Author: Danmo Anran

Recently, court documents disclosed by FTX indicated that the $230 million in proceeds from the government's seizure action may be distributed first to preferred shareholders, a move that has caused strong dissatisfaction among creditors. In response, FTX's official Twitter account posted today that the U.S. Department of Justice will be responsible for mediating the claims of both parties, and indicated that preferred shareholders are also regarded as victims of FTX's fraudulent activities and are on an equal footing with creditors.

The repayment plan of the bankrupt cryptocurrency exchange FTX is expected to hold a court confirmation hearing on October 7. If the plan is approved, creditors may begin to receive compensation as early as the end of 2024.

However, court documents disclosed by FTX recently indicated that up to $230 million (or 18%) of the proceeds from the government's seizure action will be allocated to repay preferred shareholders. This angered creditors because they are usually compensated before shareholders in bankruptcy proceedings, and they were unaware of the agreement when they voted to approve the repayment plan on August 16.

The Department of Justice is responsible for adjudicating disputes between the two parties

In response, the official FTX account posted today that the FTX debtors provided an update on the settlement agreement with preferred shareholders.

According to FTX's bankruptcy reorganization plan, FTX will return 100% of all assets under its control to creditors. In addition, the Department of Justice (DOJ) controls the distribution of assets confiscated through criminal cases and has stated that preferred shareholders are victims just like creditors under criminal law.

FTX and preferred shareholders have competing claims for the seized proceeds, and the Department of Justice will be responsible for mediating these claims. Once the settlement is accepted by the Department of Justice, the settlement will be handled in a way that FTX believes is fair to both parties and avoids long-term disputes.

Therefore, if the Department of Justice accepts this settlement agreement, preferred shareholders will receive up to $230 million in funds allocated in accordance with the original agreement.

The official account added that FTX is asking the Department of Justice to agree to a centralized distribution process through its Chapter 11 bankruptcy reorganization plan to speed up distributions to creditors and avoid unnecessary high expenses.

FTX’s preferred shareholders include many prominent people

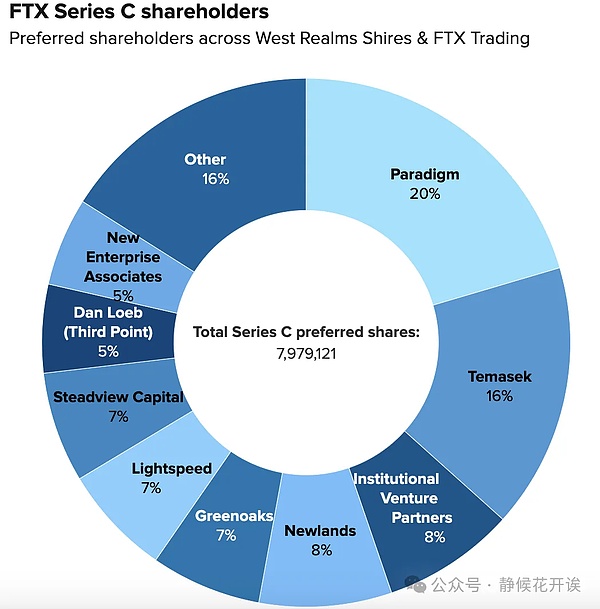

According to CNBC, FTX’s preferred shareholders include many well-known investors and institutions, for example:

Dan Loeb – controls more than 6.1 million preferred shares through a venture fund associated with Third Point.

Coinbase – owns nearly 1.3 million preferred shares.

Paul Tudor Jones – founder of hedge fund Tudor Investment, holds FTX shares through a series of family trusts.

Robert Kraft – billionaire owner of the New England Patriots, 155,144 preferred shares.

Paradigm, Temasek...

FTX will start repayment as early as the end of the year

Although there were rumors on social media yesterday that the FTX restructuring team will start paying creditors and customers on September 30, in fact, these are all false rumors because the repayment plan has not yet been approved by the court.

The confirmation hearing of FTX's repayment plan will be held on October 7, Eastern Time, when Judge John T. Dorsey of the Delaware Bankruptcy Court will decide whether to approve the plan. If approved, small creditors with claims of less than $50,000 may begin to receive compensation at the end of 2024, and creditors with larger claims may have to wait until the first or second quarter of 2025 to receive compensation.

Creditors oppose repayment plan

According to the current plan of the restructuring team, FTX will repay creditors in cash or dollar-pegged stablecoins. It is estimated that after all assets are sold, FTX will have as much as $14.5 billion to $16.3 billion in cash available for distribution, and it owes customers and other non-government creditors about $11.2 billion. FTX has said that the vast majority of users (those who once held funds below $50,000) can receive about 118% cash compensation.

However, the compensation for losses is calculated based on the platform funds on the day when FTX exercises Chapter 11 of the Bankruptcy Law, so unless the assets placed by users in FTX are stablecoins, it is actually still a big loss. For example, when the bankruptcy application was filed, the price of Bitcoin was only about $16,000, but the current price is close to $66,000, which means that if the user held a BTC in FTX at that time, he might only get back $16,000 in the end, which is less than 25% of the current value.

Therefore, the FTX creditor group led by Sunil Kavuri opposed the repayment plan for multiple reasons, including requiring compensation in the form of cryptocurrency and opposing cash payments because they would result in the need to pay taxes. However, FTX lawyers insisted that creditor compensation must be paid in cash to avoid conflicts with the current Chapter 11 bankruptcy law and hinder the reorganization process.

Alex

Alex

Alex

Alex Brian

Brian Hui Xin

Hui Xin Joy

Joy Kikyo

Kikyo Hui Xin

Hui Xin Davin

Davin Joy

Joy Davin

Davin Brian

Brian