Bonds

If you Bullish on Memecoins, Solana might be your choice, but for tokenizing billions of dollars in RWA, Ethereum is the safest bet.

Next, a big problem is the second layer.

As a unified public chain, Solana is fast and reasonably priced, but it still has shortcomings.

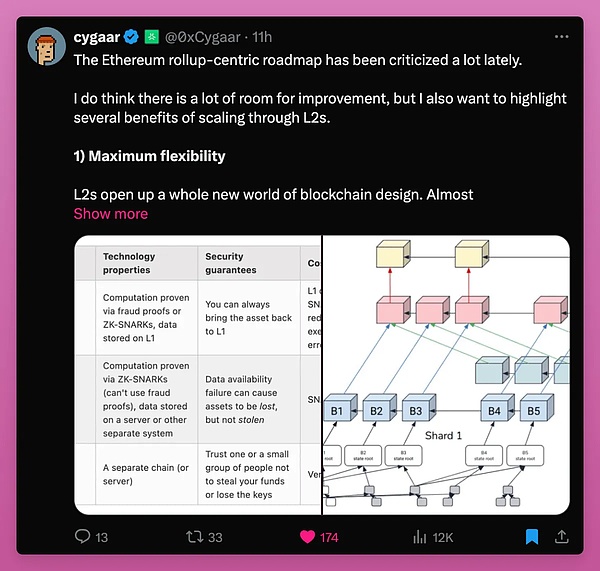

L2’s modular extensions provide a long-term solution because modular extensions can be customized for specific application scenarios, providing more of L2’s flexibility, simplicity, and cultural sovereignty space. . Cygaar explains this well in the following post:

Currently, due to reliance on cross-chain bridges, liquidity is dispersed and user experience is poor. I hope this is only temporary. For example, Catalyst AMM will allow atomic swaps between different chains, eliminating the need for bridging assets. In this case, liquidity remains dispersed, even though since liquidity comes from multiple chains, end users still get the best price. More solutions like Catalyst are in development.

In addition, L2s itself is also making greater effort.

Optimism is "integrating with ERC-7683 to allow superchains to achieve interoperability with other parts of Ethereum L2 through the application layer", which means that all L2s in the Optimism ecosystem will Become a whole.

Similarly, Polygon is building an AggLayer, "which means one-click transactions across chains. It will recreate the on-chain experience."

Then It's Caldera's Metalayer, Avail Nexus and Hyperlane.

Even though various aggregation solutions have not yet been implemented, with continued development, future liquidity and user experience issues should be solved.

I think people underestimate how quickly this will happen. I recommend following Andy on Twitter to stay up to date on modular extensions.

Also, please read this Blocmates article to learn how to resolve current issues with multiple products.

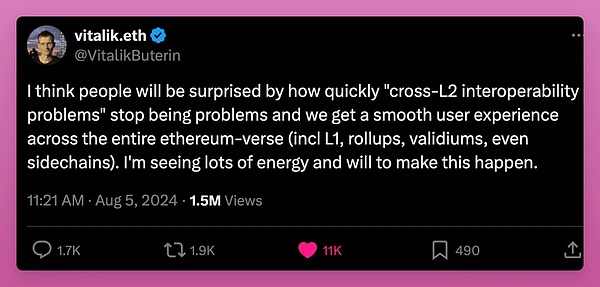

In fact, Vitalik himself has said that people will be surprised to find that the "cross-L2 interoperability" issue is no longer an issue.

If you need more see more For bullish views and reasons, please see Emmanuel's post below. He is bullish because of Ethereum's strong community, continued innovation, and long-term adaptability.

If the L2 fragmentation problem is resolved, RWA and Tokenized applications continue to grow on Ethereum, and I would be very bullish on Ethereum, but these are long-term factors.

In the short term, there is a bullish point that is rarely discussed: the Pectra upgrade.

What is the Pectra upgrade?

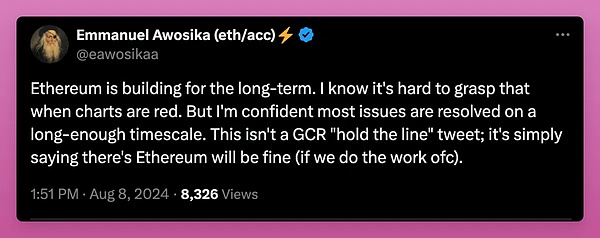

The Pectra upgrade is the next important milestone in the Ethereum upgrade path and is expected to be launched in the first quarter of 2025. It merges Prague (execution layer) and Electra (consensus layer) updates.

Pectra upgrade schedule

In the past, all major upgrades of Ethereum have attracted much attention, but this time the Pectra upgrade seems not to be affected by Market attention.

I understand why. Ethereum has previously experienced major changes: the migration from PoW to PoS, the launch of Ethereum destruction, and EIP-4884, etc. Although the Pectra upgrade is not as big as the previous ones, it does have some interesting updates.

1. Account abstraction: ultimately improving user experience

One of the biggest changes in the Pectra upgrade is the way accounts are handled.

Currently, managing a wallet requires going through many tedious steps, from signing transactions to managing transaction fees across different networks. The Pectra upgrade simplifies the entire process through account abstraction.

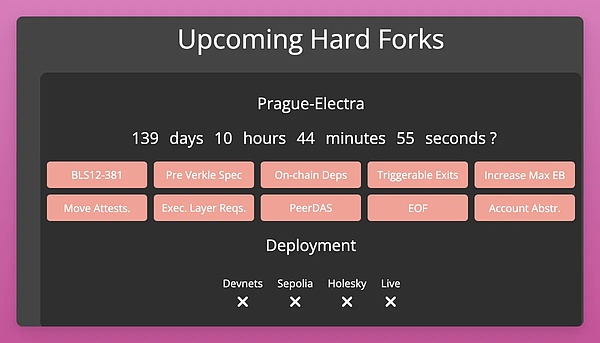

EIP-3074 and EIP-7702 are two proposed improvements. EIP-3074 allows traditional wallets (External Owned Accounts or EOAs) to interact with smart contracts, such as enabling batch transactions and sponsored transactions.

EIP-7702 goes a step further and allows EOA to temporarily act as a smart contract wallet during transactions. Temporary means that your EOA wallet only becomes a smart contract wallet during transactions. It works by adding smart contract code to the EOA address. Let's take a look at the ideal operation:

USDC can be exchanged directly for UNI in just one interaction, no approval required.

DApps can pay Gas fees for users

Pre-approval of DApps that users want to use with their wallets and set spending limits< /p>

EIP-7702 written by Vitalik seems to have given priority to EIP-3074, and EIP-7702 is also compatible with the AA implementation.

The idea of "EOA temporarily becoming a smart contract" is very cool. Because current DApps are often not compatible with smart account wallets (try using Safe or Avocado multisig with DApps). Hopefully AA will get more attention after the upgrade.

2. Staking Optimization

For users running validators, the Pectra upgrade brings some significant changes.

EIP-7251 increases the maximum validator stake amount from 32 ETH to 2048 ETH. It allows large staking providers to consolidate their staking, reducing the number of validators and reducing network load.

This is also a benefit for stakers with smaller funds, as it provides more flexible staking options (can stake 40 Ethereum or compound rewards). Additionally, Ethereum staking queues will be shortened from hours to minutes.

One of the highlights that I'm excited about has to do with MEV mitigation, but it doesn't look like it will be implemented in the Pectra upgrade.

3. Scalability improvements

Pectra introduced Peer Data Availability Sampling (PeerDAS) via EIP-7594.

Similar to Proto-Danksharding in the previous Dencun upgrade, PeerDAS will bring lower gas fees on L2. But I can't find data on how much cheaper it is (I think PeerDAS would be particularly useful during periods of high usage). 0xBreadguy mentioned that the Pectra upgrade will expand blob capacity 2-3 times.

In addition, there are many technical upgrades, such as BLS12 -381 can shorten BLS signatures (lower gas costs), and EIP-2935 can verify transactions without the need for blockchain history.

These EIPs, along with Verkle Trees Transition (EIP-6800), which will eventually replace the existing Merkle Tree structure, can make lightweight clients more secure and make it easier for nodes to participate in the network, thereby Improve decentralization.

One of the major changes is the change of EVM. Through 11 EIP standards, it will be easier to write and deploy smart contracts, reduce costs and improve efficiency. In other words, developing on Ethereum will become smoother.

This tweet from Ethereum Intern simply explains the impact of the technology upgrade.

I am very happy that single slot (SSF) is finally available Launched with the Pectra upgrade, but not yet included in the upcoming Osaka upgrade.

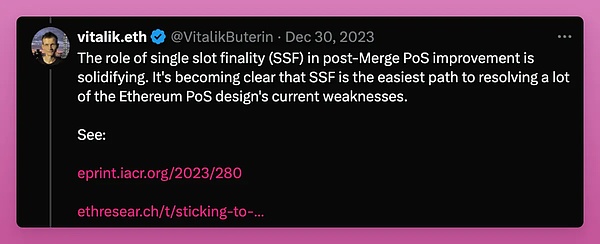

Vitalik shared in December 2023 that SSF is the simplest way to solve most of the flaws in Ethereum’s PoS design.

Currently, Ethereum’s proof-of-stake consensus mechanism takes about 15 It takes minutes for a block to be finalized, meaning that the block cannot be changed or deleted without substantial financial penalties. SSF attempts to reduce this time to a single slot of approximately 12 seconds, ensuring that blocks are finalized almost immediately after creation.

In practical terms, this means faster, more secure bridging, and faster deposits to CEX. Disappointingly, this has not yet been achieved. Not including this in the upgrade is disappointing as it shows that Ethereum developers are still not making level one scaling a priority.

In any case, the Pectra upgrade is a technology upgrade, but I think the market underestimates its importance.

Now, let’s talk about the price of Ethereum.

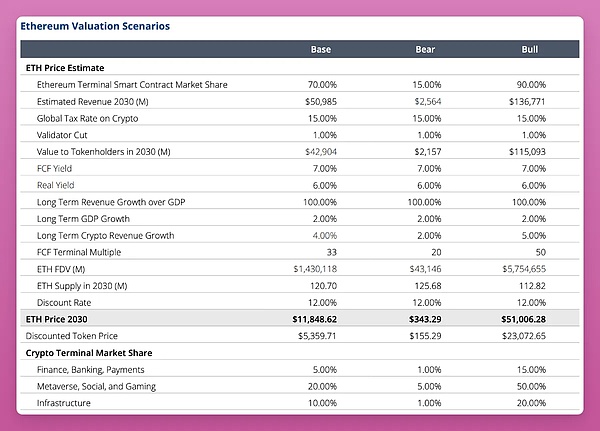

VanEck predicts that by 2030, the price of Ethereum will reach $11,800.

Honestly, the price of $11,800 is quite conservative (I hope the price of Ethereum goes higher), but keep in mind that VanEck predicts that by 2030, the price of Solana will be only $335.

Therefore, according to basic predictions, the potential of Ethereum is 4.4 times, while SOL is only 2.2 times. Note that both of these predictions were made a year ago, before the Ethereum ETF was launched, so I was interested to see their latest predictions.

By the way, if you need more bullish perspective, Ark Invest CEO Cathie Wood predicts that Ethereum will reach $166,000 and Bitcoin will reach $1.3 million by 2030 .

However, I am realistic about VanEck’s bullish view of Ethereum reaching $51,000. VanEck’s Ethereum price prediction is based on:

Ethereum’s revenue is expected to grow from $2.6 billion per year to $5.1 billion by 2030 billion dollars. This growth is attributed to increases in transaction fees, MEV, and the launch of Security as a Service (SaaS), which uses Ethereum staking to secure other protocols (restaking).

Ethereum is expected to be used in finance, banking, payment, metaverse, social, gaming and Sectors such as infrastructure account for more economic activity.

The following is a summary of the base, bear and bull scenarios.

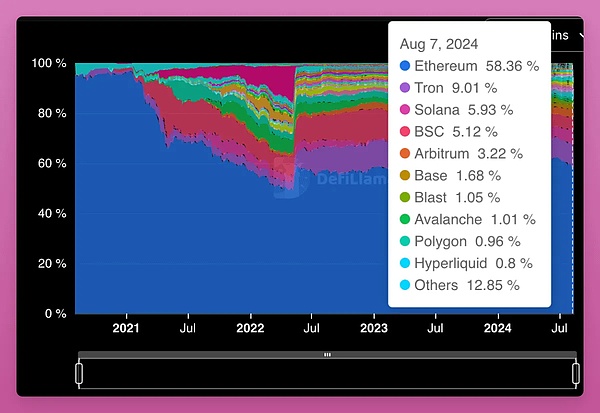

Ethereum occupies 70% of the smart contract platform status Quite reasonable in my opinion, although Ethereum's dominance is currently only 58%, when including all secondary markets, it is about 65%. Even with SOL's crazy rise, Ethereum's dominance has remained unchanged since early 2022.

The proportion of TVL will be a key indicator. Because institutions are more concerned about this indicator.

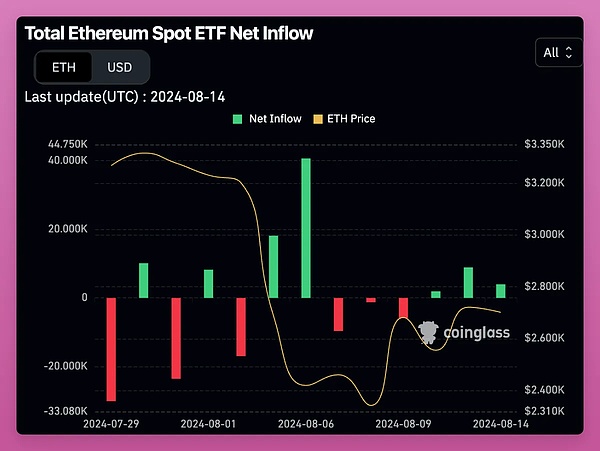

Another metric that both institutional and retail investors are watching is flows into the Ethereum spot ETF.

Ethereum Spot ETF

If someone had told me a few months ago that there was an Ethereum spot ETF but it was trading below $3,000, I would have thought the market was in a bear market .

It’s too early to tell, but the Ethereum spot ETF appears to be increasingly bullish. The rate of outflows from Grayscale Funds is declining rapidly, and net flows have been positive for three consecutive days. It seems that those who needed to exit Grayscale Fund have already exited.

We already know the possible impact of grayscale, But the magnitude of the increase will come as a surprise. If this trend continues, I am quite optimistic about the future of Ethereum.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Weiliang

Weiliang JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance