Author: Dilip Kumar Patairya, CoinTelegraph; Compiler: Baishui, Golden Finance

1. What is Liquidity Staking?

Liquidity staking allows stakers to maintain liquidity of staked tokens by using alternative tokens, which they can use to earn additional returns through DeFi protocols.

Before we dive into liquidity staking, let's first understand staking and the issues associated with it. Staking refers to the process of locking cryptocurrency in a blockchain network to maintain it, which enables stakers to earn profits. However, pledged assets usually become illiquid during the staking period because they cannot be traded or transferred.

Liquidity staking enables cryptocurrency holders to participate in staking without giving up control of their holdings. This changes the way users do staking. Projects such as Lido have introduced liquidity staking to provide tokenization of staked assets in the form of tokens and derivatives.

It allows users to gain the advantages of staking while retaining the flexibility of trading, trading these tokens in decentralized finance (DeFi) applications or transferring them to other users.

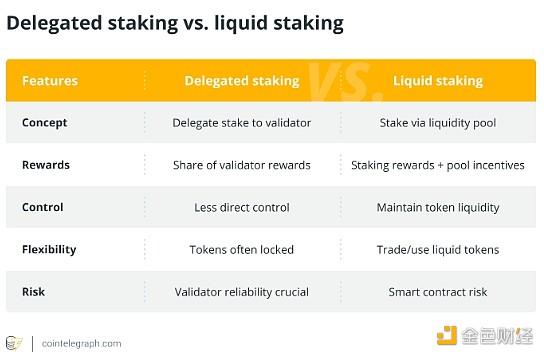

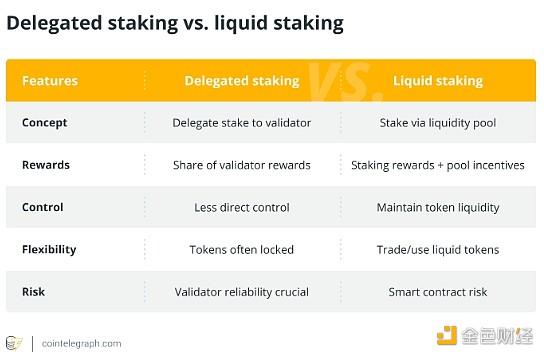

Is there a difference between delegated staking and liquid staking?

Network users in Delegated Proof of Stake (DPoS) vote for their preferred delegators. However, liquid staking aims to allow stakers to circumvent the minimum staking threshold and the mechanism of locking tokens.

Although DPoS borrows the basic concept of proof of stake, its execution is different. In DPoS, network users have the right to elect representatives called "witnesses" or "block producers" to verify blocks. The number of representatives participating in the consensus process is limited and can be adjusted through voting. Network users in DPoS can pool their tokens into a staking pool and use their combined voting power to vote for preferred representatives.

On the other hand, liquid staking aims to lower the investment threshold and provide stakers with a way to circumvent the mechanism of locking tokens. Blockchains usually have minimum requirements for staking. For example, Ethereum requires anyone who wants to set up a validator node to stake at least 32 Ethereum (ETH). It also requires specific computer hardware, software, time, and expertise, which in turn requires a lot of investment.

3. What is Staking as a Service?

Staking as a Service is a platform that acts as an intermediary, connecting the consensus mechanism of the blockchain with cryptocurrency holders who want to contribute to the network's functions.

Staking as a Service is a platform or service that enables users to entrust their crypto assets to a third party, who then participates in staking on behalf of the user, usually charging a fee or sharing rewards. JPMorgan Chase pointed out that by 2025, the size of the staking service industry will expand to $40 billion. Cryptocurrency staking services will play an important role in this emerging economy, and liquidity staking will become an indispensable part of it.

Based on the degree of decentralization, staking-as-a-service platforms can be divided into custodial and non-custodial, which plays an important role in maintaining the best interests of stakeholders and maintaining transparency. To promote decentralized governance, key decisions are made by decentralized autonomous organizations (DAOs).

Custody staking-as-a-service involves extensive management of the staking process. The staking services provided by cryptocurrency exchanges are custodial. Rewards first flow to staking providers and then to stakers.

In the non-custodial staking-as-a-service model, validators charge commissions to anyone who wants to participate in staking. In PoS networks that support native delegation, stakers' share of rewards is sent directly to them without the participation of validators.

How does liquidity staking work?

Liquidity staking aims to eliminate the threshold for staking and enable holders to profit from liquidity tokens.

Staking pools allow users to combine several small stakes into a large stake using smart contracts, which provide each staker with corresponding liquid tokens (representing their share in the staking pool).

This mechanism removes the barrier to entry to becoming a staker. Liquid staking goes a step further and enables stakers to earn double the yield. On one hand, they profit from the staked tokens, and on the other hand, they earn profit on the liquidity tokens by performing financial activities such as trading, lending, or any other activity without affecting their original staked position.

Using Lido as a case study will help us better understand how Liquidity Staking works. Lido is a liquid staking solution for PoS currencies that supports multiple PoS blockchains including Ethereum, Solana, Kusama, Polkadot, and Polygon. Lido provides an innovative solution to the obstacles posed by traditional PoS staking by effectively reducing the barriers to entry and the costs associated with locking assets in a single protocol.

Lido is a smart contract based staking pool. Users who deposit assets into the platform will stake them on the Lido blockchain through the protocol. Lido allows ETH holders to earn block rewards by staking a fraction of the minimum threshold (32 ETH). Upon depositing funds into Lido’s staking pool smart contract, users receive Lido Staked ETH (stETH), an ERC-20 compatible token that is minted upon deposit and destroyed upon withdrawal.

The protocol distributes the staked ETH to validators (node operators) within the Lido network, which are subsequently deposited into the Ethereum Beacon Chain for validation. These funds are then protected by a smart contract that is inaccessible to validators. ETH deposited through the Lido staking protocol is divided into pools of 32 ETH among active node operators on the network.

These operators utilize public validation keys to verify transactions involving users' staked assets. This mechanism allows users' staked assets to be distributed across multiple validators, reducing the risks associated with single points of failure and staking on a single validator.

Stakers who deposit Solana (SOL) tokens, Polygon (MATIC), Polkadot (DOT), and Kusama KSM through a set of smart contracts in Lido will receive stSOL, stMATIC, stDOT, and stKSM, respectively. stTokens can be used to earn DeFi yields, provide liquidity, trade on decentralized exchanges (DEX), and many other use cases.

V. Are there any risks with liquidity staking platforms?

As with any product or service in the cryptocurrency space, there are technical threats and market volatility to consider when dealing with liquidity staking.

Technical Threats

PoS blockchains are still relatively new, and there is always the possibility that a protocol bug or vulnerability could lead to the loss or exploitation of assets. Relying on validators for staking also introduces counterparty risk.

Market Risk

Liquidity staking unlocks staked assets, enabling stakers to earn rewards from DeFi applications. However, this also carries the risk of losing out on both fronts during market downturns.

Keeping liquidity staking platforms open source and audited regularly can help protect against threats to some extent. Having a bounty program in place for the platform can also help minimize errors.

Performing thorough due diligence is essential to addressing the risks associated with market volatility. This includes studying historical market data, assessing the financial health of potential investments, understanding the regulatory environment, and developing a diversified investment strategy.

JinseFinance

JinseFinance