Author: Alex Thorn, Galaxy; Translator: Deng Tong, Golden Finance

This report was originally sent privately to Galaxy clients and counterparties on November 7, 2024.

The digital asset industry is about to usher in a golden age. Cryptocurrencies in the United States may experience a whole new regulatory approach, while also welcoming new supporters in both houses of Congress and the White House. The industry has flexed its political muscle and sent a powerful warning to its enemies in a way that will reverberate across the political spectrum. The oppressive headwinds that have hampered industry development and increased legal costs over the past four years have abated, and the cryptocurrency industry is now on the downside in the world's largest capital market.

Election Night - Strikingly Similar History

President-elect Donald J. Trump made history - becoming the second president ever to win a second non-consecutive term. Grover Cleveland is the only former president to achieve this feat, defeating Benjamin Harrison in 1892 to win a second term. Then, anti-tariff, pro-gold Democrats returned to power for a second non-consecutive term in 1892, and today, pro-tariff, pro-Bitcoin Republicans won a second non-consecutive term in 2024. History is often surprising.

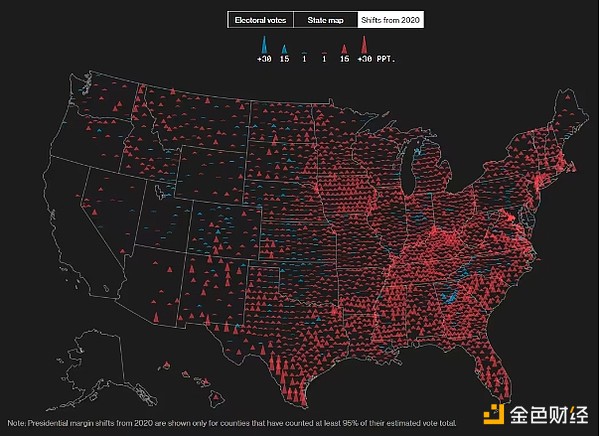

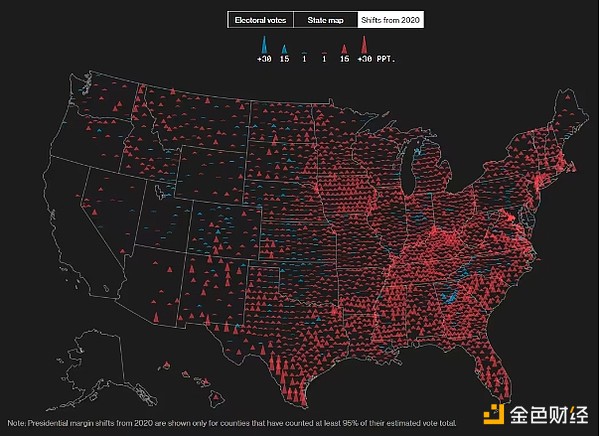

Trump’s victory is historic in the modern era, too. He will expand his electoral vote count from 306 in 2016 to more than 310. He becomes the first Republican to win a majority of the national popular vote since George W. Bush in 2004. Trump sweeps the “blue wall” states of Pennsylvania, Michigan, and Wisconsin, just as he did in 2016, but he’s also likely to win Nevada, which Clinton won in 2016. In Florida, Trump wins by a staggering 13%, though much of that performance can be attributed to demographic changes in the state over the past few election cycles. This Bloomberg heat map shows the changes in the Republican and Democratic presidential candidates for each county with more than 95% reporting and 2020 and 2024. There's too much red.

The Senate flipped to the Republicans, and the result is likely to be 54 seats controlled by the Republicans. It will take longer to know the results of the House, but the Republicans have a slight advantage and are expected to maintain control of the House.

Some other points from the election:

Cryptocurrency flexed its political muscle. In addition to very public efforts to get a broad and deep crypto agenda from President-elect Trump, the industry has also gained broad support in the House and Senate. The most notable victory was Bernie Moreno (R-OH) defeating Sherrod Brown (D-OH). Crypto PACs spent tens of millions of dollars to defeat Brown, the current chairman of the important Senate Banking Committee. Defeating Brown, an ally of Elizabeth Warren, sent a strong message that opposing cryptocurrencies is a losing position politically.

Trump enters second term. Presidents are known to tackle more complex and far-flung issues in their second terms. His win also gives him more power than in 2016, when Trump took office with the support of one of the most diverse coalitions of Republican voters in decades. This increases the likelihood that Trump will work on big ideas, which could include a major modernization of the financial system.

Trump's team is very supportive of the digital asset industry. Trump's inner circle is very supportive of digital assets, and many of them have disclosed that they own Bitcoin. Vice presidential candidate J.D. Vance disclosed that he owns Bitcoin, Vivek Ramaswamy has been an outspoken supporter of the industry throughout the campaign cycle, Robert F. Kennedy (RFK Jr.) owns Bitcoin and has been very supportive of Bitcoin for at least 2 years, transition team co-chair Howard Lutnick said that he and other Cantor Fitzgerald own "substantial" Bitcoin (Cantor Bank holds Tether), and many other major donors have either directly participated in cryptocurrencies or have shown a clear positive attitude towards the asset class and industry. Don't forget, Trump himself has issued NFTs and launched his own affiliated DeFi protocol World Liberty Financial. The affinity of his team, family, and donors for cryptocurrencies increases the likelihood that Trump will deliver on his campaign promises to the industry.

What to Expect in Washington

Let me paint a picture of what might happen with crypto policy:

Bank regulators. Trump immediately appointed a new acting Comptroller of the Currency and a new acting chair of the FDIC. These agencies have prudential and supervisory authority over banks and insured depository institutions. Perhaps within days, the bank regulators could issue guidance explicitly prohibiting unfair targeting of specific industries (Chokepoint 2.0), as Trump did when he first took office, and they could certainly revoke existing interpretive guidance or letters that are unfavorable to the industry—i.e., the January 3, 2023 joint letter. Within weeks or months, the OCC could issue guidance explicitly allowing banks to custody digital assets and use, operate, and interact with public blockchains and stablecoins. (Recall that Trump’s former acting comptroller, Brian Brooks, issued such an interpretive letter in 2020).

Market regulators. Trump promoted the current commissioners of the SEC and CFTC to acting chairs. While Trump promised to “fire Gary Gensler,” most constitutional scholars believe that the president cannot fire the duly appointed commissioners of independent agencies. However, the President could immediately designate the current Commissioner as the Acting Head of the agency. In the short term following this personnel change, some crypto enforcement would be paused, some litigation would be suspended or withdrawn, no action letters would be issued on specific topics or for specific items, and the industry and regulators would have an opportunity to discuss a reasonable path forward. More comprehensive rulemaking would take longer, but the crypto industry would likely receive waivers quickly, with the main area being a relaxation of the SEC’s stance on “security” and “exchange.” The CFTC’s stance is similar, but we would note that in the absence of comprehensive market structure legislation to draw clear lines of jurisdiction between the SEC and CFTC, it would be important for both market regulators to have a Chair who can coordinate their work and enact progressive policies.

Congressional Legislation. The biggest crypto policy agenda items in Congress are well known: market structure (clarifying the regulatory status of digital assets and who oversees them) and stablecoins (legalizing and licensing the issuance of stablecoins). In May, FIT21 passed the House of Representatives with a bipartisan majority and will form at least the outlines of future work on a market structure bill. Currently, the two parties are relatively close on stablecoin legislation, with the main disputes between Democrats and Republicans on financial services in the House being 1) whether only national banks can issue, or whether there is also a national path, and 2) which agency (or agencies) will have prudential and supervisory authority over these issuers.

Critically, if Republicans control the House, we think it is less likely that these bills will advance quickly in 2025. A unified Republican Congress would likely use the first 100 days of 2025 to focus on tax reform, trade, and other issues—using budget reconciliation to advance Republican priorities. This does not mean that crypto legislation is unlikely to advance in the next Congress, but in a unified Congress, we do think it will take a back seat to other priorities—which will require Congress and regulators to coordinate closely on crypto policy. Our base case is that crypto legislation will move to the second half of the 119th Congress, allowing cabinet officials and independent regulators to gain a foothold before engaging with Congress on policy issues.

Energy Policy. A Trump presidency, especially if Republicans control both houses of Congress, would be extremely positive for domestic energy and electricity production. This would benefit Bitcoin miners, data centers, anyone with access to large amounts of electricity, and of course, the energy producers themselves.

What This Means for Market Participation

Relaxing regulatory resistance, coupled with specific letters of interpretation, no-action letters, or regulatory guidance, could significantly expand access to cryptocurrencies for U.S. institutional investors.

The SEC relaxing the applicability of SAB 121 in September, or withdrawing the guidance altogether, would pave the way for the world’s largest custodian banks to enter the crypto space. BNY Mellon received an exemption from the onerous account guidelines because its primary prudential regulator (NYDFS) did not object, but the OCC is the primary prudential regulator for national banks such as Citigroup and JPMorgan Chase. Given that we are likely to see a significant shift in the OCC’s attitude toward banks directly interacting with cryptocurrencies, these large banks will eventually have the opportunity to become more involved.

Further institutionalization would in turn increase funding options for crypto assets, make spot crypto more accessible through existing institutional trading platforms and relationships, and increase the maturity of the institutional crypto market.

Easing the applicability of the SEC’s Howey Rule to digital assets, or expanding the “crypto-asset securities” that can be traded within broker/dealers, would allow more participants to enter the exchange space, which could include traditional financial institutions such as banks, exchanges, or brokerage firms. Additionally, relaxing the applicability of the SEC’s Howey Rule could lead to more spot-based crypto ETFs in the United States.

Clarity and permissiveness from regulators could allow traditional financial services firms and investors to operate on-chain for the first time, bringing new opportunities for yield and other strategies.

Expanded access to public blockchains could also revolutionize transaction efficiency, transparency, issuance, and other aspects of finance. Depending on the regulatory landscape and any legislation enacted, a merger of traditional and decentralized finance could eventually arrive.

Similarly, depending on the SEC’s stance on howvery and token disclosure, we could see a wave of new types of tokens, perhaps even equity securities, while existing tokens could add more equity-like features to enhance their value proposition. An expanded and improved ecosystem of assets would support a liquid crypto hedge fund industry, where the investable universe continues to mature and expand. Improved token disclosure and issuance capabilities in the U.S. could ultimately challenge or even reverse the existing SAFT-low float high FDV regime, which favors venture capital over liquid capital.

On the venture capital side, the IPO market could open up more meaningfully to crypto-native companies, ultimately providing a path to realizing investment returns through exits. Today, the only venture-backed crypto startup to go public (aside from a handful of SPACs) is Coinbase. By our estimates, there could be dozens of crypto companies seeking to go public in the U.S. if conditions are right and regulators are open.

Bitcoin Market Analysis

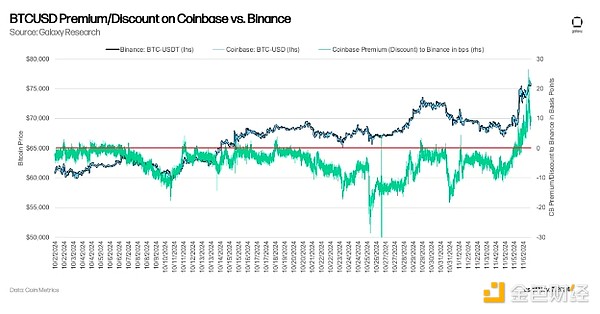

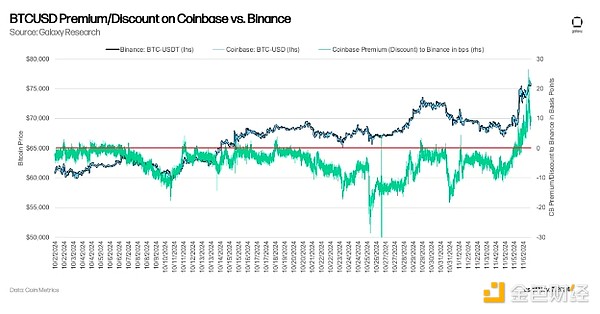

On Monday, November 4, Bitcoin traded as low as $66,700, but has since risen 15% to a new all-time high. Bitcoin surged to a new all-time high as Trump's odds of a November 5 victory rose, and has since hovered in the $75-76,000 region. Despite the sharp price swings — up 15% since Monday and 26% since October 1 — the market does not appear to be overheated from a fundamental perspective. On Tuesday evening, "Coinbase Premium" made a sharp comeback as Bitcoin rallied on election news, turning positive for the first time in at least a month.

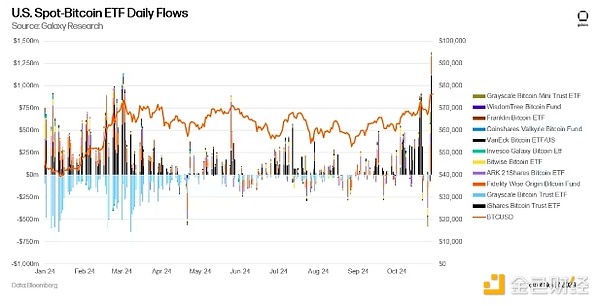

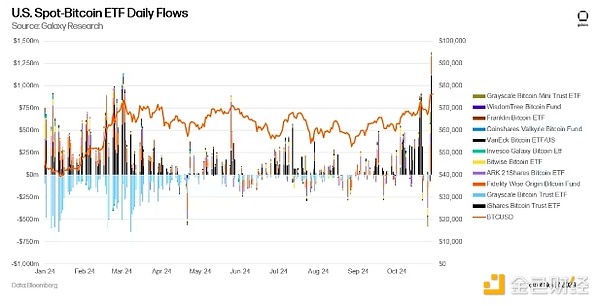

Bitcoin ETFs have been booming, with the largest net inflow in history on Thursday, November 7, with inflows of up to $1.375 billion, pushing BTC to a new all-time high. This figure exceeds the previous largest net inflow day on March 12, 2024, when net inflows were $1 billion.

Bitcoin Cyclicity

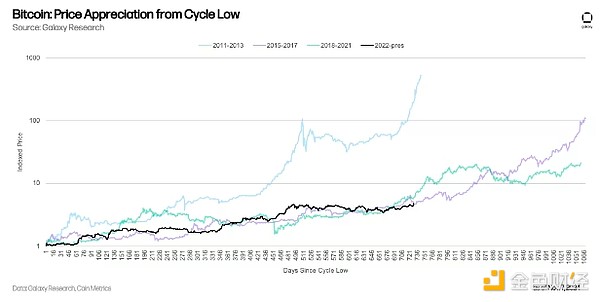

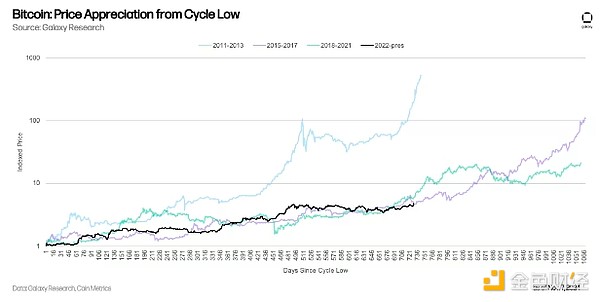

Looking back, Bitcoin is on track with the previous two bull runs. Judging from the cycle lows (2011: $2, 2015: $152, 2018: $3122, 2022: $15460), Bitcoin is on track with the 2017 bull run, slightly behind the 2021 bull run.

Looking back at previous bull market pullbacks, the 2024 pullback is milder than those during the 2021 and 2017 bull markets.

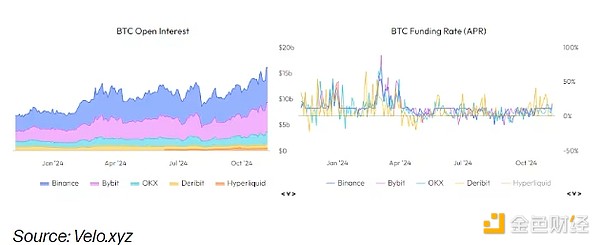

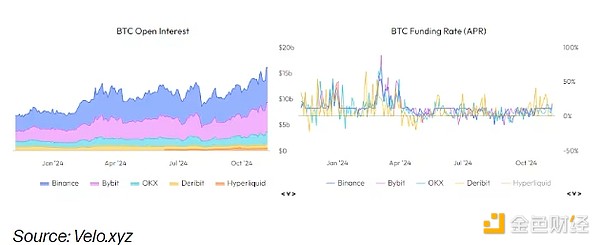

Futures and Financing

While futures open interest on cryptocurrency exchanges rose slightly to a yearly high, financing rates remained largely unchanged, suggesting that these movements were primarily driven by spot.

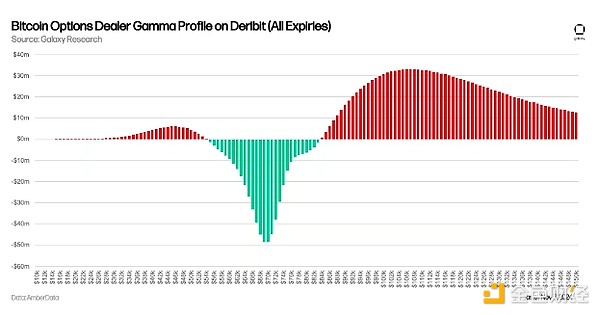

Bitcoin Options Market

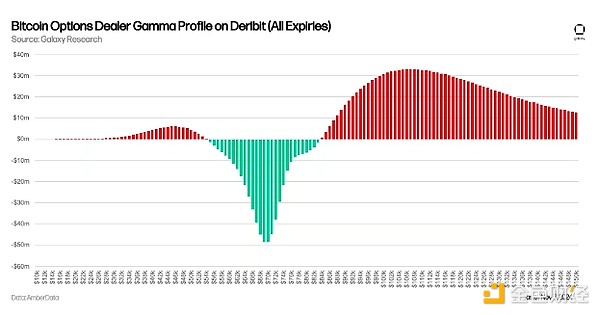

Bitcoin options traders are net short gamma between $54,000 and $84,000, which will accelerate any move. It should be reminded that when traders are short gamma, they usually hedge by buying spot when prices rise or by selling spot when prices fall. This effect can accelerate moves in either direction and increase volatility. Alternatively, when traders are short gamma, they do the opposite and sell when prices rise and buy when prices fall, thereby reducing volatility. Our analysis shows that short gamma currently peaks at $70,000, so as BTCUSD slowly moves higher, this effect is decreasing. That being said, many call option holders in the current high range are profitable, so these investors may decide to roll at higher strike prices, which will pull short gamma to higher strike price ranges. The chart below shows our view of net trader gamma positions for all BTC expiration dates between November 7 and September 26, 2025.

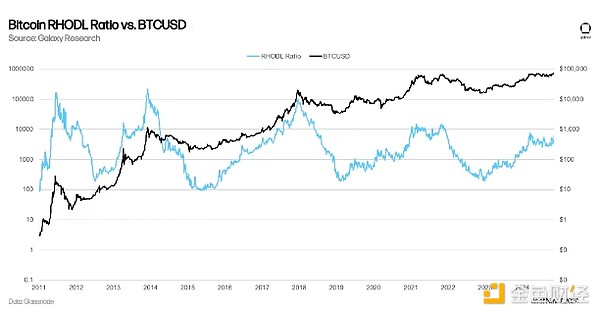

Bitcoin Basics

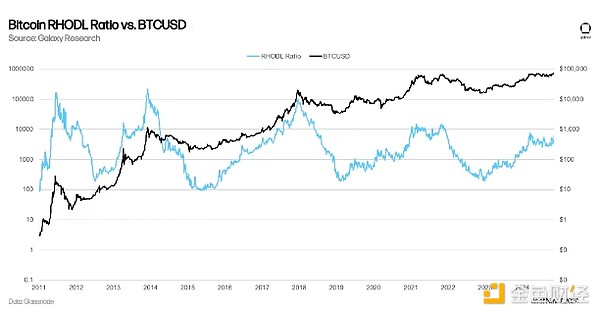

The Realized HODL Ratio is a metric that measures the ratio between the 1-week and 1-2 year Realized Market Cap HODL ranges (the realized value of the last coins moved during these time periods). Higher ratios indicate an overheated market, with peaks tending to coincide with market tops. The sideways movement of RHODL in 2024 is more reminiscent of the sideways movement in 2019-2020 than any peak activity, suggesting more room for upside in the near and medium term.

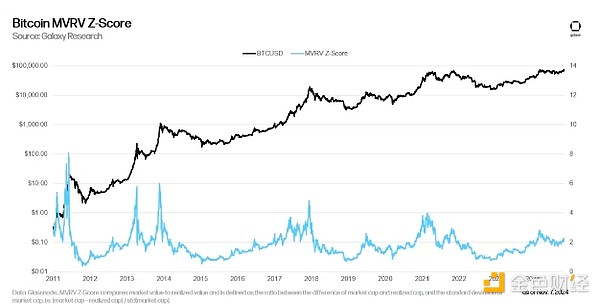

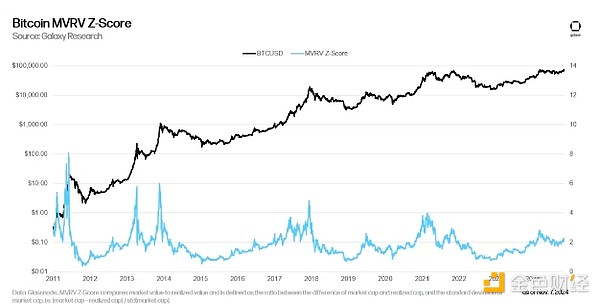

The MVRV Z-score is the ratio of market value to realized value and the standard deviation of market value, helping to identify the difference between an asset's trading value and its total cost basis. Historically, this indicator has been very effective in identifying market peaks, and its current value suggests that BTCUSD is not yet close to overheating or topping territory.

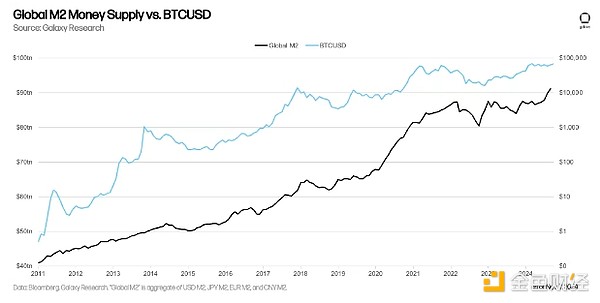

Bitcoin and Global M2

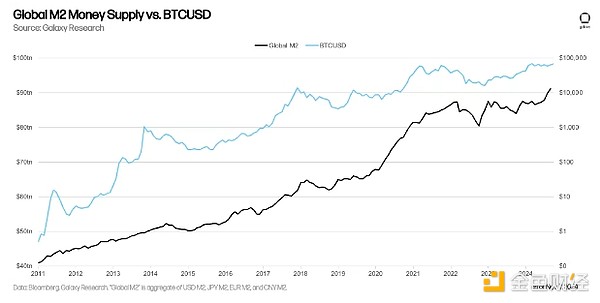

Bitcoin has historically responded to changes in the global money supply. While this correlation is not unique to Bitcoin, it is still worth paying attention to, especially if Bitcoin starts to be used more as a hedge asset as Larry Fink has called for.

Outlook

The incoming Trump administration coupled with a strong Republican Senate that can confirm its appointed agencies is a boon for regulatory relief for the U.S. cryptocurrency industry. We expect various forms of exemption relief to be introduced soon, while a stronger supportive regulatory framework will take more time to emerge. A relaxed enforcement environment coupled with progressive policy thinking will pave the way for traditional financial services firms and institutional investors to deepen their participation in the asset class. This will challenge the moats of existing crypto infrastructure players, but will also broadly support the expansion and maturity of the asset class. In this environment, we expect Bitcoin and other digital assets to trade well above today’s all-time highs over the next 12-18 months.

Weatherly

Weatherly