Author: UkuriaOC, CryptoVizArt, Glassnode; Compiler: Baishui, Golden Finance

Summary

Despite Bitcoin trading sideways and falling, a large portion of the market remains profitable, while short-term holders bear most of the losses.

By combining on-chain pricing models and technical indicators, we define and explore a range of potential scenarios for the future development of the market.

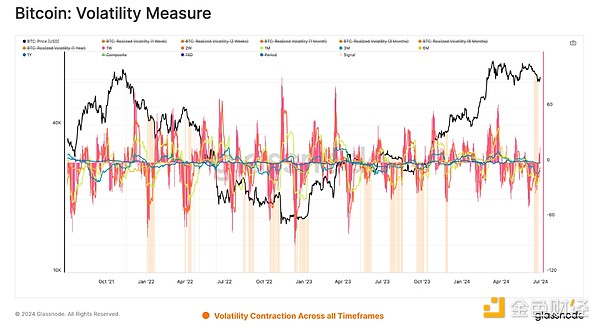

Volatility continues to be in a state of historical compression, which indicates a certain degree of investor apathy, but also indicates that there is a lack of index for future volatility increases.

Market profitability remains strong

With the BTC price falling to the $60,000 region, many digital asset investors can feel a certain degree of fear and bearishness. This is not uncommon when market volatility stagnates and goes dormant and apathy spreads.

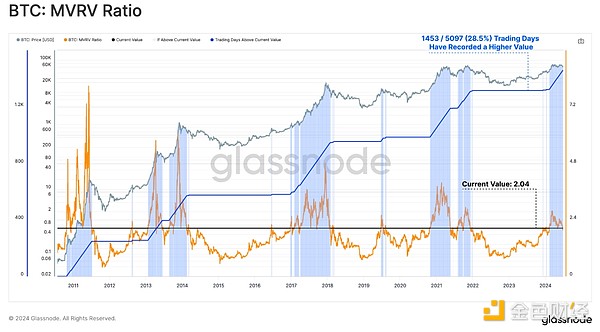

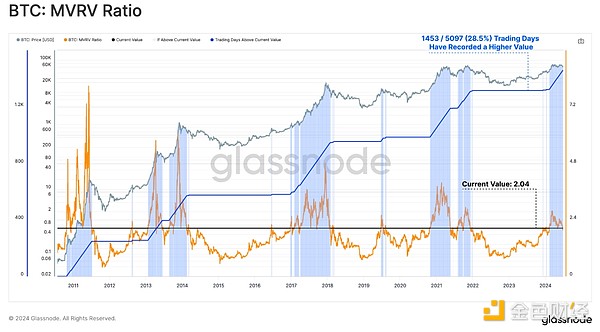

Nevertheless, overall profitability for investors remains very strong from a MVRV ratio perspective, with the average coin still maintaining a 2x profit multiple. This level typically depicts the "enthusiasm" and "excitement" bull market phase.

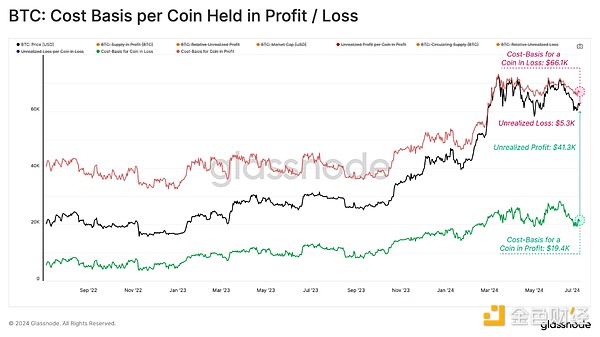

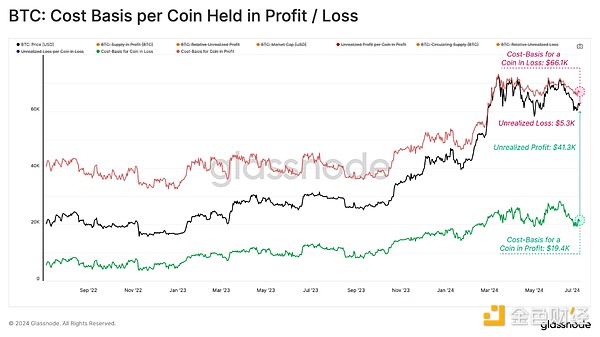

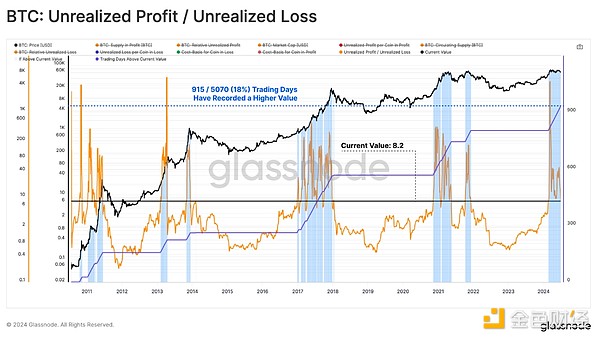

Going one level deeper, we can separate out all the coins holding unrealized profits or losses. This allows us to assess the average cost basis of each group, as well as the average magnitude of unrealized gains or losses held by each coin.

The average profit token has an unrealized gain of +$41,300 and a cost basis of approximately $19,400. It is worth noting that this number will be partially affected by the last coins to move in earlier cycles, including the Patoshi entity, early miners, and lost coins. (red)

The average losing token has an unrealized loss of -$5300 and a cost basis of approximately $661000. These tokens are primarily held by short-term holders, as few of the “top buyers” from the 2021 cycle remain to date. (Blue)

Both indicators can help identify potential points of selling pressure as investors seek to hold gains and avoid holding the worst unrealized losses.

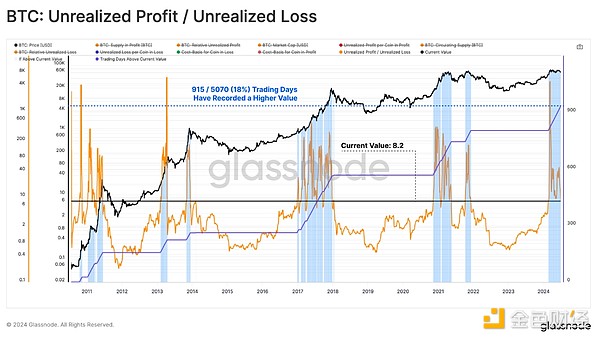

If we look at the ratio between unrealized profit/loss per coin, we can see that the size of paper gains held is 8.2 times that of paper losses. Only 18% of trading days recorded large relative values, all of which fell into the excitement bull range.

It can be said that the March ATH set after the ETF approval had several characteristics consistent with historical bull market peaks.

Focus on the short-term holder group

Since the March ATH, the Bitcoin price has been consolidating in a clear range between $60,000 and $70,000, with the market failing to establish a strong trend in either direction.

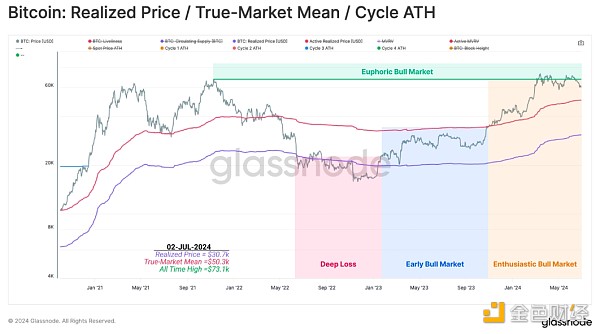

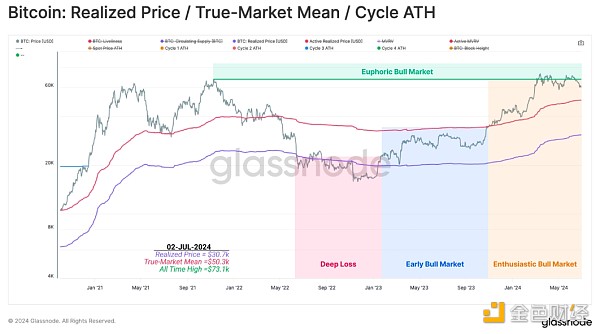

To ground our position in the cycle, we’ll refer to a simplified framework for thinking about historical Bitcoin market cycles:

Deep Bear Market:Price trades below the realized price. (Red)

Early Bull Market:Price trades between the realized price and the true market mean. (Blue)

Enthusiastic Bull Market:Price trades between the ATH and the true market mean. (Orange)

Excited Bull Market:Price is trading above the ATH of the previous cycle.

Currently, after a few very brief forays into the euphoria zone, price remains within the euphoria bull market territory. The True Market Average is $50k and represents the average cost basis per active investor.

If the macro bull market is expected to continue, this level remains a critical pricing level for the market to remain above.

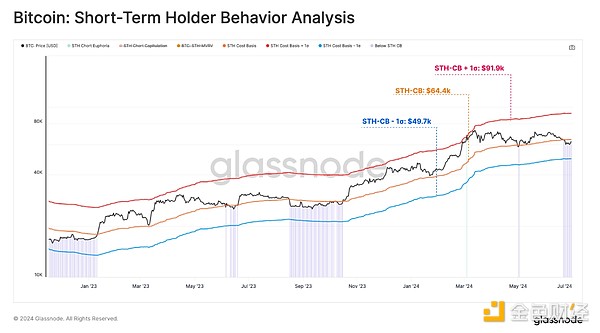

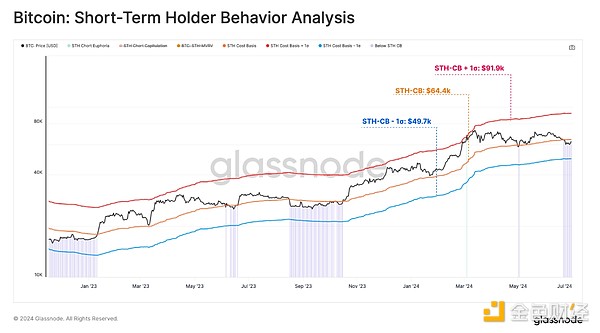

Next, we look at the short-term holder cohort and overlay their cost basis with the level representing +-1 standard deviation. This provides insight into areas where these price sensitive holders may begin to react:

Large amounts of unrealized profits signal a potential overheated market, currently valued at $92,000. (red)

The breakeven level for the STH cohort is $64,000, with spot prices currently trading below that level but attempting to reclaim it. (Orange)

Significant unrealized losses signal a potential oversold market, currently valued at $50,000. This is consistent with the true market mean as a bull run breakpoint. (Blue)

Notably, only 7% of trading days saw the spot price trade below the -1SD range, making this a relatively rare occurrence.

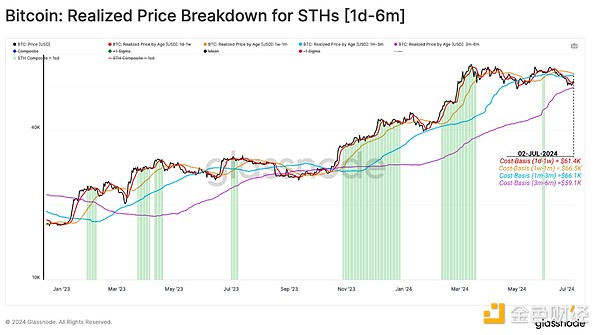

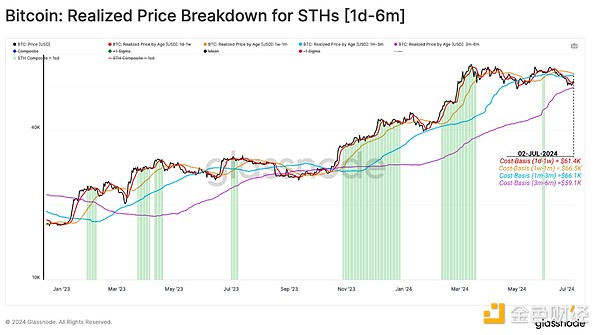

Since prices trade below the cost basis of something, it is wise to examine the degree of financial stress of various subsets of this group. Using our segmentation by vintage metric, we can dissect and examine the cost basis of different coin-age investors within the short-term holder group.

Currently, the 1d-1w, 1w-1m, and 1m-3m coin ages all have unrealized losses on average. This suggests that this consolidation range has been largely unproductive for traders and investors.

The 3m-6m cohort remains the only subgroup to maintain unrealized profits, with an average cost basis of $58k. This is consistent with the low price of this correction, again marking this as a key area of focus.

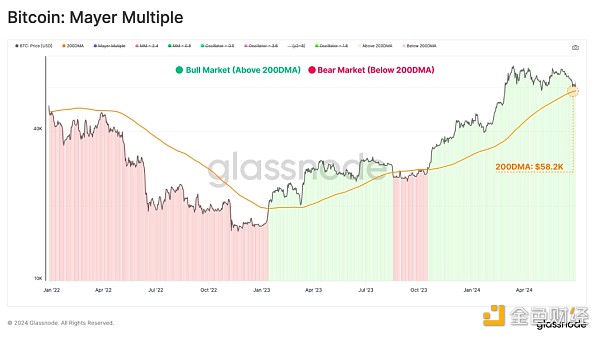

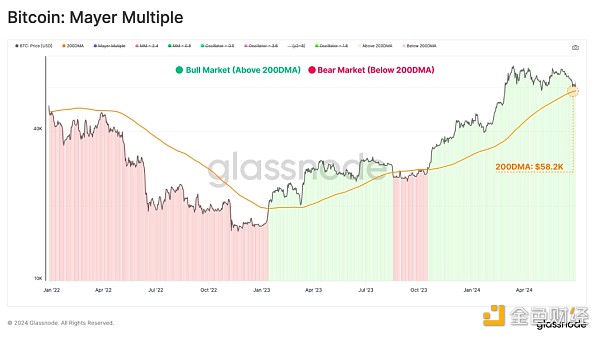

Turn to technical indicators. We can use the widely used Mayer Multiple indicator, which evaluates the ratio between price and its 200DMA. The 200DMA is often used as a simple indicator to evaluate bullish or bearish momentum, making any breakout or breakout a key market pivot point.

The 200DMA is currently valued at $58,000, again providing convergence with the on-chain price model.

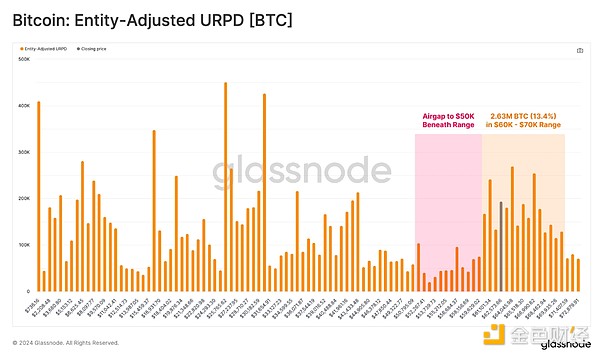

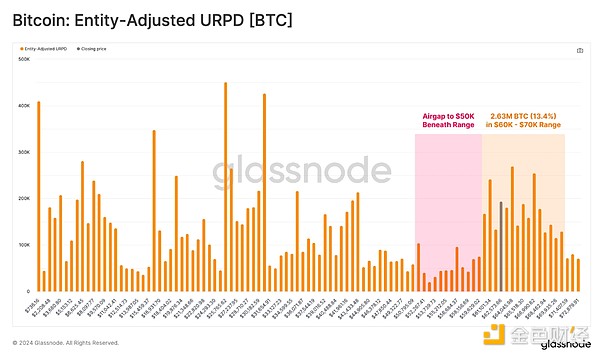

We can use the URPD indicator to further evaluate the concentration of supply around specific cost basis clusters. Currently, the spot price is near the lower bound of a large supply node between $60,000 and the ATH. This is consistent with a cost basis model for short-term holders.

With 2.63 million BTC (13.4% of circulating supply) sitting in the $60k-$70k range, small price fluctuations can significantly impact the profitability of tokens and investor portfolios.

Overall, this suggests that many investors may be sensitive to a price drop below $60k.

Volatility Expectations

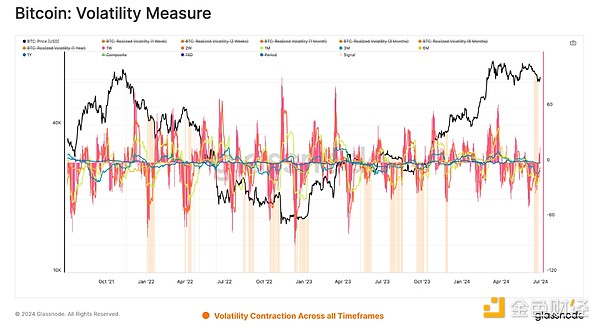

After several months of range-bound price action, we’ve noticed a significant drop in volatility across many rolling window timeframes. To visualize this phenomenon, we introduce a simple tool to detect periods of contracting realized volatility, which can often provide an indicator that heightened volatility may be ahead.

The model evaluates 30-day changes in realized volatility across 1-week, 2-week, 1-month, 3-month, 6-month, and 1-year timeframes. When all windows exhibit a negative 30-day change, a signal is triggered, inferring that volatility is compressing and investors’ expectations of lower volatility in the future are also compressing.

We can also assess market volatility by measuring the percentage range between the highest and lowest price changes over the past 60 days. By this metric, volatility continues to compress to levels that are rare, but usually precede large market moves after long periods of consolidation.

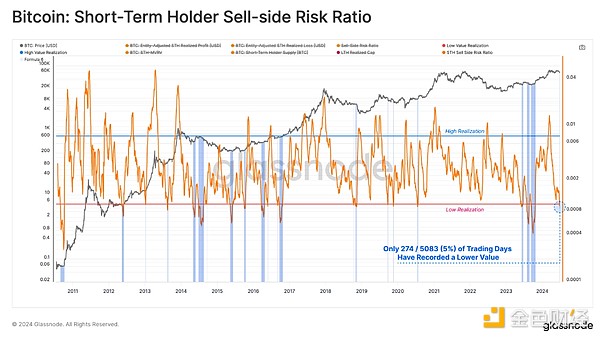

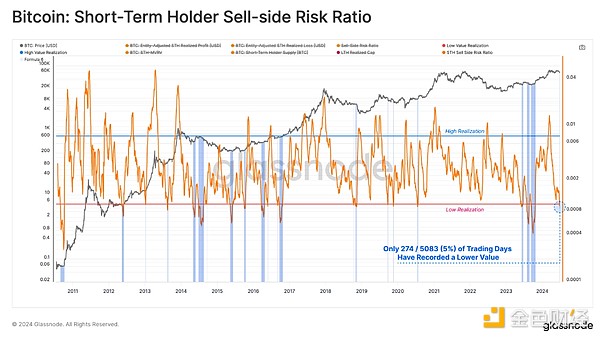

Finally, we can use the sell-side risk ratio to strengthen our volatility assessment. This tool assesses the absolute sum of realized profits and losses locked in by investors relative to the size of the asset (realized cap). We can think of this metric under the following framework:

High values indicate that investors are spending tokens at large profits or losses relative to their cost basis. This situation indicates that the market may need to re-find equilibrium and is usually accompanied by sharp price fluctuations.

The low values indicate that most tokens are spending relatively close to their breakeven cost basis, suggesting that a degree of equilibrium has been reached. This situation typically means that the "breakeven" within the current price range is exhausted, and generally describes a low volatility environment.

Notably, STH sell-side risk has fallen to historical lows, with only 274 of 5083 trading days (5%) recording lower values. This suggests that a degree of equilibrium has been established during the price consolidation, and suggests that expectations for increased volatility in the near term.

Summary

The Bitcoin market is in an interesting place, with apathy and boredom reigning despite prices being 20% below ATH. The average coin is still holding 2x unrealized profits. However, new buyers are woefully under-represented.

We also explore key pricing levels where investor behavior patterns could change. We look for some degree of convergence between on-chain and technical indicators and arrive at three key areas of interest.

A break below $58,000 to $60,000 would see a large number of STHs suffer losses and trade below the 200-day moving average price level.

Price action between $60,000 and $64,000 continues the sideways trajectory of the current market decision.

If the decision breaks above $64,000, a large number of STH tokens will return to profitability and investor sentiment may rise.

From a pricing and on-chain perspective, volatility continues to compress across multiple timeframes. Indicators such as the sell-side risk ratio and the 60-day price range have fallen to all-time lows. This suggests that the current trading range is in the late stages of the next range expansion development.

Joy

Joy