Source: Glassnode; Compiled by: Baishui, Golden Finance

Summary

Bybit suffered one of the largest hacks in the history of cryptocurrency, losing 403,996 ETH (about $1.13 billion) in its cold wallets due to a smart contract vulnerability. The vulnerability led to panic withdrawals, with total exchange outflows of Bitcoin and stablecoins reaching about $4.3 billion.

Market sentiment deteriorated rapidly, triggering a widespread sell-off. Bitcoin's monthly performance fell to -13.6%, while Ethereum (-22.9%), Solana (-40%) and Meme Coins (-36.9%) erased months of gains, resetting market momentum to April 2024 levels.

The price decline pushed Bitcoin back into the actual supply “space” between $70,000 and $88,000, an area of low cost basis density. This weakness was initially driven by long-term holder selling, and the Bybit hack exacerbated this weakness, adding to downside momentum.

As prices fell below the short-term holder cost basis, new demand investors came under intense pressure and began to suffer significant losses. Historically, this marks a period of seller exhaustion, however, a continued lack of demand could extend the current downtrend.

Historic hack shocks the market

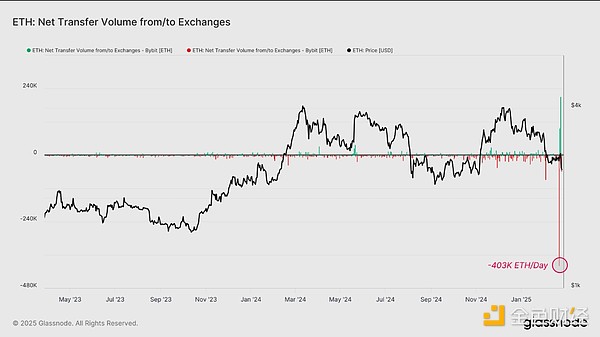

On February 21, 2025, one of the largest exchange hacks in cryptocurrency history shocked the market, with Bybit suffering a serious security breach. The attacker stole 403,996 ETH (about $1.13 billion) from the platform’s Ethereum cold wallets, exploiting smart contract permissions to reroute the funds to an unidentified address.

Bybit CEO Ben Zhou explained that the attack was carried out through a "Musked UI," in which a fraudulent interface tricked signatories into approving malicious transactions. Despite the severity of the breach, Bybit assured users that other cold wallets remain safe and withdrawals are still possible.

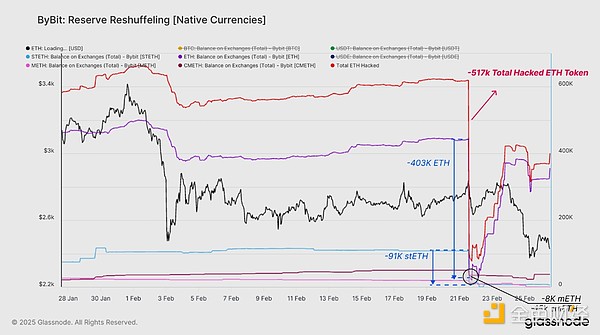

The hacker’s transactions showed that the stolen assets were not limited to Ethereum, and multiple assets suffered significant losses:

Ethereum (ETH): 403,996 ETH hacked

Stacked Ethereum (stETH): 91,076 stETH hacked

mETH: 8,000 mETH hacked

cmETH: 15,000 cmETH hacked

The hack resulted in the theft of nearly $1.48 billion in funds, which made the market nervous and raised concerns about the security of exchanges, funds and potential market-wide selling pressure.

Market Impact and Exchange Fund Outflow

After the hacker attack, market volatility intensified, panic withdrawals, and users rushed to protect their assets, causing Bybit reserves to drop sharply.

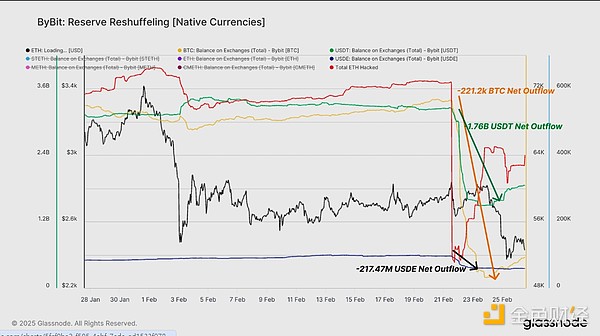

As of February 24, 2025, Bybit has seen significant outflows from its BTC, USDT, and USDE reserves:

Bitcoin (BTC): 21,248 BTC net outflow (70,604 BTC → 49,356 BTC)

Tether (USDT): $1.76 billion USDT net outflow (3.25 billion → $1.5 billion USDT)

USDE: $217.47 million USDE net outflow (578.37 million → $360.9 million USDE)

These numbers illustrate Bybit’s liquidity drain, heightening concerns about the security of centralized exchanges.

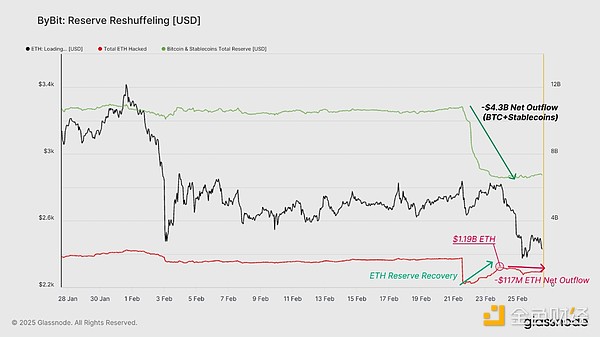

Outflow Peak

By February 24, 2025, Bybit's main asset reserves (including Bitcoin and stablecoins) fell from $10.8 billion at the time of the hack to $6.5 billion, with a cumulative outflow of $4.3 billion. Although the initial wave of panic withdrawals was severe, the outflow rate has since eased, indicating that it is gradually stabilizing.

At the same time, Ethereum reserves (including native ETH and pledged ETH) rebounded to $1.19 billion as Bybit made efforts to replenish its holdings. ETH price action remains weak, falling to $2,490, while the subsequent outflow of approximately $117 million following the buyback suggests that investor confidence remains fragile.

ETH Reserve Recovery

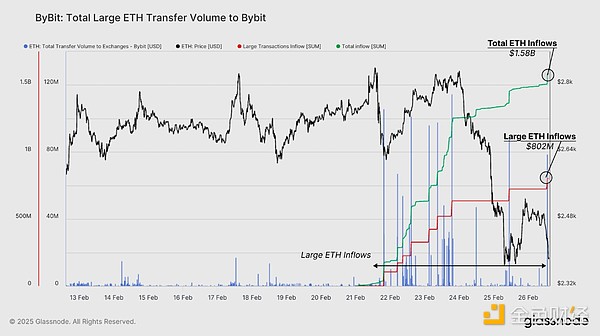

As of February 26, 2025, Bybit has received a total of $1.58 billion in ETH inflows, of which $802 million (50.7%) came from just eight large transactions.

These inflows suggest an intention to replenish reserves, perhaps through intra-exchange transfers, strategic acquisitions, or external deposits from institutional liquidity providers.

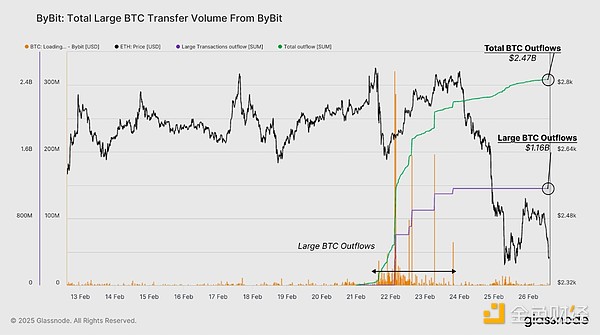

While Bybit is working to replenish its Ethereum reserves, the exchange has also seen significant Bitcoin outflows. Since the hack, total Bitcoin outflows have reached $2.47 billion, of which 47.2% ($1.16 billion) has flowed out through five large transactions.

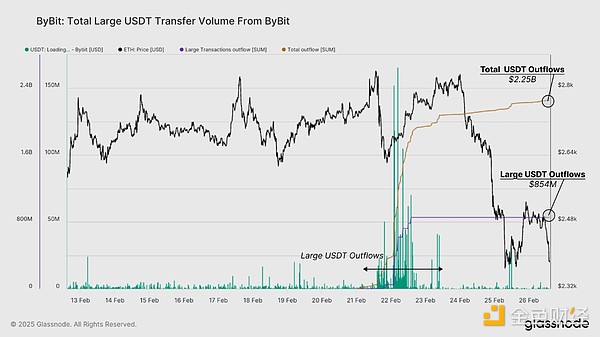

Tether (USDT) also saw a similar outflow. During the same period, outflows reached $2.25 billion, of which 38.1% ($854 million) came from eight large transactions.

Analyzing Bybit’s Ethereum replenishment efforts and massive Bitcoin and Tether outflows, we gain insight into how the exchange (and larger entities) responded to one of the largest hacks in cryptocurrency history.

Market Turbulence After the Hack

As the impact of the Bybit hack became apparent, the market responded with increased volatility and a sharp decline. As liquidity across the market declined and spot demand cooled, selling pressure intensified, triggering a broader correction.

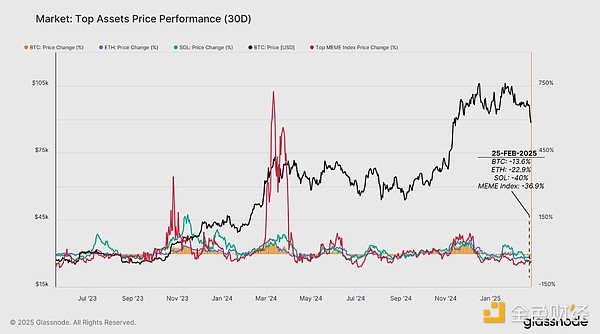

Increasing weakness across the market caused Bitcoin price momentum to plummet by -13.6% in monthly terms, while Ethereum and Solana saw even larger declines of -22.9% and -40%, respectively. The Meme Coin Index also plunged by -36.9%, highlighting the strong risk-off sentiment.

The decline reversed a multi-month positive price rally and brought momentum back to levels last seen in April 2024. The magnitude of the decline highlights the widespread fragility of market sentiment following the all-time high set in December 2024.

Bitcoin Reenters Low Liquidity Zone

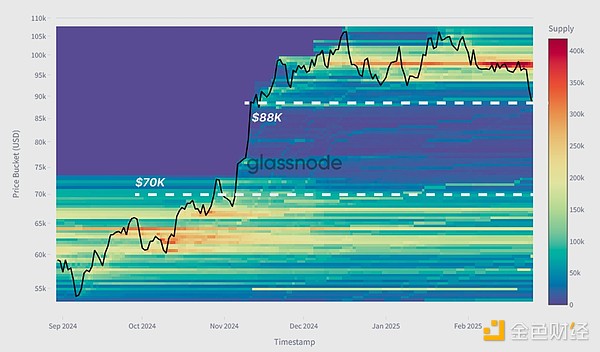

The Cost Basis Distribution (CBD) heat map illustrates how Bitcoin’s December 2024 ATH created a gap in actual supply between $70,000 and $88,000. During strong trends, price increases tend to outpace capital inflows, leading to a decrease in actual supply concentration in these ranges.

As the market rallied to new highs, long-term holders began to allocate supply, weakening price momentum. The Bybit hack further exacerbated this downward trend, pushing Bitcoin back into the low liquidity gap shown in the chart below. With prices now retesting this area, the market is looking for demand as further declines could trigger heightened volatility and additional selling pressure.

Short-Term Holders Under Pressure

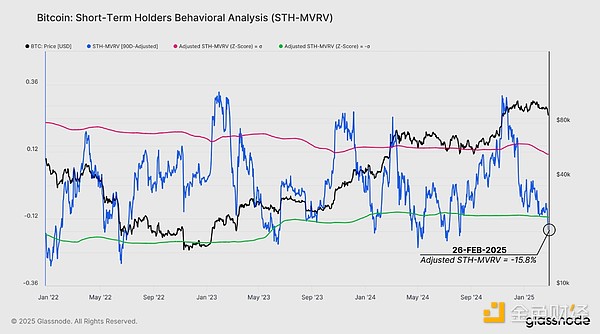

With Bitcoin plunging to $87,000 and now 20% below its $109,000 high, near-term investors are under severe psychological pressure as prices are trading around 5% below their cost basis (STH-MVRV=0.95).

Adjusting STH-MVRV, we observe that profitability of new investors has declined by -15.8% from its quarterly median, which is below the one standard deviation threshold (-11%). This indicates significant unrealized losses, a situation that historically leads to selling events or forced selling during market downtrends.

Short-term holders begin to realize losses

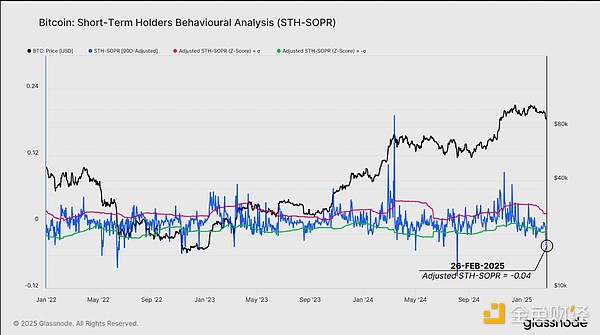

To further analyze the reaction of new investors, we adopt STH-SOPR (Spending Output Profitability Ratio) to measure whether short-term holders sell at a profit or loss.

STH-SOPR has fallen -0.04, below its quarterly median and well below the one standard deviation threshold (-0.01).

This suggests a significant increase in loss realization as many recent buyers are exiting their positions at a loss.

Historically, deep SOPR contractions have led to at least temporary market stability as the weak side exits. However, under current macroeconomic conditions, the risk of further price declines could remain if no strong demand catalyst emerges.

Summary

A broad market correction following the Bybit hack has caused Bitcoin’s monthly performance to fall to -13.6%, while Ethereum, Solana, and Meme Coins have fallen more, resetting market momentum to April 2024 levels.

As Bitcoin retraces to its realized supply “range,” short-term holders face increasing unrealized losses. As a result, STH-MVRV and STH-SOPR have fallen below statistical lows, indicating significant losses for new investors due to declining profit margins.

Further downside risks remain if demand fails to recover, so the coming weeks will be critical in determining whether Bitcoin stabilizes or the sell-off intensifies.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Ledgerinsights

Ledgerinsights cryptopotato

cryptopotato Bitcoinist

Bitcoinist Nulltx

Nulltx