DeFi data

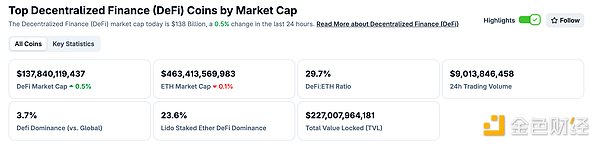

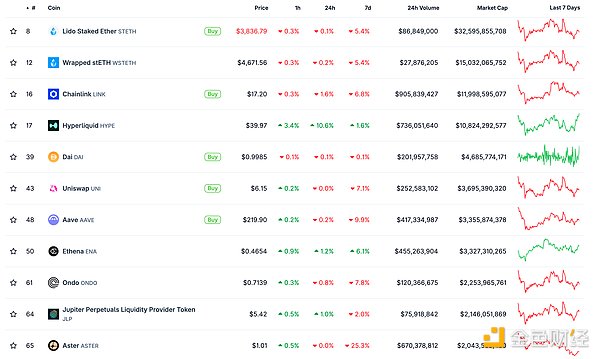

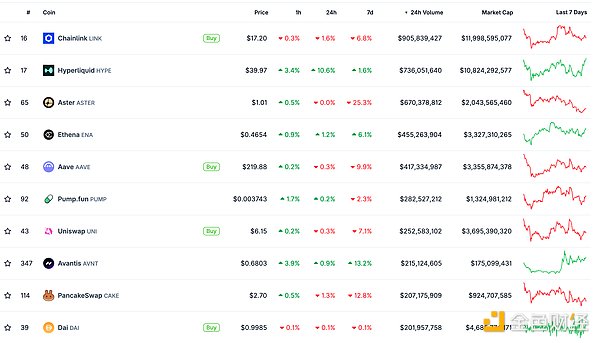

1. Total market value of DeFi tokens: 137.84 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours is US$90.13

Trading volume of decentralized exchanges in the past 24 hours Data source: coingecko

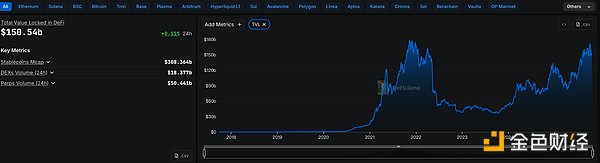

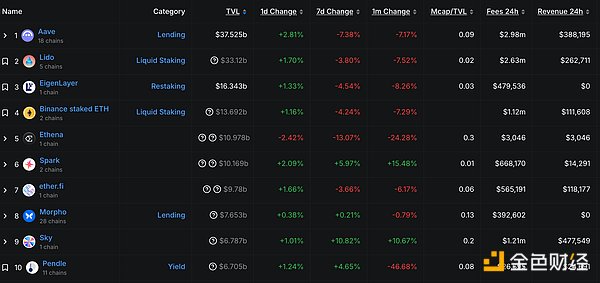

3. Assets locked in DeFi: US$150.54 billion

Top 10 DeFi Projects with Locked Assets and Locked Amounts Data Source: defillama

NFT Data

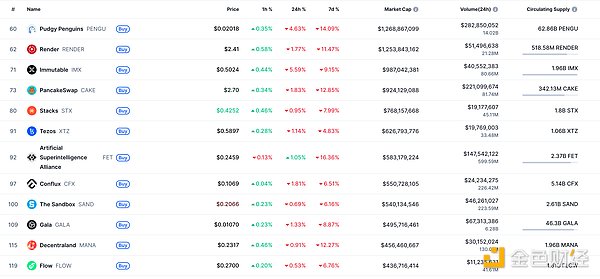

1. Total NFT Market Value: US$15.735 Billion

NFT total market value, top ten projects by market value Data source: Coinmarketcap

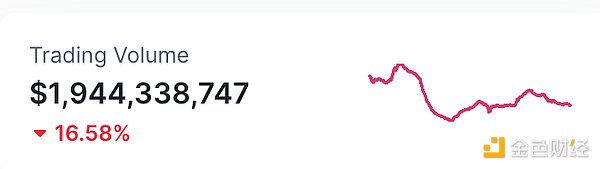

2. 24-hour NFT trading volume: 1.944 billion US dollars

NFT total market value, market value ranking of the top ten projects Data source: Coinmarketcap

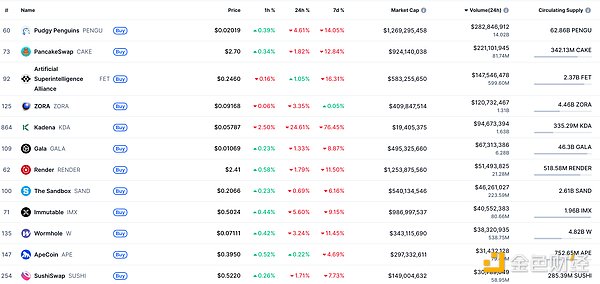

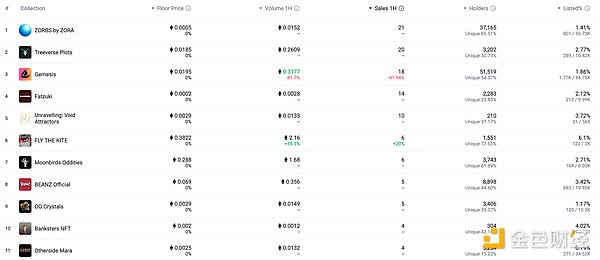

3. Top NFTs in 24 hours

Top 10 NFTs with the Highest Sales in 24 Hours. Data Source: NFTGO

Headline

LayerZero Officially Launches Sui

Sui Network announced on the X platform that LayerZero has officially launched Sui, enabling seamless interoperability with over 600 applications and $80 billion in assets, including:

BitGo's WBTC

Elixir's deUSD Ondo Finance's USDY Prediction Market Hot Topics 1. Polymarket to Provide Clearing Services for DraftKings' Prediction Market Jinse Finance reported that Polymarket will be the designated clearing agency for the prediction market to be launched following DraftKings' acquisition of Railbird. This move marks a significant development in Polymarket's institutional clearing business. Polymarket already has a significant presence in the global retail prediction market. Industry insider Dustin Gouker believes that DraftKings' entry will have a significant impact on existing platforms such as Kalshi. Polymarket has previously begun testing a sports betting application in the United States. Earlier that day, Polymarket also signed a multi-year licensing agreement with the National Hockey League.

2. Polymarket is seeking financing at a valuation of up to $15 billion

According to market sources, prediction market Polymarket is in early-stage talks with investors and is seeking financing at a valuation of $12 billion to $15 billion, which is more than ten times higher than its value four months ago. In June of this year, Peter Thiel's Founders Fund led a $200 million financing round for the startup, which was valued at $1 billion at the time. Earlier this month, Intercontinental Exchange Group, the parent company of the New York Stock Exchange, said it would invest up to $2 billion in Polymarket at a valuation of approximately $8 billion. The deal makes CEO Shayne Coplan the youngest self-made billionaire. The soaring valuation highlights the surging interest in this fast-growing emerging industry as the gambling and financial markets merge.

1. Ethereum Treasury Company ETHZilla Invests $15 Million in Satschel

Golden Finance reports that Ethereum Treasury company ETHZilla announced a strategic partnership with Liquidity.io, a regulated broker-dealer and digital alternative trading system (ATS) operator, and invested $15 million ($5 million in cash and $10 million in equity) in its wholly-owned subsidiary Satschel. The investment aims to explore RWA securitization strategies and enhance ETHZilla's institutional-grade tokenization capabilities.

2. aPriori Announces APR Airdrop Redemption Now Available

Golden Finance reports that according to market news: The National Hockey League has reached a licensing agreement with Polymarket. 3. Kinetiq, the Hyperliquid-based liquid staking platform, launches KNTQ governance token. Golden Finance reported that on Wednesday, the Kinetiq Foundation officially launched KNTQ, the protocol's official governance token. As the largest liquid staking platform within the Hyperliquid public chain's Layer 1 (HyperEVM) ecosystem, Kinetiq's current TVL has exceeded $1.6 billion.

The total supply of this token is capped at 1 billion. Eligible airdrop recipients must agree to the Kinetiq Foundation Terms of Use by 20:00 UTC on November 21st to receive the token.

According to the token distribution plan, 30% of KNTQ will be used for protocol development and reward distribution; 25% will be used for the initial airdrop, of which 1% will be allocated to Hypurr holders and 24% will belong to kPoints holders - this points system was launched in mid-July. Users accumulate points by staking HYPE in dimensions such as the amount and duration in preparation for the airdrop; 23.5% will be allocated to core contributors, 10% will be held by the Kinetiq Foundation, 7.5% will be for investors, and the remaining 4% will be used for liquidity support.

4. Sonic: All nodes on the mainnet and testnet must be upgraded to version 2.1.2 immediately to avoid disconnection

Golden Finance reported that Sonic issued a notice on the X platform stating that all nodes on the mainnet and testnet must be upgraded to version 2.1.2 immediately to avoid disconnection. This version introduces native fee subsidies and key security improvements. It replaces the earlier v2.1 before the Sonic mainnet is fully upgraded to Pectra compatibility. It is applicable to validators, RPC providers, archive nodes, exchanges, and other node operators. After the upgrade, the nodes will continue to run on the current mainnet until the complete transition on November 3, 2025. Coinbase CEO: Building private transactions on Base. Golden Finance reported that Coinbase CEO Brian Armstrong stated in a post on X that private transactions are being built on Base. Coinbase began working on this project after acquiring the Iron Fish team in March 2025. Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. Please establish correct investment concepts and be sure to increase your risk awareness.

Bitcoinist

Bitcoinist

Bitcoinist

Bitcoinist Coinlive

Coinlive  Coinlive

Coinlive  Others

Others Tristan

Tristan Coinlive

Coinlive  Beincrypto

Beincrypto Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph