According to the official Announcement: Binance has added Usual (USUAL) as a borrowable asset for Binance Lending (Flexible Rate). Users can view the latest interest rates and a complete list of borrowable and collateral assets through loan data. To place new Binance Lending (Flexible Rate) orders through the Binance App, please upgrade the App to iOS v2.78.0 or Android v2.78.0 and above. Old versions of the App no longer support the creation of new Binance Lending (Flexible Rate) orders. /p>

DeFi Hotspots

1.Swan Chain announced the completion of US$2 million in financing

Golden Finance reported that AI super chain Swan Chain completed US$2 million in financing. The investment was led by DWF Labs, Optimism Foundation and Promontory Tech.

2. Report: The number of DeFi attacks dropped by 40% in 2024. According to the annual "Web3 Security Report" by blockchain security company Hacken, the amount of losses from CeFi security incidents has risen to $694 million. Due to improved protocols, improved bridging, and more advanced encryption measures, the losses caused by security incidents in the DeFi field decreased by 40% from 2023 to 2024.

At the same time, as CEX has become a major target for access control vulnerabilities and other major security risks, CeFi security incidents more than doubled, with losses rising to $694 million. The surge in attacks was mainly attributed to access control vulnerabilities and noteworthy incidents.

The report shows that DeFi's financial losses fell sharply in 2024, from $787 million in 2023. billion to $474 million this year. Among them, the losses caused by bridging-related security incidents have dropped sharply from US$338 million in 2023 to US$114 million in 2024. .An anonymous user pledged 10,000 BTC during the Babylon Cap-3 mainnet staking period, worth over $1 billion

Golden Finance reported that according to Official news, Bitcoin staking protocol Babylon disclosed that on December 15, during the Cap-3 mainnet staking period, an anonymous staker pledged 10,000 Bitcoins through three transactions, worth more than $1 billion.

Babylon said, Prior to this, the largest amounts of staking came from entities that wanted to stake for their users (like the LST protocol and custodians), but such a large amount of staking from an individual is significant for Babylon and its protocol.

Earlier on December 17, Babylon announced on X that the Cap-3 mainnet pledge has ended, with the value of pledged BTC exceeding $6 billion.

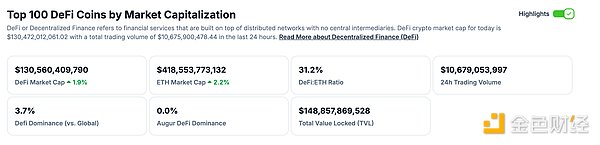

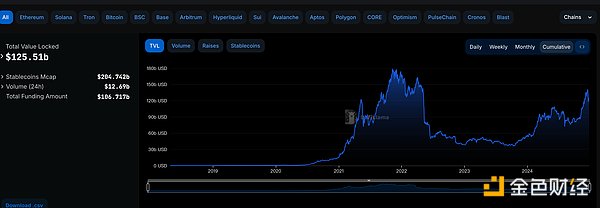

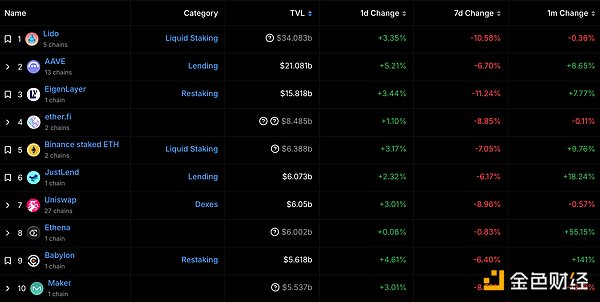

4. Aave and Lido’s total net deposits exceeded US$70 billion for the first time, accounting for 45.5% of the total deposits of the top 20 DeFi applications. According to the data, the total net deposits of lending protocol Aave and liquidity pledge protocol Lido exceeded $70 billion for the first time in December (currently falling back to $67.37 billion). Among them, Aave ranked first with $34.3 billion, followed by Lido with $33.1 billion. USD. The two protocols together account for 45.5% of the total deposits of the top 20 DeFi applications.

In terms of TVL, Lido leads the DeFi ecosystem with $33.8 billion, and Aave ranks second with $20.6 billion. In the past 30 days, Aave's revenue increased by 27.5% to $12.5 million, and Lido's revenue increased by 24% to $9.6 million. USD. In 2024, the total locked amount of DeFi has increased by 107% to 185 billion USD, and on December 16, it once exceeded 212 billion USD.

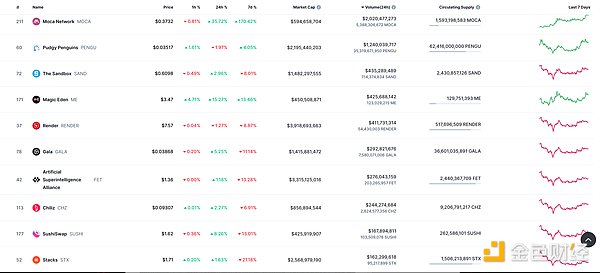

5< /strong>.Manta Network deployer address deposited 4 million MANTA into Binance

Golden Finance reported that according to Ember monitoring, 8 Hours ago, the deployer address of Manta Network transferred 4 million MANTA (US$3.78 million) to Binance.

Disclaimer: Golden Finance is a blockchain information platform. The content of the article is for information reference only and is not intended as actual investment advice. Please establish a correct investment philosophy and be sure to increase your risk awareness.

JinseFinance

JinseFinance

< /p>

< /p>