Source: Grayscale; Compiled by: Tao Zhu, Golden Finance

One of the hallmarks of public blockchains is their ability to operate without any central authority. To achieve this — and also to govern how their networks operate — they employ a set of algorithms and economic incentives, collectively known as consensus mechanisms.

The Bitcoin network is secured by miners through a Proof-of-Work (PoW) consensus mechanism, while Ethereum is secured by stakers through a Proof-of-Stake (PoS) consensus mechanism. Unlike PoW, where miners secure the network through computing power, PoS requires stakers to demonstrate their determination to “get in on the action” by putting their token capital at risk.

Stakers are rewarded for the services they provide by maintaining the blockchain. Token holders who stake their assets and validate transactions can therefore generate income. However, staking rewards are typically small relative to token price volatility, which should be considered the primary risk and potential source of return for most crypto asset investments.

Public blockchains offer a new way to organize digital commerce, based on an open architecture platform without any central authority. Unlike companies that are overseen by a board of directors and governed by the laws of the country in which they are located, public blockchains are globally decentralized networks of computers that are secured by cryptography and economic incentives. The mechanisms used to align economic incentives and keep the network functioning are arguably the core innovation of this new technology.

Proof of Stake vs. Proof of Work

A blockchain stores the same information on every node in its network. [1] In order to agree on the correct information to store on the network, the nodes must reach a consensus without the help of a central authority. To manage this process, every public blockchain includes a “consensus mechanism”: a canonical decision-making algorithm based on economic incentives that brings the nodes to a consensus. [2]

Bitcoin’s consensus mechanism is called Proof of Work (PoW). Under PoW, specialized service providers called miners compete to solve computational problems, and the winning miners are awarded the right to update the blockchain and be rewarded with tokens. [3] These puzzles are solved by brute force (i.e., by repeated guessing), and therefore require significant resources, including upfront capital expenditures and ongoing electricity costs. Solving the puzzle therefore proves to other network participants that the winning miner has a vested economic interest and can be trusted to update the chain. Miners are rewarded with tokens for their services.

Ethereum initially used the same PoW algorithm, but transitioned to a new consensus mechanism, Proof of Stake (PoS), in 2022. This approach also relies on economic incentives; however, rather than solving energy-intensive computational problems, network participants demonstrate their vested economic interest by “staking” Ether, the native token on the Ethereum blockchain. Stakers are responsible for validating transactions and updating the blockchain. Those who perform these duties correctly are rewarded with additional tokens, while those who go against the interest of the chain see their rewards “slashed” (i.e., punished and reduced). Because stakers have an economic interest in the health of the chain—they have a “skin in the game”—they can be trusted to validate transactions and update the network. Unlike mining, staking consumes a small amount of electricity[4], which some consider to be a more environmentally friendly method of blockchain consensus.

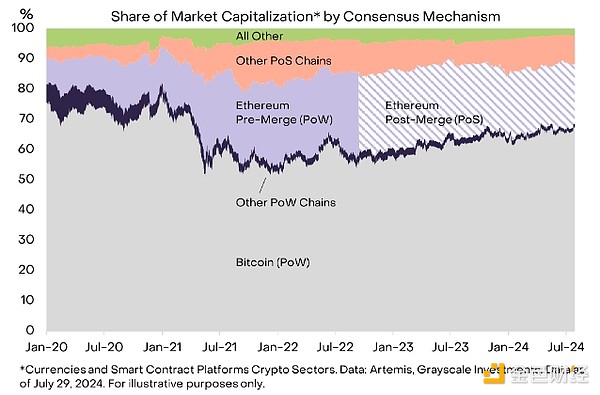

While Bitcoin remains the largest public blockchain by market cap, PoS networks have been growing in popularity. For example, more than half of the protocols in our currency crypto and smart contract platform crypto sectors use a PoS consensus mechanism. By market cap, PoS-based blockchains account for approximately 30% of the total market cap of these crypto sectors and 90% of the market cap excluding Bitcoin (Exhibit 1).

Figure 1: In addition to Bitcoin, PoS is now the mainstream consensus mechanism

Ethereum Transactions and the Role of Stakeholders

On a PoS blockchain like Ethereum, stakers are responsible for verifying that all transactions comply with the network rules. Without this service, the blockchain cannot function.

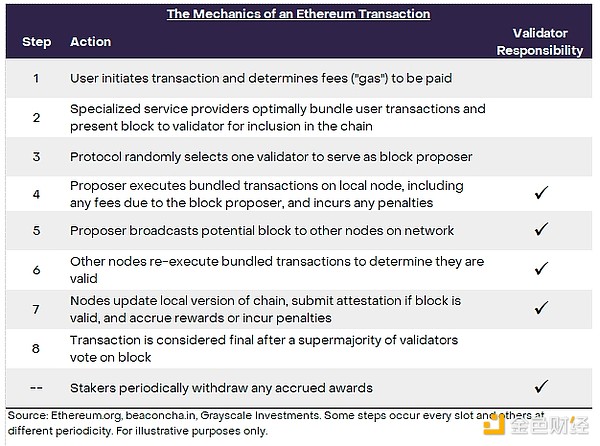

To better understand the role of stakers, it is helpful to consider the mechanics of an Ethereum transaction. As shown in the stylized description in Figure 2, an Ethereum transaction involves approximately eight steps (Figure 2). While the user initiates the process and some steps may involve other specialized service providers[5], most steps require the active participation of validator nodes. Since all Ethereum transactions (or other state changes) are made through the coordinated operation of validator nodes, stakers are, in effect, responsible for running the blockchain.

Figure 2: Validator nodes are responsible for processing transactions

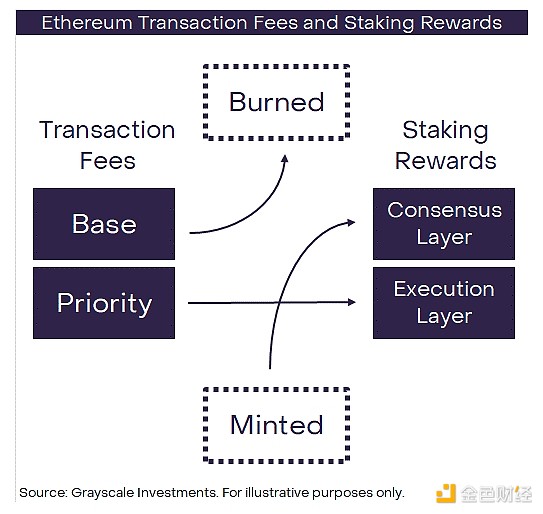

By providing these services, stakers are rewarded in the form of additional tokens, which are derived from fees paid by users and newly issued tokens. On Ethereum, fees are divided into base fees and priority fees (“tips”). The network automatically destroys ETH paid as base fees, aiming to benefit all users by reducing the token supply. Stakers receive priority fees in addition to newly issued ETH[6] (Figure 3). Ethereum staking involves a variety of other complexities that are not discussed in this article; see the Technical Appendix for more details.

Figure 3: Ethereum staking rewards come from priority fees and new issuance

Staking Rewards and Income

Stakers can earn potential income from their assets due to token rewards. In traditional markets, the best analogy might be agricultural land. Land itself has a market value and its price may rise or fall over time, but it can also be made more productive by growing crops. Just as staking rewards are a reward for the service of validating the blockchain, crops can be thought of as a reward for the service of cultivating agricultural land. In both cases, the asset owner is providing a useful service and generating service revenue.

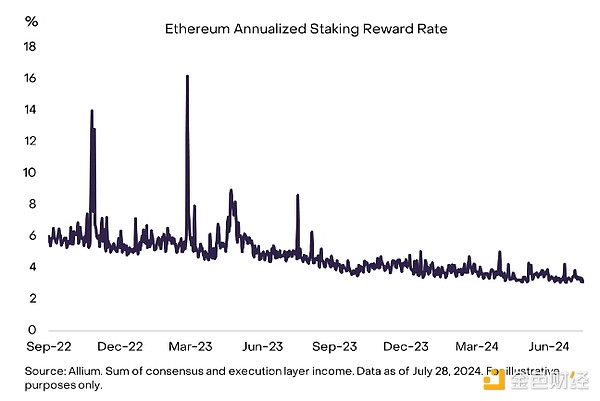

The average reward rate for Ethereum stakers is currently 3.1% (Figure 4). [7] According to calculations by data provider Allium, Ethereum’s staking reward rate has been declining over time as the share of Ethereum supply increases (when the staked supply decreases, the protocol offers higher reward rates to incentivize staking activity). Day-to-day changes in staking rewards also reflect changes in network congestion and priority fees: when network traffic increases, users typically pay higher fees to have their transactions confirmed.

Figure 4: Ethereum stakers currently receive an annualized return of approximately 3%

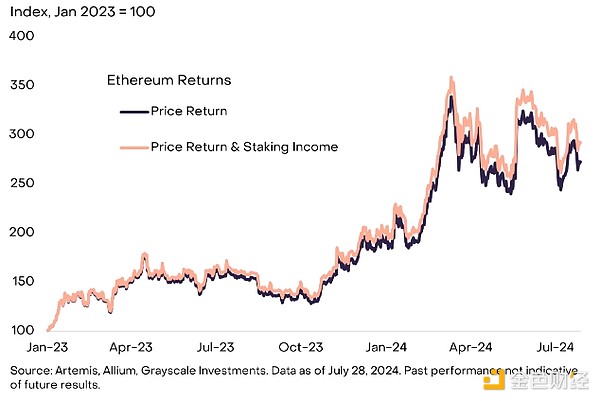

For Ethereum holders who stake their tokens and provide validation services, staking rewards can be considered a source of income. For example, since the beginning of 2023, the spot price of Ethereum has increased by 173%. [8] During this period, we estimate that staking rewards have averaged approximately 4.5% annualized. [9] Therefore, the hypothetical return for Ethereum stakers (including price returns and staking income) would be 192% (Figure 5)[10]. The calculations assume that stakers perform their duties correctly (i.e., receive all rewards and do not incur slashing) and that no third-party fees are paid. [11] In practice, the income earned by Ethereum stakers will depend on these assumptions.

Figure 5: Staking rewards can be considered asset income

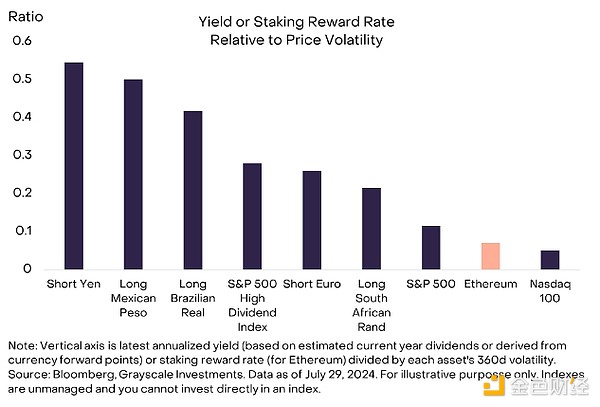

While staking rewards can increase returns to token holders over time compared to other assets, Ethereum’s staking returns are relatively low given its volatility. In other words, investors should view the token price itself, rather than staking rewards, as the primary source of risk and potential return. For example, Figure 6 shows Ethereum’s staking returns relative to its volatility, compared to various currency market “carry trades” and the dividend yields of certain stock indices. Investments held primarily for income typically have high yields relative to their price volatility (otherwise gains/losses from price changes would overwhelm the income return). Ethereum’s staking returns relative to its price volatility are relatively low—comparable to the dividend yields of U.S. stock indices. These types of investments are typically made primarily for potential capital gains from price appreciation, rather than income returns.

Figure 6: Ethereum’s staking rewards are modest compared to the asset’s volatility

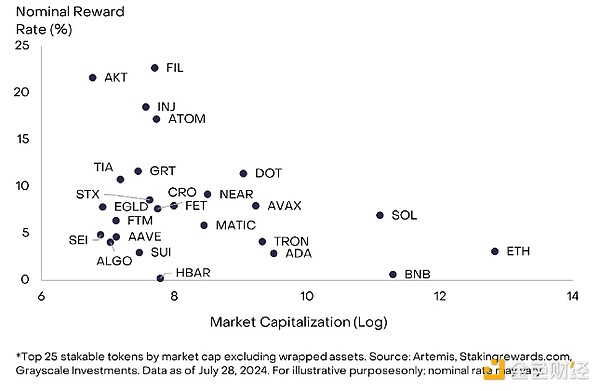

Staking returns vary widely across PoS blockchains. For example, several smaller networks (by market cap) offer nominal staking returns of 10%-20% (Figure 7). However, keep in mind that staking rewards are typically funded through a combination of transaction fees and newly minted tokens. In many cases, high staking returns are only possible if there is high token supply inflation, which can have an impact on price returns. Therefore, investors should also consider real (inflation-adjusted) staking returns (just as analysts often consider real interest rates in the context of bond markets or money markets). Ethereum’s supply growth is close to zero, so its nominal and real staking returns are roughly the same—around 3%. In contrast, while Filecoin (FIL) offers a nominal staking return of 23%, the circulating supply is expected to increase by 20% over the next year[12], which means the real staking return is only 3% (Figure 7).

Figure 7: High nominal returns are often associated with high inflation

What’s at Stake

Consensus is to blockchain what law and property rights are to traditional commercial enterprises: one cannot exist without the other. As the crypto industry grows, Grayscale Research expects PoS consensus and staking will become an increasingly important part of the ecosystem. Although staking rewards are generally low compared to cryptoasset price fluctuations, they can be a source of additional income over time, so many token holders are willing to act as validators to earn these rewards.

Technical Appendix

While conceptually simple, in practice staking involves additional complexities, several of which are discussed below.

Four Ways to Stake

There are four ways to stake Ethereum: Solo Home Staking, Staking as a Service, Pooled Staking, and Centralized Exchanges. Solo Home Staking is the most impactful and trustless method, offering full control and rewards, but requires at least 32 Ether, a dedicated computer, and some technical knowledge to enhance network decentralization. The above discussion is from the perspective of Solo Staking. Staking as a Service allows users to delegate hardware management while earning native block rewards, requires 32 Ethereum, and withdrawal keys are typically retained by the user. Pooled staking allows users to stake any amount of Ethereum, earning rewards through a streamlined process involving third-party solutions and liquidity tokens, allowing for easy exits but bearing third-party risk. Centralized exchanges offer minimal oversight and effort, suitable for those unwilling to self-custody, but involve higher trust assumptions and centralization risks, integrating large pools of Ethereum and providing a fallback option to earn yield.

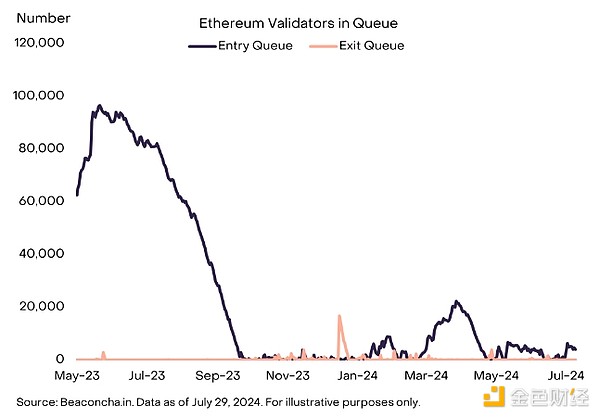

Bond/Unbond Queues

Bond/Unbond queues in Ethereum involve validators waiting to start staking or unstaking due to a rate limit on the network’s processing per epoch called churn (Exhibit 8). These queues protect the stability of Ethereum’s PoS consensus. The queue duration increases if validators join faster than they can be processed, and decreases if validators join less frequently. Churn is the rate limit on validator entry or exit per epoch, adjusted based on the number of active validators to maintain consensus stability. An epoch is a period of 32 slots, each 12 seconds long, for a total of 6.4 minutes, during which validators propose and attest to blocks. A sweep is the time it takes for funds to exit a validator’s queue and become available for withdrawal to a specified address; the more validators there are, the longer the sweep delay.

Figure 8: Validators typically have to wait to enter and exit

Liquidity Staking Derivatives

Liquidity Staking Derivatives (LSD) were created to address the locked-in nature of staked Ether, providing liquidity to staked assets that would otherwise be unavailable. When a user stakes Ether with a liquidity staking provider, they receive an LSD token representing the staked Ether. The token is fungible, transferable, and can be used for a variety of decentralized finance (DeFi) activities. LSD unlocks the liquidity of staked Ether, enabling users to earn additional yield through DeFi activities such as lending, providing liquidity, and using it as collateral, while still receiving staking rewards.

Restaking

Restaking involves using staked Ether to simultaneously secure the Ethereum network and other decentralized protocols, thereby earning additional rewards. The purpose of restaking is to help less developed protocols leverage Ethereum's strong validator community without incurring high costs and resources. Restaking was introduced by a third-party protocol, EigenLayer, rather than through an Ethereum Improvement Proposal (EIP) or the Ethereum roadmap.

Notes

[1] Light nodes only store a subset of the blockchain information.

[2] Fork choice rules and social coordination can also be considered part of the consensus mechanism.

[3] There can be multiple winning miners, resulting in orphan blocks.

[4] Source: Ethereum.org.

[5] In the initial phase, searchers, builders, and relayers may participate in preparing transactions.

[6] Priority fees are earned by block proposers.

[7] In comparison, the U.S. agricultural sector earned a return of approximately 3.5% over the five years ending 2022, defined as net farm income as a percentage of farm assets. Source: USDA, Grayscale Investments. Data as of USDA’s latest report, February 2024.

[8] Source: Artemis. Data as of July 28, 2024.

[9] Source: Allium, Grayscale Investments. Data as of July 28, 2024. Simple average of annualized staking returns since January 1, 2023.

[10] To arrive at a hypothetical return for an Ethereum staker, we calculated the change in ETH’s price and staking rewards for all validators during that time period and added the returns. This return is hypothetical and does not reflect actual returns for any investor. Actual returns may be higher or lower. This hypothetical return does not include fees, which would impact returns.

[11] Total returns include returns on Maximum Extractable Value (MEV), an additional portion of potential returns for block producers based on transaction ordering.

[12] Source: Token Unlocks, Grayscale Investments. Data as of July 29, 2024.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Sanya

Sanya CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX Beincrypto

Beincrypto Beincrypto

Beincrypto Coinlive

Coinlive  Tristan

Tristan 链向资讯

链向资讯