Author: Zack Pokorny, Galaxy; Translator: Baishui, Golden Finance

Summary

In our 2025 Cryptocurrency and Bitcoin predictions, we noted that DAOs (decentralized autonomous organizations) would begin experimenting with Futarchy in their governance procedures. This view was based on the success and scale of the Polymarket election market, which proved that prediction markets are more accurate, responsive, and democratic than centralized voting venues. In just two months since our predictions were published, we have seen multiple advances in Futarchy and a growing interest in prediction markets. This article explores the latest developments and status of Futarchy/DAO governance and on-chain prediction markets.

What is Futarchy?

Futarchy is a governance system that, like democracy, allows anyone to express their views; however, it separates the process of setting goals from the process of evaluating the means to achieve them. In traditional democratic systems, voters typically cast votes that reflect their values and beliefs. When voters choose candidates or vote on policies, they typically express what they value (e.g. fairness, economic growth, or social justice) and what they believe will best achieve those values (based on their assessment of the candidate's abilities or the policy's effectiveness). This is in stark contrast to Futarchy, where individuals vote for goals based on their values, and prediction markets (or "staking") are used to measure the most effective means of achieving those goals. This effectively separates the evaluation part from the prediction part (i.e. the outcome). The main advantage of Futarchy is that it uses the predictive power of financial markets and asset prices to guide decisions, with participants placing real monetary stakes behind their predictions. This market-based approach combines incentives for accurate predictions and rigorous analysis, which free-to-play ballot boxes typically fail to do.

The State of On-Chain Prediction Markets

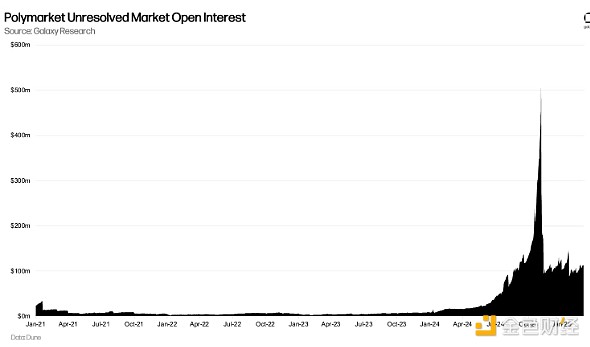

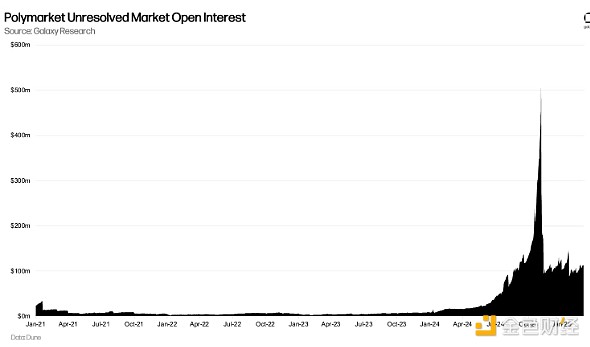

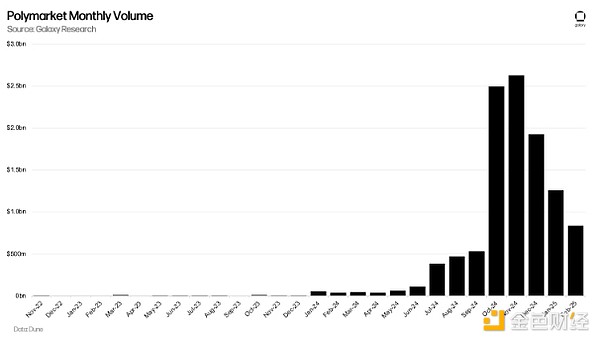

Polymarket's open interest (the value of open interest in active markets on the app) in pending markets has fallen significantly since the US election, from $512 million at its peak to $113.2 million today. While a large amount of holdings have been withdrawn from the app, usage has since remained stable and above pre-election levels.

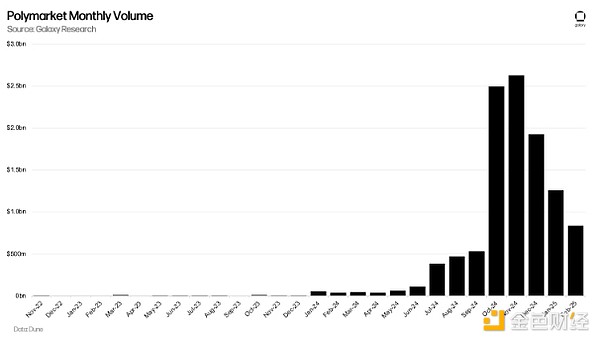

Users trading outcome tokens are also above pre-election levels, with monthly volume at $835.1 million as of the end of February. While monthly volume is down 68% from election month highs, it is still 23% higher than the average of the six months before the election (including October 2024) and 57% higher than monthly volume in September 2024. It’s also worth noting that DeFi activity in general has been declining since the highs of December 2024/early January 2025. Therefore, the slow growth in open interest and volume on Polymarket could be a result of increasing market forces.

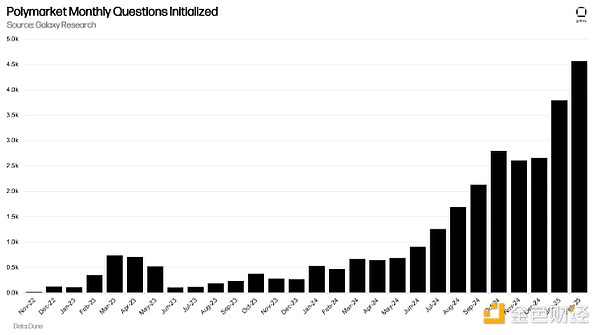

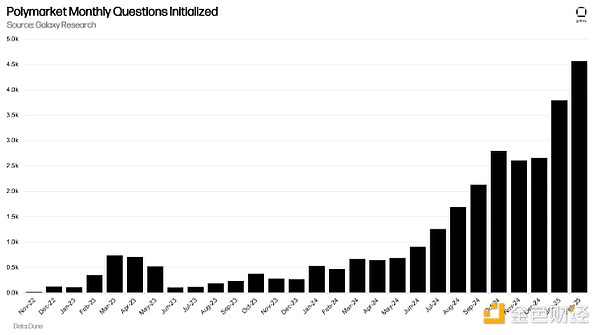

One notable area of growth for Polymarket is the number of monthly “initialization issues” (aka markets) on the app. The increase in the number of markets, while expanding the topics and events available to bet on, could also be a factor in the decline in volume and open interest, as market oversaturation can weaken the network effects of a few concentrated markets when activity decreases.

Futarchy on-chain status

While Polymarket activity has clearly retreated from its election-frenzy highs, the inertia of its success is showing up across DAO governance. The most attention paid to Futarchy on-chain governance is centered around Solana, with much of the discussion and implementation of the concept being conducted by the Solana community and the Solana chain. In addition to Optimism running a test market on the total value locked in the application, a joint grant from the Optimism and Uniswap Foundations has led some early initiatives to explore Futarchy in the Ethereum ecosystem.

MetaDAO

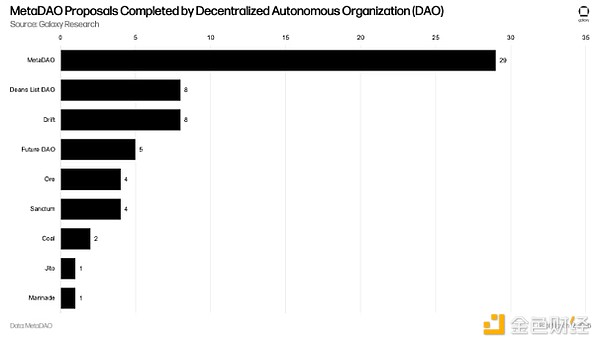

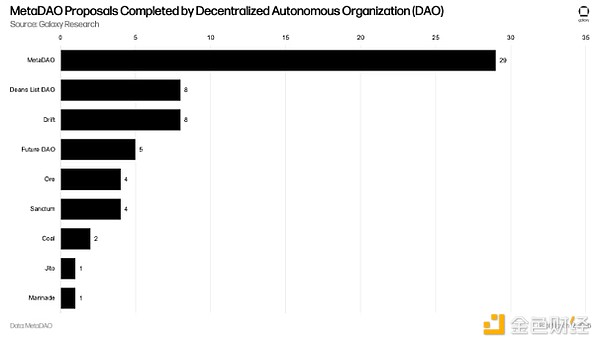

Solana’s MetaDAO is the first large-scale implementation of Futarchy in the governance space, providing DAOs with a platform for launching Futarchy markets and user participation in voting. Since its launch in November 2023, the platform has facilitated 62 Futarchies across 9 DAOs (including itself), 19 of which were completed after elections. The three largest Solana-based DAOs (Jito, Marinade, and Sanctum) have completed their first Futarchies after the election, with Sanctum resolving four decisions through Futarchy voting. Notably, Sanctum, along with Ore, has adopted MetaDAO as the primary platform for its governance operations, fully dedicated to Futarchy.

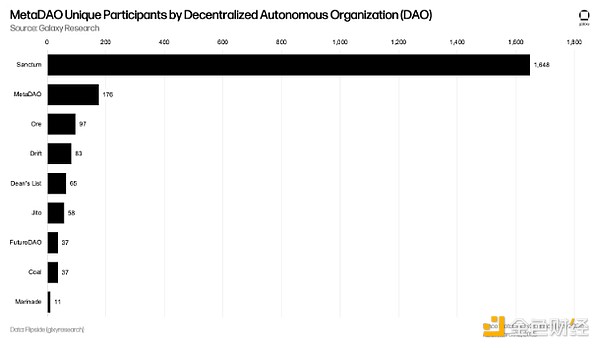

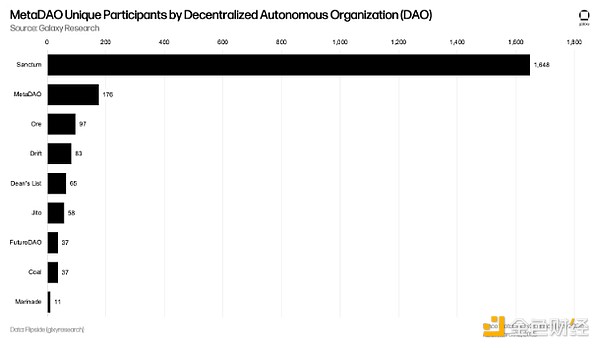

Sanctum attracted 1,648 unique voters despite only four votes. This is more than the number of unique voters that Lido and Ethereum Name Service (ENS) received for their four proposals in 2024. However, speculation about the application's second season airdrop and other incentives may distort this number. In other DAOs, the number of participants remains small, which can be partly attributed to their experiments with Futarchy while maintaining traditional governance voting processes.

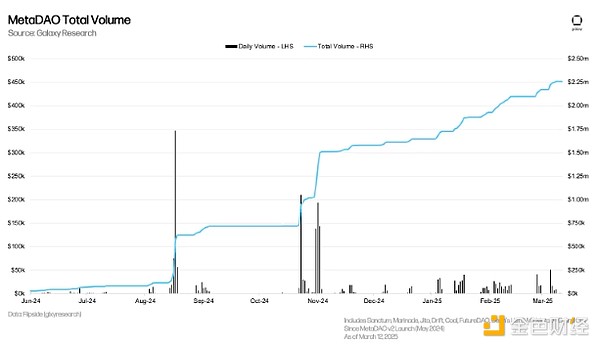

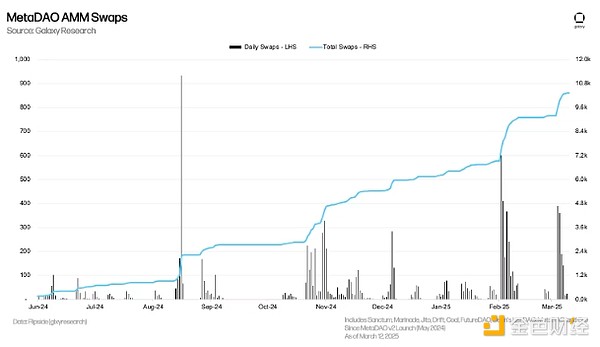

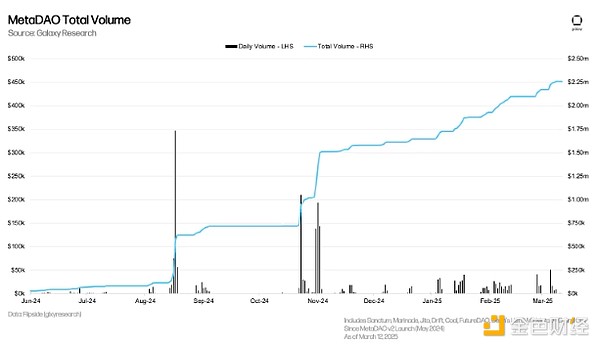

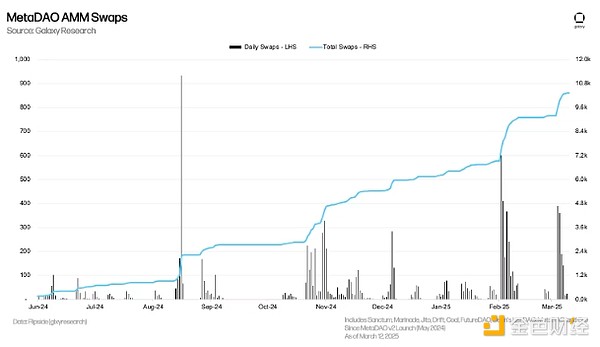

Under the Futarchy system, the voting process is a market. Therefore, tracking swaps and swap volumes provides an additional measure of participation. Since the launch of MetaDAO v2 in May 2024, the platform's Futarchies have generated $2.26 million in cumulative trading volume. Of this, $902,600 (40%) was executed after November 1, 2024.

This volume was traded across 10,318 transactions across all Futarchies. This translates to about $219 per voting action and 246 voting actions per Futarchy since MetaDao v2 went live. For reference, Aave and Uniswap averaged over $450,000 per vote in 2024, with over 600 votes per proposal. So while Futarchies have fewer voting actions per proposal, the lower dollar value per voting action suggests that smaller players are gaining more influence in the voting outcome.

Futarchy Beyond Solana

Futarchy experiments have also expanded to Ethereum and its Layer 2 (L2). Optimism and the Uniswap Foundation announced a joint initiative to experiment with prediction markets within their governance frameworks, and Uniswap announced the first implementation of futarchic governance on Unichain, centered around grants to lending apps. The deadline for lending apps to apply for grants is February 21. It is unclear when this particular futarchy will be run.

Optimism also opened a futarchy competition on March 10, offering OP token rewards. The competition is powered by a simulated token and allows users to vote on changes in the total locked value (TVL) of applications on Hyperchains (an umbrella term for chains developed on the OP technology stack). Users can vote for or against based on how they think the TVL of the application will move. Users who vote correctly will be rewarded with OP tokens at the settlement date of June 12, 2025.

New Use Cases and Expanding Futarchy

MetaDAO recently passed the launchpad, which provides a unique opportunity for DAOs to launch more seamlessly as Futarchies and attempts to solve the capital/trust paradox that plagues projects and early investors. The launchpad will initially be permissioned for testing, but the proposal points to a long-term plan to launch the Futarchy DAO without permission.

This launchpad model is beneficial to projects because they raise funds and build communities before token generation and can launch as Futarchy from day one. It provides an out-of-the-box solution for launching DAOs and tokens, making Futarchies easier to form. An ongoing issue for existing DAOs adopting Futarchy is migrating from their legacy governance systems, which include 50/50 Futarchy/legacy governance. Migrating to a fully Futarchic model can confuse users and negatively impact Futarchy participation - launching as a Futarchy on day one can help drive participation.

The launchpad model is better for investors because part of the capital they contribute is converted into initial liquidity for the token, and the funds are locked in the Futarchy and require community consent to unlock. In this case, the capital they contribute enhances the on-chain liquidity of their investment, and the founding team cannot use the pre-raised funds at will. At any time, the community can collectively agree to press the eject button to return funds to pre-token investors.

Mtndao will be the first Futarchy to be launched through the MetaDAOs launchpad. The token sale is scheduled to take place around the week of March 31, 2025, with the specific start date yet to be determined. The token sale is expected to last about a week.

Conclusion

There is growing interest in using Futarchy to improve DAO governance. The success of Polymarket has raised questions about how the model can benefit decentralized organizations. As many cryptocurrency users believe that existing DAO governance is broken and in desperate need of disruption, Futarchy has emerged as a promising alternative. While its initial implementation is primarily on Solana, its iteration on Ethereum will allow for valuable comparisons to traditional DeFi DAO governance models. Additionally, new developments like the MetaDAO Launchpad could make the Futarchy model more scalable and give new DAOs the option to adopt it from day one.

Kikyo

Kikyo