Author: TechFlow

Open crypto Twitter, and you can always see those cryptocurrency masters who show off their assets of more than 8 figures and make unlimited profits from one contract.

Whether it’s filters or strength, it’s not the luck of ordinary people to get big results in the cryptocurrency circle.

Recently, the well-known up master of B station "Feng Ge Fu Ming Tian Ya" (Feng Ge) recorded with the camera the story of a man who was once the deputy director of a state-owned enterprise in Handan, Hebei, who lost 3 million yuan in debt due to cryptocurrency speculation and fell into a life of falling.

As of press time, the video has been played 750,000 times, and discussions about the story on social media are endless.

Tear off the glamorous illusion of getting rich quickly, this is a true story of an ordinary cryptocurrency trader who is constrained by information asymmetry and trapped by greed.

From factory manager to driving a ride-hailing car with debt

Since the original interview did not mention the specific name of the protagonist of the story, but the interviewee's B station ID is "Zheli Rebirth", the following will refer to him as Rebirth Brother.

Once, Rebirth Brother's life was enviable.

According to his own disclosure in front of the camera, he was once the deputy director of a coal washing plant of a state-owned enterprise in Handan, Hebei Province. He had a monthly salary of 9,000 yuan after tax, lived in a house without a mortgage, drove an Audi car, managed 20-30 people, and his status as a deputy section-level cadre also brought respect from others.

In 2018, Reborn Brother married his wife and had a five-year-old daughter. His family was happy.

"We are also a well-off family... not as good as the best, but better than the worst." When he recalled, his tone was filled with a distant sense of warmth.

At that time, he took his daughter to travel in Shandong and Zhengzhou, practicing the concept of "raising a daughter in wealth", and his parents' pensions made the family have no financial pressure. Such days are as solid as a rock, and it is difficult for you to find signs of collapse.

Now, everything has turned to ashes.

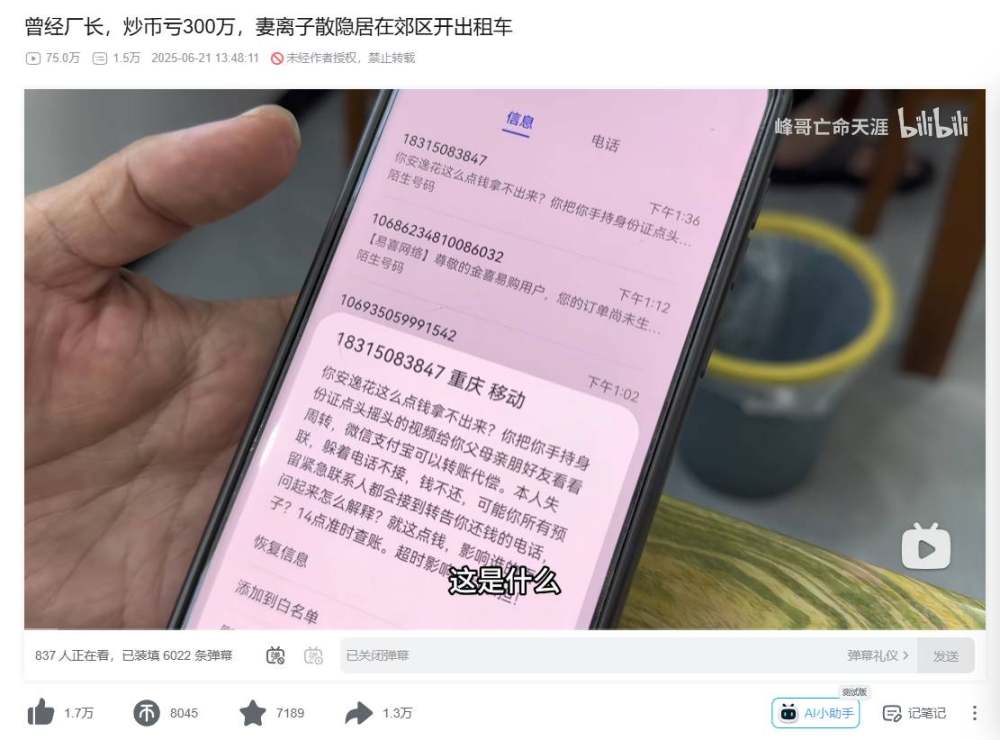

At the beginning of the video, Chongshengge showed the interfaces and debts of various loan apps on his mobile phone. He owed more than 100,000 yuan in loans on one of the apps, and he lost a total of 3 million yuan in cryptocurrency trading. He worked hard every day to pay off the high-value loans.

Now he drives an online car-hailing service for 13-14 hours a day, with a turnover of 300 yuan. After deducting car rental and living expenses, he only has 100 yuan left. He rents a single room for 600 yuan per month, and the independent bathroom is his last dignity.

Millions of debts follow like a shadow, with an annual interest of 200,000 to 300,000 yuan. Most of the loans have been overdue, and debt collection calls are endless.

When asked why he accepted Feng Ge’s interview and that his story might be made public, Chongsheng Ge said:

“The main reason I refused your interview was because I was afraid that it would affect my work. Now I don’t plan to go back to work anymore. I can’t go back, so I just don’t have any worries. I’ll just work hard outside and make money to pay off my debts.”

The courage to face the camera and life is in contrast to the collapse of the family:

Two months ago, his wife divorced him due to a debt crisis and took their daughter away; his parents were completely desperate, and his father’s text message was even more heartbreaking: “This family no longer has you, and everything about you is over.”

The five-year-old daughter didn’t know the truth because she was too young, and only knew that “Dad went out to work.”

From senior executives of state-owned enterprises to indebted drivers, the fall of the interviewees is indeed lamentable. The reason for the rapid fall comes from the madness of high leverage in the currency circle and the obsession of borrowing to turn over.

Copyright coins, high leverage, no stop loss

His story may also be a microcosm of countless ordinary currency speculators - being swallowed by greed and illusions is often not a stud, but a process.

Under the camera, the reborn brother also confessed his journey in the currency circle: from the first taste of sweetness to high leverage, the loss of 3 million is not an overnight collapse, but the accumulation of countless behaviors.

The enlightenment of the reborn brother in the currency circle began with the earlier stamp and coin card transactions. In the 2010s, stamps and coins, as an online financial product, claimed to be supported by stamps, attracted countless retail investors to enter. After trying the water, Chongsheng made a small profit of 10,000 or 20,000 yuan, and luckily escaped the crash, accumulating the confidence of "buy low and sell high".

He admitted that he was still cautious at the time, but this sweet taste had already planted the seeds of speculation.

In 2020, he entered the cryptocurrency circle and began to try spot trading. He was cautious at first, but his greed was soon magnified.

In order to make more profits, he began to chase altcoins and opened contracts. Contract trading allows borrowing to magnify the principal, and 10 times, 50 times or even 100 times leverage can multiply profits and risks.

According to his own description, a principal of several hundred yuan could make a profit of 40-50% at the beginning, so he began to gradually increase the investment, and began to add more to the principal and leverage multiples.

Zhongsheng Ge himself described this as "cutting meat with a blunt knife". He never borrowed money at once and invested it all in one go. It was more like boiling a frog in warm water. Today he deposited 20,000 yuan and lost it, and tomorrow he borrowed another 20,000 yuan to deposit it and try again.

One of the ridiculous details in the original video interview is that the up master brother Feng thought that his behavior of entering the market in batches was still steady and solid, while the reborn brother immediately denied himself:

"It's not steady and solid. If I had 20,000 yuan to open a contract today, I would open a very low leverage, not such a high leverage. There would be basically no problem with low-leverage altcoin contracts... Because at that time, my mind was already twisted and perverted. I wanted to make money back so much that I would start high leverage at a point I thought was appropriate. I had opened 10 times, 50 times, and 100 times."

Obviously, Chongshengge underestimated the volatility of altcoins in the cryptocurrency circle, and it was reasonable for him to blow up his position. Another reason why he kept borrowing money to fill the hole was that he had no discipline in trading.

Chongshengge said that his biggest problem was not setting a stop loss. After setting a stop loss, he would cancel the stop loss again, imagining that it could rebound.

This irrational game also caused him to blow up his position again and again, and borrow money again and again, but everyone knows the final result.

Four times of borrowing money, no one turned around

In 2020, he exhausted his savings of 10,000 yuan and tasted the bitter fruit of a blow-up for the first time.

He borrowed 100,000 yuan through online loans such as Alipay Jiebei and Anyihua, and his relatives and friends raised 120,000 yuan to fill the 220,000 yuan hole, and his parents emptied their savings to pay it off. After that, he promised not to play, but less than half a year later, he ignited the idea again, "swiping the news of Bitcoin's skyrocketing... made me mistakenly believe that there was an opportunity."

The second time, he borrowed 150,000 yuan from online loans and 150,000 yuan from relatives and friends, a total of 300,000 yuan, and continued to speculate in coins with high leverage. After the explosion, he deceived himself that "tens of thousands of yuan can be solved slowly by myself", but it buried a greater hidden danger.

In 2023, the debt soared to more than 600,000 yuan, and it was difficult to raise the money from online loans and loans from relatives and friends to pay it back. He sold his sister's house of less than 70 square meters for 500,000 yuan, and his relatives supplemented it with 100,000 yuan, and once again completely paid off the debt.

However, this short-lived "landing" did not bring him relief, but deepened the twisted mentality of needing to earn back what he lost --- selling the house caused his sister to lose her dowry, and his parents were shocked and emotionally collapsed. He obviously blamed himself and said frankly that "life was particularly depressing."

The currency circle has cycles, and the story of gradually getting rich from the trough also influences the entry choices of the frustrated, and has become a motivation to enter the market again to win back.

In 2024-2025, he mortgaged his own house, borrowed 700,000 yuan in usury (20-30% interest) and 300,000 yuan in online loans to continue speculating in currencies, and also made his total debt exceed one million.

Of course, every time he borrowed money to open a contract, he did not make a comeback.

The cost of borrowing is not only money, but also the collapse of trust. In order to raise money, he made up lies to deceive relatives and friends; friends who often lie also know that when you want to make a lie, you often need to cover it with bigger lies, overdrawing more connections and credit.

"Pretending to be a good person in front of others and a bad person behind their backs, you don't even have the bottom line of being a human being..." The reborn brother also ushered in the East Window in the torment.

A friend informed his wife, exposing his total debt, and his wife collapsed and filed for divorce; his parents learned that he had mortgaged the house, and they were completely desperate, and left a text message like this:

"You have been possessed by a demon, you have mortgaged the house... This family no longer has you."

After being interviewed by Brother Feng, Brother Chongsheng also opened an account and warned everyone not to borrow money to touch similar products again, "I ruined my wonderful life with my own hands."

The two words "turn over" can be the name of a subway station in Shenzhen, and it can be the unwilling fantasy when losing too much, but it is more likely to be a snowball-like abyss of greed.

Liang Xi helps, the road ahead is long

After Feng Ge’s video was spread, Liang Xi, the KOL who loves to open contracts the most in the Chinese currency circle, posted a message, announcing that he would subsidize Chongsheng Ge 50,000 yuan, and provide an additional 60,000 yuan as monthly living expenses for one year (5,000 yuan per month) to prevent him from continuing to speculate in coins.

Liang Xi can naturally understand Chongsheng Ge. They are both dancing on the edge of the contract and have experienced the taste of liquidation. This wave of help, from the perspective of motivation, is more like saving the former self.

However, any good deed should have its limits in the implementation process.

The addiction of Reborn Brother to cryptocurrency trading cannot be ignored. With the obsession of "turning over" and the blessing of sunk costs, he may still continue on the road of no return, especially in the cryptocurrency culture, where the narrative of "borrowing money to turn over" is everywhere, not to mention that the person who lent him money is Liang Xi himself, who has a full contract drama effect.

If a contract master lends you money to help you and asks you not to play contracts anymore, will you stop?

Don't forget that in reality, Reborn Brother is still relying on being an online car-hailing driver to maintain his expenses. The hard-earned money saved by overdrawing his physical strength is still too slow compared to the pleasure brought by the contract in a short time.

With millions of debts following him, we still don’t know which path he will choose, nor do we know whether it is for another comeback or to redeem the lost dignity.

Miyuki

Miyuki

Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Weiliang

Weiliang