Deng Tong, Golden Finance

On May 27, 2025, sports betting operator SharpLink Gaming, Inc. (NASDAQ: SBET) announced the signing of a securities purchase agreement for a $425 million private placement (PIPE) of a public company, planning to issue approximately 69.1 million shares of common stock (or equivalent securities) at a price of $6.15 per share (US$6.72 per share for members of the company's management team).

Consensys Software Inc. led the investment as the main investor, and the participating parties included well-known crypto venture capital institutions such as ParaFi Capital, Electric Capital, Pantera Capital, and Galaxy Digital.

SharpLink will use the raised funds to purchase Ethereum (ETH) as the company's main treasury reserve asset. After the transaction is completed, Ethereum co-founder, Consensys founder and CEO Joseph Lubin will serve as chairman of the board of directors of SharpLink and assist the company in developing its core business as a strategic advisor.

Since then, SharpLink has officially become an Ethereum treasury enterprise, known as the "ETH version of MicroStrategy".

Why did SharpLink transform into an Ethereum treasury company? What are the important nodes on the road to ETH treasury strategy? What opportunities and challenges does SharpLink face after the transformation?

1. SharpLink's predecessor

SharpLink's predecessor was MER Telemanagement Solutions Ltd., which was founded in 1995 and initially focused on traditional communications businesses such as telecommunications cost management, call billing and contact center software. In 2019, it was renamed SharpLink Gaming and mainly engaged in gambling. However, it has fallen into serious difficulties in recent years: revenue in 2024 fell 26% year-on-year to US$3.66 million, and the company suffered a net loss from continuing operations, and faced the risk of delisting due to its stock price being below the Nasdaq minimum standard for a long time.

II. SharpLink ETH Treasury Strategy Important Time Points

On May 27, it announced that it had received $425 million in private placement and used ETH as a treasury reserve asset;

On May 30, it submitted Form S-3ASR to the U.S. SEC, intending to raise $1 billion to increase its holdings of ETH;

On June 2, it completed $425 million in private placement.

On June 13, it purchased 176,271 ETH for $463 million;

From June 18 to 21, it purchased another 6,744 ETH;

On June 23, it announced that it had obtained Nasdaq’s approval to launch option trading under the standard rules and regulations established by Nasdaq and OCC, with the stock code "SBET";

On June 24, it announced that it had increased its total ETH holdings to 188,478;

On June 25, it bought 5,989 ETH (US$14.47 million) through Galaxy Digital;

On June 28, it purchased 1,989 ETH (US$4.82 million) through OTC;

On July 1, it increased its holdings by another 4,951 ETH, about 12.4 million US dollars;

On July 3, 2,738 ETH were increased through OTC;

On July 10, 5,072 ETH were increased, worth about 13.51 million US dollars; 10,000 ETH were directly purchased from the Ethereum Foundation, with a total amount of 25.7237 million US dollars;

On July 11, 12,648 ETH were increased, worth 35.31 million US dollars;

On July 12, 21,487 ETH were purchased, worth about 64.26 million US dollars;

On July 14, 16,373 ETH were purchased through Galaxy, worth 48.85 million US dollars, and the total holdings reached 270,000 ETH, surpassing the Ethereum Foundation's 242,500 ETH and ranking first.

On July 15, 24,371 ETH were added, worth $73.21 million.

On July 16, 5,188 ETH were added, worth about $15.76 million.

III. What opportunities does SharpLink's transformation bring?

1. Save the stock price

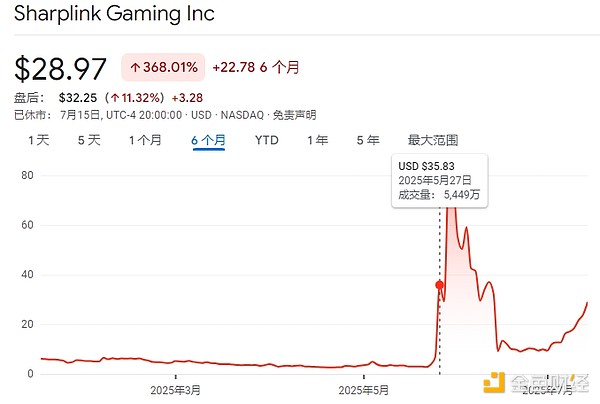

The most direct impact is reflected in the company's stock price. After SharpLink officially announced that it had become an Ethereum treasury enterprise, its stock price began to soar.

Affected by the good news on May 27, SharpLink's stock price soared by more than 650% on the same day. The company's market value soared from US$2 million to US$2.5 billion. SharpLink's stock price was only US$2.79 three trading days ago, and it rose by more than 17.56 times in three days, ending the continuous downturn and climbing to a high of US$79.21 on May 29. As of press time, SharpLink's stock price was US$28.97.

2. Deeply bound to the Ethereum ecosystem

In May 2025, SharpLink was deeply bound to the Ethereum ecosystem when it raised funds - led by ConsenSys, and participating investors included ParaFi, Pantera and other leading encryption institutions.

ConsenSys founder and Ethereum co-founder Joseph Lubin once said: "After the transaction is completed, Consensys looks forward to working with SharpLink to explore and develop Ethereum treasury strategies and serve as a strategic advisor on its core business. This is an exciting time for the Ethereum community, and I am very happy to work with Rob and his team to bring the potential of Ethereum to the public capital market."

3. Business scope expands from traditional gambling to crypto gambling

SharpLink acquired a 10% stake in Armchair Enterprises, the parent company of CryptoCasino.com, for $500,000 in cash in early 2025. This means that SharpLink has begun to get involved in the gambling market in the field of cryptocurrency and blockchain.

Fourth, the future of SharpLink

1. Affected by the trend of the crypto market and ETH

In the short term, SharpLink's prospects will be highly bound to the crypto market. Since SharpLink holds a large amount of ETH, its stock price fluctuations are strongly correlated with the price of ETH. In this round of market cycle, affected by factors such as ETF net inflows, stablecoin ecosystem development, and the entry of institutions and whales, the price trend of ETH is experiencing a breakthrough.

More and more companies hold mainstream cryptocurrencies such as BTC and ETH as corporate treasury reserves, which will also affect the favor of more traditional financial markets for these crypto assets. The price trend of ETH will bring more surprises to investors and will also drive up the share price of SharpLink.

2. How to truly achieve landing applications is still worth exploring

SharpLink used to focus on traditional sports betting business. After transforming into an Ethereum treasury company, how to achieve real landing applications in the field of cryptocurrency is an urgent issue to consider. Although SharpLink has acquired 10% of the shares of Armchair Enterprises, the parent company of CryptoCasino.com, it does not mean that SharpLink already has stable users and liquidity. Polymarket, the leader of the crypto prediction market, has become popular with a series of political prediction events, and how to share a piece of the pie is still a difficult problem that SharpLink needs to explore.

3. Or face regulatory dilemma

The US CFTC regards the prediction market as a binary option, and Polymarket faces compliance pressure because US users account for 25%.

Shao Shiwei, a lawyer at Mankiw Law Firm, once wrote: The crypto prediction market platform does provide a binary option product. Users have two options of "yes" or "no" for the results of the predicted events. This option is the option product obtained by the user. Under the US regulatory environment, over-the-counter binary options are completely prohibited, and only two major exchanges, the North American Derivatives Exchange (Nadex) and the Cantor Exchange, are allowed to provide legal binary options transactions. In addition, the United States stipulates that brokers can only choose to cooperate with US payment service providers to supervise the whereabouts of funds.

Whether the gambling platform can eventually operate under the compliance regulatory framework is not only a test for SharpLink, but also a dilemma for all gambling platforms.

V. Summary

SharpLink's current development momentum is eye-catching, but the label of ETH treasury reserve + gambling alone cannot sustain the narrative for a long time. In the short term, affected by the crypto market and the treasury reserve boom, SharpLink has attracted a lot of attention. But in the long run, whether it can achieve real landing applications, how to compete with giants in the same industry, and whether it can develop in compliance under the regulatory framework are all difficulties that SharpLink needs to break through.

Alex

Alex

Alex

Alex Jasper

Jasper Alex

Alex CaptainX

CaptainX Nulltx

Nulltx ABGA

ABGA ABGA

ABGA Cointelegraph

Cointelegraph Catherine

Catherine Bitcoinist

Bitcoinist