Ethereum Core Developers Unveil Details on Pectra Upgrade: What to Expect

Ethereum devs tackle Pectra upgrade challenges, improving Devnet stability and communication, with major protocol transitions underway.

Bernice

Bernice

Source: LXDAO

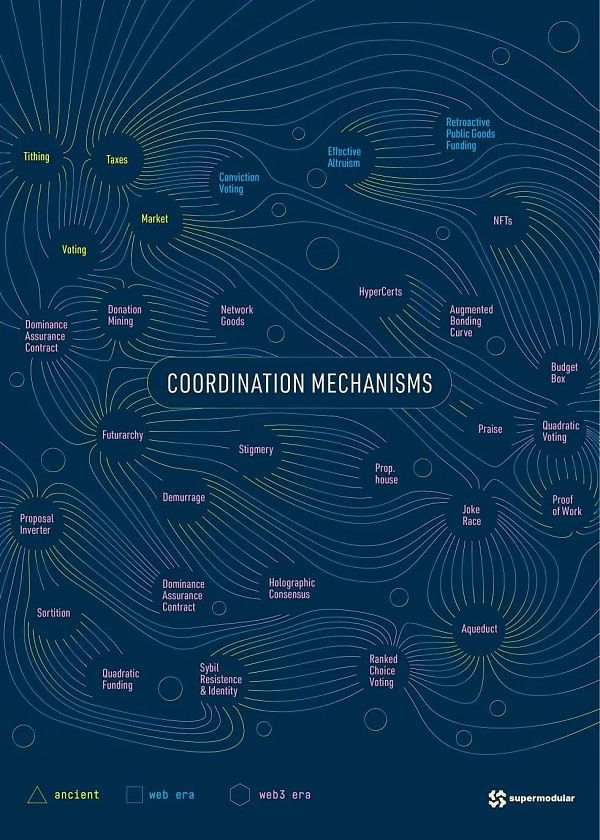

In episode 65 of the GreenPill Podcast, Giveth's Griff Green and Gitcoin founder Kevin Owocki, discussed nearly 30 different mechanisms for coordinating collective intelligence to achieve better collective resource allocation, and this article is extracted from their conversation.

Coordination mechanism diagram originally posted by Kevin Owocki on Twitter from Octavian

When you can achieve better collective intelligence, you can achieve better collective resource allocation. That's a great thing when you're trying to fund public affairs and build a regenerative financial system. —— Kevin Owocki

Let us start with a few classic example mechanisms:

Tithing strong>

Tithing - This is an ancient religious behavior. The historical method of operation is to donate part of the income to churches, non-profit organizations, etc. It is simple and easy to understand; the disadvantage is , without feedback, people won’t know what is being done with their money, there is no enforcement, there are no checks and balances, and there needs to be a strong cultural driver to keep it working.

Taxes

Taxes – Like “mandatory” tithing, you are required to give a portion of your money to the government, The shortcomings of taxation are: power leads to corruption, and centralized institutions decide the use of funds from the top down; the only feedback path is voting. Although this process is very slow, it must be admitted that this is currently the best form of obtaining funds for public goods. .

Voting

Voting - there are many forms of voting, it usually manifests as majority rule, representative democracy is also a majority rule; another way It's a consensus vote - basically it requires absolute unanimity in order to move forward.

Taxation is a fund-raising mechanism, and voting is a fund-distribution mechanism. There are many powerful mechanisms to raise funds for public resources, but the allocation mechanism seems to be less effective. Voting will be corrupted by money, so the "market" What is the distribution mechanism?

What if there was a market for trading “clean rivers”? This will allow different companies to compete in this new market. Collectives can use supply and demand to choose the public goods we want and reward value creators.

Markets

Markets - usually regarded as the best way to allocate resources, but are not suitable for collective resource allocation - the market pursues maximization of interests, Services are only provided to those who can afford the purchase price, and are only applicable to highly excludable goods. Market failure is obvious in the financing of public goods; but the market itself is a decentralized collective intelligence mechanism, and any consumer who has consumer demand and is willing to Products paid for will be produced, which also encourages innovation.

“The coolest thing about markets is that it's win-win. Nobody is losing. If you're creating value, you win, which is amazing. The real problem is commons don't have markets to push back.” — Griff Green

The cool thing about markets is that it’s a win-win situation. No one loses. If you create value, you win something. That’s so cool. Bravo. The real problem is that there is no market for public goods for feedback regulation.

As we move from the industrial age to the information age, there is an opportunity to implement more effective governance mechanisms that can provide market-like funding scales with the legitimacy and public interest that taxation and coordination bring. The mechanism to truly democratize the economy is that whenever people create a high-definition image of the need for public goods, collective wisdom will invest money to realize it.

The following are 27 mechanisms discussed by Griff and Owocki. Of course, they all have some limitations.

Quadratic Funding

Quadratic Funding - Created by Microsoft's Glen Weyl and Ethereum founder Vitalik Buterin, this mechanism uses a central fund pool To raise funds, allocate funds based on the public's support for the project, rather than based on the amount of capital investment. This is in contrast to the 1:1 approach, which is plutocracy and reflects only the needs of capital. Quadratic financing is based on the number of contributors rather than the amount of funds, which reduces the influence of large investors and is more democratic.

Example: You started a fundraiser that raised $100 from 100 donors, and I started a fundraiser that only raised $100 from one donor, even though two Each donation is funded by a $100 donation, but you'll receive 99% of the matching pool, which helps direct funds to the "poor and the many" and while you may only be donating a dollar, you're actually doing the public will In part, it provides direction for the allocation of public funds.

Problem: Possible Sybil attack and need to raise public pool of funds.

Conviction Voting

Conviction Voting - This is a method similar to quadratic financing, which also mitigates the influence of plutocracy, but requires Time, the rules are: the supported proposals are represented by staking tokens, which can be withdrawn or reallocated at any time; the weight of the vote increases as the token staking time increases. Once the proposal reaches the threshold, the proposal is passed.

If you own more tokens, you have more say, but even if you only own a minority share, you can still advance a large proposal, it just takes longer. This applies to competing proposals within the same tier, and among all proposals, you can allocate your tokens to your preferred proposal in various ways. The concept comes from Michael Zargham and others, and is implemented by 1Hive. It works very well if there are a lot of competing proposals and a clear budget, allocating the amount the community wants in a given period of time.

Problem: Many proposals are needed to compete, otherwise it will be easy to pass the proposal. The good thing is: minority opinions can actually pass proposals.

Retroactive Public Goods Funding

Retroactive Public Goods Funding - Karl Floersch was the inspiration for this mechanism and they implemented it at Optimism mechanism. They create a committee of experts and allocate revenue from the Optimism network to that committee of experts, who allocate funds to things that provide value to the ecosystem.

The advantage is: more talents can develop current public goods based on expected future income, and funders do not need to worry about the difficulty of measuring funding results.

Network Goods

Network Goods - Private goods are competitive, the iPhone is an example: you have to afford it to own it ;Public goods are non-rivalrous, such as breathing air: everyone has access to it, regardless of financial status. Online goods become more valuable as more and more people consume them, just like open source software. The more attention NFT art receives, the higher its value will be. By issuing NFT art for public goods, the value of NFT art can be increased through the spread of public goods to achieve funding purposes.

Effective Altruism

Effective Altruism - Effective altruism follows the principle of cost-benefit and aims to fund the most efficient groups that do the best work. Every penny gets the most results.

Kevin: Effective altruism is based on the theory that we don’t actually give to make an impact, but to make ourselves feel better. As a kind of philosophical thinking, effective altruism is different in practice for everyone. If we classify public undertakings according to a utilitarian perspective, how do we judge which undertaking can produce the greatest benefits?

Suppose I donate US$5 to buy 5 anti-mosquito tents, which can save 100 people from malaria in a certain area within 5 to 10 years; while the same amount of money can only save 2 people by funding other projects. It would be interesting to think of a similar mechanism for prioritizing funded public goods, donating our money to the most effective public goods.

The limitation of effective altruism is that this model cannot identify projects that are not proven to be effective in the future, so it is suitable for large-scale operation, which will produce an integration effect.

Griff: The problem with effective altruism is that analyzing impact data is difficult. The impact is qualitative in nature, but we are trying to quantify it. But some values cannot be quantified. For example, how much is a sunset worth? These are all money vectors. A more immediate ethical dilemma is the trolley problem: How to quantify the value of life?

Hypercerts

Hypercerts - Owocki is working with Protocol Labs to develop this mechanism. The principle of super certificate is this: suppose I collect ten tons of carbon in the atmosphere and obtain a certificate, then this certificate may have value in the market, because another person may be able to emit ten more tons.

Super certificates can extend similar proof of impact factor contribution to any impact vector. I saved ten people, picked up ten tons of garbage, and helped ten old ladies cross the road. Any positive impact on us All can issue hypercertificates for it, and then launch a market of impact evaluators, attracting those who want to collect Hypercerts to demonstrate their virtues. Web3 provides tangible proof of virtue.

We are launching a three-party market where any DAO that makes a positive impact can issue super certificates, impact evaluators can stamp certifications, and people who care can buy them.

The overall value is that any DAO that generates positive impact can shift from worrying about how much impact it can capture to worrying about how much impact it can create, which fundamentally changes the incentives for impact DAOs so that It can build business models, which means more capital and talent can flow into Influence DAO.

At the same time, this also solves the problem of effective altruism mentioned above - if you can create a decentralized market regulated by collective intelligence where people can issue, evaluate and purchase super certificates, then You can then have a decentralized source of data on impact to detect whether impact is occurring in the future.

Why haven’t they worked in the past? Influence markets existed before the emergence of NFTs and are not new, but they are not often talked about in traditional systems. What is different now?

Globally transparent, programmable, and tamper-proof ledgers are the key. For example, carbon emissions, influence flows within the global system. Previously, people lacked a basis for consensus; at the same time, I learned something from carbon emissions. The thing is, initiating purchase pressure will be the most difficult part. Carbon emissions can be regarded as a subset of the large-scale application of super certificates. The organization’s regulations on carbon emission shares, 99% come from government regulations, but a decentralized The market, how do we exert that buying pressure? Have Vitalik tweet something? Or will the number of super certificates be a mandatory requirement for funding? I think the most likely way to achieve a major application change is to use the power of society and culture to make collecting super certificates a fashionable thing. This may be possible, but before that, we can still build a market, a Donate to the game.

Augmented Bonding Curve

The enhanced bond curve - the bond curve is a smart contract and a means of initiating the market. The method is: Mint corresponding tokens for reserve assets. Whenever an asset is added to it, it will mint tokens. Otherwise, the tokens will be burned to release the collateral; the transaction object of the token is a contract, so there is no need for a buyer when selling. The price of the token increases with each minting and decreases with burning; by improving the liquidity base, the price discovery problem during cold starts is solved.

The Enhanced Bond Curve (ABC) adds fees during the minting and burning process, so when assets are sent to ABC to mint tokens, a portion of those funds go into funds managed by token holders pool and the rest is used to mint tokens.

If someone destroys a token by sending it to ABC, a portion of the funds released will go into the collective. This is a continuous flow of funds based on the market. As long as there is buying and selling, there will be fluctuations in asset prices.

ABC also added a "Hatch" to its initialization to collect funds before the bond issuance curve, with part of the funds used to mint tokens at the same price for all participants and another part of the funds used collectively .

Dominant Assurance Contracts

Dominant Assurance Contract - An assurance contract is a funding commitment with a preset premise, that is, "I want to fund this project, But only if others do the same." If the fundraiser doesn't reach the threshold within x weeks, all funds will be refunded. Kickstarter is famous for this model.

Lead guarantee contracts go one step further and are a kind of bet: if the contract reaches its goals, the lead funder gets their money back plus some profits, but if the project doesn't get funded, his money goes is distributed to all secondary holders, so it is a game of making money, donation and vision, with enough incentives for both egoism and altruism to participate, in an interesting enough way to promote the public for public goods Funding, this model grew out of Alex Trabarrok's development of the concept.

Donation Mining

Donation Mining - Giveth.io is a community-driven organization that funds non-profits and social causes, GIVbacks It is its previous donor reward mechanism. Every two weeks, GIVbacks will reward GIV governance tokens to donors of verified impact projects, allowing donors to build their own influence in the organization when funding the development of public goods. And expect to increase the value of GIV through network effects to obtain returns; in addition to GIback, you can also participate in GIVpower, increase the exposure of a project to be funded by staking GIV tokens, and obtain mining rewards.

Pairwise (formerly Budget Box)

Pairwise (formerly Budget Box) - This tool comes from the Colony ecosystem (2018). Pairwise evaluation is when two options appear on the screen and you choose the one you prefer; at the end, you get a list ranked based on your preference. Your rankings can be merged with other people's rankings, and you can end up with an ordered list, a preference, or a weighted list for allocating your budget.

Collaborative filtering: It pairs you with other users with similar preferences. With large-scale data sets and collective choice preferences, once you have a sufficient amount of user profile data, you can use collaborative filtering to evaluate other options they might like without having to make all kinds of complicated choices.

Furthermore, voting should essentially be a signal aggregation. How awesome would it be to have a personal server, run your own personal AI bot, train it to vote for you by sending all your online content and even personal private messages, and you just have to watch the availability once in a while.

Futurarchy

Futurarchy - Created by Robin Hanson, Futurarchy is a bet that the future will A mechanism to have an impact in some way, where you state that a certain proposal will have an impact, and if it does, you get a reward, otherwise you lose the bet. This is like including the impact of a proposal on the economy or other items you are voting on in your vote choices. It introduces voters to prediction markets so that the market can filter which policies will create indicators of national well-being. This uses the market The power, but the danger is that once an indicator becomes a target, it ceases to be a good indicator.

Stigmergy

Stigmergy coordination - This is an indirect coordination mechanism, or a characteristic common to all coordination mechanisms, rather than the mechanism itself. Stimulating collaboration is a trace of historical action that narrows the scope of consensus and ultimately achieves coordination goals. The principle is that the traces left by individual actions in the environment stimulate the same or different agents to perform subsequent actions. This is how ants coordinate their actions, leaving stimulating traces that guide other ants to achieve their goals.

If you can build a network of trust and tell others that these are trustworthy people, they have high credibility, and the more good they do, the more credibility they have. ; For example, when people share their behavior after donating on Gitcoin, it is a pheromone behavior that encourages others to donate; this mechanism has a self-reinforcing property.

Praise

Praise - A bottom-up, peer-to-peer collaborative reward/reputation system, Praise maintains a reward by giving community members appreciation fund. Appreciations are automatically calculated and recorded, and every two weeks, a team of quantifiers rate the value of each appreciation. Praise recipients are rewarded with tokens based on these quantified results, linking each token allocation to each compliment. Praise is motivated by gratitude, high emotions, positivity, and more, while this rich data can be used to incentivize contributions, inform the community about who is doing what, and more. People vote with each other to tell everyone who they think is valuable and who is adding value, which creates a similar trust network model, and now we can stake tokens on the trust network, which is even cooler

In Regen web3 we are connecting financial capital to other types of capital such as social and cultural capital, while also making finance serve social and cultural capital. Reference Gregory Landua and his theory of the 8 forms of capital.

Demurrage

Demurrage - it's a bit like inflation - increasing the total amount of tokens decreases the unit value, the opposite, but with the same purpose (currency depreciates over time). In demurrage, if you have 1 currency unit and hold it, over time, eventually you will only have 0.99 currency units left, and the other 0.01 currency units will be put into a common pool, this mechanism Designed to incentivize the velocity of currency, it primarily referenced the characteristics of perishable assets, such as rice or flour, which would rot over time, so the church would issue a seal stating that the rice was rotting, meaning that its Value decreases over time, demurrage originally comes from shipping, meaning "to stay" (Old French), and refers to the time lost required for goods to be unloaded from a ship. This is "liquidation damages." While there are some relatively successful examples of demurrage currencies, which all lead to similar results, the user experience seems to be better in the latter case, where demurrage is a bit like a forced tax.

Proposal Inverter

Proposal Inverter - Proposal Inverter is generated from research on DAO coordination with DAO, usually the proposer is A proposal faces a DAO. Now the proposal inverter acts as a middleware to face a proposal to multiple funders or DAOs at the same time. If a proposal may solve the problems of multiple DAOs, they can jointly fund it, and then the funds are agreed. The good ones are collected and distributed by milestones.

Prop House

Prop House - Nouns DAO created this funding mechanism where the community raises funds in their community house, where During the fundraising process, builders can think that each round of fundraising has a certain amount of funds that can be won by a certain number of proposals, and then community token holders vote to select the best proposal to receive a certain amount of funds.

Quadratic Voting

Quadratic Voting - Quadratic voting is a branch of quadratic voting that not only measures population preferences but Measuring the strength of these preferences is an alternative to the one-person-one-vote system. You are awarded a certain number of voting points and can vote on any number of questions, and you can add a weight to each proposal that is the square root of the voting points you staked behind that question. Based on the number of voting points someone places on a particular issue, it is possible to see not only a voter's preferences, but also the strength of their preferences for that issue. This avoids the consequences of plutocracy, where loud decibels influence judgments about what voters like, but rather broad consensus among the crowd swayes the issue. It also encourages voting on multiple proposals, rather than investing all your voting points on one proposal.

JokeRace

Created by JokeDAO, this mechanism is a bottom-up on-chain governance method that you can use on JokeDAO The channel tells a joke, and if you make it funny enough, you can get a grant that can be used for anything from curating a community roadmap, generating ideas, supporting bounty missions, and more. There are different forms of voting for funny identification, including 1 token: 1 vote, voting that decays over time, and secondary voting. The most fun thing is that they hold a distributed decentralized joke competition every week< /p>

$25 Trillion Opportunity

$25 Trillion Opportunity – The public goods sector is serious business! If we could improve the world better than governments can, we could determine the money that is currently wasted by governments on providing value to society for nothing, more than $25 trillion a year on public goods. If we can create a more efficient system and capture a fraction of the value that is created, entrepreneurs can enter the space and innovate. We might even be able to transform private goods into public goods: food, water, shelter, and other basic needs—bringing them into the realm of public goods.

“We can invent higher resolution mechanisms for democracy. Regen web3 is a blue ocean of opportunity.” — Griff Green

We can invent higher resolution mechanisms for democracy. mechanism. Regen web3 is a blue ocean full of opportunities.

Holographic Consensus

Holographic Consensus - OG DAO technology proposed by DAOStack, holographic consensus is a future politics A hybrid of regular DAO voting. Anyone can make a proposal (very easy), token holders can "stake" (vote) on the proposal, and when they do, they "enhance" the proposal so that it gets more attention and even speeds up voting process. If the proposal passes, those who staked will win tokens (Griff calls it “money”), while those who vote against it will lose their stakes.

The attention economy is taken into consideration here. Not everyone has time to pay attention to all proposals and votes, but when someone you know votes for a certain proposal, it is equivalent to him making some kind of identification for you. You'll probably follow up on it, which works well when there are a lot of proposals and too many things to focus on.

The holographic consensus is conducive to maintaining scalability and being elastic at the same time, which is difficult to achieve at the same time. In this way, the bettors play the role of market prediction.

Skeuomorphism

Skeuomorphism - is a classification of mechanisms, not the mechanism itself. Skeuomorphism divides coordination mechanisms into skeuomorphism and non-objective. One example is the way Google and Yahoo choose to retrieve information. Yahoo is skeuomorphic in that they use a traditional library card catalog system model where you search for content that interests you by parent topic and subtopic, just like you would find books along categories in a physical library. Google is non-modular, providing information retrieval results by creating a simple search box in a way the Internet has never seen before.

“The earliest ideas for blockchain ledger technology are going to be just to port over existing methods and ideas. The best, most interesting mechanisms are going to be non-skeuomorphic.” — Kevin Owocki

< /p>

The earliest ideas for blockchain ledger technology will just be to transplant existing methods and concepts. The best, most interesting mechanics will be non-skeuomorphic.

Sortition

Sortition - rarely used in real life, juries The exception is duties, where drawing lots involves selecting a few people from a subset of likely voters and letting them make their own decisions. Kind of like delegation, but randomly selected from a larger group of "normal people". Why is it not common in blockchain? No conclusion yet!

Aqueduct

Aqueduct - A channel in an irrigation system used to direct water from one system to another if we want To build a diverse public goods funding system, what would it look like to build bridges between different public goods funding mechanisms? Send a channel from your DAO to another DAO, connecting modules for public goods funding. A water channel that can connect to any other mechanism in the ecosystem. Like Radicle Drips - you can program a percentage of your revenue here and there based on your governance. This is a recurring token flow. Set it and forget it.

Owocki's example is Gitcoin Grant 2's new “aqueduct”: a project will allocate a percentage of its DAO-governed funds to stream to the Gitcoin Grant's Matching Pool, which will run a quadratic funding round based on the project's vesting schedule.

Owocki's example is Gitcoin Grant 2's new "water channel": a project will allocate a portion of its DAO-managed funds to flow to a matching pool of Gitcoin Grants, which will be vested according to the project A quadratic capital raise is planned.

High level primitive here is simply "money (token) streaming". The high-level primitive here is simply "money (token) flow".

Ranked Choice Voting

Ranked Choice Voting - Instead of selecting a representative to vote for, an ordered list can be submitted (first choice, first choice Second choice, etc.). In reality, votes are counted in a way that gives seemingly minority candidates a chance and allows voters to express their true preferences rather than strategically voting for the "lesser of two evils" "candidate. Eliminates the problem of third parties sabotaging ballots. Useful for first-run voting with 4-8 candidates.

Staking/Slashing

Staking/Slashing - Staking on Ethereum means depositing 32 ETH, thus activating the validator software and following the protocol Consensus rules in exchange for receiving a small amount of issuance interest. If you provide false information to the protocol, or basically do anything that could cause a consensus fork, your stake may be slashed, meaning you lose your deposit. If you are offline for a day or two in a row, you may also get a small cut due to inactivity. This system creates a cryptoeconomic incentive because funds are at risk and can be staked, slashed, or increased at any time through the protocol. This is a way to tie capital to protocol behavior.

Disadvantages: It requires capital and is somewhat plutocracy.

Proof-of-Work

Proof-of-Work - Proof-of-Work is the predecessor of Proof-of-Stake and still works in Bitcoin (unfortunately (generates large amounts of carbon emissions), and is actually used in many projects to allocate resources outside of the energy-intensive Bitcoin network. This resource is issuance ("printing money"). Griff cited several examples, such as CureCoin and FoldingCoin, which reward issuance (tokens) with proof of useful work (folding proteins) to find cures for cancer, Alzheimer's, and other diseases. Those who fold more proteins will get more release.

Decentralized Identity

Decentralized Identity - We don’t want oligarchic digital identity, privacy being crushed or identity leaked; we want to have A sovereign digital identity (assuming it is protected). An important opportunity is that we can build systems that do not treat participants as interchangeable. We can build mechanisms to have a one-person-one-vote approach, which is inherently more democratic, or a one-coin-one-vote approach, or something in between (like quadratic voting).

To build a more regenerative cryptoeconomic Internet, we need to be able to engage in positive-sum games and repeated interactions with each other - you do something to help me, you get a certificate, and vice versa , which would allow us to establish trust based on certifiable behavior, which is very interesting. By accumulating positive-sum reputations, we start a virtuous cycle that increases the complexity of the space in which all the coordination mechanisms we mentioned in this episode can be designed to accommodate the vast number of subtle positive behavioral markers. Over time, the system will begin to generate gravity, creating an economic gravity well that attracts more people to participate. The cycle repeats until we have a crypto-economic regenerative internet.

Web3 Social

Decentralized social media applications are great because they have sovereignty, privacy and we can move the social graph from a website Features taken to another website. Network effects need to be built, and that takes time. Once we shift our attention from Web2 social, have our own social graph and can fork the interface, and reflect the commonality of our own circle of influence on the social graph, this will make you one of the multi-center collective coordination mechanisms Center, this is also one of the future of group coordination mechanisms.

Ethereum devs tackle Pectra upgrade challenges, improving Devnet stability and communication, with major protocol transitions underway.

Bernice

BerniceIn the past, the income from Gitcoin airdrops may only depend on donations, but now it depends on the amount, donation project, donation round, etc. It is more of a "weight" of the project airdrop.

JinseFinance

JinseFinanceDive into the world of Gitcoin Grants, a decentralized platform revolutionizing the funding landscape for open-source software and public goods projects. Learn about the innovative quadratic funding mechanism employed by Gitcoin Grants, where community engagement plays a pivotal role in determining funding allocations. Explore the benefits of this decentralized platform, including transparency, accountability, and resistance to censorship. Delve into the investment potential of Gitcoin Grants, highlighted by a significant $70 million funding round in 2022 led by Andreessen Horowitz. Assess the platform's role in accelerating technological development and its standing in the larger cryptocurrency ecosystem. This article provides insights into whether Gitcoin Grants is poised to become a game-changer in public goods funding or if it's merely a product of hype.

Sanya

SanyaEveryone saw Gensler refusing to answer if ETH is a security. And now we know why.

Alex

AlexGitcoin accidentally sent $460,000 worth of GTC tokens to an untraceable contract address, leading to a loss with no means of recovery.

Bitcoinworld

BitcoinworldThis guide will guide you to complete the donation from scratch, and use zkSync to pay the donation, saving you transaction costs.

Nell

NellThis guide will be walking you through the whole process step-by-step and donate via zkSync, to save up on transaction fees.

Nell

NellAll claims that Celsius Network's CEO attempted to leave the country have been refuted by the company. This news came ...

Bitcoinist

BitcoinistOn May 26, 2022, CoinEx Charity Book Donation Worldwide kicked off in Turkey. During this global campaign, funded by CoinEx ...

Bitcoinist

BitcoinistOn May 26, 2022, the CoinEx Charity activity of “Over 10,000 Books for Children’s Dreams” was officially launched in Turkey. ...

Bitcoinist

Bitcoinist