Author: Thaddeus Pinakiewicz, Vice President of Galaxy Digital Research Center; Translator: Jinse Finance xiaozou 1. Irrational Carnival: Some Anchored Assets Decoupled Amidst the Storm Trump's unexpected tariff announcement at 8:50 PM UTC on Friday ignited a market turmoil, triggering the largest nominal deleveraging in crypto history: over $19 billion in positions were liquidated in approximately 24 hours, sending Bitcoin plummeting to a low of $106,000-$107,000 before rebounding. US stocks also fell (the Nasdaq fell 3.6% and the S&P 500 fell 2.7%, their worst single-day performances since April). Binance's three pegged assets, USDe, BNSOL, and WBETH, experienced significant decoupling. USDe, which is supposed to be pegged 1:1 to the US dollar, plummeted to as low as $0.65, but minting and redemption functions on the Ethena platform remained functional and maintained parity on most exchanges. wBETH plummeted to $430 at its trough, while BNSOL hit $34.90, representing discounts of 80%-90% to their underlying assets, ETH and SOL. These sharp declines triggered risk management mechanisms on large-scale liquidation exchanges, triggering automatic position reduction (ADL) on multiple platforms to limit losses during the "free fall" period through forced liquidations.

2Event Context and Timeline

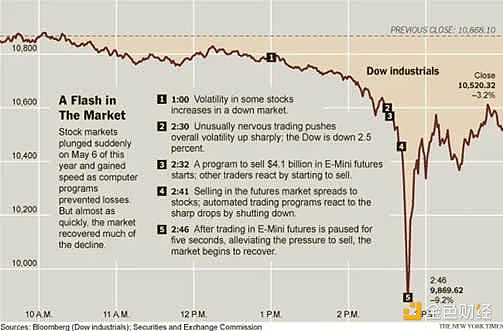

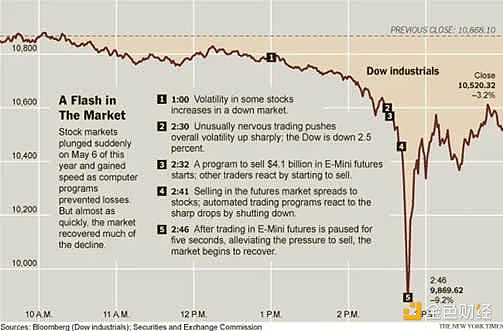

October 9, 04:40 UTC: Hyperliquid "insiders" injected $80 million USDC into the trading account. From 4:40 AM on October 9 to 8:49 PM on October 10: The insider gradually built a short position of approximately $400 million in BTC, stopping just one minute before President Trump announced his tariff policy. From 8:50 PM to 9:20 PM on October 10: Trump threatened to impose 100% tariffs on China on Truth Social. Within minutes, crypto futures plummeted and options implied volatility soared as market makers priced in regulatory uncertainty, drying up liquidity. Bitcoin fell approximately 10% on the day, and Ethereum fell approximately 13%. October 10, 21:20-21:42 UTC: USDe began to fall below its $1 peg on Binance as BTC and ETH hit intraday lows. October 10, 21:42-21:51 UTC: USDe fell to a low of $0.65, with decoupling and cascading liquidations on Binance intensifying. The pegged assets were subject to massive liquidations and sell-offs, with WBETH losing 80% of its value relative to its peg in two minutes, and BNSOL following suit with an 80% drop in the following seven minutes. October 10, 21:51-23:59 UTC: The market bottomed after the liquidation wave subsided. USDe was the first to restore its peg thanks to its fundamental redemption mechanism. WBETH and BNSOL gradually returned to their pegs overnight as market makers and traders assessed the severity of the plunge and reassessed counterparty and platform risks. October 11: Markets resumed normal operations. This plunge was reminiscent of the 2010 "flash crash," when the S&P 500 fell nearly 10% in approximately 30 minutes, recovering most of its losses by the close. That crash was a market microstructure shock, triggered by the interaction of peculiar order types in algorithmic trading. Fundamentals took time to address the market crash, ultimately returning the market to normal before the close.

3、"Insider Trading Suspicion?HyperliquidWhale Movements"

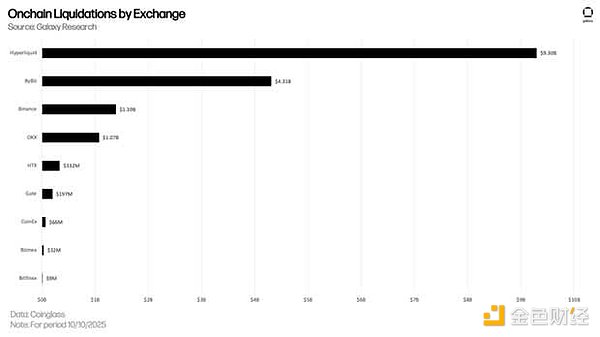

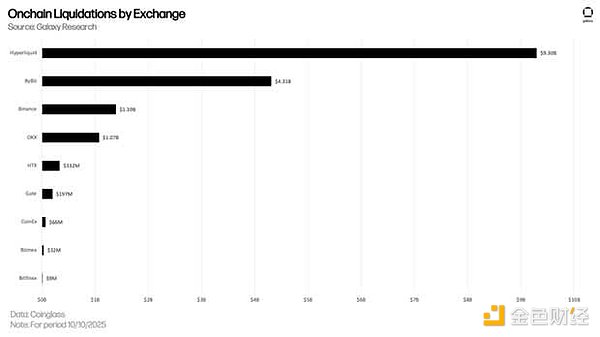

A Hyperliquid account instantly established a massive BTC short position before the tariff announcement and profited handsomely. The trader completed their position at 8:49 PM UTC, exactly one minute before Trump's announcement at 8:50 PM UTC. Such precise timing and sheer size immediately sparked market speculation about whether the trader had advance knowledge of Trump's policy moves. The inability to verify this often leads us to downplay such narratives. People prefer to believe this was a coordinated operation rather than simply admitting that the market was collectively spiraling out of control due to excessive leverage, but the timing is certainly too coincidental. On-chain sleuths Eyeonchains traced the funds from the address to fund manager Garrett Jin, who claimed the funds came from clients and denied any connection to the Trump campaign in a now-deleted tweet. Another blockchain observer, ZackXBT, added that the wallets involved likely involved multiple entities rather than a single individual. While a notable episode in this recent market crash, a $400 million short position in perpetual swaps alone is not enough to shake the entire market. The chain of events is this: short positions triggered the Binance decoupling before a broader sell-off, and the decoupling, in turn, exacerbated the liquidation wave due to the collapse in collateral value. The decoupling of USDe, BNSOL, and wBETH occurred after the primary decline in BTC/ETH. Binance attributed the decoupling to weak order book liquidity and infrastructure pressured by the intense liquidation wave. Notably, Binance was in the process of transitioning margin calculations for these assets from price-based to redemption/fundamentals-based, but the transition was not completed in time to mitigate price sensitivity. Binance subsequently announced that it would compensate users whose pegged assets were liquidated due to a sharp drop in their prices relative to the underlying assets. Approximately $300 million in compensation has been distributed (without recovering profits), and a $100 million low-cost loan program has been launched to support market makers. Binance explicitly stated that it would not cover traders' losses, emphasizing that these measures are intended to restore market confidence rather than admit fault. 5. Causes of the Incident: In short: High leverage, thin order book depth, and macro black swan events combined to trigger the crash. The crypto market entered this crisis with high open interest and strong risk appetite. Under the impact of breaking macro news, option spreads widened, hedging demand surged, market makers reduced their exposure, and multiple perpetual swap platforms triggered automatic position reductions, creating a procyclical death spiral amidst thin order books. This wasn't a story caused by option expiration, but rather a chain reaction of liquidity and leverage. Traders sold all available collateral, including the "pegged asset" that was supposed to be anchored to fundamentals, until forced sales encountered zero takeover. Although Ethena, the underlying protocol for USDe, maintained minting and redemption capabilities and the system remained overcollateralized, the token fell to as low as $0.65 on Binance. From a mechanistic perspective, the price shock forced over-leveraged USDe holders on Binance to liquidate their positions as liquidity dried up. The ecosystem leverage built around USDe amplified the ripple effect after the order book's deep evaporation. With the concept of leveraged "decentralized perpetual swaps" becoming the dominant market narrative in recent months, a market cleanup was inevitable once all the necessary conditions were met. During the market turmoil, USDe depreciated from its peg on Binance's centralized order book, plummeting to as low as $0.65, yet its minting/redemption functions remained functional. This vividly illustrates a classic example of a protocol's value not being equal to the exchange's market price during a panic. This incident also reignited discussions about oracles and pricing mechanisms, including Aave's decision to hard-peg USDe to USDT to avoid flash crashes and depreciation cycles triggered by exchange market prices. While hard-coded assumptions may work this time, they can mask the true risks; essentially, they're choosing what tail risk to accept. Prices during liquidation shouldn't be forced to equal "fundamental value." If no bids are placed, the liquidation price will naturally decline, and closing positions based on that price is inherently part of the trader's game. While embedding "fundamental anchoring" into oracles can solve the immediate problem, it simply replaces price risk with fundamental risk. Don't underestimate these "risk control solutions" that simply transfer risk: There are no risk-free wrapped assets, and fundamental oracles directly deprive users of the ability to balance the risk of wrapped assets with the underlying assets. Can Binance's custody or multi-chain deployments truly be risk-free? Clearly not. Fundamental oracles can mitigate short-term volatility like last week's, but if the wrapped entity experiences problems, the risks will escalate in the opposite direction. Fundamental oracles are not superior to price oracles; they simply optimize different dimensions of outcomes. 7. A historical record? While $19 billion in single-day liquidations was a record, it only represents 0.45% of the current $4.2 trillion crypto market capitalization—a sign of dramatic deleveraging rather than a structural collapse. The rebound the following day confirms that this pullback was driven more by market microstructure than deteriorating fundamentals. In nominal terms, this was indeed the largest liquidation event in crypto history, far exceeding the previous high of approximately $10 billion on April 17, 2021. From a relative scale perspective, Friday's liquidation intensity significantly eased: accounting for 45 basis points of the $4.2 trillion market capitalization, only 5 basis points higher than the liquidation share in April 2021, when the market capitalization was $2.3 trillion. While Binance-specific market issues exacerbated liquidation pressure, the primary pressure was concentrated on perpetual swap exchanges such as Hyperliquid and Bybit (Coinglass does not currently include Aster data), which accounted for 75% of total liquidations.

8. Key Points for Subsequent Focus

Ultimately, crypto assets are guided by price mechanisms, not contractual principles. Liquidations are based on market prices, not courtesy notifications. Participating in perpetual swaps or leveraged stablecoin circulation transactions essentially assumes microstructural risks. When order book liquidity dries up during a crisis, the automatic position deleveraging (ADL) mechanism will harvest profitable positions.

Traders must remain clear-headed when participating in the market: What are you actually buying? What is your true risk exposure? This incident is neither unprecedented nor unpredictable. The excess returns from leveraged trading and yield farming inevitably come with liquidation risk. Don't expect market makers to unconditionally guarantee price stability and liquidity. When markets are in trouble, they prioritize self-protection. No one "owes" you a "fair" quote. The exchanges' response has been equally disheartening. The crypto industry is embedding assumptions into markets and protocols. While these measures may alleviate the immediate crisis, they sow further dangers in the future. Hard-coding "fundamental" values into oracles or indices may prevent a recurrence of this type of depegging, but it effectively socializes a different kind of tail risk (custodian/cross-chain/issuer failure). Understand your risk exposure and don't be shocked when the leveraged machine reveals its true nature. For the broader market structure, this purge is healthy. It removes excess leverage. As market makers re-entered the market, IBIT volatility was barely affected, and option volatility returned to its mean within a day, all of which confirmed the overall resilience of the crypto market (except for the on-chain Meme coin casino).

Weatherly

Weatherly