Jessy, Golden Finance

Friend.Tech has run away.

According to The Block, the developers of Friend.Tech, a Web3 social network that was established just one year ago, gave up control of the smart contract and the platform has been closed. According to data monitoring by on-chain data analysts, the project has earned $52.4 million through the project.

Friend.Tech set a record of daily revenue exceeding Ethereum in just over a month after its establishment. It was once extremely popular and had countless imitations. But the other side of the coin that is not known to the public is that the project has reached its peak after the rapid development in the first three months, and then it has been on a downward slope. First of all, the number of people in the agreement has basically not increased significantly, the TVL of the agreement has also fallen continuously, and the transaction volume has plummeted. The lowest daily activity was only a dozen people.

Looking back on the development history of Friend.Tech in the past year, we will find that it has not been able to get rid of the negative comments from the beginning of its establishment, such as "Ponzi", "casino", and "difficult to sustain business model". Within a year, its version update, coin issuance and other behaviors were only short-term life-extending behaviors.

And star projects like Friend.Tech have all failed. Does this prove that the Socialfi track is just a false proposition?

Projects suitable for KOLs to open "markets"

Friend.Tech, as a decentralized social platform, allows users to obtain the right to directly communicate with any user on Friend.Tech through the strong binding method of X, and the Key can also be resold. For buyers, they can bet on the future potential of the user by purchasing the Key.

And users can issue their own personal tokens on Friend.Tech, and users holding personal tokens can obtain exclusive content from the issuer.

This seems to be a platform for creators to monetize content. Compared with other platforms, it helps users save a lot of tedious processes to operate content. In fact, it is a simple and crude way for users to directly monetize their connections.

The product design is simple enough, and it only has the functions of adding friends and joining group chats at the beginning. It is built on the large traffic pool of X, and the platform's built-in airdrop expectations are also attractive enough. It promotes interaction and dissemination among users through invitation codes and points.

Friend.Tech also enables personal influence to be equityized and traded by setting a price curve. This mechanism design refers to the practice in AMM, that is, price discovery and fluctuation can be achieved without a large number of transactions. This method gives personal influence a certain economic value. The user's stock price can be automatically discovered and adjusted according to the price curve under the condition of sufficient liquidity. Even in the case of low trading volume, personal stock prices can be reasonably reflected. This influence pricing and trading mechanism is the core innovation of Friend.Tech compared with traditional social tokens.

In general, the project seems to be born for KOLs in terms of dissemination mechanism. It is for this reason that through the large-scale dissemination of KOLs, it has spread in a fission-like manner in a short period of time. Similarly, its pricing method for personal "Key" has also been innovated with reference to the AMM model. This has enabled the project to quickly break the circle. KOLs and project parties have made a lot of money.

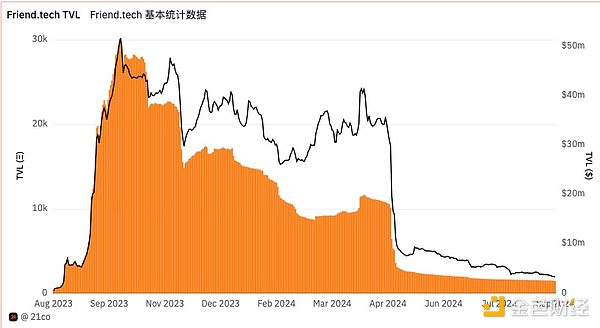

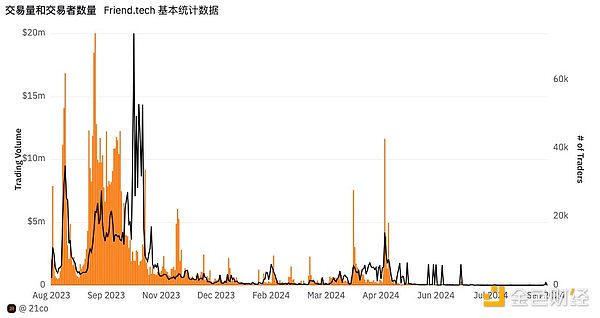

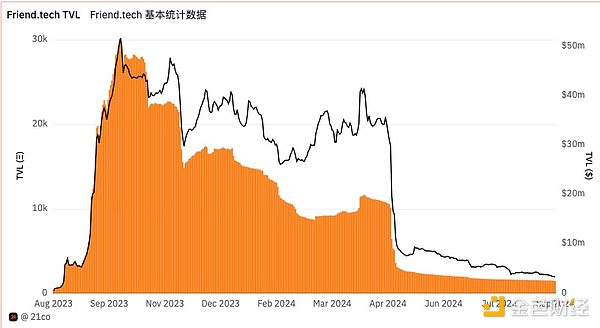

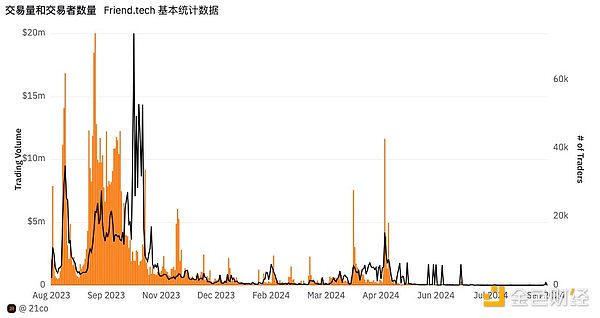

One day in September 2023, it set a record of daily revenue surpassing Ethereum. According to the analysis created by Dune user @21co, its TVL locked volume peaked in October 2023 at 51.68 million US dollars.

Using the thinking of opening a casino to do social networking is doomed to fail

The first three months were the most glorious period for Friend.Tech. After October 2023, Friend.Tech began to go downhill.

Is the price curve pushed up in the short term sustainable? In fact, many users only speculate or get token incentives, which makes Friend.Tech have such active transactions in the short term. How to maintain long-term user stickiness?

Friend.Tech's transaction volume this year also proves that the project itself is unsustainable and has not really retained users.

According to the analysis created by Dune user @21co, its highest transaction volume was in the first three months, and then it was quiet, and the second relative high point was in May 2024.

At that time, Friend.Tech launched the V2 version and issued the platform currency FRIEND, which can be redeemed for points on the platform. At the same time, the project also announced that in addition to the 100 million points initially established, 12 million FRIEND incentives will be allocated to LP providers in the next 12 months.

Although the transaction volume and daily activity on the Friend.Tech platform are difficult to reproduce the glory of the initial establishment, FRIEND's market value exceeded 200 million US dollars in a short period of time after its launch, and FRIEND's transaction volume achieved a breakthrough of 100 million US dollars within a week of its launch. In addition, Friend.Tech provides LPs with generous rewards, which also attracts more FRIEND token liquidity locks, among which Huang Licheng is the largest LP of FRIEND tokens. (According to the information on the chain, Huang Licheng, the eldest brother of Maji, currently holds a total of 11.1 million FRIENDs, and has suffered a floating loss of at least $15 million.)

Friend.Tech V2 version launched the paid group "Club" function. The paid transactions of Club only support the platform currency FRIEND. The platform charges a handling fee during the transaction process.

Although the launch of V2 and the token airdrop brought some users to the platform, these so-called "innovations" did not save Friend.Tech's decline. The protocol fees began to stagnate soon after. According to data from The Block, V2 has only generated about $60,000 in protocol fees since June 2024. In July 2024, its daily active users were as low as 15 people.

At its core, the project is unsustainable.

The core of the project is to turn personal connections into resources. When the connections are exhausted, how can the project continue to develop? If you want to develop continuously, you need to continuously iterate the product and establish a business capability that can continue to make money.

The launch of V2 was an iteration that Friend.Tech tried to make, but it was not successful. Friend.Tech itself is still a "casino" and "Ponzi" built by consuming connections. These two characteristics are actually not a problem from the perspective of profitability. In the early days, "Ponzi" was used to attract people to expand the market and inject traffic into the casino. The initial traffic was there, and the casino could continue to operate. The core is that new plates need to appear continuously, and the project party continues to earn commissions in the meantime.

Unfortunately, Friend.Tech failed to continue to attract people to open the market. Because the product itself is deformed, it is not a pure casino, it is a social product. The market is opened by KOLs, and the chips are his Key. However, there are limited influential KOLs, and only the "market opened by influential KOLs" has higher liquidity. Ordinary KEYs are not bought by anyone. Without new KOLs to open the market, the project will no longer be active, and it will be difficult for the project party to make money.

If it is just a casino, allowing people to issue coins, similar to Pump.fun, it can survive well. However, using social networking mixed with casinos actually greatly raises the threshold for issuing coins.

If we examine it from the perspective of social products, we will find that people who enter this project are basically not here for social interaction, but to monetize their connections, or to make money by buying and selling tokens.

In this way, the project is just a casino packaged as a social product, but the casino is not simple and pure. Such a deformed product is bound to fail.

Socialfi is a false proposition?

The failure of Friend.Tech has caused people in the industry to question: Is "SocialFi" a false proposition?

If Social is just for making money, it will definitely fail, and Friend.Tech proves this. The first attribute that a good social product needs to meet must be people's social needs.

On this basis, Web3 social products need to compete with Web2 social products and meet social needs that are difficult to meet on other platforms, so that people will be willing to migrate.

Web3 social products should put aside the value propositions of Web3 and how to make users make money through social networking, and give priority to how to make a product that can meet a certain social need of most people.

People's social needs have actually never changed: sex, communication, and maintenance of relationships are the most basic needs. Going up is the need to own or monetize social assets such as connections, high-quality content, etc.

To make social products, you need to meet the most basic needs first, and then make a fuss about the upper layer. The advantage of blockchain is that it can make the things that are needed at the upper layer be confirmed as personal real assets.

Socialfi itself may not be a false proposition, but the reality is that many current projects, without doing well in the underlying needs, blindly do the upper layer, which will definitely fall into either the unsustainable Ponzi model of quick success and instant benefits, or it will not make any waves and have few users.

Web3 social networking itself is definitely in demand. With the increase in blockchain users and people's emphasis on personal social assets, the original Web2 social products can no longer meet all of people's social needs.

Telegram's success in meeting some of the blockchain users' Web3 needs such as on-chain interaction, blockchain asset storage, and transactions also proves that Web3 social networking itself has demand and market.

Socialfi will also have it, and everyone is waiting for a successful product.

JinseFinance

JinseFinance