First give a big stick, then throw some sweet dates. Trump obviously used the business methods commonly used by businessmen in governing the country's economy and trade. But it is obvious that the globalized economy cannot be left to Trump alone.

Theory Ventures, which invests in early-stage software companies, mentioned that this round of tariffs will "definitely" affect venture investors. "If investors see that no company in the market can advance to an IPO or be acquired for more than a year, I expect corporate valuations to fall."Genoa Ventures, a venture capital firm Vikram Chaudhery, partner at VC firm Investor Relations, said late-stage venture capital and private equity funds and their limited partners have become increasingly cautious in signing new deals, to the point that "capital that we thought might be available now is not flowing."

Companies tend to take a wait-and-see approach when policy direction shifts rapidly. With an uncertain macro and regulatory outlook, it is difficult for companies to adapt quickly to the market while planning ahead for the future. Ana Levine, founder of venture capital firm E1 Ventures, said some investors will delay Series A financing until tariff exemption terms are clear. The same is true for new funds that are raising funds. In the past week, at least two limited partners said they have suspended new investments or raised new capital to support venture capital firms until the economy stabilizes. At the same time, some funds dominated by the Canadian, Mexican or Chinese markets may be slightly affected, and private equity funds "face valuation pressure and slower transaction completion." Some investment institutions will also recommend that companies that rely on international trade conduct "scenario planning" and develop more flexible supply chains. nodeleaf="">

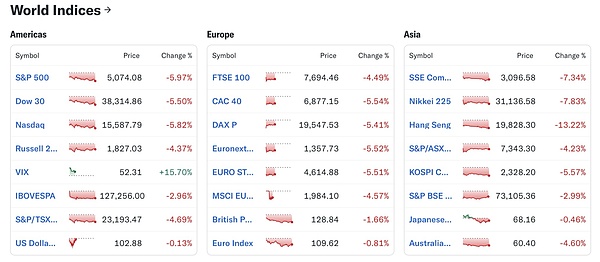

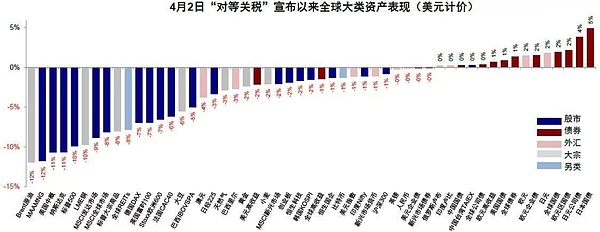

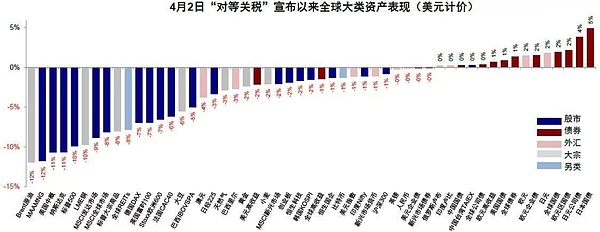

(Image: Bloomberg, FactSet, CICC Research)

Eric Bahn, co-founder of early-stage venture capital firm Hustle Fund, advises startups to be more cautious in spending and buy any hardware such as laptops or mobile phones before prices rise."The safest thing to do is assume that your last (venture capital) financing is really your last financing for a while."He also talked about"making full use of artificial intelligence to ease cash consumption pressure and improve efficiency. ”

Software companiesmay not be immune, with some customers that spend millions of dollars a year on software delaying deals with Microsoft, Salesforce, SAP, Oracle and ServiceNow, choosing to wait and see how the market moves and cut costs.

Other forms of investmentare also slowing down, with some wealth group investors re-examining their portfolio companies and worrying about the operating companies responsible for their wealth. Fintrx data shows that family offices completed only 40 direct transactions in March, down 45% year-on-year and 22% month-on-month.

However, some investment institutions have avoided the tariff crisis.

Lead Edge Capitala growth equity investment firm “We invest primarily in high-gross-margin digital businesses, so we are less vulnerable to the direct impact of tariffs at this time,” said Mitchell Green, founder and managing partner of the firm, which has invested in Zoom and Spotify, in an email. ” Software startups and logistics startups that can help companies increase visibility into their supply chains could both benefit from the tariffs, said Jake Saper, general partner at Emergence Capital.

Another industry that could benefit is companies that develop software for international shipping and ports, said Hans Swildens, CEO and founder of investment firm Industry Ventures

Swildens said the new tariffs could open up new revenue streams for companies that provide software to help importers manage taxes and legal compliance.

"Venture capital firms could get big returns if they can find startups that can help companies adapt to tariff changes. Or they could lose everything," he said. "That's venture capital. ”

02 Hard technology has become the hardest hit area: facing multiple tariffs Companies stop deliveries and prices may skyrocket

Under the US tariff policy, the hard technology industry may become one of the “hardest hit areas” in the United States, and some consumers may ultimately pay the bill.

In the automotive industry For example, Trump announced a 25% tariff on all imported cars and a 25% tariff on certain auto parts. Some people calculated that if all these taxes were passed on to consumers, the average price of imported cars could rise by $12,500.

Global auto companies have responded differently to this.

First is Tesla. All Tesla cars sold in the North American market are produced in factories in Fremont, California and Austin, Texas. This also means that Tesla does not need to pay a 25% car import tax. However, about 20% to 30% of Tesla's auto parts are imported, and Tesla cannot be completely immune from the tariff changes.

For this purpose, Musk once again used his political power. According to the Wall Street Journal, Musk, who has successfully "entered the house", recently directly suggested to Trump: cancel the tariff policy, but Trump bluntly said it was impossible. Musk proposed again in a roundabout way to establish a US-EU reciprocal zone, which was also rejected.

On April 7, Musk secretly shared a video on his social media account showing the benefits of global trade cooperation from a wooden pencil, implying that he does not support the tariff policy.

Tesla is not the auto company most affected by the tariffs, and may even be the auto company with the least damage, because all automakers will be in a worse situation than Tesla.

Someemerging electric vehicle manufacturers, such asRivianandLucid Motors, although they produce electric vehicles in the United States, their imported parts are subject to tariffs. At the same time, these companies have not yet made full profits, which means that the company is still losing money on each electric vehicle sold, and the company will bear greater operating pressure. For example, Ford's most popular all-electric Mustang Mach-E and hybrid pickup Maverick are both produced in Mexico, and General Motors produces the Blazer and Equinox electric vehicles in Mexico. Imported cars are also one of the victims of the tariffs. Italian luxury car manufacturer Ferrari and General Motors said they will raise the prices of some models after April 1, with the price of each ordinary car increasing by up to $50,000.

South KoreaHyundai Motor, which makes almost all of its electric vehicles in South Korea, has pledged not to raise prices on existing models through June 2. Nissan Motor

Infini

said QX50 and QX55 production would be suspended "until further notice."

GermanyVolkswagenis launching an emergency plan for the North American market: a complete suspension of rail transport of vehicles through Mexico and stranded vehicles waiting to be sold at European shipping ports. Germany's Audi

on April 7 decided to suspend deliveries of new vehicles to U.S. dealers.

(U.S. Port Terminal Source: The Information)

The situation is changing, and many automobile companies have quickly responded to the market and started to plan the next step in advance.

Stellantisannounced on Thursday that it will suspend production at two assembly plants in Canada and Mexico, and 900 workers will suspend work. The Canadian plant will be shut down for two weeks and the Mexican plant will be shut down for one month.

SwedishVolvoCar Company said it intends to produce more cars in the United States and increase regionalization efforts by setting up centers in China and Europe. The company is considering expanding production of its EX90 SUV in the United States to increase output and reduce costs.

In addition to automobiles, consumer electronics products have also been affected.

Among them, the most representative is

Apple, Apple's stock price fell 19% in three days, and its market value evaporated by $638 billion. It is reported that Apple shipped five planes full of iPhones and other products from India to the United States in just three days at the end of March. Apple has always been trying to expand globally, but whether it is China, Vietnam, India, or even Thailand and Malaysia, they are all key areas for this tariff.

According to Evercore ISI, a third-party research organization, 90% of iPhones, 55% of Macs, and 80% of iPads are assembled in China. About 10% to 15% of iPhones are assembled in India. About 20% of iPad production and 90% of Apple wearable products (such as Apple Watch) are assembled in Vietnam.

Not only that, Apple also has a lot of parts coming from China, and Chinese suppliers account for about 40% of Apple's total suppliers. This also means that even if they are assembled in the United States, many parts will face double tariffs. UBS analysts estimate that the price of Apple's highest-end iPhone may rise by about $350 from the current $1,199, an increase of about 30%.

In addition,tariffs have caused a partial "shutdown" in the aerospace industry.The aerospace industry has always been the largest export industry in the United States, and the contract delivery time of aircraft is often long and there are many variables. Not only that, aircraft are the product of global integrated innovation.

A plane often hides a global supply chain. For example, the supply chain of the Boeing 787 assembled in South Carolina extends from Japan to Italy. Howmet mainly provides key components for jetliners for Airbus and Boeing. After the US tariff policy is enacted, Howmet will no longer provide any products or services affected by the declared national emergency or tariff executive order.

According to

Boeing, more than two-thirds of the company's aircraft orders in the past decade came from customers outside the United States.Airbus

jets are currently mainly manufactured in Europe."The U.S. technology industry may be set back ten years."

said an investor. He believes that tariffs are essentially a war, and in the end all prices will eventually be paid by consumers, and inflation will increase.

03 Consumption: From eggs to beer and coffeeNo one is immune to tariffs

Who would have thought that in 2025, ordinary eggs would become a "luxury" in the hearts of ordinary Americans?

According to data from the American Egg Board, the average retail price of a dozen eggs has risen by 65% in the past year to $4.15, and in some areas it has been as high as $9.

Just as the global trade market is working, and eggs imported from Turkey and Europe are helping to improve the "egg shortage" in American supermarkets, tariffs will disrupt everything again. Turkey basically accounts for 60% of the eggs imported into the United States, with a new reciprocal tariff of 10%, and Mexico accounts for nearly 40% of the imported eggs.

In addition to eggs, coffee, which Americans love to drink the most, has also encountered double tariffs. Because you know, the United States does not produce coffee, but mainly imports coffee beans from Colombia, Brazil, Indonesia and other coffee producing countries. Now, these countries are facing new tariff policies, and price increases are inevitable.

Not only coffee beans themselves, the Trump administration has imposed a 25% tariff on all empty aluminum cans, which will further aggravate the price increase of coffee products. Other beverages are also unable to escape the tariff crackdown, and all canned beer imports are also subject to a 25% tariff. Bananas, toilet paper and other daily necessities are also facing tariff threats. After hearing the news of tariffs, many Americans rushed to supermarkets to start stockpiling. Some food processing companies were caught off guard by the sudden change in tariffs. Ori Zohar, co-founder of New York spice company Burlap & Barrel, said he did not intend to renegotiate with farmers or raise prices for customers. The company mainly sells high-end spices from small farmers around the world, including Vietnam and India, with an annual revenue of $9 million. Today, the company has chosen to freeze recruitment and suspend the release of many new products to temporarily stabilize the situation. Similarly, Krista LeRay, owner of canvas embroidery company Penny Linn Designs, said it would be "very difficult" to absorb the higher costs of tariffs without passing them on to consumers. Higher taxes will not only affect the price of raw materials, but also the export price of goods. "Some products have no profit and have to increase prices, and once the price goes up, it is difficult to reduce it." Today, small and medium-sized enterprises in the United States either raise prices and reduce the scope of customers, or bear the extra costs themselves and suffer losses in corporate profits. It is foreseeable that once the survival of most people encounters difficulties, it may be difficult for everyone to invest in some clothing and soft furnishings, and many small and medium-sized enterprises will also face operational difficulties. Conclusion: Is it a slogan or a signal? The direction of tariffs is confusingThis tariff shock is a "thunderbolt" to the world economic market after Trump took office.

When Trump announced the tariff policy, he also laid a lot of groundwork for this tariff policy and found good excuses, such as reviving the manufacturing industry, helping to repay US debts, increasing bargaining chips in trade negotiations, reducing trade deficits, and stimulating the US economy. But in short, Trump is trying every possible way to "make money."

Where does the money come from? Whether it is enterprises, consumers, or the government itself, it doesn't seem to matter to Trump. As long as the problem can be solved, "tariffs are a panacea for solving economic problems." Trump said.

Currently, the U.S. Congress is also proposing a new bill to try to limit Trump's power to set tariffs, and hopes that Congress will have the power to repeal the tariff policy within 60 days. But now, the possibility of the bill passing is very small. From Musk to the U.S. Congress, and then to the millions of people who took to the streets, in just 100 days, the new president elected by the entire American people has picked up the tariff "mace" and hit everything with it.

From the "Chips Act" during the Biden era, to the repeatedly delayed TIKTOK ban, to this tariff policy. The U.S. economy and politics are in turmoil. "I don't think the tariff policy will still exist in two months." Many people said.

Will the story of "The Wolf is Coming" continue in the United States? What is the direction of tariff policy? No one can see clearly, but what is certain is that the world economic system is entering an unpredictable situation, the global order system is gradually collapsing, and venture capitalists in China and the United States may need to face market changes more flexibly.

Catherine

Catherine