Author: Glassnode, UkuriaOC, CryptoVizArt, Alice Kohn; Translator: Tao Zhu, Golden Finance

Abstract:

The fourth Bitcoin halving initially led to a sell-off, with Bitcoin prices falling to $57,000 before quickly recovering. This was the most severe pullback since the FTX low.

Ethereum showed similar price performance, experiencing the largest drop of this cycle, which was twice as severe as Bitcoin.

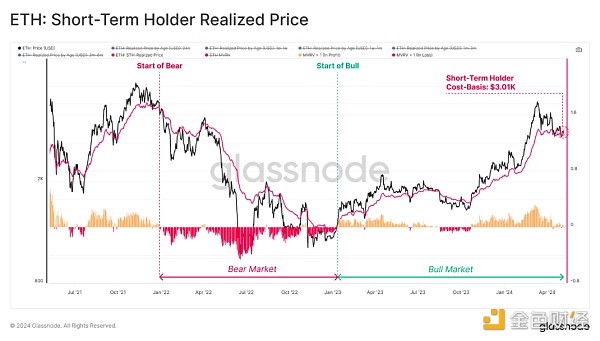

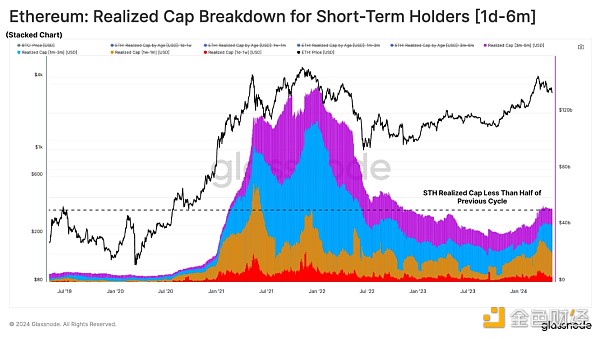

Ethereum's underperformance relative to Bitcoin this cycle is reflected in the obvious lag in speculative interest from the short-term holder community.

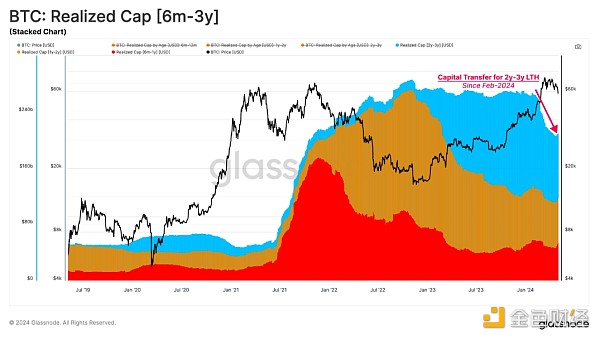

The realized caps associated with long-term holders for both assets remain relatively low, indicating that the market may be in the early stages of a macro uptrend.

Price/Performance

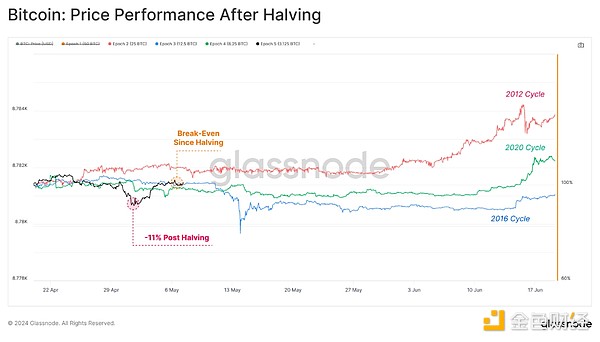

Bitcoin halving events are well publicized in advance and have historically been a volatile sell-off news event in the short term. The fourth halving was no exception, with BTC prices falling 11% to trade in the $57k region. This is the lowest price in the past two months, although markets have returned to a more even tone since the halving.

Oddly, the first two halving cycles saw prices flatline two weeks later, with only the first halving cycle seeing gains of +11%. Overall, the 60 days following a halving event tend to be volatile, sideways, with slight declines to around -5% to -15%.

Stage 2: +9.0%

Stage 3: +0.4%

Stage 4: -1.5%

Stage 5: 0.3%

Live Workbench

Ethereum prices experienced similar pressure, with Bitcoin prices falling immediately after the halving and posting its worst post-halving performance on record. However, in the following days, ETH prices also recovered, bringing the overall performance into positive territory.

Stage 3: +16%

Stage 4: -4%

Stage 5: +1.5%

Live Workbench

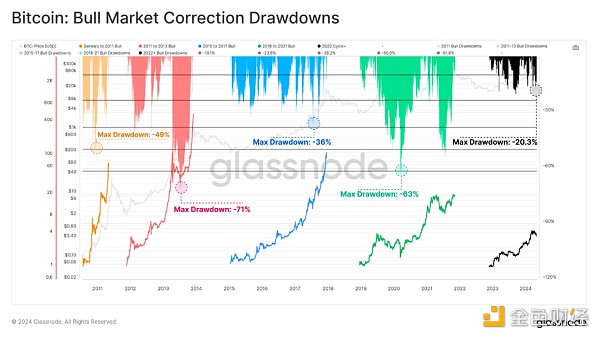

For Ethereum, we can see a similar retracement structure, with the correction since the FTX low being significantly shallower. This has affected a degree of resilience during pullbacks and reduced volatility across the digital asset space.

However, it is worth noting that Ethereum’s maximum drop this cycle was -44%, more than double Bitcoin’s -21% drop. This highlights Ethereum’s relative underperformance over the past two years, which is also reflected in the weakness of the ETH/BTC ratio.

Live Workbench

Investor Positioning

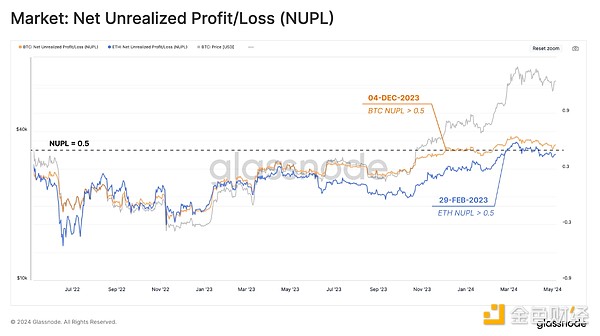

To compare the relative performance between BTC and ETH, we can turn to the Net Unrealized Profit and Loss (NUPL) metric. By comparing NUPL, we can understand how the profitability of BTC vs ETH investors is performing relative to the average on-chain cost basis of each asset.

The main threshold for this indicator is NUPL > 0.5, which usually coincides with the breakout of a new ATH and the beginning of the Excitement Phase. NUPL values above 0.5 mean that investors are holding unrealized profits exceeding 50% of the asset's market value.

Amid the hype and market rally surrounding the approval of a spot Bitcoin ETF, unrealized profits for Bitcoin holders grew much faster than those of Ethereum investors. As a result, the Bitcoin NUPL indicator broke through 0.5 three months earlier than the Ethereum equivalent, entering the Excitement Phase.

Live Workbench

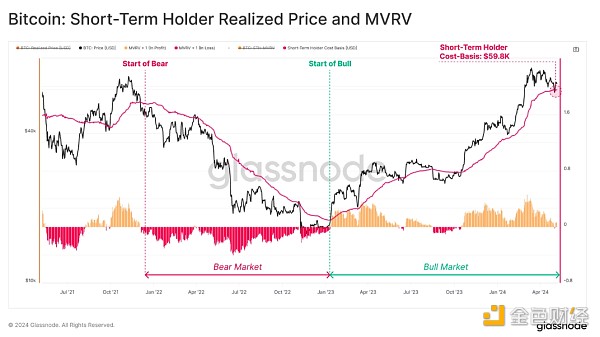

The short-term holder group consists of investors who purchased tokens in the past 155 days and is often seen as a proxy for new investor demand. Typically, the average purchase price of this group has strong resistance in bearish trends and acts as a support area in bullish trends.

So far this week, this thesis has held true, with the Bitcoin market pulling back below the STH cost basis of $59,800, where it found support and rebounded higher. Historically, retests of the STH cost basis have been common during uptrends and provide a key level to monitor for potential inflection points if it fails to hold.

Live Workbench

We can also assess Ethereum's STH cost basis, which has provided support multiple times during this uptrend. Ethereum's STH-MVRV is currently trading at a very low level, which could indicate that spot price is very close to the cost basis for recent buyers, who may panic if the market sees downside volatility.

Live Workbench

Growing Divergence

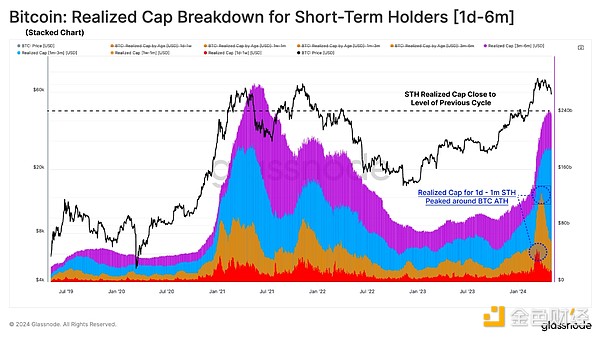

Before Bitcoin hit its all-time high (ATH) on March 14, there was a clear increase in speculative activity. Specifically, capital accumulation was observed among short-term holders, with USD wealth held in tokens approaching $240 billion in the past 6 months, close to the ATH.

Live Workbench Chart

However, this trend is not reflected on ETH, and its price has not yet broken through the 2021 ATH. While Bitcoin's STH achieved cap is almost the same as the last bull run peak, ETH's STH achieved cap has barely recovered from the lows, indicating a clear lack of new capital inflows.

In many ways, the lack of new capital inflows reflects ETH's underperformance relative to BTC. This may be partially attributed to the attention and access that spot Bitcoin ETFs have brought.

The market is still awaiting the SEC's decision to approve a series of ETH ETFs expected to launch in late May.

Live Workbench Chart

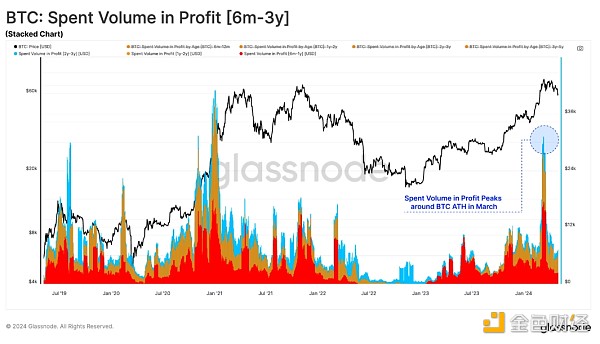

If we notice a significant drop in 2-3 years, we can do a similar analysis for long-term holders. A portion of this is tokens purchased 3 years ago (May 2021) with an expiration date of 3-5 years, but the rest indicates profit-taking withdrawals.

This may be influenced by the ETF approval, and a large portion of these withdrawals occurred in February 2024 when the market rose, about a month before BTC reached its current $73k ATH. These long-term holders have historically waited for strong demand inflows to turn profits into market strength.

Live Workbench Chart

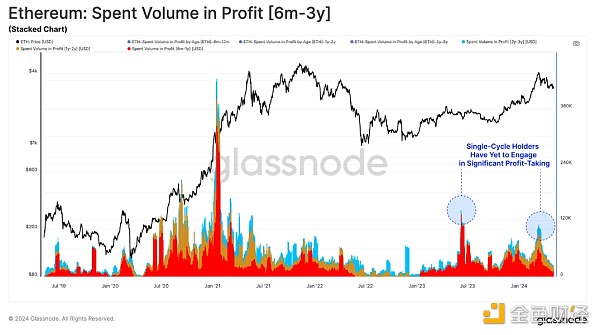

For Ethereum, we continue to see sustained holding behavior, especially among 1 to 3 year investors. It appears thatexperienced investors are patiently waiting for higher prices as ETH is currently underperforming. Live Workbench Chart If we examine the amount of profit payouts for LTH, we can see that the group of BTC holders who have held for 6 months to 2 years increased their withdrawals during the ATH rally.

Live Workbench Chart

From this perspective, long-term Ethereum holders seem to still be waiting for better profit-taking opportunities.

Live Workbench Chart

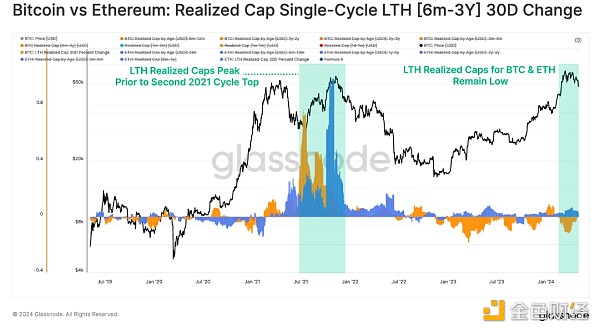

As we noted in WoC 08, inflows into ETH do tend to lag relative to BTC. In the 2021 cycle, the peak in new capital inflows into BTC occurred 20 days before the peak inflows into ETH. We can monitor the capital rotation between the two assets by evaluating the 30-day change in realized cap.

In this example, we have broken down this metric by short-term and long-term holders. For both assets, the short-term holder variant peaked just before the 2021 cycle tops for both assets. This year, BTC short-term holder realized cap has peaked near all-time highs, while the ETH metric has barely moved higher. Live Workbench Chart For the long-term holder variant, both assets saw relative maximums near the second cycle tops. This is a very different interpretation, as it takes at least 155 days for capital to reach LTH status.

Thus, this indicator describes the top buyers in Q1 2021 who first bought BTC and then ETH and who maintained supply until the peak in October-November 2021. These buyers are likely the ones who weathered the storm and created selling pressure in the subsequent 2022 bear market.

Live Workbench Chart

Summary

The market trend before and after Bitcoin's fourth halving was very similar to previous cycles, with prices temporarily falling to $57,000 before rebounding to flat overall. The Ethereum market followed a similar trajectory, but several indicators showed ETH's underperformance relative to BTC.

When we break down capital flows and rotations between BTC and ETH, we can see that Bitcoin has received the largest share of inflows, likely driven in part by US spot ETFs. Short-term holders and speculative activity appear to be concentrated in Bitcoin, with very little spillover into Ethereum to date.

CaptainX

CaptainX

CaptainX

CaptainX CaptainX

CaptainX CaptainX

CaptainX Olive

Olive Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph