Source: CryptoVizArt, UkuriaOC, Glassnode; Compiled by: Baishui, Golden Finance

Summary

Strong capital inflows into ETFs and spot markets drove Bitcoin to $93,000. More than $62.9 billion entered the market in the past 30 days, with BTC dominating demand inflows.

The increase in unrealized profits among long-term holders triggered a massive spending campaign, with 128,000 bitcoins sold between October 8 and November 13.

U.S. spot ETFs played a key role, absorbing about 90% of the selling pressure from long-term holders during the analysis period. This highlights the growing importance of ETFs in maintaining liquidity and stabilizing markets.

Capital Inflows Surge

Bitcoin’s price performance has been exceptional since early November, with new ATHs being formed throughout the month. When comparing the current cycle’s price performance to the 2015-2018 (blue) and 2018-2022 (green) cycles, striking consistent similarities can be seen. Despite widely varying market conditions, both the magnitude and duration of the rallies have been surprisingly consistent.

This long-term consistency across cycles remains interesting and provides insights into Bitcoin’s macro price behavior and cyclical market structure.

Historically, past bull runs have lasted between 4 and 11 months from the current point, providing a historical framework for assessing cycle duration and momentum.

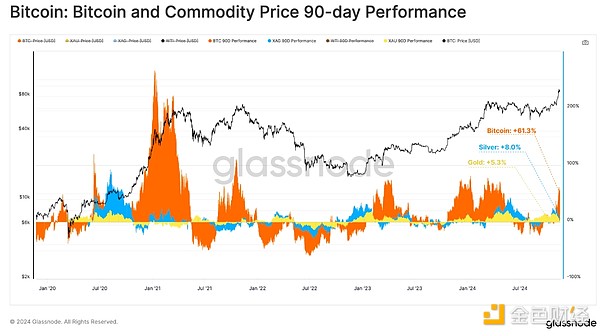

This week’s new ATH was set at $93,200, bringing Bitcoin’s quarterly performance to an impressive +61.3%. This is an order of magnitude higher than the relative performance of gold and silver, which posted quarterly gains of +5.3% and +8.0%, respectively.

This stark contrast suggests that capital may be shifting away from traditional commodity stores of value assets toward younger, emerging, and digital assets like Bitcoin.

Bitcoin’s market cap also expanded to a staggering $1.796 trillion, making it the world’s seventh-largest asset. The move places Bitcoin above two symbolically important global assets: Silver, valued at $1.763 trillion, and Saudi Aramco, valued at $1.791 trillion.

As of now, Bitcoin is only 20% behind Amazon, making it the next major milestone in its journey to become one of the world’s most valuable assets.

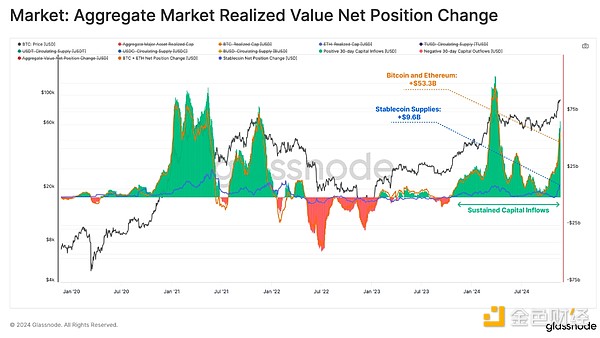

After Bitcoin’s stellar 90-day run, the broader digital asset market is beginning to experience a massive influx of capital. Over the past 30 days, total inflows reached $62.9 billion, with the Bitcoin and Ethereum networks absorbing $53.3 billion, while the supply of stablecoins increased by $9.6 billion.

This is the highest level since the peak in March 2024, reflecting the restoration of confidence and renewed demand after the US presidential election.

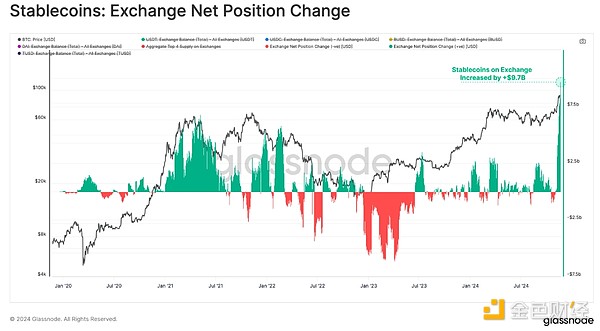

Expanding the observed capital inflows, the vast majority of the $9.7 billion in stablecoins minted in the past 30 days were deployed directly to centralized exchanges. This inflow is closely correlated with total capital flows of stablecoin assets during the same period, highlighting their key role in stimulating market activity.

The surge in stablecoin balances on exchanges reflects strong speculative demand from investors to take advantage of the trend, further reinforcing the bullish narrative and post-election momentum.

Investigating Investor Profitability

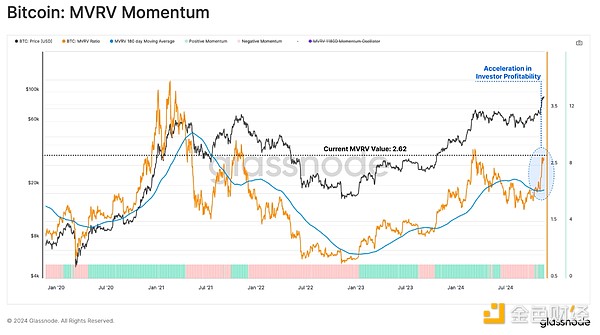

So far, we have explored the trend of rising market liquidity, which supports Bitcoin's outperformance. In the next section, we will evaluate how this price behavior affects the unrealized profitability (paper gains) of market investors using the MVRV ratio.

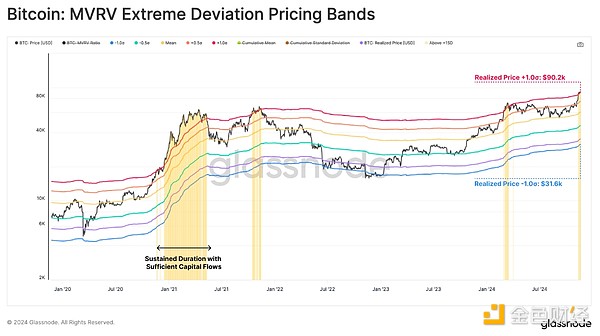

When comparing the current value of the MVRV ratio (orange) to its annual moving average (blue), we can see an acceleration in investor profitability. This phenomenon is often a supportive environment for continued market momentum, but it also creates conditions where investors are more likely to start taking profits to realize paper gains.

As investor profitability in the market increases, the potential for renewed sell-side pressure grows. By overlaying the MVRV ratio with the ±1 standard deviation band, we can construct a framework to assess overheated and underheated market conditions.

Bitcoin's price recently breached the +1σ zone, or $89,500. This suggests that investors are currently holding statistically significant unrealized profits and points to an increased likelihood of profit-taking activity.

However, historically markets have remained in this overheated state for extended periods of time, especially when supported by sufficiently large capital inflows to absorb the selling pressure.

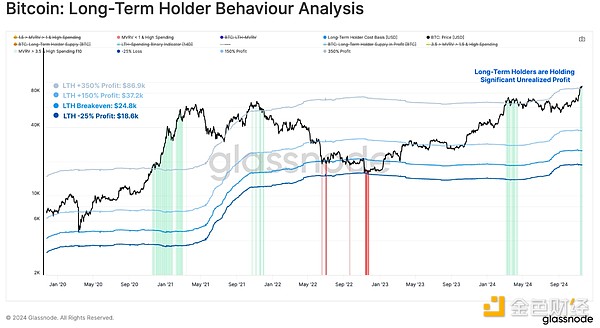

Extreme Spending by Long-Term Holders

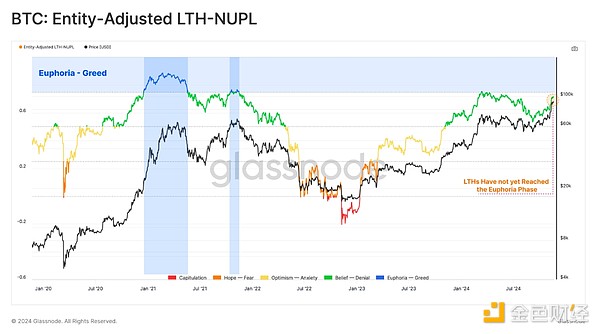

During the euphoric phase of a market cycle, the behavior of long-term investors becomes critical. LTH controls a large portion of the supply, and its spending dynamics can greatly influence market stability, ultimately forming local and global tops.

We can assess the paper gains held by LTH using the NUPL indicator, which is currently 0.72, just below the threshold of 0.75 for conviction (green) to excitement (blue). Despite the sharp price increase, sentiment among these investors remains low compared to previous cycle tops, suggesting there could be further room for growth.

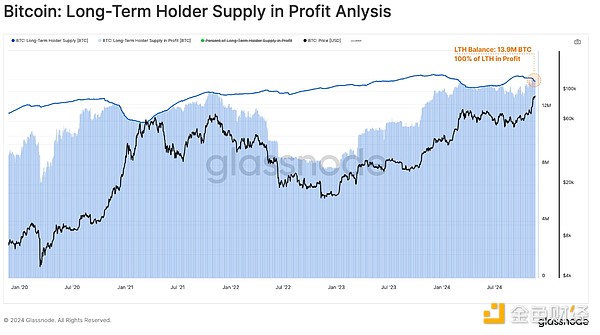

As Bitcoin broke above $75,600, 100% of the 14m Bitcoin held by long term holders converted into profit, spurring an acceleration in spending. This has resulted in a balance drop of +200k BTC since the ATH breakout.

This is a classic and repeating pattern where long term holders begin to take profits whenever price action is strong and demand is strong enough to absorb profits. Since LTH still holds a large amount of Bitcoin, it is likely that many LTH are waiting for higher prices before releasing more Bitcoin back into liquid circulation.

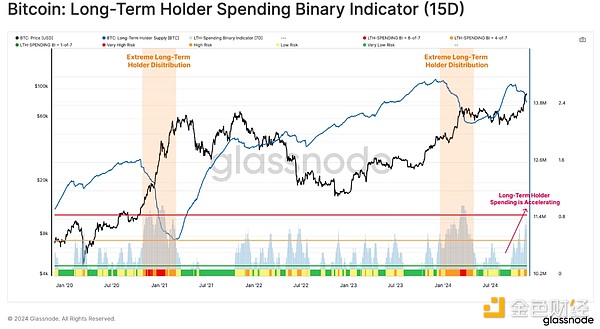

We can use the long-term holder spending binary indicator to assess the intensity of LTH seller pressure. The tool assesses the percentage of days in the past two weeks that the group's spending exceeded its accumulation, resulting in a net decline in its holdings.

Since the beginning of September, long-term holder spending has steadily increased as Bitcoin prices have risen. With the recent surge to $93,000, the indicator reached a value that indicated that LTH balances had fallen in 11 of the past 15 days.

This highlights increased pressure on long-term holders to allocate, although not yet to the extent observed around the March 2021 and March 2024 peaks.

Having identified the increased spending behavior of long-term holders, we can consult the next tool to gain more insight into their activity around key market points. The interplay of profit-taking and unrealized profits helps highlight their role in shaping cycle shifts.

The chart visually shows:

LTH Realized Price (blue): The average acquisition price by long term holders.

Profit/Loss Pricing Range (blue): The range representing extreme profit (+150%, +350%) and loss (-25%) levels, which usually triggers significant spending activity.

Profit Taking (green): The stage where long term holders hold profits of more than 350% and increase spending.

Sell-offs (red): high-spending periods with long-term holders in -25%+ loss territory.

Bitcoin’s price has surged past the 350%+ profit zone at $87K, prompting significant profit-taking by this cohort. As the market rises, distribution pressures are likely to increase, and these unrealized gains will expand accordingly. That said, this has historically marked the beginning of the most extreme phases of prior bull markets, with unrealized profits growing to over 800% in the 2021 cycle.

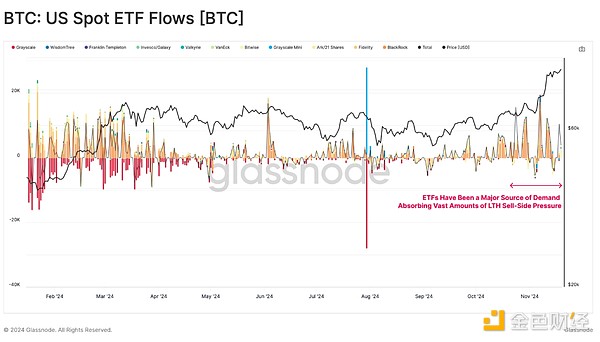

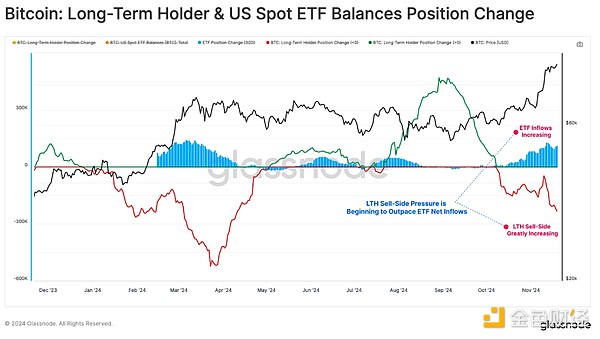

Institutional Buyers

We will now turn our attention to the role of institutional buyers in the market, particularly through US spot ETFs. ETFs have been the primary source of demand in recent weeks, absorbing the majority of LTH’s sell-side. This dynamic also highlights the growing influence of institutional demand in shaping the structure of the modern Bitcoin market.

Since mid-October, weekly ETF inflows have surged to between $1 billion and $2 billion per week. This represents a significant uptick in institutional demand and one of the most notable periods of inflows to date.

To visualize the balancing force of LTH selling pressure and ETF demand, we can analyze the 30-day changes in the Bitcoin balance of each group.

The chart below shows that from October 8 to November 13, the ETF absorbed about 128,000 BTC, accounting for about 93% of the 137,000 BTC net selling pressure exerted by LTH. This highlights the key role of ETFs in stabilizing the market during periods of increased selling activity.

However, since November 13, LTH sell-side pressure has begun to outpace ETF net inflows, echoing a pattern observed in late February 2024, when supply-demand imbalances led to increased market volatility and consolidation.

Summary

Bitcoin's rally to $93,000 was supported by strong capital inflows, with about $62.9 billion worth of capital flowing into the digital asset space over the past 30 days. This demand was led by institutional investors via US spot ETFs, even as capital flowed out of gold and silver. ETFs played a key role, absorbing over 90% of the sell-side pressure from long-term holders. However, as unrealized profits reach more extreme levels, we can expect LTH payouts to increase, with inflows exceeding ETF inflows in the short term. ETFs played a key role, absorbing over 90% of the sell-side pressure from long-term holders. However, as unrealized profits reach more extreme levels, we can expect LTH payouts to increase, with inflows exceeding ETF inflows in the short term.

Alex

Alex

Alex

Alex Joy

Joy Brian

Brian Weiliang

Weiliang Joy

Joy Alex

Alex Miyuki

Miyuki Joy

Joy Joy

Joy Joy

Joy