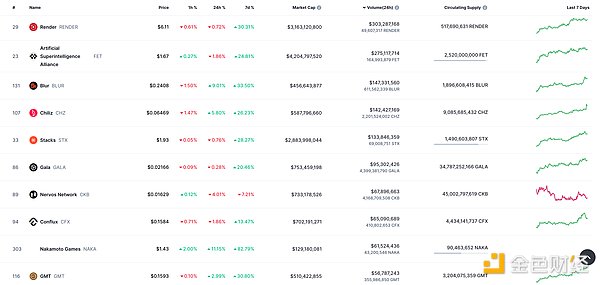

DeFi data

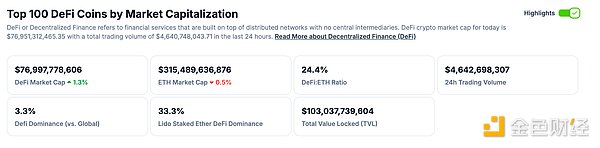

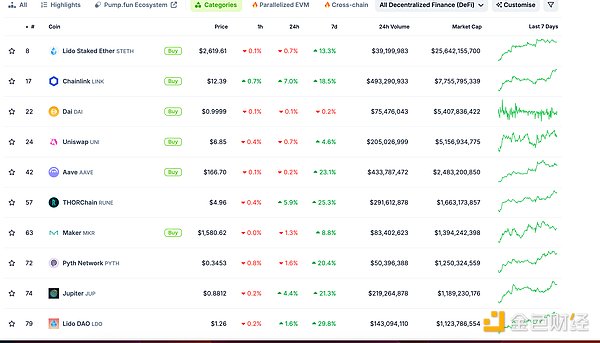

1. Total market value of DeFi tokens: US$76.997 billion

2. Transactions on decentralized exchanges in the past 24 hours 4.642 billion USD

Data source for decentralized exchange trading volume in the past 24 hours: coingecko

< strong>

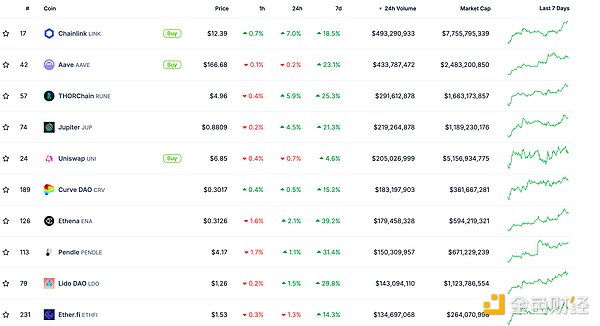

The top ten rankings of DeFi projects’ locked assets and locked-in amount data source: defillama

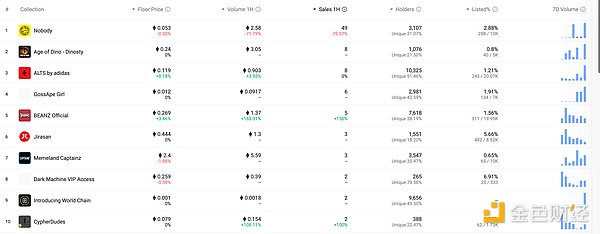

NFT data

1.NFT total market value: 31.161 billion US dollars

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

2.24-hour NFT trading volume: 2.669 billionUSD

NFT total market value, market value ranking of the top ten projects data source: Coinmarketcap

3. Top NFTs in 24 hours

< /p>

< /p>

The top ten NFTs with the highest sales growth in 24 hours. Data source: NFTGO

Headlines

DeFi Hotspots

1. Cosmos SDK releases new version of software development kit Olympus (v0.52)

Golden Finance reported that Cosmos is on the X platform Announced the launch of the latest version of Cosmos SDK, codenamed Olympus (v0.52). The core improvements of the new version include:

Separation of core components, allowing developers to use the SDK core independently;

Introduction of protocol pool module to simplify fund management;

Reconstruction of governance system, enhancement Decision-making process; Added account module to provide more flexible account management; Improved pledge module to support consensus key rotation.

2.Data: Ronin network staked volume reaches 224 million RON

On September 25, the latest data from the blockchain game sidechain Ronin network showed that currently, there are 285,083 independent stakers participating in the Ronin network, with a total stake of 224 million RON. Tokens. These tokens are distributed among 26 active validating nodes.

3.Solana On-Chain DEX 24 Hourly trading volume of $1.13 billion, surpassing Ethereum and returning to the top of the rankings

Golden Finance reported that according to DefiLlama data, Solana on-chain DEX 24-hour trading The volume was 1.13 billion US dollars, surpassing Ethereum (1.118 billion US dollars) and ranking first.

4.Assetera will provide tokenized assets on Polygon

On September 25, according to CoinDesk, Assetera , a blockchain-based financial instruments investment and trading firm, has tapped Polygon to power its secondary market Real World Assets (RWA) platform. The platform offers tokenized assets such as securities, funds and money market instruments on regulated digital trading venues. Assetera will use Ethereum extension network Polygon to protect transactions and utilize stablecoins for purchases, clearing and settlement to ensure the process Fast and efficient.

The Austrian-regulated firm holds both MiFID II and Virtual Asset Service Provider (VASP) licenses and plans to upgrade to meet the Markets in Crypto-Assets (MiCA) standards, which will open up its services across the EU. The platform is open to both retail and professional clients.

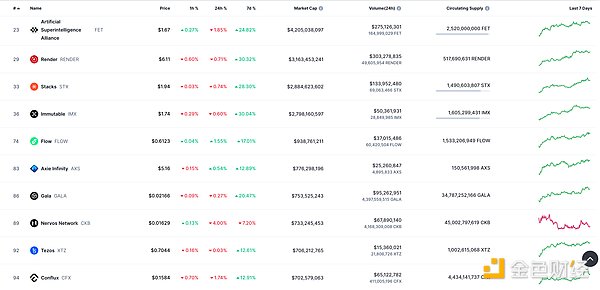

5Game hot spots

1. The Japanese Financial Services Agency promotes games On September 25, the Japanese Financial Services Agency held a meeting of its working group on the revision of the Funds Settlement Law. , discussed providing enterprises with a more convenient mechanism for handling encrypted assets (virtual currency). Participants believed that reducing the burden on enterprises would promote the participation of large domestic game companies and promote the research and development of related blockchain ecosystems. As the virtual currency market expands, discussions about exchange supervision and new regulations are becoming more frequent.

Liberal Democratic Party Web3 Project Team Leader Ping Masaaki pointed out that the unoptimized taxation issues have become obstacles to the establishment of start-ups, causing outstanding talents and companies to flow overseas.

The Financial Services Agency emphasized that the direct taxation of self-issued tokens has been resolved through tax reform. Assessing taxation issues, but still facing audit challenges for non-mainstream tokens. /ol>Disclaimer: As a blockchain information platform, Golden Finance publishes articles for information reference only and is not intended as actual investment advice. Correct investment philosophy must enhance risk awareness.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance ZeZheng

ZeZheng JinseFinance

JinseFinance JinseFinance

JinseFinance Jixu

Jixu JinseFinance

JinseFinance Others

Others Finbold

Finbold Bitcoinist

Bitcoinist