Author: Tobias Vilkenson, CoinTelegraph; Compiled by: Whitewater, Golden Finance

What is a Bitcoin whale?

Bitcoin whales are individuals or organizations that own large amounts of Bitcoin and are able to influence the market through trading strategies.

The term "Bitcoin whale" is often used to refer to holders of large amounts of Bitcoin compared to smaller players, who are often referred to as "minnows" in the market. The owner of a wallet or cluster of wallets controlled by one entity may be an individual or a group that is pooling funds to make a large investment.

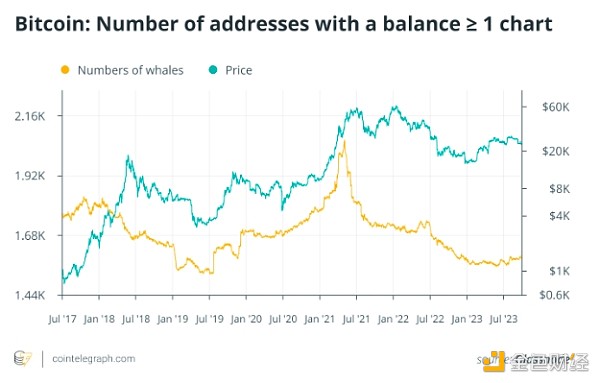

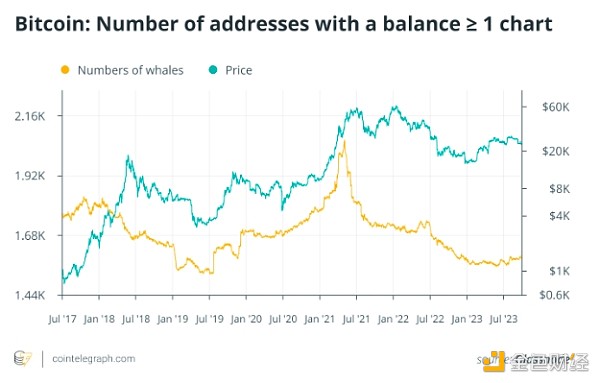

A large amount of their assets have been accumulated through mining, early-stage investing, and other methods. Whales can hold large amounts of Bitcoin, which gives them the ability to manipulate the market by causing price fluctuations through large purchases or sales of the asset. In the cryptocurrency space, large numbers of whales and extreme volatility are often associated.

How much money can cryptocurrency holders make?

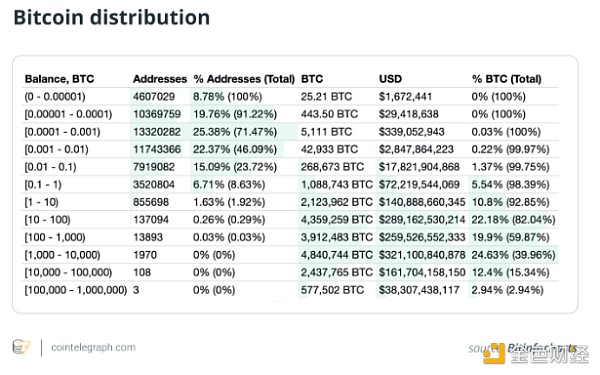

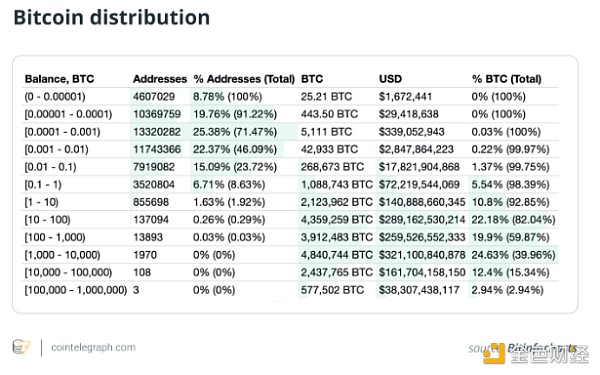

A person or organization is considered a "Bitcoin whale" if it owns a large amount of Bitcoin; however, the threshold for this classification has not yet been set. The widely recognized threshold for becoming a Bitcoin whale is 1,000 BTC. Cryptocurrency analysis firms such as Glassnode typically cite this threshold when identifying network entities (clusters of addresses) with at least 1,000 Bitcoins.

As of March 2024 In September, Bitcoin ownership distribution was highly concentrated. Only three Bitcoin addresses hold between 100,000 and 1 million BTC, for a total of 577,502 BTC. The next 108 largest owners own a combined 2,437,765 BTC, with individual holdings ranging from 10,000 to 100,000 BTC. The 111 richest addresses combined account for approximately 15.34% of the total Bitcoin supply.

Why do Bitcoin whales influence the market?

Whales have significant influence over their market dynamics. The large amount of Bitcoin they hold gives them the ability to influence the supply and demand of Bitcoin, causing price fluctuations in transactions. When whales add to their Bitcoin reserves, prices tend to surge, while selling some of their Bitcoins can cause prices to fall.

By holding large amounts of cryptocurrency, crypto whales can create scarcity, driving up demand and value. Large trades by whales can trigger significant price movements, guiding the actions of other traders.

These whales often operate in the public eye, and their wallets are tracked by the wider trading community. As a result, as traders follow through, their trading decisions or anticipated movements may trigger significant price movements.

Some Bitcoin whales choose to trade over-the-counter (OTC) cryptocurrencies to minimize their impact on prices, while others use exchanges to manipulate the market by issuing massive buy or sell signals.

What trading strategies do Bitcoin whales use?

Crypto whales stand out from ordinary investors because they have a long-term view of the cryptocurrency market and often use advanced investment strategies.

Market Manipulation

Large Bitcoin players occasionally engage in pump-and-dump schemes, where they buy large amounts at once Bitcoin is used to drive up its price and then sold at a profit, causing other investors to suffer losses.

Additionally, they may spread rumors on social media to increase interest and drive up prices to attract smaller investors to join. Bitcoin whales will eventually sell, causing the price to drop and causing losses to small investors.

Accumulation

Whales can gradually accumulate by making planned purchases at low prices or during market downturns Accumulate Bitcoin. Over time, they take advantage of the opportunity to buy large amounts of Bitcoin at favorable prices, thereby increasing their Bitcoin holdings.

Hold for the long term

By holding Bitcoin for the long term, whales can protect themselves from the effects of inflation or profit from possible long-term increases in Bitcoin’s value .

Diversification

In addition to Bitcoin, some whales also diversify by investing in other digital assets Cryptocurrency holdings to diversify risk and gain potential profits from all areas of the cryptocurrency market.

Short-Term vs. Long-Term Strategies

When Bitcoin whales predict a price drop, they can use short-term strategies to sell the cryptocurrency in large quantities, scaring off small investors and further depressing the market.

Instead, they can use a long-term strategy to strategically acquire Bitcoin over time, which will generate positive momentum and encourage smaller investors to join the market, driving the price higher.

Stop-loss strategy

Stop-loss strategy involves deliberately manipulating the price of Bitcoin to trigger other traders' Stop-loss orders, allowing whales to buy at a lower price before the market rebounds.

How to discover BitcoinCoin whale

Whales often move funds secretly, using innovative methods to hide their identities and the amount of funds they possess. Nonetheless, the transparency of blockchain and various whale alert platforms makes it possible to identify these whales. However, identifying them requires in-depth blockchain exploration and vigilant monitoring, known as on-chain analysis.

Here are some ways to spot Bitcoin whales.

Search for large trades

To gain valuable insights and make informed investment decisions, traders and investors can closely monitor the behavior of large Bitcoin holders—a process known as “whale watching.”

Large trades made by whales often cause sudden price drops or increases. When large amounts of cryptocurrency move, it’s usually due to these whales moving between wallets or exchanges. Bitcoin’s public distributed ledger can help access all whale transactions and identify large amounts of Bitcoin being transferred.

Xu Lin

Xu Lin