Author: James Smith, CoinTelegraph; Compiler: Wuzhu, Golden Finance

1. Analysis of tokenized commodities

Tokenized commodities represent partial ownership of real-world assets using digital tokens on the blockchain while retaining their tangible value.

Tokenized commodities are digital versions of real-world items (such as gold, oil, or crops) recorded on the blockchain. Each token represents a part or all of the commodity, making it easier to divide and trade. This simplifies the buying and selling of small portions of commodities for investors, provides more liquidity, and provides access to markets that are usually difficult to trade.

Imagine that you have a giant pizza that one person can't eat. Instead of giving the whole pizza to one person, you cut it into slices. Now everyone can buy and enjoy the right amount of food that suits their appetite.

Tokenized physical commodities work similarly. Commodities such as gold or oil are giant pizzas. Instead of buying the entire commodity (which can be very expensive and impractical), you divide it into small pieces called tokens. Each token represents a small portion of the commodity.

Second, the tokenization process

Have you ever thought about owning a fraction of a barrel of oil or a fraction of a gold bar? These are tokenized commodities, a combination of blockchain technology and traditional assets.

Tokenized commodities become digital tokens, opening up new trading and access channels for investors. Here are the steps involved in the tokenization process:

Creating tokens:Creating tokens that represent commodities. One way to achieve this is to establish the identity of the property owner as a legal entity. Tokens enable holders to share in the value of the commodity.

Execution of smart contracts:Smart contracts implement the allocation, monitoring and payment of digital token rewards. Once launched, these programs run without human intervention.

Token distribution and sale:Tokens are distributed to investors through smart contracts through a combination of private sales, public sales or whitelist models. A whitelist is a setting that only allows pre-approved or trusted users, entities, or operations to run.

Asset Management:After the token is sold, new holders can participate in the management of the underlying commodity. Smart contracts specify the scope of control and decision-making process for token holders.

Secondary Market Trading:After the token is issued, it can be traded on the secondary market, creating liquidity. Unlike traditional commodity investors who may find it difficult to sell assets, token holders can more easily sell their shares.

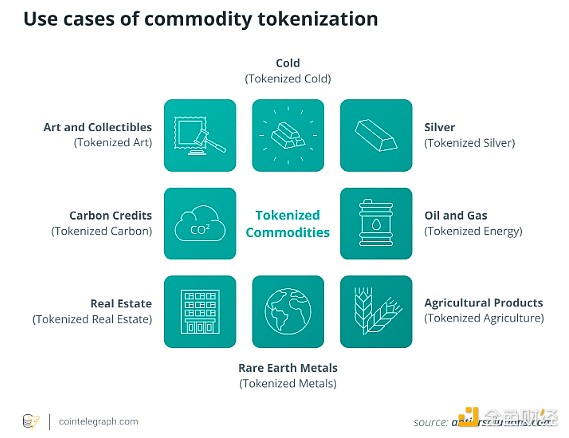

Types of Tokenized Commodities

Blockchain technology can help tokenize a variety of commodities, including energy resources, real estate, precious metals, and agricultural products.

Let's explore the various tokenized commodities:

Precious Metals:Tokenizing precious metals such as platinum, gold, and silver allows investors to hold small amounts of precious metals without physical storage. This helps with portfolio diversification and hedging, while also increasing the accessibility of these assets.

Energy Resources:Tokenizing energy refers to converting actual energy sources, such as solar or wind power, into digital units on a digital platform. This facilitates new energy-related use cases, such as exchanging excess solar energy between neighbors, streamlining renewable energy credits, and improving grid management.

Agricultural Resources:Blockchain enables the tokenization of agricultural resources, creating a secure record that represents the products exchanged on a digital ledger. This brings efficiency, security, openness, and cost reduction to commodity trading for retail investors.

Real Estate:Investors can tokenize real estate by splitting it into smaller pieces and automating operations using smart contracts. Records are stored in a secure digital system. Owners can prove their ownership using a private key. Anyone interested in buying, renting, or financing can easily view the history of a property using this system. Past transactions regarding a property, including any outstanding debt, are displayed as a transparent, unchangeable record.

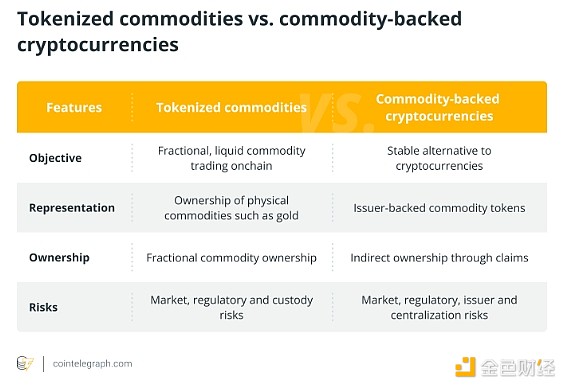

Fourth, tokenized commodities and commodity-backed cryptocurrencies

Commodity-backed cryptocurrencies are digital assets that are designed to be more stable than volatile cryptocurrencies. This stability is achieved by pegging their value to tangible commodities such as real estate, gold, or oil.

A company or organization holds the actual commodity and issues a token that represents a specific amount of that commodity. The value of the token fluctuates with the cost of the underlying commodity.

For example, commodity-backed cryptocurrencies Tether Gold and Pax Gold are both backed by actual gold. Similarly, other cryptocurrencies can be backed by commodities such as oil reserves or other precious commodities.

The following table explains the difference between tokenized commodities and commodity-backed cryptocurrencies:

V. Benefits of Commodity Tokenization

Commodity tokenization clarifies ownership, enables fractional ownership, simplifies transactions, and promotes market activities.

Let's take gold-backed tokens as an example to understand the advantages of commodity tokenization.

Enhanced Liquidity:One of the major advantages of tokenized commodities is enhanced liquidity. By converting commodities such as gold into digital tokens, these assets can be easily traded on blockchain platforms. This allows investors to buy and sell fractions of commodities without an intermediary, which reduces transaction costs and transaction time.

Fractional ownership:Fractional ownership is another important advantage of tokenized commodities. It allows more investors who may not have the funds to purchase full units to purchase commodities. This makes commodities more accessible to investors, allowing them to diversify their portfolios.

Better security and transparency:Tokenization uses blockchain, which is like a digital notebook that records every transaction. This notebook cannot be changed, ensuring transparency and security because everyone can see who owns what.

Easier to trade:Traditional methods of trading commodities can be time-consuming and complicated. Digital tokens allow users to trade conveniently anytime, anywhere, making the investment process much simpler.

Six, the risks of tokenized commodities

While promising, tokenized commodities also face challenges. The rules are not always clear, as existing rules may not fully cover them. The technology behind tokenized commodities must be properly tested to handle the complexity of creating and trading these tokens.

Continuing with the example of gold-backed tokens, let’s dive deeper into the risks associated with tokenized commodities.

Liquidity: Tokenization is of little use if the secondary market is not large enough to handle the volume. Building market depth requires trust between institutional investors and traditional market participants using blockchain technology.

Standardization and Interoperability: Standardization and interoperability are required for the smooth integration of tokenized commodities with the existing financial system. Compatible token standards, smart contracts, and data formats between various blockchain platforms and commodity markets are essential for efficient trade settlement and asset transfer.

Cybersecurity: Protecting the integrity of tokens, private keys, and sensitive transaction data requires strong security measures, such as encryption and two-factor authentication (2FA). Constant monitoring is required to prevent theft, hacking, and exploitation.

Regulatory Challenges:Tokenized physical commodities are subject to securities, commodity trading, and financial market laws. In order to comply with these laws, strong governance mechanisms must be in place to prevent fraud, market manipulation, and regulatory violations.

Alex

Alex

Alex

Alex Anais

Anais Miyuki

Miyuki Kikyo

Kikyo Weiliang

Weiliang Anais

Anais Alex

Alex Catherine

Catherine Weatherly

Weatherly Alex

Alex