DeFi data

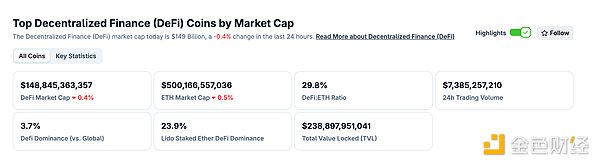

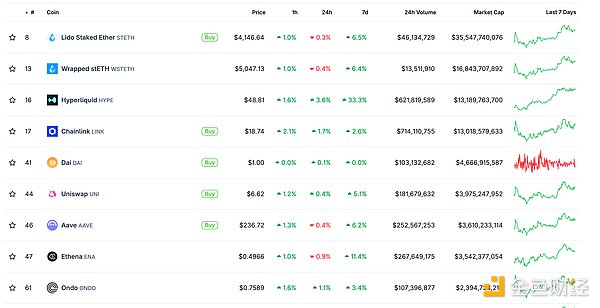

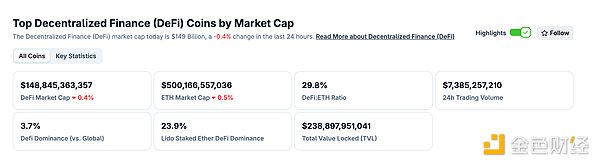

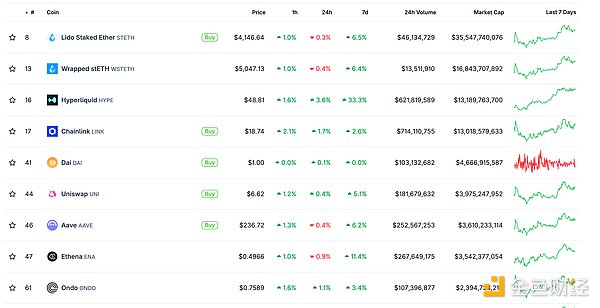

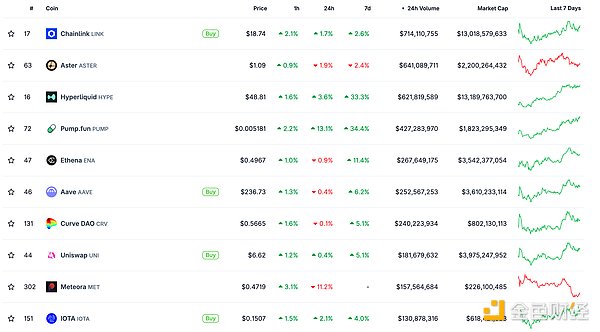

1. Total market value of DeFi tokens: 148.845 billion US dollars

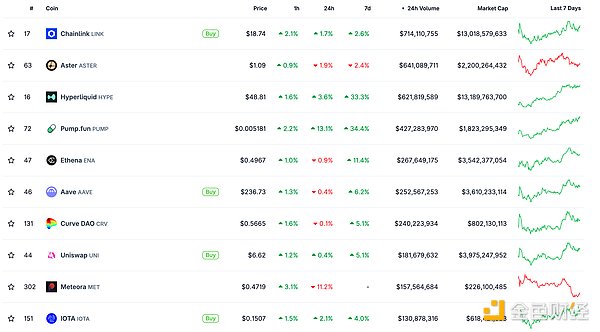

2. The trading volume of decentralized exchanges in the past 24 hours is US$73.85

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

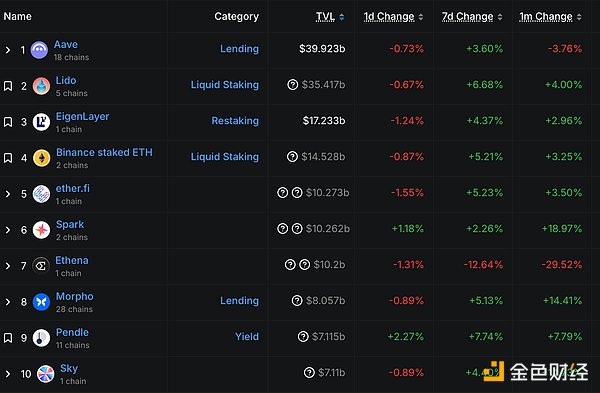

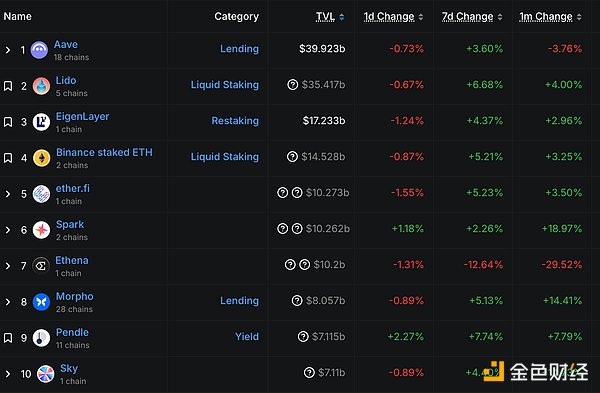

3. Assets locked in DeFi: US$156.433 billion

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

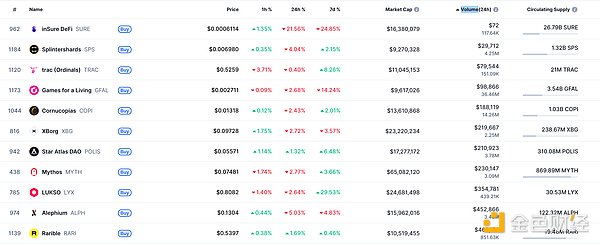

NFT Data

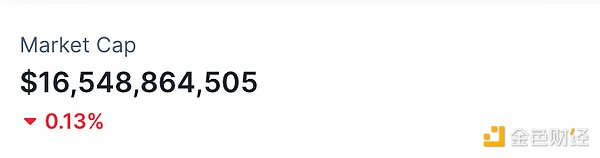

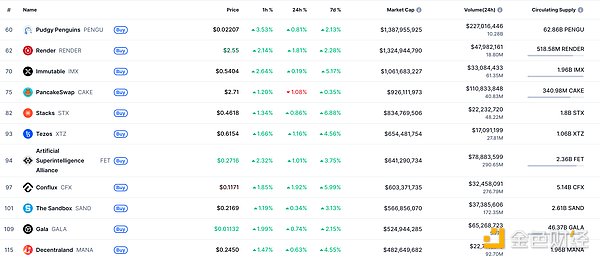

1. Total NFT Market Value: US$16.548 billion

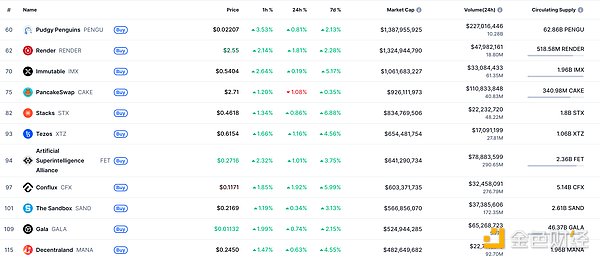

NFT total market value, top ten projects by market value Data source: Coinmarketcap

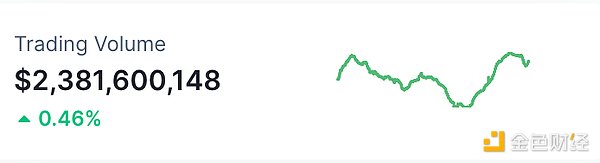

2. 24-hour NFT trading volume: 2.381 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

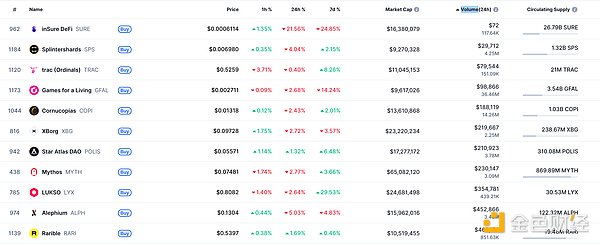

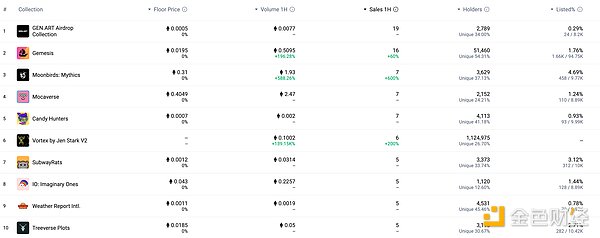

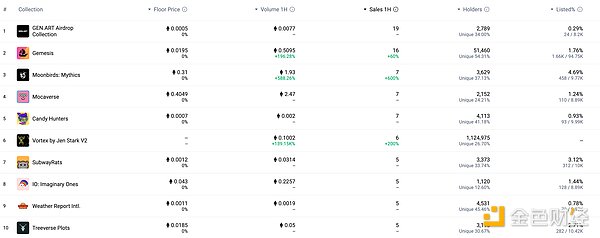

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales volume in 24 hours. Data source: NFTGO

Headlines

Grayscale Solana Trust ETF is scheduled to be listed on October 29

A person familiar with the matter said that the Grayscale Solana Trust ETF is scheduled to be listed on October 29. NFT Hotspots 1. A Whale Has Hoarded $16.38 Million in Pump Over the Past Two Weeks. According to Golden Finance, according to OnchainLens monitoring, a whale withdrew 1.29 billion Pumps from Binance 20 minutes ago, valued at $6.39 million.

This whale has accumulated 3.3 billion Pumps worth $16.38 million over the past two weeks.

2.SharpLink plans to deploy $200 million in ETH on Linea to obtain staking rewards

Golden Finance reported that Ethereum treasury company SharpLink announced that it plans to cooperate with ether.fi, EigenCloud, and Anchorage Digital to deploy $200 million in ETH on Linea to obtain Ethereum staking income and direct incentives from Linea and EtherFi.

3. CoinShares launches staked TON ETP "CTON"

Golden Finance reported that digital asset management company CoinShares announced the launch of a staked TON exchange-traded product, CoinShares Physical Staked Toncoin (CTON). It is reported that this ETP will directly invest in the underlying TON tokens at a 1:1 ratio, aiming to provide investors with TON investment exposure.

4. Tokenization platform Securitize will go public through a SPAC merger

Golden Finance reported that Securitize, an RWA platform for tokenized money market funds, will go public through a merger with a special purpose acquisition company (SPAC), CEO Carlos Domingo said in an exclusive interview. The fintech company will merge with Cantor Equity Partners II, Inc., a shell company sponsored by affiliates of Cantor Fitzgerald, trading under the ticker symbol CEPT.

5. Privacy blockchain infrastructure developer Fhenix announced investments from Biprogy and TransLink Capital. According to Techinasia, Israeli privacy blockchain infrastructure developer Fhenix has secured investments from Japan's Biprogy and TransLink Capital.

Fhenix focuses on developing privacy-oriented blockchain infrastructure, using homomorphic encryption to enable confidential transactions on decentralized financial platforms. Biprogy is a major Japanese information technology services company with a significant presence in the financial services sector.

This round of investment will support Fhenix's entry into Japan's Web3 and fintech markets, including potential partnerships with local financial institutions. The funds will help it adapt its privacy technology to the needs of the Japanese market.

Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to enhance risk awareness.

Anais

Anais