Comparison of cross-chain token frameworks

Issuing a token used to be simple: you just deployed it on Ethereum, and all the activity was going on there — users, traders, capital, and liquidity. Today, it’s much more complicated.

JinseFinance

JinseFinance

Author : @0xCryptoAndrew, @YihanYihan_W

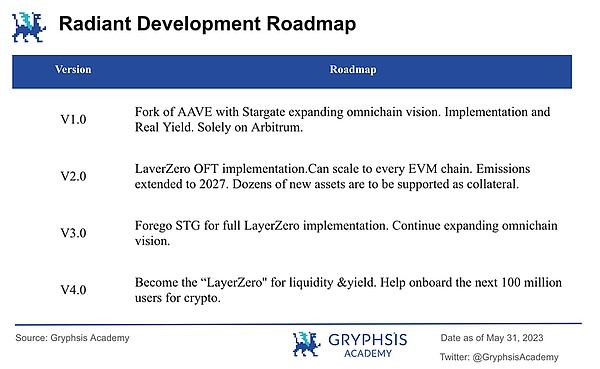

Radiant Capital is a decentralized lending protocol that runs on multiple chains, enabling users to deposit any major digital asset and borrow assets supported by other platforms across chains. Radiant Capital's cross-chain operations are built on Layer Zero and Stargate, allowing users to cross-chain lending and liquidity mining.

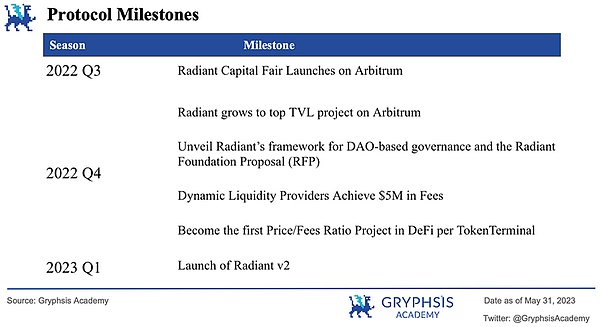

Radiant Capital has achieved milestones, including becoming the highest TVL lending project on the Arbitrum chain, and launching Radiant Capital V2 of launch. The current roadmap includes cross-chain clearing capabilities, abstracted repayment (one-click repayment on any supported chain), collateral expansion, and application deployment on more chains.

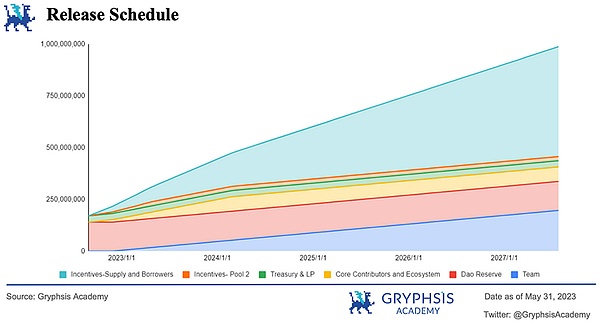

The total supply of RDNT tokens is 1 billion, allocated to Incentives, teams, reserves, contributors, treasury & LP, and liquidity providers. All tokens will be fully unlocked by July 2027.

Radiant has seen significant growth in revenue and transaction volume, indicating increasing demand for the protocol. Radiant is the leader on the Arbitrum chain, with a high TVL and a large user base. Radiant has surpassed Aave and Compound in 90-day revenue and outperformed in user engagement, cumulative users (216,831) and transaction volume ($740.7 million) in May.

Based on the probability-weighted DCF valuation, RDNT is expected to be worth $168.14 million by December 2023, per The price of one token is $0.37. Taking into account P/TVL, P/E, P/S ratio and weighted DCF, the combined analysis yields a price range of $0.45 to $0.67. Of course, the actual token price will also depend on future market conditions and protocol operation.

Recommendations for Radiant include further integration of omnichain solutions , optimize user experience, diversify collateral types, expand business lines, and integrate with other DeFi protocols to create a comprehensive financial ecosystem.

Radiant Capital is a decentralized cross-chain lending protocol built on LayerZero. It aims to create a chain-wide currency market where users can deposit any major asset into any major blockchain and borrow a variety of supported assets across chains, eliminating liquidity silos .

Unlike most cryptocurrency lending platforms, Radiant Capital does not require users to choose a specific chain to work on, nor does it limit the use of that chain specific token. Instead, theRadiant Capital program will operate on most major blockchains, making it easier for users to borrow assets and generate returns by contributing their capital for lending.

Radiant Capital generates actual revenue from its protocol fees and related activities. Investors can deposit their assets into the platform and earn returns by locking, vesting and lending their assets. Through the lending mechanism, users can use their assets as collateral to increase their liquidity.

Overall, Radiant Capital provides a more flexible and inclusive approach to decentralized lending, making it easier for users to obtain on multiple chains liquidity while also earning returns on their assets. As Radiant Capital continues to grow and expand, it has the potential to become a leader in the cross-chain currency markets space.

Radiant Capital owns a 14 A team of people, whose members have worked for companies such as Morgan Stanley, Apple, and Google, have been involved in the DeFi field since the early summer of 2020, and many of them have been exposed to cryptocurrencies as early as 2015.

The original founders and developers of Radiant Capital are completely independent funding supported the development of the project. No private equity, IDO or venture capital is involved in the project, in line with the philosophy of unbiased decentralization.

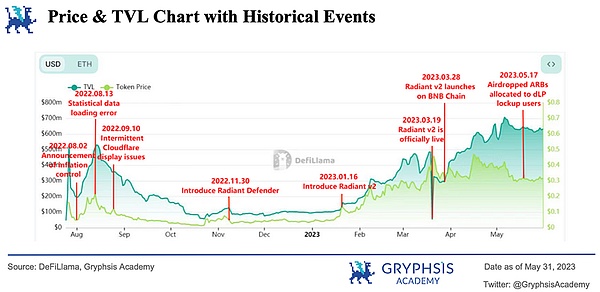

Major events and announcements have triggered to a certain extent the price and total locked value of decentralized lending protocols (such as Radiant Capital) ( TVL) fluctuations. We can see from the chart that on August 2, 2022, when the team announced its intention to control token inflation, both the price and TVL of RDNT increased significantly.

Conversely, when problems with the protocol occur, such as statistics loading errors and UI display issues, user confidence may subsequently decline, which leads to a decrease in the price of RDNT and TVL decline. On January 16, 2023, the team announced that Radiant v2 would be released in the future, which was regarded as positive news by the public; the currency price began to rise (of course also affected by the blockchain market), and TVL also doubled accordingly. Ichiban.

Then, when Radiant v2 was officially released on March 19, 2023, the version transition caused a temporary drop in TVL. However, TVL quickly recovered over the next few days as the V2 version became stable. On March 28, Radiant v2 expanded to the BNB chain, and this expansion brought huge traffic, causing TVL to rise rapidly within a few days.

This inspires us, major events and announcements of the project, Changes in user sentiment and overall market conditions may affect the price and TVL of decentralized protocols. It is important to pay attention to this information and indices in investment operations.

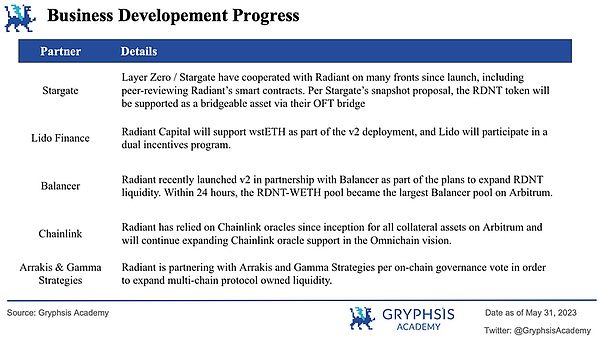

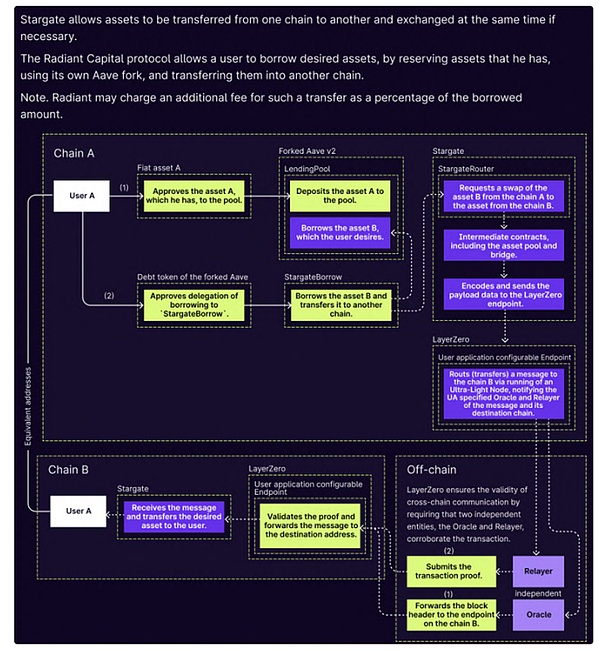

Radiant Capital’s cross-chain operations use Stargate Stable routing interface and built on Layer Zero. Radiant Capital allows users to deposit their assets from major blockchains and let other users borrow those assets without a middleman. People who contribute funds to the platform can earn lower-risk returns.

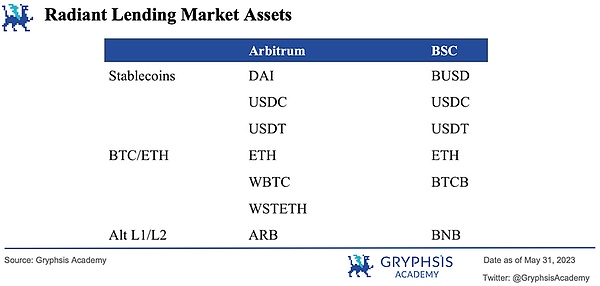

The Radiant lending market supports many assets on the Arbitrum chain and BSC smart chain. On Arbitrum, users can deposit and borrow stablecoins such as DAI, USDC, and USDT, or mainstream cryptocurrencies such as ETH, WBTC, and WSTETH, or Layer2 ghostwriter ARB. On the BSC chain, supported assets include stablecoins BUSD, USDC and USDT, as well as mainstream cryptocurrencies ETH and BTCB, and other tokens include BNB. Users can deposit and borrow across chains and deeply participate in the Radiant lending market.

Radiant UI

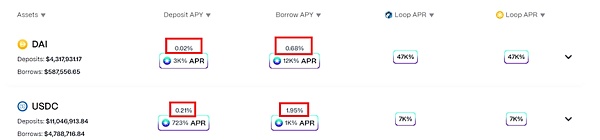

Radiant market provides two interest rates, as shown in the figure, The red box refers to the APY lent and borrowed by the market to users, calculated based on the underlying assets. The purple box APR refers to the reward of Radiant’s native utility token $RDNT. The annual amount formed by Radiant’s issuance of $RDNT to users who provide liquidity and borrowers interest rate. Currently, the higher borrowing rates are compensated by high $RDNT rewards, attracting many users.

Deposit: at Radiant Deposit into the lending pool, earn interest, and gain additional value through $RDNT earnings. Deposits can be used as collateral, and depositors can withdraw their assets to a designated chain. rTokens are interest-bearing tokens, such as rUSDC, that are minted and burned upon deposits and withdrawals. Interest will be distributed directly to rTokens holders.

Loans: Radiant adds utility to users through lending. Users who do not want to sell their assets can use their assets as collateral to obtain additional liquidity. Borrowers pay loan fees and interest to the Radiant DAO and liquidity providers. Borrowers with a health factor below 1 will trigger liquidation.

Liquidation: Radiant's liquidation process guarantees that the borrower's debt will not be less than the value of the collateral. When a borrower's health factor drops to 1 or below, they are liquidated. The overall penalty factor for liquidation is 15%.

Revolving Loan and Lock: The Revolving and Locking function allows users with a health factor greater than 1.11 to automatically make multiple deposits and borrowing cycles to increase the value of its collateral. The feature also automatically borrows ETH and transfers it into locked dLP positions to meet the 5% dLP requirement to activate RDNT issuance. 1-Click Loop provides users with an easier way to gradually increase liquidity and achieve higher returns with up to 5x leverage.

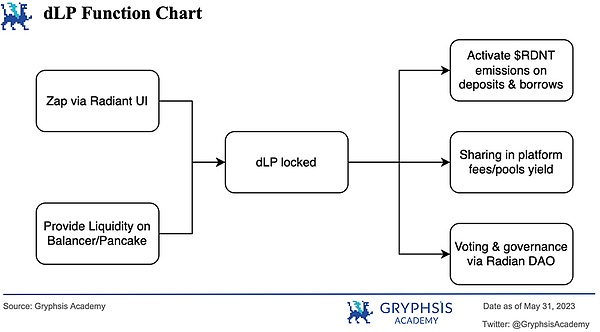

Radian Capital investors can earn income by locking and vesting RDNT tokens. Dynamic Liquidity Providers (dLPs) are RDNT liquidity providing tokens. Radiant allows users to provide liquidity using the zap function.

There are currently two forms of dLP trading pairs:

Arbitrum : Balancer 80/20 composition (80% RDNT & 20% ETH)

BSC: Pancakeswap 50/50 (50% RDNT & 50% BNB)< /p>

The locked dLP obtains platform income through the distribution of rTokens (interest-bearing tokens), and users can withdraw the income or use the income as collateral. The platform determines the share of interest payments and liquidation fees based on the DLP holding shares. Users must lock at least 5% of their deposit value in USD in dLP to be eligible for RDNT bonus issuance on borrowing and depositing.

Recently, the vesting lock-up period of RDNT has been increased from 28 days to 90 days. There is a penalty fee for early exit. Users who exit early can receive RDNT rewards. 10% to 75%. The issuance of $RDNT incentivizes ecosystem participants to provide utility to the platform as dynamic liquidity providers (dLPs).

RDNT OFT Bridge: $RDNT is an OFT-20 token. Layer Zero Labs’ blockchain-wide universal fungible token (OFT) interoperability solutionenables native cross-chain token transfers. OFT allows for combination across multiple blockchains, there is no more fragmented liquidity, smart contract or finality risk, and it also avoids the custody risk of specialized tokens.

Radiant-Stargate Bridge: Radiant Capital offers user lending and bridging via the Stargate Router Function. A bridge based onLayer Zero’s Delta (Δ) algorithm enables raw assets to be transferred between unified liquidity pools.

Radiant V1 allows users to deposit assets on the root chain (Arbitrum) and borrow assets from any EVM chain supported by Stargate Finance. Radiant V2 supports depositing assets on the Arbitrum and BSC chains, and can lend to any EVM chain supported by Stargate Finance. Radiant is currently undergoing development testing and plans to offer full chain-wide deposit and borrowing functionality in the near future.

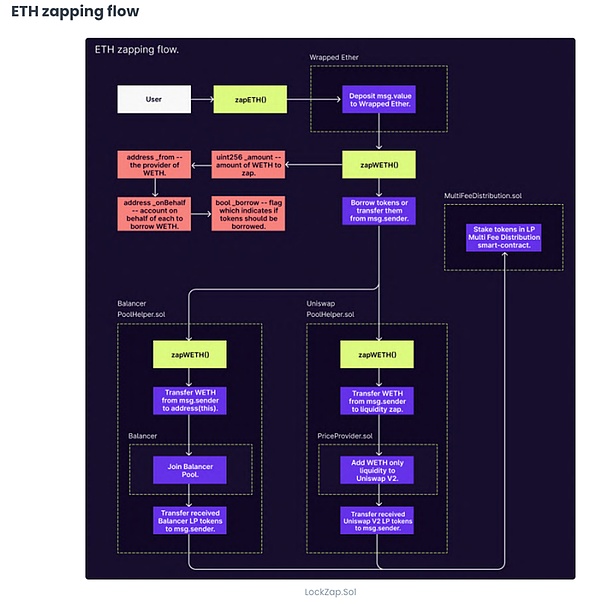

The main functions of Radiant app are Zap (locked dLP) and lending.

Users zap dLP tokens and deposit them into Balancer or Uniswap, and receive corresponding staking rewards through MultiFeeDesitrbutions.sol.

Users interact with the lending pool named LendingPool.sol, such as deposits, borrows, withdrawals, repayments, flash loans and liquidations, interactive operations burning/minting ATokens. ChefIncentiveController.sol calculates a user's balance and rewards, while MultiFeeDistribution.sol distributes rewards to users.

Here are the details of the Zapping and one-click looping process. If only one type of crypto asset is provided, the system automatically borrows another asset and pairs it with a Uniswap or Balancer pool.

Source: Radiant Capital

< img src="https://img.jinse.cn/7178728_image3.png">

Radiant connects with LayerZero and uses Stargate's reliable router interface, so Users will have the ability to deposit any token on Arbitrum and borrow it on the same chain, or borrow it and transfer it to another chain through a single interface.

LayerZero:

LayerZero is a universal chain , enabling different blockchain networks to communicate with each other and operate seamlessly. Radiant Capital achieves its goal of enabling fast and secure trading of a variety of digital assets through a currency market built on LayerZero.

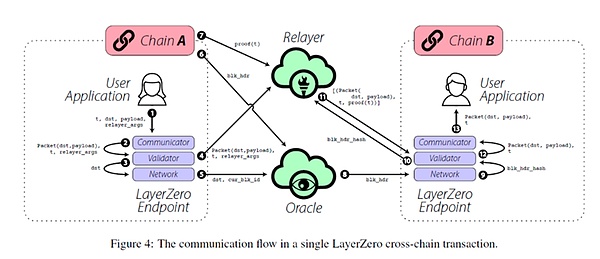

LayerZero enables cross-chain communication by deploying a LayerZero endpoint on different chains, facilitating the transmission of messages through Relayers and Oracles. When a user application (UA) sends a message from chain A to chain B, it will notify the specified Oracle and Relayer through the endpoint of chain A. The Oracle sends the block header to the endpoint of the B chain, and the Relayer submits the transaction proof. Once verified on the destination chain, the message is forwarded to the intended address. In summary, the oracle validates the message on chain A, while the relayer checks the transaction proof to ensure that when both the oracle and the relayer have the same message, the commit from chain A to chain B was successful.

Source: Blocktempo

Stargate: < /strong>

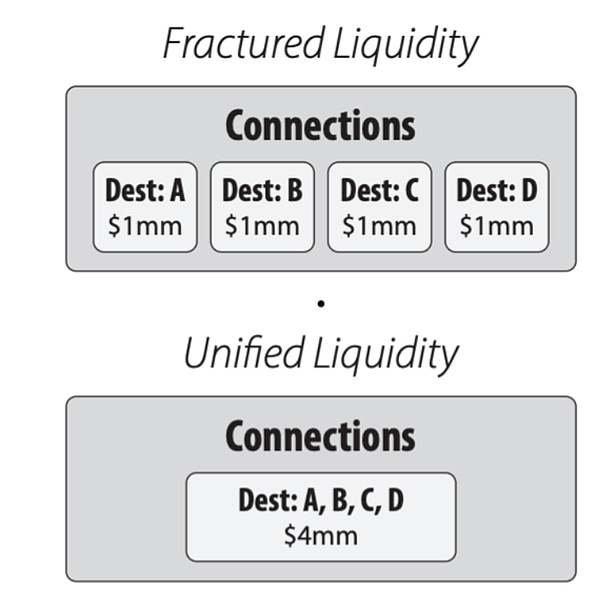

Stargate bridge utilizes a unified liquidity pool shared across chains to ensure sufficient liquidity, prevent transaction reversals, and ensure instant finality. Powered by the Δ algorithm, liquidity pools are automatically rebalanced to support the Δ bridge.

For example, when exchanging USDT in Ethereum with USDC on Polygon, the user deposits USDT into a single USDT liquidity pool on Ethereum. and receive USDC from a single USDC liquidity pool on Polygon. The Δ algorithm seamlessly rebalances the two pools across chains to maintain a balance between the amounts deposited and withdrawn. Stargate avoids maintaining separate liquidity pools for each cross-chain connection by employing a single, unified liquidity pool for every asset on all supported chains.

Source: Consensys

Radiant integration:

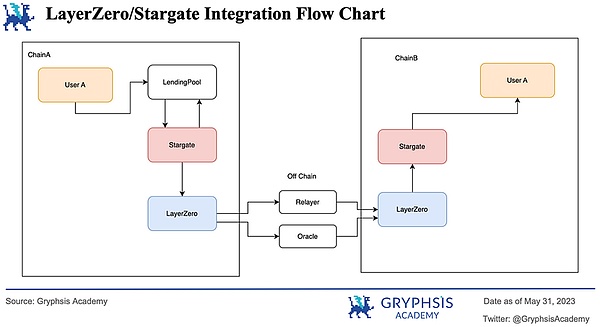

The following is a simplified flow chart illustrating how assets are cross-chain borrowed through LayerZero and Stargate.

Users initiate loans or deposits and interact with the lending pool. When an asset is borrowed cross-chain, StargateBorrow is called and the asset is reserved in Stargate's unified liquidity pool. Stargate sends messages across chains via LayerZero Endpoints, which are verified by off-chain oracles and relayers. The following is a detailed flow chart:

Source: Radiant Capital

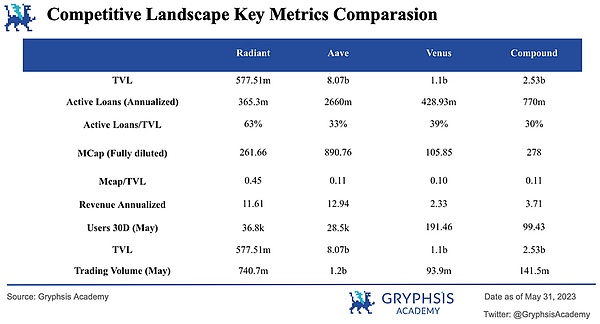

The lending industry is an important part of the decentralized finance (DeFi) field, with its total value locked (TVL) in DEXes (Decentralized exchange industry) and Liquid Staking (liquidity staking) industry, ranking third. Competition in the lending category is fierce, with more than 200 protocols vying for market share. Currently, top lending protocols include AAVE, JustLend, Compound, Venus, Morpho, and Radiant.

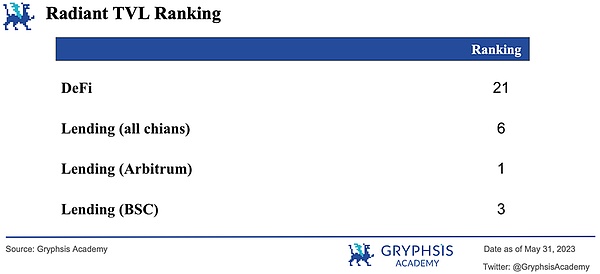

Radiant stands out as a leading player in the Arbitrum and BSC smart chain ecosystem. Radiant landed on the Arbitrum chain last year, and its TVL on the Arbitrum chain has exceeded AAVE. On the BSC chain, Radiant went live in March 2023 and quickly rose to third place in terms of TVL. These achievements underscore Radiant's strong performance on both platforms and its growing prominence in the lending space.

Radiant is the first to be built on Layer Zero Full-chain lending and flash loan protocols. In the current market, there are fewer competitors for cross-chain lending. Radiant is a leader in cross-chain lending. With future support for more chains and assets, Radiant has the potential to gain more liquidity and users.

As mentioned earlier, Radiant differs from other lending protocols in that it allows users to deposit collateral on one chain and use it on another Lending and borrowing on a chain. Radiant’s cross-chain functionality is implemented through Stargate’s cross-chain router. It allows users to deposit assets on Arbitrum and borrow on any Stargate supported EVM chain.

In contrast, AAVE's assets currently cannot be borrowed from each other on different chains, resulting in fragmented liquidity and limited asset utilization. The booming development of Layer 2 has brought indispensable demand for cross-chain asset interaction. Radiant uses LayerZero’s Omnichain technology to establish interoperability between its full chains, a good solution to the problem of liquidity dispersion between different chains.

Radiant Capital holds relative liquidity in the decentralized lending market. Its dLP "Dynamic Liquidity Provision Mechanism" dynamically adjusts their mining incremental rewards based on the proportion of liquidity provided, which incentivizes the platform's lenders and borrowers. This can lock a certain amount of RDNT in the market and enhance liquidity for long-term development. In addition,Radiant Capital has a first-mover advantage in full-chain lending, which other lending protocols (such as AAVE) cannot imitate and surpass in a short period of time.

RDNT’s total token supply is 1,000,000,000.

54% released over five years as an incentive for providers and borrowers.

20% is allocated to the team and released in three months and five years (10% of which is locked when the agreement is generated and unlocked after three months).

14% allocated to Radiant DAO Reserve

7% allocated to core contributors and advisors , released within one and a half years

3% reserved for Treasury & LP

2 % allocated to Pool 2 liquidity providers between August 3, 2022 and March 17, 2023, which is currently deprecated following the approval of the RFP-8 governance proposal.

The picture above is the unlocking time after the issuance of RDNT tokens Table, on July 24, 2022, a major token unlocking and distribution occurred in the Radiant ecosystem. Treasury has unlocked 30 million RDNT tokens, while the DAO reserve has unlocked 140 million RDNT tokens. Secondly, 70 million RDNT tokens are allocated to core contributors and advisors, to be gradually released over 18 months.

In addition, 540 million RDNT tokens are allocated for supply and borrower incentives, to be released within 60 months. Pool 2 was incentivized with 20 million RDNT tokens, which are expected to be released within 8 months. The currently remaining locked tokens will be gradually released in the future until all are unlocked in July 2027.

These unlockings and allocations shape the RDNT token distribution model, incentivize participants, and affect liquidity within the Radiant ecosystem to ensure reasonable distribution of tokens and sustainable growth. This phased approach is aligned with the project’s long-term vision and promotes stability and planning for token holders and ecosystem participants.

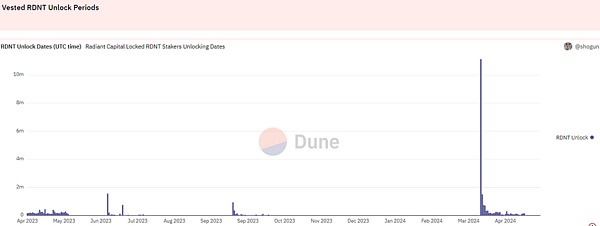

The chart below clearly shows the time it takes to unlock RDNT tokens that are currently vested. In March 2024, over 10 million RDNT will be unlocked. This unlocking event may affect the circulation of tokens and have a certain impact on market dynamics during this period. Investors should be aware of such milestone events and consider the potential impact on the value and trading of RDNT tokens.

Source: Dune Analytics (@shogun)

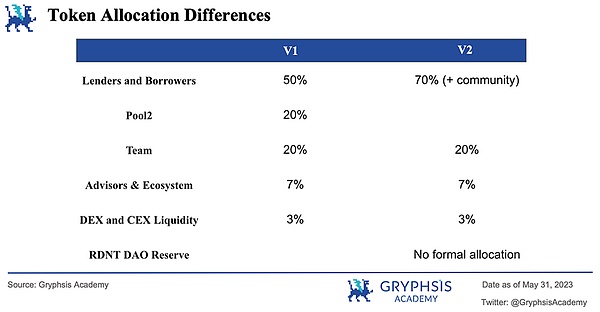

Radiant v1 design:

All token releases are directed towards the initial deployment of RDNT on Arbitrum.

Proposed design for Radiant v2:

Total Max Emissions Represents the total release allocated to all Radiant deployments in a given month; the maximum total release will run according to the proposed schedule, ending in July 2027. At the end of each month, the DAO will review the total value locked (TVL) on each chain and allocate releases accordingly for the next month. For example, at the end of March, if the total Radiant locked value of the Arbitrum chain is 30%, the BNB chain is 30%, and the Eth Mainnet is 20%, then the release amount of these three chains in the following month should be distributed as 30%/30 %/20%.

At the launch of the project, 100% of the token release was directed to the Arbitrum Radiant market; after launch on the BSC Chain, the proposal recommended the 1st 50% of the monthly release is directed to BNB Chain. This is a simple approach, more complex ideas (e.g. per-chain, per-market metrics, distribution based on generated protocol fees) should continue to be discussed and brought to subsequent proposals.

This section of the RFP can be updated based on subsequent proposals generated by DAO stakeholders. This is a predictable and formulaic approach that gives transparency in the short term. Following the voting results of Governance Proposal RFP-4, the release rules for$RDNT incentivize ecosystem participants to provide utility to the platform as dynamic liquidity providers (dLPs). Because only users who have locked dLP (liquidity tokens) will activate their RDNT token release bonus eligibility for deposits or loans.

Given Radiant's cross-chain vision and the shift from unilateral locking to LP locking, this allows Radiant to plan for the long-term future more reasonably and provides the possibility for more chain deployments.

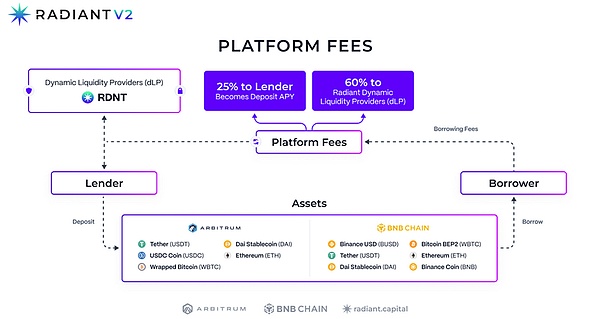

The income of this contract mainly comes from borrowing interest and loans cost. The process involves lenders depositing their assets onto the platform, which are then borrowed by borrowers with collateral. Borrowers pay borrowing fees to obtain a loan.

If the borrower fails to repay the loan according to the agreed terms and conditions, the assets used as collateral may be liquidated. The platform then collects fees from these transactions and distributes rewards to lenders and dynamic liquidity providers. This revenue model incentivizes user engagement and provides a revenue generation mechanism for the platform and its participants.

Loan interest, the interest rate changes dynamically based on working capital

Liquidation fee

Early exit Fine

Revenue & Fee Path, Source: Radiant Capital

Minimum 5% deposit dLP to activate RDNT generation for borrowers/lenders Coin release, which is an additional value in addition to the basic market interest rate

dLP lockers (locked RDNT liquidity) earn 60% of platform fees

RDNT holders can also participate in DAO governance

Utility Flow Chart, Source: Radiant Capital

Sustainability is an important key performance indicator for Radiant DAO, therefore, the protocol implements a Dynamic Liquidity (dLP) mechanism that only allows rewards to be transferred The RDNT tokens and platform fees are allocated to Dynamic Liquidity Providers (dLPs). As mentioned above, the dLP mechanism is a good improvement compared to Radiant v1. It incentivizes users to provide liquidity for $RDNT. The RDNT token release incentives can only be fully obtained after a 90-day lock-up period, and early withdrawal will be punished. This penalty mechanism can reduce the selling pressure of the token.

Radiant has the highest TVL on the Arbitrum chain. Radiant TVL ranks higher relative to other lending protocols of similar market cap due to its easy-to-use locking and rotating features and highly incentivized rewards. However, its MCap/TVL ratio is higher than its peers, suggesting it is now slightly more valued.

Since the launch of V1, there have been two waves of user surges during the Arbitrum craze in Q3 2022 and January, but there has been no significant uptick in users after the launch of Radiant V2. The current cumulative users are 216,831 and the daily active users are 4,750.

Source: Dune Analytics (@defimochi)

$RDNT issuance incentivized transaction volume from both borrowers and lenders, reflecting the platform’s drive for engagement and mobility abilities. With transaction volume of $740.7 million in May, Radiant Capital’s trading volume exceeded that of lending protocols with similar market capitalizations, indicating that Radiant is effectively attracting users and inspiring a lot of trading activity.

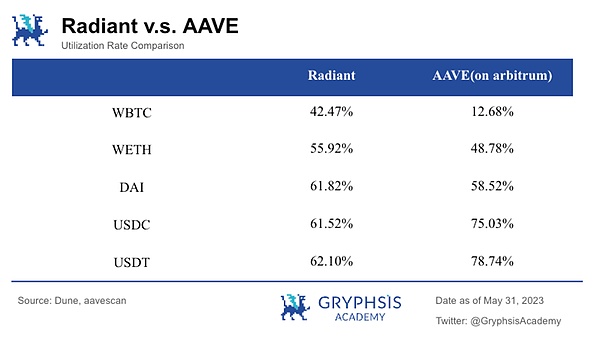

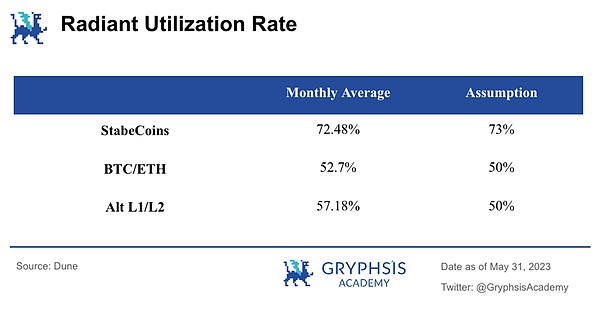

The total utilization rate is approximately 60%, which is relatively higher than similar lending agreements. $RDNT rewards and a simple user interface for rotation and locking increase asset utilization. Broken down per asset, Radiant has similar utilization to AAVE when it comes to stablecoins, but higher utilization when it comes to wbtc and weth.

Radiant was launched on Binance Smart Chain (BSC chain) on March 27, with more than $33 million in locked funds. The green area in the chart below shows the revenue RDNT has received from the BSC chain since March 27, and the purple section shows the revenue RDNT has received from the ARB chain. It is clear that starting in mid-April, RDNT received more revenue from the BSC chain than from the ARB chain. Over the past 90 days, revenue has increased 115.9%, a significant increase in revenue. Even surpassing well-known protocols like Aave and Compound making it bigger in terms of 90-day revenue. This suggests that Radiant is experiencing rapid expansion and gaining traction within the industry.

Source: Token Terminal

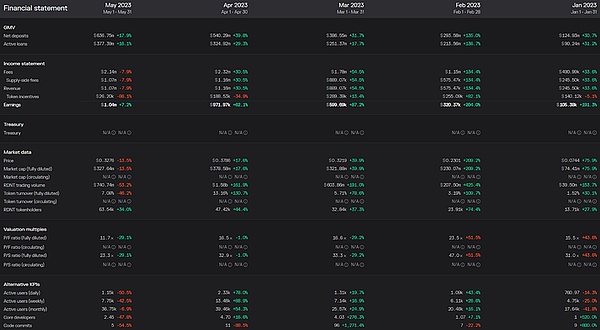

According to financial report statistics, in the past few months, RDNT’s revenue and trading volume have been significant increase. In January and May, RDNT's revenue was $105.38k and $1.04m respectively, an increase of 886.90%. In January and May, RDNT’s trading volume was $39.5 million and $740.74 million, indicating that RDNT’s performance is rapidly improving. Increases in revenue and transaction volume indicate growing demand for the protocol.

As of May 31, 2023, the platform had $377.39 million in active loans and $636.75 million in net deposits. The total net deposits of $636.75 million indicate that the platform has a large amount of liquidity, which is an important factor in maintaining user trust and ensuring that the platform can meet the needs of users’ lending activities.

In addition, $377.39 million in active loans means that users are highly engaged with the platform, which is also a positive sign for the platform's growth prospects. Additionally, a healthy loan-to-debit ratio indicates that the platform is managing its lending activities effectively and maintaining a healthy balance between lending and borrowing.

Source: Token Terminal (Date as of May 31, 2023)

In general, the financial statements show that RDNT is in good financial condition and has a good foundation to continue to expand its user base and expand decentralized lending market services.

The prosperity of Layer2 has promoted the RDNT protocol development of. As more users and transactions migrate to Layer 2, demand for RDNT’s decentralized lending services will increase. Radiant’s planned launch on Ethereum and zkSync also demonstrates its commitment to capturing this growing market.

Radiant is the first functional cross-chain lending market. Given the frequent occurrence of cross-chain bridge thefts and hacking incidents, cross-chain lending provides a promising alternative that can alleviate the need for traditional cross-chain bridges. If the protocol succeeds in enabling full cross-chain lending, it will enhance RDNT’s utility and demand, ultimately driving its price up. Radiant is at the forefront of the cross-chain lending market, with the potential to reshape cross-chain transactions and solidify Radiant’s value proposition.

Users earn low-risk passive income through cross-chain lending/borrowing in bear markets.

Token Design V2's token economic model improves the incentive value and allocates RDNT issuance to long-term protocol users to promote its sustainability. The "5% locked dlp" threshold incentivizes users to purchase RDNT and re-lock more LP to stay above the minimum threshold.

Radiant plans to airdrop $ARB to long-term dlp holders. Additionally, there are LayerZero and ZKSync narratives attracting users to the Radiant platform for potential airdrops.

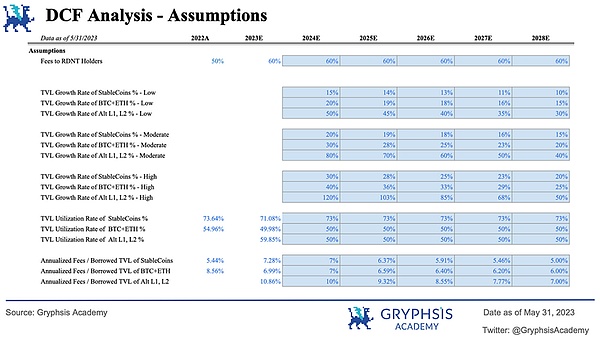

Our valuation is based on DCF analysis and comparable analysis methods, both of which can be adjusted accordingly in our valuation model (Radiant Capital Valuation Model - Gryphsis Academy). Below is a detailed description and explanation of the valuation method.

Discounted cash flow (DCF) is a valuation method used to estimate the value of an asset based on its expected future cash flows. The principle is that an investment must be worth today equal to the cash it generates in the future. Our model uses a 5-year forecast period and accounts for any cash flows thereafter with an estimated terminal value.

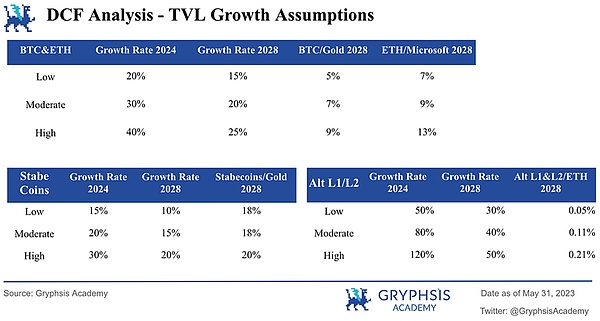

Protocol Total Value Locked (TVL) Growth Rate:We divide the assets available for lending into three categories: BTC and ETH, stablecoins, L1 and L2 alternative assets, and assume the growth rate of each asset class in three scenarios: low, medium and high. .

We use historical annual growth rates over the past five years to predict the market capitalization of Microsoft and gold, and use Ethereum market capitalization as a percentage of Microsoft market capitalization and Bitcoin market capitalization as The percentage of gold's market capitalization is used to prove whether the growth rate estimates under the three scenarios of high, medium and low are reasonable. Our false growth rate is linearly decreasing.

Since Radiant self-supported BSC and provided BNB lending in the market, the TVL of Alt L1/L2 assets increased by 231.53% in the following month . It is therefore reasonable to assume that L1 and L2 alternative assets have higher growth rates compared to stablecoins and BTC/ETH.

Utilization: Asset utilization remains at similar levels in Radiant v1 and Radiant v2. We rounded the average, choosing a stablecoin utilization rate of 73%, and lowering the estimated utilization rate for BTC, ETH, Alt L1, and L2 to 50% to accommodate market uncertainty.

Annualized fees/loaned assets: We compared this ratio to AAVE, a relatively mature lending protocol, and calculated the average annualized fees/loaned assets for both protocols. We compare this rate to Radiant's current annual rate and select the lower of the two rates as the final year rate in 2028. The proportion for the remaining years is calculated by linearly increasing to the interest rate in the last year.

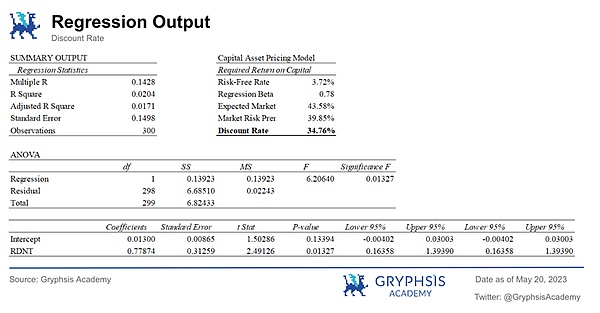

Discount rate: We use the 10-year US Treasury note as the risk-free rate and BTC as the market benchmark. The beta value is obtained from a regression model of RNDT returns as a function of BTC returns. The regression analysis is based on data starting from the RDNT IDO day, July 22, 2022. The Capital Asset Pricing Model (CAMP) calculates the cost of capital to be 35%. Regression analysis shows that Bitcoin returns significantly predict RDNT prices, but the model only explains 1.7% of the total variance. Therefore, we choose 35% as the discount rate, which is similar to the average return of venture capital funds of 30%.

Terminal P/E: Assume an exit PE multiple of 10x for projected free cash flow in 2028, which is consistent with the P/E of publicly traded loan agreements.

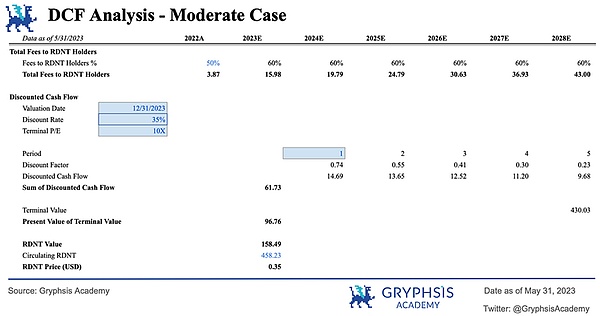

The results for the medium case are shown below. In this case, the RDNT price is expected to be $0.35, valuing it at $158.49 million on December 31, 2023.

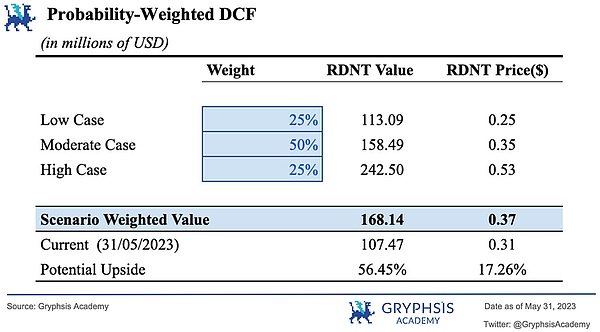

We allocate 25% to the low and high scenarios respectively Probability, the medium scenario is assigned a probability of 50%. The probability-weighted DCF valuation of the RDNT price was calculated at $0.37, valuing the protocol at $168.14 million. The RDNT price on May 31, 2023 was $0.31, with a potential upside of 17.26%.

Comparable analysis is a commonly used valuation method. Valuation is done by comparing with similar businesses in the same industry. The basic assumption is that similar companies should have similar valuation multiples, such as price-to-sales (P/S) and price-to-earnings (P/E) ratios.

Of course, it needs to be stated that there may be certain limitations when using this valuation method to value these lending protocols in the field of decentralized finance. , because reliable sales revenue data may not be available.

When conducting a comparability analysis, it is critical to select businesses that are as similar as possible in terms of industry, business model, risk profile and market dynamics. By ensuring comparability in these aspects, the impact of external factors is reduced, allowing us to focus on the intrinsic value drivers of the companies being analyzed.

If the comparable companies we select belong to the decentralized lending industry and have similar business nature and risk profile to RDNT, this can enhance the effectiveness of the comparative analysis . By treating lending and borrowing protocols within the decentralized exchange (DEX) industry as comparable protocols, the problem of different market risks between different industries can be solved.

Since these four comparable projects all belong to the DEX lending industry within the decentralized financial market, it is reasonable to assume that they face similar market risks.

Market Cap/Total Locked Value Ratio (Fully Diluted Valuation / TVL Ratio):

This ratio is calculated by dividing market cap with The Total Value Locked (TVL) comparison reflects the market sentiment and perception of the value of the protocol. It provides investors with insights into the corresponding valuations resulting from the protocol’s assets and economic activity. Secondly, TVL represents the total value of locked assets. Dividing market capitalization by TVL can give an indicator of the efficiency of the protocol in attracting and retaining assets compared to market capitalization. A lower P/TVL ratio indicates potential undervaluation and stronger growth prospects. Taking these factors into account, the P/TVL ratio can be a relevant and useful comparable multiple for calculating the valuation of DeFi lending protocols.

Price/Earnings Ratio:

The P/E ratio helps investors assess whether the market is fairly valuing a decentralized lending protocol by considering the relationship between price and earnings, or whether it is overvalued or undervalued compared to its earnings potential, which can help identify potential Investment opportunities or risks.

Price/Sales Ratio:

The price-to-sales ratio is often used to assess the valuation of traditional companies based on revenue. For decentralized lending protocols, protocol fees (known as “sales revenue” in traditional companies) are a key factor in assessing their financial performance and sustainability. By using the price-to-sales ratio, which takes into account the relationship between the market capitalization (price) and the fees incurred by the protocol, you can understand how the market assesses the earning power of the protocol.

Average P/S ratio:

We adopt the market multiplier method commonly used in the crypto industry and use the average of the price-to-sales ratios of four comparable protocols as the market multiplier of 1. By calculating the average, we essentially take into account the upper and lower bounds of comparable items, providing a balanced market multiple estimate. Therefore, we choose to use the average of comparable items as a quantitative market multiple to avoid the potential bias that may arise from relying solely on the maximum or minimum value.

Median:

From statistics Scientifically speaking, the median is not affected by extreme values in the distribution sequence, which to a certain extent improves the representativeness of the median to the distribution sequence. Therefore, we believe that choosing the median as the market multiplier of 2 is reasonable.

Revenue and protocol fees:

Analyzing the revenue generated by a protocol allows you to evaluate its ability to generate revenue and sustain operations. Revenue is a key indicator of a protocol's financial health and growth potential. The evaluation of protocol fees helps to understand the revenue streams directly related to lending activities and the profitability of the lending agreement. Revenue and protocol fees can come from a variety of sources within decentralized lending protocols, including interest rate differentials, liquidation penalties, transaction fees, and other revenue sharing. By considering revenue and protocol fees as variables, analysts can evaluate the diversification of revenue streams. This helps assess a protocol's ability to withstand market fluctuations and long-term viability.

According to the figure below, Radiant's TVL on May 31, 2023 was US$636.75 million, ranking between Benqi and Venus. The fully diluted valuation is $312.92 million, which is smaller compared to Aave and Compound but larger than Benqi and Venus.

Radiant's fully diluted valuation/TVL ratio is 0.49, which is high relative to other protocols, indicating that Radiant is, relative to the capital it has locked within the protocol, Its valuation may be overvalued. This could mean the market may be pricing Radiant higher than its underlying value. However, Radiant's estimated annualized total revenue of $15.98 million and annualized agreement fees of $26.63 million are evidence of Radiant's strong revenue-generating capabilities.

In addition, the price-to-earnings (P/E) and price-to-sales (P/S) ratios are low relative to the average ratios of selected decentralized lending protocols, and the value Possibility of being underestimated. Finally, based on these three valuation multiples, potential prices for RDNT are deduced to be $0.16, $0.40, and $1.73 respectively.

It is worth noting that the establishment of the valuation model and the derived token price are based on the current data provided and market conditions. Actual future market dynamics and Radiant Protocol performance will ultimately determine its true market value.

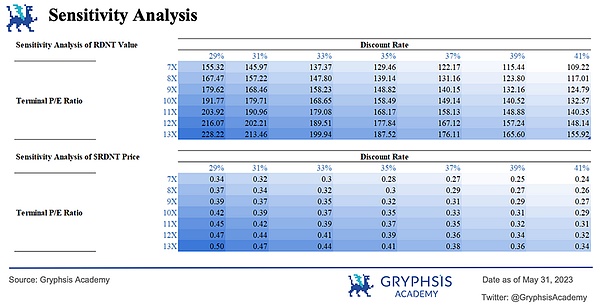

Finally, we performed a sensitivity analysis and obtained the final valuation range.

Three values are selected for comparative analysis, namely P/TVL, P/E and P/S ratio. At the same time, we select the maximum and minimum values of the probability-weighted DCF valuation (cash flow valuation) under different terminal value P/E ratios and discount rates from the sensitivity analysis. Combining the above data, the weights of the three comparative analysis multiples are 15% respectively, the weighted DCF is 55%, and the comprehensive analysis results in a price range of $0.45-0.67.

Although Radiant v2 smart contracts have been audited by well-known companies such as BlockSecTeam, Peckshield and Zokyo_io, and are pending review by OpenZeppelin, But there are still inherent smart contract risks. Additionally, reliance on external components such as Stargate and LayerZero introduces potential additional risks. Since Radiant will be launched in 2022, the maturity period is less than one year, and there is a lack of long-term testing, so there may be certain technical risks.

Radiant faces high inflation rates, a potential risk that could impact the value and purchasing power of the native token, or the overall stability and sustainability of the lending ecosystem.

Radiant is in the lending field with a large number of competitors. The existence of more mature lending protocols that support cross-chain lending has increased competition, which may affect the growth and user volume of the Radiant protocol. For Radiant, being able to provide unique value is extremely important in attracting users and maintaining market share.

Radiant is governed by the Radiant DAO, which exposes the protocol to potential governance-related risks. This includes potential challenges in quickly implementing change proposals or responding to market demands, as well as vulnerability to governance attacks or manipulations. Robust governance processes and transparency are critical to mitigating these risks and ensuring the long-term success and stability of the protocol.

Potential investors and users need to be aware of these risks and conduct their own due diligence. Assessing and understanding the risks associated with decentralized lending protocols like Radiant is especially important for making informed investment decisions and risk management.

Radiant’s recent performance in the cross-chain lending space has been impressive. However, there is still a long way to go to achieve a full-chain currency market. If it relies heavily on Stargate and LayerZero to achieve cross-chain purposes, its development may be restricted. Radiant can grow further by integrating more omnichain technology solutions to optimize the user experience.

In addition, Radiant can further expand its business lines in the money market beyond just lending. Some possible ways to improve the protocol:

Risk management framework:

One of the challenges faced by decentralized lending protocols is the lack of diversified collateral and corresponding mature risk management frameworks. Implementing a strong risk management framework can help mitigate a range of risks, and Radiant can improve the overall stability of the protocol by continually improving dynamic collateral ratios, liquidation penalties, and risk-based interest rates.

Incorporate more asset types:

Decenter The lending protocol currently mainly supports cryptocurrencies as collateral. However, the inclusion of more asset types, such as real-world assets and LSD, could help increase diversity in currency markets and attract new users who may not be comfortable with cryptocurrencies.

Integration with other DeFi protocols:

The Radiant Lending Protocol can also be integrated with other DeFi protocols, such as decentralized exchanges, yield aggregators, etc., thereby creating a more comprehensive financial ecosystem.

Expand other Defi products:

Radiant Capital can explore Opportunities beyond lending and leveraging its omnichain’s capabilities to expand its operations into other DeFi products such as LSD and Collateralized Debt Positions (CDP), adding a broader range of token utility use cases. Leverage the advantages of its RDNT's OFT-20 token standard to create more token scenarios and achieve seamless cross-chain token transfer, making it easier for users to exchange and use any dApp on any chain, thereby attracting more users to to the platform.

As Radiant gradually integrates more cross-chain money market businesses, it can create more empowerment for its tokens Scenario, it becomes a financial platform with a variety of DeFi products. As the value of the platform and user experience increase, it will help to increase the price of tokens.

Overall, the future prospects of RDNT are bright, with many opportunities for growth and innovation. By implementing a robust risk management framework, incorporating new asset types, integrating with other DeFi protocols, and expanding into more DeFi applications, Radiant Capital can continue to grow and attract new users into Radiant's full-chain currency market.

Issuing a token used to be simple: you just deployed it on Ethereum, and all the activity was going on there — users, traders, capital, and liquidity. Today, it’s much more complicated.

JinseFinance

JinseFinanceThe Singapore Token 2049 Conference will be held as scheduled on September 18-19, 2024. This conference will bring together many industry leaders. Golden Finance has compiled a conference guide to help you attend the conference with peace of mind.

JinseFinance

JinseFinanceOn April 18-19, 2024, the TOKEN 2049 Dubai conference co-organized by Bingx, M2, DWF LABS, ZEEBU, DOP, KUCOIN, CoinW, TRON, and telos will be held at the Madinat Jumeirah Resort in Dubai.

JinseFinance

JinseFinanceTOKEN2049 Dubai will take place in the Madinat Jumeirah from April 18th-19th 2024, bringing together an estimated 7,500+ attendees from across the globe

Brian

BrianDubai edition announced as TOKEN2049 Singapore fully sells out amid record-breaking attendee numbers.

Olive

OliveWhile some exchanges are keen on embracing crypto and crypto products, others have indicated a more ambivalent outlook

Clement

ClementCurrently, it has a massive number of 2.67M total users, giving an average of 95.56K opinions collected every day on the general cryptocurrency market.

Nulltx

NulltxTOKEN2049 brings together the leading voices in crypto and creates unparalleled networking opportunities.

Coinlive

Coinlive The ShibaDoge team is excited to announce the release of the SHIBDOGE token. According to the team, the token was ...

Bitcoinist

BitcoinistWe will explore how you could potentially make a profit through cryptocurrency. Specifically, with FIREPIN Token (FRPN), Elrond (EGLD), and ...

Bitcoinist

Bitcoinist