Author: Jaleel Jialiu Source: X, @0xJaleel_eth

RUNES wants to be the "Las Vegas" of the Bitcoin network, but BRC20 does not want to be "Atlantic City".

When it comes to several well-known casinos in the world, many people's first reaction is "Las Vegas" or "Macau", while "Atlantic City", located in southeastern New Jersey, the first gambling city in the history of the United States, has long been in decline and forgotten, even though "Atlantic City" once made a net profit of 3 billion US dollars a year.

Image source: Internet

At the Ordinals Asia event at the Hong Kong Bitcoin Week two weeks ago, Casey Rodarmor, founder of Ordinals and RUNES protocol, said directly and frankly in his speech: "If Ordinals and Runes are a casino that is more transparent, more decentralized, and has a lower house advantage than Las Vegas, all Degens can be happy here, and I think this is also very good."

The RUNES ecosystem has been online for more than a month, and its current market value has not only reached Casey’s initial target of one billion US dollars, but in recent days, ecological assets have also ushered in a new round of general increases across the board.

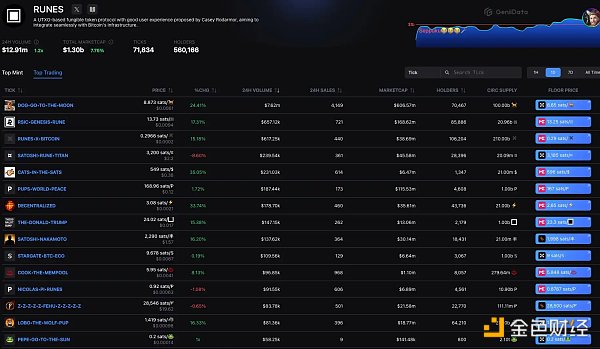

On May 29, DOG•GO•TO•THE•MOON rose 38.83% in 24 hours, a record high; RSIC•GENESIS•RUNE rose 14.15% in 24 hours; PUPS•WORLD•PEACE rose 31% in 24 hours; CATS•IN•THE•SATS rose 56% in 24 hours.

Yesterday's RUNES ecosystem increase, data source: Geniidata

Casey honestly admitted that the RUNES he created is a casino, and he hopes that users can get the best experience here. "For each of us, it is honest and practical to view Ordinals, inscriptions, and the construction on runes from the perspective of building social, gambling, and entertainment products. We don't need to hide anything, so that your users can experience the fairest and most interesting products."

While RUNES rose across the board, many community friends also remembered the first MEME casino in the Bitcoin ecosystem. Is BRC20, like "Atlantic City", declining?

How big is the threat of RUNES to BRC20?

Before runes were officially launched, many community friends seemed to have captured the relationship between RUNES and BRC20 with some competition. Everyone often joked that Ordinals is an ecosystem that "quarrels non-stop", and the imminent launch of "Runes" also means that this conflict of ideas will become a real war, a war between new casinos and old casinos.

The personal experience of "gamblers"

For "gamblers", the biggest difference and advantage of RUNES compared to BRC20 is that the "casino" trading experience is better.

BRC20 requires two transactions, engraving and transfer, to make a transfer, while RUNES saves the engraving step and only needs one transaction to complete.

"The selling process of BRC20 is that I need to engrave a transfer inscription first, and after the chain is confirmed, I transfer this transfer inscription out, which requires chain confirmation again. This requires two gas and two waits, which is very costly in time and money. And it will cause a lot more 546 sats in the wallet to be occupied, and these garbage will always exist." Bitcoin ecosystem observer and player 0xSea explained in detail to BlockBeats.

This means that BRC20 leaves more transaction records on the blockchain, and each transfer adds additional transactions, which not only increases costs but also increases the burden on the network. In contrast, RUNES has significantly lower fees and is more efficient.

From a cost perspective, the RUNES protocol can reduce the total cost of minting transactions by up to 60%. In the interview, 0xSea commented: "RUNES does improve some problems of BRC20. For example, when dealing with small UTXO inflation, BRC20 requires additional inscribe operations, while RUNES does not because it is based on the UTXO mechanism. Although BRC20 has also improved on this point, RUNES is more obvious in the deployment of new currencies."

This is also what Casey has always been dissatisfied with BRC20-generating a large amount of "junk" UTXO, and it is also the reason why Casey released the "Runes" concept. Runes is native to Bitcoin's unspent transaction output (UTXO) model, which minimizes the generation of "junk" UTXO, thereby achieving more responsible UTXO management and a smaller on-chain footprint.

“I really don’t like this about BRC20. Transactions require so much Gas. When the Gas fee is high, the cost for minting, listing and selling is really high,” said an anonymous community member in an exchange with BlockBeats. "Because of this, when you sell it, you have to triple or quadruple it to get your money back. If there is no good support and development background behind the token, then the minting will be a loss."

RUNE's trading experience is smoother and seamless. The anonymous community member said bluntly: "In comparison, BRC20's multiple transactions and complex steps are cumbersome and time-consuming. Sometimes I even think that this has a lot to do with Domo's personality or way of doing things. He is really slow in promoting BRC20. Unlike Casey, everyone submits code directly on GitHub, and Casey merges it directly if he thinks it's OK."

However, some community members believe that Domo's cautious and steady progress is also reasonable: "To ensure the security and stability of this system to a certain extent, a slow pace is acceptable."

BRC20 small and medium-sized assets are lingering

Image source: Internet

"For existing head BRC20 currencies such as Ordi and Sats, there will not be much impact, but for small and medium-sized BRC20 currencies, RUNES will definitely have a greater impact on them." 0xSea told BlockBeats. 0xSea further explained: The threat of RUNES to BRC20 can be seen from multiple levels. For BRC20, Ordi has been listed on the largest trading platforms OKX and Binance, and their liquidity is mainly concentrated in CEX, so they will not be threatened too much by RUNES. But for the newly issued currencies of BRC20, I think it will have a great impact, especially those small and medium-sized currencies with a market value of only a few million US dollars. "This is also confirmed by the data. As of the time of writing, Ordi has risen from the bottom of around $36 to $49, an increase of 36%, and Sats has also risen by 14% this week.

Looking at the trading volume, the Ordi/usdt trading pair on Binance has a trading volume of 208 million US dollars in the past 24 hours, and the Sats/usdt trading pair has a 24-hour trading volume of 97.97 million US dollars, but the on-chain trading volume is only 130,000 US dollars and 38,000 US dollars respectively. Obviously, more trading volumes of Ordi and Sats are on centralized trading platforms.

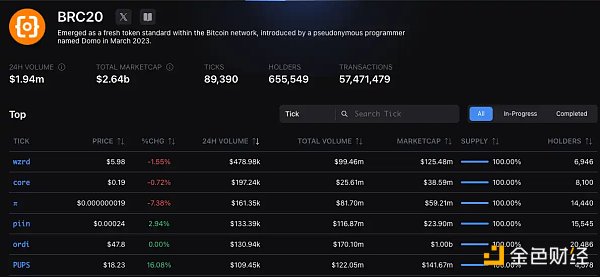

Data source: Geniidata

According to Geniidata data, on May 31, only wzrd, core, Pi, Piin, Ordi and PUPS had a 24-hour transaction volume of more than 100,000 US dollars in BRC20. As for RUNES, according to Geniidata data on May 31, 24-hour transaction volume of 17 tokens reached 100,000 US dollars.

Data source: Geniidata

"If you originally planned to issue a new coin on BRC20, or the project wanted to issue a new coin, under the current circumstances, everyone might choose RUNES. Because RUNES has gained more on-chain infrastructure support in a very short period of time, such as support from wallets and casting platforms. In the short term, RUNES's traffic exposure far exceeds BRC20." 0xSea told BlockBeats.

In the communication with BlockBeats, the Bitcoin ecological lending protocol Shell Finance team revealed that they would use the NFT Fair Launch on the Ordinals protocol to complete the construction of the community core and the cold start of the product and liquidity. The Shell Finance team believes that the view that "BRC20 will be completely replaced by RUNES" is not entirely true. "This view is only partially correct. RUNES assets do have an impact on BRC20, but the main impact is on BRC20's MEME coin."

How to defend if you don't want to be Atlantic City's BRC20?

During the booming gambling industry in Atlantic City, theaters, cinemas, concert halls, dance halls, gift shops, etc. that serve the gambling industry also opened one after another and developed rapidly. At the same time, because it is a seaside tourist resort and a famous sanatorium city, there is a world-famous seaside boardwalk built along the coast. Therefore, after the decline of the gambling city business, Atlantic City has almost transformed into a tourist city with travel as its main business.

Now, facing the direct attack of RUNES and the attack of various other Bitcoin FT protocols, BRC20's "casino" business is also undergoing "industry upgrading and migration" as a defense.

5-character inscription and "self-minting" mechanism

"How should BRC20 deal with it? In fact, I think many people in the BRC20 ecosystem have already realized this problem, so they released an improved upgrade one to two weeks before the official release of RUNES. This update introduced a five-character ticker, allowing project parties to self-mint. This is entirely for the consideration of project parties, so that they can choose to self-mint tokens and then decide how to distribute them to other users." 0xSea analyzed.

Stuck at the time point on the eve of RUNES's launch, BRC20's recent update not only supports the 5-character ticker, but also introduces a "self-issuance" mechanism, that is, the project party can deploy and complete the token issuance by itself, and also supports the burning mechanism.

These updates have enabled BRC20 to complete a certain degree of industrial upgrading, which not only facilitates the centralized issuance of the project party, but also stimulates market performance through deflationary gameplay. Whether or not the founder Domo intended to do so, it means that the two will have fierce competition.

After the 5-character was activated at block height 837090, the first batch of enthusiasts who rushed to deploy the five-character tokens even raised the gas cost to thousands of dollars. More careful people found that a user who was keen on buying had engraved the inscription "I collect these tickers in the hope of donating them for free to interesting and hardworking individuals or teams that are constantly building in the Ordinals ecosystem" in his wallet address.

The Pizza currently being airdropped by Unisat was also one of the 5-character tickers that were snapped up at the time and was given to Unisat by community friends.

The Shell Finance team said: "After upgrading to a five-character ticker, it means that BRC20 has begun to shift from a MEME coin factory to DeFi systematic infrastructure and applications. RUNES mainly impacts the assets and traffic of four-character MEME coins, which I agree with because it does have a great impact. But for the Bifi scenario on Bitcoin, it is the end of the war of asset protocols on the first layer. Whoever can attract more developers to build new applications based on asset protocols will have the last laugh. At present, BRC20 has begun to get involved, AVM is advancing, and Runes has not started yet."

Is "industry migration" competitive?

Just like after "Atlantic City" was replaced by "Las Vegas", it began to actively or passively develop the tourism industry.

After BRC20 was no longer the first choice of "gamblers", the industry began to migrate actively or passively, from "Bitcoin casino" to DeFi infrastructure. "In the early days, we chose the synthetic stablecoin asset $BTCx issued on BRC20, because Shell Finance needed a Swap protocol and service provider support. In contrast, BRC20 has more mature infrastructure such as Unisat to help develop." Shell Finance said so.

"With the development of the Runes protocol, we can also see that some DEX infrastructure projects have begun to be built on Runes. Whether it is MagicEden launching the Runes Swap function or Runes DEX, they have begun to build infrastructure based on Runes. So we are also continuing to observe and consider whether we should switch to the Runes track to build Shell Finance." Shell Finance told BlockBeats.

With the development of Runes, if DeFi protocols also appear in its ecosystem, supporting functions such as mortgage and asset management, then there will still be a certain competitive pressure on BRC-20. So it seems that BRC20's "industry migration" does not have much long-term competitiveness and advantages.

In the long run, BRC20 still faces several threats: although RUNES is a standard at the Ordinals protocol level, its implementation itself does not depend on the Ordinals protocol. It is independent like Taproot Assets and RGB. The implementation of BRC20 depends on the Ordinals protocol. In the long run, the development of BRC20 appears passive.

Secondly, there will be more "interactivity" between RUNES and Ordinals protocols. For example, BLOB team Lianchuang is one of the developers of the Ordinals protocol, and is currently developing recursive runes about the "linkage" between RUNES and Ordinals?

"The RUNES protocol cannot be viewed and evaluated alone. It should be evaluated together with Ordinals. This is an important dimension to attract developers." 0xSea said so. He agrees that the relationship between RUNES and Ordinals is like soy milk and fried dough sticks, just like the relationship between Ethereum's ERC20 and ERC721. It will form a good synergy, and the effect is definitely one plus one greater than two. "The effect achieved by the interoperability between the RUNES and Ordinals protocols may be doubled, but of course, the challenges faced by developers and projects are also doubled."

Fortunately, for BRC20, the infrastructure development of RUNES is not yet fully sound, and the DeFi infrastructure is in a state of vacillation. The leading effect of RUNES has not yet fully emerged. In addition to the DOG•GO•TO•THE•MOON of Runestone, there is no particularly clear leader on RUNES, unlike Ordi and Sats who have firmly sat on the "dragon throne".

Faced with the siege of new casinos, how can old casinos continue to survive? In this critical year, BRC20 must give its own answer.

Thanks to: Interviewees 0xSea, Shell Finance

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Zoey

Zoey JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance