Author: Dilip Kumar Patairya; Compiler: Wuzhu, Golden Finance

1. What is an inverse futures contract?

An inverse futures contract is a financial arrangement that requires the seller to pay the buyer the difference between the agreed price and the current price at the expiration of the contract. Unlike traditional futures, the seller benefits from a drop in price.

Regardless of the underlying cryptocurrency being traded, the contract value of an inverse futures contract is denominated in fiat currency (such as the US dollar) or stablecoins (such as Tether's USDT). There is an inverse relationship between profit and loss (PnL) and the price movement of the underlying cryptocurrency.

As a derivative, an inverse futures contract is priced in US dollars and settled/margined using the underlying cryptocurrency. For example, the market price of the BTC/USD pair is determined in US dollars, while profits and margin are calculated in Bitcoin (BTC).

2. How do inverse futures contracts work?

The nature of inverse futures contracts is non-linear. When a trader goes long a BTC/USD inverse futures contract, they are shorting the US dollar. Since the contract is inverse, the trader's position is worth less in Bitcoin, and the higher the value of Bitcoin, the higher its value relative to the U.S. dollar.

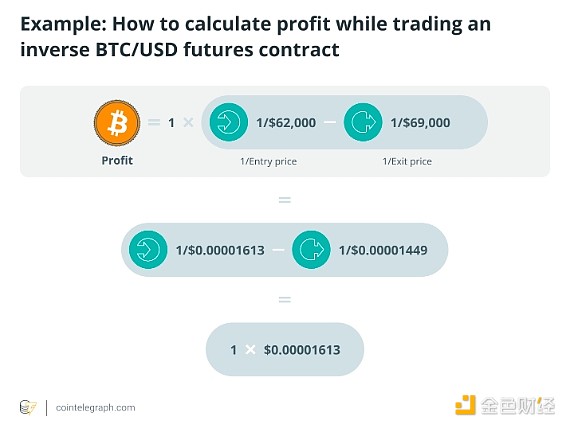

To understand how inverse futures contracts work and the associated calculations, let's take an example. It involves calculating the profit of a BTC position using an inverse futures contract.

Here's the breakdown:

Position size: 1 BTC

Entry price (BTC): $62,000

Exit price (BTC): $69,000

The formula for calculating profit is as follows:

This formula uses the difference between the entry price and the exit price to determine the profit (or loss) of the underlying cryptocurrency.

Assume that a user is trading an inverse BTC/USD futures contract with a position size of 1-BTC. If the entry price is $62,000 and the exit price is $69,000, the calculation would be as follows:

According to the calculation, the trader will make a profit of 0.00000164 BTC from this trade, which will appear in their crypto wallet. Those who want to profit from an asset's rise in value sometimes go long, meaning they bet on a price increase. On the inverse contract side, investors who take a long position will benefit from the appreciation of the underlying asset against the dollar (in this case, BTC).

Suppose an investor chooses to go long an inverse contract pegged to BTC/USD. The value of the Bitcoin they hold rises in tandem with the price of the cryptocurrency. Therefore, the value of the USD they hold increases as the price of Bitcoin rises. The price of Bitcoin and the value of the USD-denominated inverse contract are directly correlated, providing investors with a simple opportunity to profit from favorable market conditions.

III. The difference between forward and inverse futures contracts

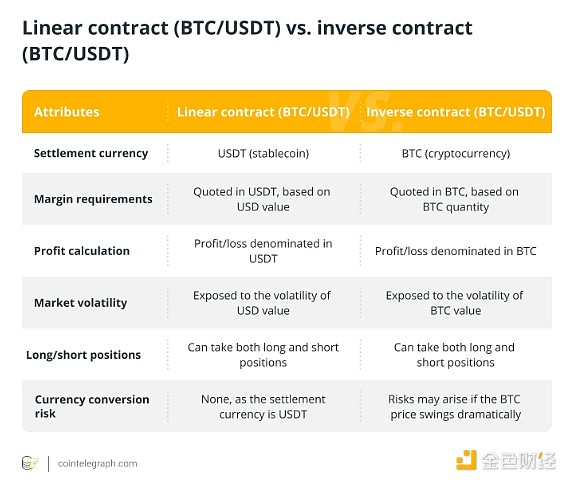

Linear futures contracts are settled in stablecoins (such as USDT), while inverse futures contracts are settled in the underlying cryptocurrency (such as BTC).

In linear futures contracts, traders use and earn the same currency. For example, in a USD-denominated Bitcoin contract, margin and P&L are both denominated in USD. In linear futures contracts, margin and P&L are denominated in the quote currency, commonly referred to as "vanilla". Therefore, a USD-denominated Bitcoin Vanilla futures contract is denominated and settled in USD.

In contrast, in an inverse futures contract, traders use the base currency (such as Bitcoin) but earn P&L in the quote currency (such as USD).

Comparison of Linear and Inverse Futures Contracts:

As linear futures contracts allow traders to settle in stablecoins such as USDT across multiple futures markets, it provides flexibility. This simplifies trading operations as there is no need to purchase the underlying cryptocurrency to fund the futures contract.

When settlement is made using stablecoins such as USDT, calculating profits in fiat currency is simple. Traders can easily assess gains or losses in traditional currencies, allowing for better financial planning and analysis.

Fourth, the advantages of inverse futures contracts

Inverse futures contracts can help traders build long-term reserves, allowing them to reinvest their earnings in cryptocurrency holdings, provide leverage in bull markets to obtain higher profits, and act as an effective hedging tool without converting holdings into stablecoins such as USDT.

Here are the advantages of inverse futures contracts:

Long-term accumulation

Traders' profits can be directly reinvested into long-term cryptocurrency holdings through inverse futures contracts, which are priced and settled in cryptocurrencies. It can help miners and long-term holders steadily build their cryptocurrency reserves over time.

Leverage in a bull market

During a bull market, inverse futures contracts can provide traders with leverage, allowing them to increase profits when the value of the underlying cryptocurrency rises. For traders who correctly predict rising price changes, this leverage can increase profits.

Hedging

Traders can hedge their positions in the futures market by holding and investing in crypto assets at the same time without converting any holdings into stablecoins such as USDT. This improves risk management skills in futures trading, allowing traders to guard against possible losses while maintaining exposure to the cryptocurrency market.

V. Risks Associated with Inverse Futures Contracts

Cryptocurrency traders engaging in inverse futures contracts must consider liquidity issues, counterparty risk, and market volatility.

Market Volatility

Inverse futures contracts can be extremely susceptible to market volatility, increasing profits and losses. Rapid changes in the price of the underlying cryptocurrency can cause traders to suffer huge losses.

Counterparty Risk

Trading platforms or exchanges often participate in inverse futures contract transactions. If the exchange is unable to pay its dues or goes bankrupt, there is a possibility of counterparty default, which can cause traders to lose funds.

Liquidity Risk

Inverse futures contracts can experience liquidity issues, especially during times of market tension or low trading activity. Lower liquidity can result in greater slippage, which can affect overall profitability and make it difficult for traders to complete transactions at the price they want.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Clement

Clement Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx Cointelegraph

Cointelegraph