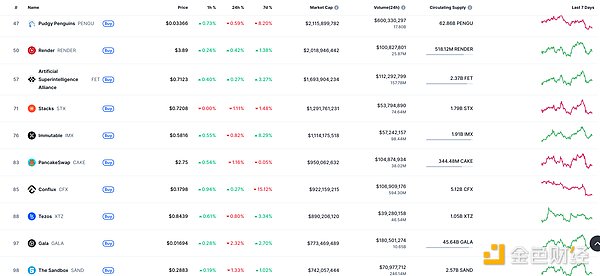

DeFi data

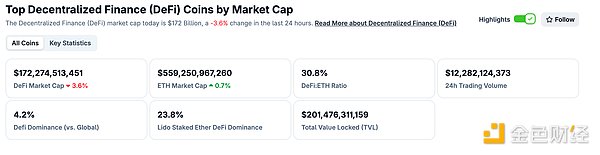

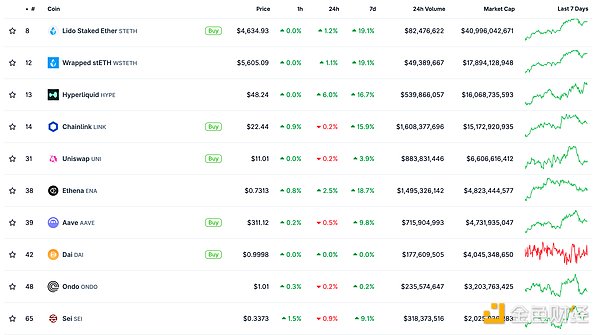

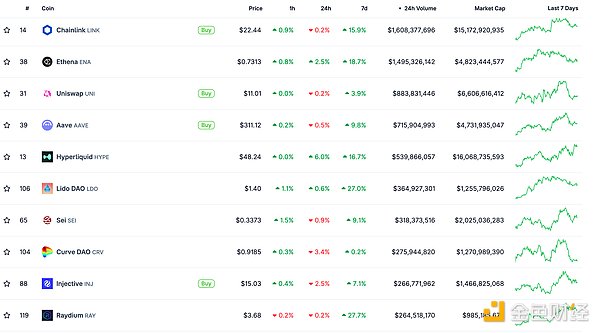

1. Total market value of DeFi tokens: 172.274 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours was US$12.282 billion

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

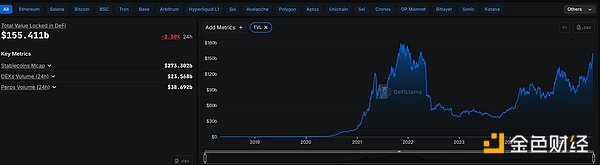

3. Assets locked in DeFi: 155.411 billion US dollars

img src="https://img.jinse.cn/7391917_watermarknone.png" title="7391917" alt="RkMmu6LdIyRc87ei02QUpEANoA4jUUvs9OauLoYZ.png">

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

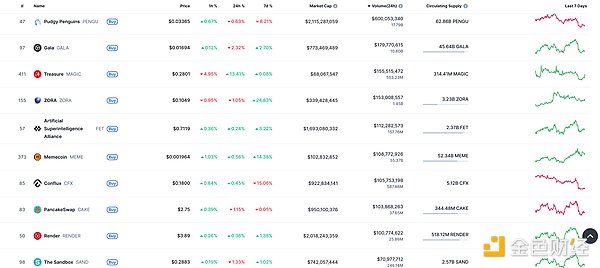

NFT Data

1. Total NFT Market Value: US$23.413 Billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

2. 24-hour NFT trading volume: 3.099 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

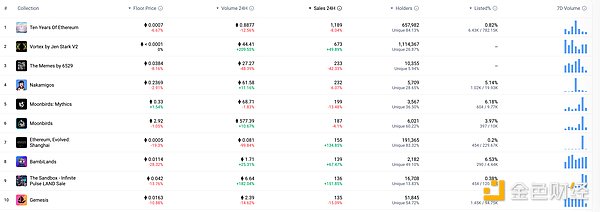

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headline

Citigroup is considering providing stablecoin and crypto ETF custody and payment services

Golden Finance reported that Citigroup is exploring the provision of custody, payment and US dollar exchange services for stablecoins and crypto-asset-related ETFs. It plans to custody the U.S. Treasury bonds and cash that support stablecoins, and may issue its own stablecoins. This move was driven by the passage of stablecoin legislation by the US Congress and the Trump administration's deregulation. Citi is also considering using stablecoins for instant cross-border payments and is discussing application scenarios with clients. Coinbase currently dominates the custody business in this area. NFT Hot Topics 1. Data: Bitwise Invest's Blue Chip NFT Index Fund Rises 92% in the Past Month Golden Finance reports that Berko, community leader of the blue-chip NFT project "Fat Penguins," posted on the X platform that Bitwise Invest's Blue Chip NFT Index Fund has risen 92% in the past month.

DeFi hotspot

110 million USDT transferred from Kraken to Aave

Golden Finance reported that according to @whale_alert monitoring, at 17:56, 100 million USDT (worth US$100,089,999) was transferred from Kraken (cryptocurrency exchange) to Aave (decentralized lending platform). 2. Tether Treasury minted 1 billion USDT on the Ethereum chain. Golden Finance reported that according to Whale Alert monitoring, Tether Treasury minted 1 billion USDT on the Ethereum chain approximately 4 minutes ago. 3. TVL on the Ethereum chain exceeded US$95 billion for the first time since January 2022. Golden Finance reported that the TVL (total locked value) on the Ethereum chain is approaching its highest point since 2021, exceeding US$95 billion for the first time since January 2022.

4. Ethereum Treasury and Ethereum ETF’s holdings exceed 10 million ETH

Golden Finance reported that according to the chart released by @SERdotxyz, the holdings of Ethereum Treasury and Ethereum ETF have officially exceeded 10 million ETH.

5. Hyperion DeFi financial report: HYPE token holdings have exceeded 1.5 million

Golden Finance reported that Nasdaq-listed company Hyperion DeFi released its second quarter financial results report as of June 30, disclosing that the company has completed US$50 million in fundraising to support its cryptocurrency treasury reserves focused on HYPE tokens. To date, the company has purchased more than 1.5 million HYPE tokens and held cash and cash equivalents worth approximately US$7.5 million as of June 30. 6. Zhu Su: I'm curious about SBF's views on Hyperliquid and the current Solana ecosystem, and I hope to discuss this with him. Golden Finance reported that Zhu Su, founder of Three Arrows Capital, stated in a post that 3AC had won its lawsuit against FTX and received $1.53 billion in damages. I'd love to hear if SBF has any new project ideas, and I'm also curious about his thoughts on Hyperliquid and the current Solana ecosystem. Is there any way I can email him?

On March 14, 2025, the Delaware Bankruptcy Court approved Three Arrows Capital's (3AC) application to increase its claim against FTX from $120 million to $1.53 billion. Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Alex

Alex

Alex

Alex Brian

Brian Kikyo

Kikyo Brian

Brian Alex

Alex Kikyo

Kikyo Brian

Brian Brian

Brian Kikyo

Kikyo Joy

Joy