To describe the global market recently as "turbulent" would be an understatement. Various "once-in-a-decade" changes have taken place one after another, from Trump's change of position on the Ukraine issue, to Musk's riot in Washington, and Germany's determination to "do whatever it takes".

How to understand all this? Today we will deeply analyze the core logic behind this major change and try to make a prediction: What will happen next?

From "Biden's Great Cycle" to "Trump's Great Reset"

Let's start with a recent wonderful research report from CICC.

In this report titled "Trump's "Great Reset": Debt Reduction, De-virtualization, and Dollar Depreciation", CICC's macroeconomic research team first explained the most important logic of global capital flows in the past few years - the "Biden Great Cycle":

After the 2020 epidemic, the Biden administration launched a massive fiscal stimulus, coupled with a technological craze driven by AI and industrial policies. The United States achieved high growth, high interest rates, and a prosperous stock market, attracting overseas funds to continue to flow into the United States, supporting the appreciation of the dollar trend. In terms of approach and effect, the Biden administration has actually reproduced the "Reagan Great Cycle" and raised the valuation of U.S. stocks and the dollar to historical highs.

But the "Biden Great Cycle" has two fatal flaws:

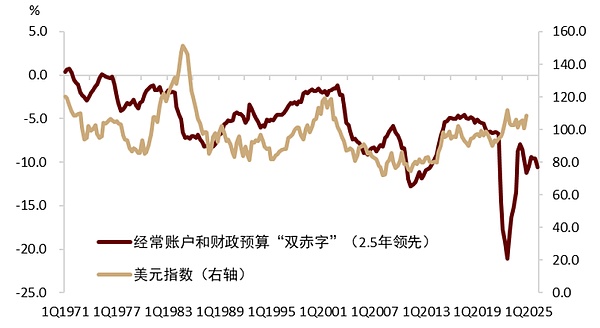

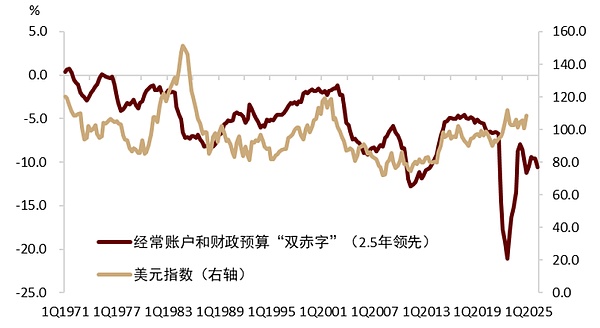

One is the huge risk in the financial market: high debt. This has been played out in the "Reagan Great Cycle". The huge fiscal stimulus promotes high economic growth and the appreciation of the US dollar, which often leads to the deterioration of the trade deficit. The fiscal deficit is difficult to converge in the short term. The double deficit problem will eventually attract investors' attention and even worry. When the US double deficit exceeds a certain threshold for a certain period of time, under certain catalysts, it often triggers the dollar to start a long-term depreciation.

To a certain extent, this is what is happening in the US market now. But at least before last year's election, Biden successfully suppressed the risks in the US financial market. The US economic situation looks very good, with high economic growth and a booming stock market.

However, Biden and the Democratic Party lost.

The problem is another fatal flaw of the "Biden Great Cycle": the polarization between the rich and the poor.

The new U.S. Treasury Secretary, Benson, made a pointed analysis of this this week.

He bluntly criticized the Biden administration's unrestrained fiscal spending, which actually hurt the interests of the bottom 50% of the people. In the years when the U.S. stock market soared, the wealth of the top 10% of the rich rose with the appreciation of assets, while ordinary people without assets faced the dilemma of skyrocketing prices and high debts.

What's more, inflation hits different classes unequally, and the price increase of daily consumption (such as used cars, car insurance, rent, food, etc.) of the bottom people is much higher than other goods and services. Bessant believes that this inequality has exacerbated social instability and is undoubtedly a heavy blow to the "American Dream".

In other words, "Biden's big cycle" allows a small number of American property owners to earn more, and financial capital is prevalent. Industrial capital is declining, and for most Americans, the "American Dream" is gone. As the famous saying goes, life is in dire straits.

Biden's loss is not unfair, and Trump, who won, "took over" the "Biden cycle" at a high position.

Trump saw Biden's previous experience very clearly, so "Trump 2.0" must clean up the mess left by the "Biden cycle".

Trump's idea is "big reset".

What are Trump's "big reset"?

On the surface, "Trump 2.0" has already made three moves, and Bessant explained it very clearly.

The first move is to reduce debt by cutting government spending. It is planned to reduce debt and deficit levels to the long-term average level by 2028, that is, the deficit accounts for about 3.5% of GDP.

The second move is to relax financial supervision and encourage the private sector to re-leverage, that is, the government deleverages and the private sector leverages, so that those laid-off civil servants can be absorbed by more productive sectors.

The third move is to readjust the international trade system and bring manufacturing jobs back to the United States through the tariff stick to revive the middle class.

CICC calls this the American version of "de-virtualization and real economy", which aims to reset the capital structure and adjust the relationship between industrial capital and financial capital, that is, heavy industry vs. light finance.

But it is extremely difficult to achieve the goal. Because the "Trump Great Reset" also has inherent flaws.

If the United States wants to reduce its high debt, it must control new debt and resolve existing debt.

To control new debt, the United States must increase revenue and reduce expenditure.

In terms of increasing revenue, Trump has done everything he can. The world is wielding the tariff stick, and even selling American Gold Cards.

I have to mention here, and this is also what shocked Wall Street and the American business community: Tariffs are not a means, but really an end!

What is even more difficult is to cut federal government spending.

Trump's most direct trick is Musk's DOGE. Musk is like the "Nezha" released by Trump, turning the tide in Washington, drastically and even brutally cutting jobs and spending.

However, the problem is that reducing government fiscal spending will lead to an economic recession. How to deal with public anger? The Trump administration must take advantage of the fact that it has just taken over and put all the blame on Biden.

So there is the recent famous saying by Bessant: The United States is "addicted to debt" and the economy will have a withdrawal period.

Detoxification is of course very painful, investors? Sorry, Trump can't take care of it.

But those who understand know that relying on DOGE alone is far from enough.

Under the iron rule of "whoever touches the social security benefits of Americans will die", Trump can only touch two things: the huge military spending of the United States and the even larger debt interest expenditure.

So, we see that Trump is eager to end the Russia-Ukraine conflict and at the same time put pressure on other NATO countries to increase military spending. This move has greatly changed the global geopolitical landscape and brought about a huge change that even Wall Street did not expect: Germany shouted "At all costs", ending decades of "fiscal prudence" and opening up "Fiscal Rocket Launcher". You should know that since 2022, the United States' interest expenses have exceeded its military spending.

"Ferguson's Law" tells us: When the interest expenses of any major country exceed its military spending, it is no longer a major power.

Trump must Debt Reduction.

As CICC said, there are generally three ways to reduce debt: debt restructuring; inflation; technological progress.

US debt restructuring, a concept that the market had never dared to imagine before, now seems not so far-fetched.

The "Mar-a-Lago Agreement" that has been hotly discussed in the financial market recently is debt reduction. One proposal is to convert some U.S. Treasury bonds into 100-year, non-tradable zero-interest bonds. If these countries are in urgent need of cash, the Federal Reserve can temporarily provide them with liquidity through special loan tools.

In addition to forcing other countries to comply, Trump must also find ways to lower debt interest rates, which requires the cooperation of an important institution: the Federal Reserve.

The Federal Reserve is in an extremely awkward position at this time.

On the one hand, "Trump's detoxification period" is slowing down the US economy and even towards a recession, so in theory the Fed needs to cut interest rates.

On the other hand, the "Biden cycle" has already kept inflation at a high level and has shown strong stickiness. The Fed has failed to suppress inflation after raising interest rates many times, and it is on the verge of a comeback at any time. Trump's tariffs may be the next fire that ignites the second round of inflation, and interest rate cuts at this time are "adding fuel to the fire." Powell is "in a dilemma" and can only maintain the status quo. At the press conference after the March resolution, he used a meaningful word: "inertia." The implication is that even the Federal Reserve is not sure what will happen in the future. It is difficult to cut interest rates, so the Federal Reserve has to think of other ways. There is a potential big move in reserve: QE. Finally, let's talk about the third way to reduce debt: productivity improvement brought about by technological progress. CICC believes that the "AI narrative" of the United States in the past two years has not only supported the valuation of US technology stocks, but more importantly, it has supported investors' "fiscal faith" in the US government: they tend to believe that the United States has a greater probability of using AI to drive real technological progress and then improve total factor productivity to reduce debt.

That is, the "American exceptionalism" formed by the financial market in the past few years has supported the high valuation of US stocks.

But DeepSeek's "out of nowhere" at the beginning of the year has dealt a heavy blow to the US AI narrative and shaken the "American exceptionalism".

The market began to question: Can the massive investment of the US government and AI technology giants in the past two years bring the expected returns? Can this round of AI technology revolution really improve the total factor productivity of the United States? Even more likely to achieve total factor productivity in China?

In other words, the market may gradually price the US debt risk in US dollar assets.

So it may not be an exaggeration to say that DeepSeek is a "national innovation".

The above is the change in US policy thinking since Trump took office two months ago, which is the logic of "Trump's Great Reset".

Next, let's talk about what this means for financial markets and global capital flows? What will happen next?

Global Capital Changes

The keen capital market has realized that "something is wrong".

After Trump won the election in November last year, US stocks and the US dollar soared, and the market was jubilant. The logic is that the market believes that Trump will definitely promote growth.

Since Trump took office, everything has completely reversed. US stocks and the US dollar have both fallen for two months, which is rare. According to Goldman Sachs statistics, this situation has only happened five times in the past 33 years!

Because the market realizes that Trump no longer uses the US stock market as a KPI, the KPI of "Trump 2.0" is US debt. For this reason, Trump is willing to let the US decline and let the US economy "detoxify".

On the other side of the Atlantic, Germany, which is rich but notoriously stingy, suddenly started to borrow money and spend a lot of money! This brought an unexpected variable to Trump. It not only gave a shot in the arm to the German and European stock markets, but also significantly pushed up the yields of European government bonds, including German government bonds.

The result of this unexpected change is that the interest rate gap between the United States and Europe has narrowed significantly, affecting the flow of trillion-level "European old money", which in turn will affect the demand for US debt and push up the yield of US debt, which may be unexpected by Trump.

The real impact of the "Trump Great Reset" lies in the reshaping of the US dollar system.

CICC Research Report believes:

Since the 1980s, when the United States and Europe started global integration and financial liberalization, the circulation of the US dollar has been based on the following key paths: the United States maintains a current account deficit, trading partners purchase US dollar assets with trade surpluses, and the United States maintains a financial account surplus. Since the outbreak, the US dollar has tended to strengthen under the circumstances of worsening US double deficits. One very important reason is that overseas funds tend to buy a large number of US dollar assets. According to the balance of payments equation, the improvement of the US trade deficit means a reduction in the surplus of the financial capital account, among which portfolio investment projects will bear the brunt.

In plain words: the smaller the US trade deficit, the smaller the demand for US dollar assets will be. The "sky-high valuation" of US stocks in the past will face severe challenges, but will bring opportunities to assets in other countries. "The rise of the East and the fall of the West" is not groundless.

Trump's tariffs will hit core U.S. stock assets such as Mag 7 and U.S. bonds hard.

The U.S. dollar no longer has the safe-haven properties it once had. When U.S. stocks fall, the U.S. dollar will fall along with it.

Along with the U.S. dollar, U.S. bonds will also lose their hedging and safe-haven properties. If the U.S. economy really enters a recession later this year, even if the Fed is forced to cut interest rates, perhaps the market will see a repeat of last September, that is, the Fed cuts interest rates, but U.S. bond yields rise instead.

What will happen next?

CICC warned of the risk of a "triple kill" of US stocks, bonds and currencies in the short term:

From a technical perspective, since the Fed's balance sheet reduction in 2022, US hedge funds (especially multi-strategy platform funds) have become the largest marginal buyers of US Treasuries. Hedge funds continue to buy US Treasuries on a large scale not because they are bullish on US Treasuries, but because they are doing Treasury basis arbitrage transactions (Treasurybasistrade): long US Treasury bonds on the left hand and short US Treasury futures on the right hand. When the market fluctuates little, holding futures until maturity can earn term spread basis with lower risk. These hedge funds often leverage to buy US Treasury bonds in the repo market to increase their returns.

The size of this transaction may have reached nearly twice the historical high in the second half of 2019, and the trigger for the global financial market shock in March 2020 (selling all assets for cash) was the unexpected liquidation of the then historically large basis arbitrage trade. This transaction is essentially shorting volatility, so once volatility rises sharply, it is easy to trigger liquidation risks and asset sales.

What factors may trigger a sharp increase in financial market volatility? We believe that the resolution of the debt ceiling is a key event. Once the debt ceiling is resolved, the Treasury Department will issue new U.S. bonds that were previously restricted by the debt ceiling. In the absence of debt restructuring, the risk of a "triple kill" of U.S. stocks, bonds and currencies will increase.

What else will Trump do?

First, the "Mar-a-Lago" agreement or its variant may become a reality in the near future. Some countries, such as Japan, are likely to agree to exchange and restructure their holdings of U.S. debt under the threat of tariffs. Other countries may also agree to purchase U.S. debt in exchange for tariff exemptions.

When interest rate cuts are ineffective or even counterproductive, the Federal Reserve may restart measures such as QE or YCC, and the U.S. government will also relax bank supervision measures to encourage more banks to hold U.S. debt.

We may even see the United States redefine the statistical methods and calibers of inflation and even GDP.

Having said this, I believe everyone understands that Trump is playing a difficult tightrope game that tests the fate of the United States.

If Trump succeeds, then as he himself claims, the new golden age of the United States will begin.

Even so, the huge uncertainty in the process will turn the financial market upside down.

If Trump "plays too hard", what will we see?

The good situation is: the valuation of US dollar assets will go down, and the attractiveness of physical assets and cash flow assets will increase.

The bad situation is: internal reforms cannot solve the problem, and the United States can only transfer the contradictions to the outside.

What does this mean? It has been played out too many times in history, and those who understand will understand.

Kikyo

Kikyo