Author: Cole

Since the outbreak of AI, AI agents have become a hot topic in the entire technology circle. When OpenAI launched the o1 model, Claude supported computer operations, and Google released Gemini 2.0, everyone was asking the same question: What's next for AI agents?

One answer is: Let the agents pay for themselves. Imagine a scenario: your AI assistant needs to check the weather, book flights, and book hotels to complete a trip. On the traditional internet, it's stuck: it needs to register an account, set up API keys, and link payment information. But on the new internet, it can discover these services, automatically pay a small fee, and complete the entire task in seconds—without any human intervention. This is becoming a reality, driven by something called the X402 protocol. When Coinbase created it, Google backed it, and a16z invested in its ecosystem, on-chain transaction volume soared 10,000%. A fundamental shift is taking place. The internet is gaining something it should have had 27 years ago but is only now ready: a native, blockchain-grade payment layer. 01 What is X402? The internet has an age-old problem: a lack of native payment methods. Want to buy an article for $0.01? Credit card fees of $0.30 per transaction make that impossible. Want to call an API to perform a calculation? Also impossible. So the internet turned to advertising or subscriptions—Google and Facebook built on this missing piece. In 1997, the Internet Standards Committee created the HTTP 402 status code (Payment Required) in an attempt to fill this niche. But without viable technology, it lay dormant for 27 years. X402 is the key to waking it up. The protocol is simple: using blockchain to make payments the native language of the internet—as fundamental as HTTP itself. How does it work? The X402 process is straightforward: proxy requests data → server returns "402 Payment Required" → proxy generates a cryptographically signed payment instruction (offline) → re-requests with signature → server delivers data immediately and asynchronously broadcasts the transaction to the blockchain. The core innovation here is delivering data without waiting for blockchain confirmation. Why? Because blockchain transactions take seconds to confirm, but API users demand millisecond responses. X402 cleverly separates "payment intent verification" and "on-chain settlement"—trading minimal risk for immediacy. There are three key roles in the ecosystem. First is the client—the AI or user who holds a crypto wallet. Second is the resource server—the API that provides paid services. Finally, there is the service provider—an optional but crucial third party responsible for handling complex on-chain operations. Coinbase is an official service provider, freeing developers from having to manage private keys and gas fees themselves—significantly lowering the barrier to entry. Why now? Three technologies are maturing simultaneously. Powerful LLMs allow AI agents to complete complex tasks autonomously, requiring frequent calls to various services. This creates an urgent need for high-frequency, low-value machine payments—the first change brought about by AI breakthroughs. Second, the maturity of Ethereum's Layer 2 (L2) platforms like Base. These networks have reduced transaction costs to fractions of a cent, making payments of $0.001 economically feasible—a feat completely impossible with traditional payment systems. Third, regulated stablecoins like USDC provide a reliable unit of account, bridging the gap between the crypto and traditional economies. Core Problems Solved: X402 First, it solves the micropayment problem. Credit cards' fixed fee of $0.30 makes any microtransaction economically meaningless. X402's protocol-level fee is zero, allowing transactions as low as $0.001, with settlement in seconds and global reach. This represents a completely different order of magnitude. Secondly, it changes user access methods. Traditional methods require account registration, key setup, and payment binding. X402, on the other hand, adopts a "payment-as-authentication" model—the agent discovers services, retrieves prices, automatically pays, and acquires resources, seamlessly completing the entire process. This represents a shift from a "platform-first" world (controlled by intermediaries like Stripe and Apple) to a "protocol-first" world (open standards) where developers can finally monetize directly.

02 Giant Participants and Ecological Status

X402 is not a marginal experiment. Currently, many giants have participated in and promoted the development of the X402 ecosystem:

Coinbase

Protocol creator, official service provider for Base L2 operations

Strategic goal: Build infrastructure for "agent networks" (AI agent-driven crypto-economy)

Top venture capital firm supporting the "agency-based commerce" track

Investing in ecosystem-related projects such as Catena Labs

Believes that protocols such as X402 far surpass Visa and SWIFT in speed, cost, and programmability

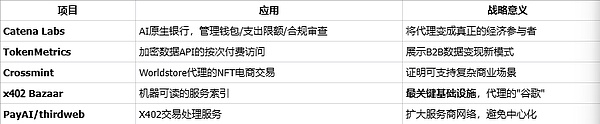

Major participants in the ecosystem

x402 The Power of Bazaar

Bazaar is the most critical link in the ecosystem. Imagine if there are thousands of X402 services. How can agents know about them? This is the problem Bazaar solves - it creates a standardized, machine-readable service index that agents can dynamically query, discover, and automatically call. No human intervention is required.

Put this capability to work in a real-world scenario: A travel planning agent needs to complete a reservation. It uses Bazaar to discover weather APIs, flight APIs, hotel APIs, and car rental APIs in sequence, automatically paying for each call, and completing the entire complex reservation in seconds. This is the emergent behavior of the agent network - agents learn to combine and use various services on their own. Dune Analytics data shows that X402 has seen monthly growth exceeding 10,000%, with hundreds of thousands of transactions per day. What's behind these numbers? The launch of the PING token attracted a large number of speculators. But why is this important? While growth is driven by speculation, it validates the technical feasibility and system stability. Hundreds of thousands of daily transactions demonstrate that the system can handle real workloads without crashing. What's truly worth observing is whether the ecosystem can transition from the speculative phase to real commercial application. 03. Potential Problems User experience is X402's weakest link. The protocol itself is designed for machines, but humans still need to initialize wallets, manage private keys, and purchase stablecoins. This requires a user-friendly "agent management platform" to completely hide all of this complexity. Security and regulatory risks are also not to be ignored. Malicious notification injection and infinite spending loops are potential threats. X402's reliance on stablecoins puts it squarely in the crosshairs of financial regulators. From a network effect perspective, X402 requires a sufficient number of service providers and usage agents. This presents a classic "chicken and egg" dilemma. Bazaar is breaking this deadlock through standardized service discovery mechanisms. Finally, there's competition from traditional finance. Visa's "Smart Commerce API" and Mastercard's "Proxy Payment API" are both real threats—they just take a centralized, permissioned approach. This is essentially an architectural battle: centralized platforms versus open protocols. Historically, open networks have often triumphed over closed platforms (HTTP triumphed over AOL), but this time, the incumbents are too powerful. The future may see a coexistence of both approaches. 04 Summary X402 is a redesign of the internet's infrastructure. From its definition in 1997 to its awakening in 2025, this story is one of waiting—waiting for AI, waiting for blockchain, and waiting for the technology to mature. Now, the conditions are in place. It's not perfect and faces challenges, including security and regulation. But it's an open solution backed by top American companies. For those interested in encryption and AI, X402 is a core infrastructure worth understanding in depth. Before the golden age of the proxy economy arrives, payment protocols like this will become the invisible gear driving the entire ecosystem. The revolution in the underlying infrastructure of internet payments has begun.

Alex

Alex

Alex

Alex Alex

Alex Alex

Alex Catherine

Catherine Kikyo

Kikyo Weatherly

Weatherly Catherine

Catherine Anais

Anais Kikyo

Kikyo Weatherly

Weatherly