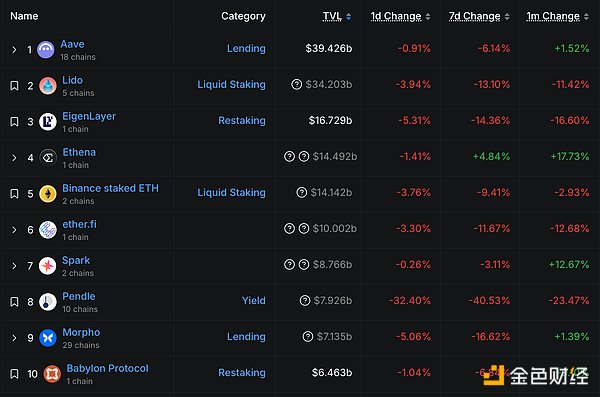

DeFi data

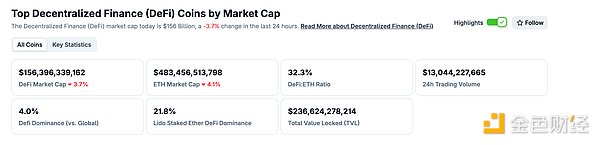

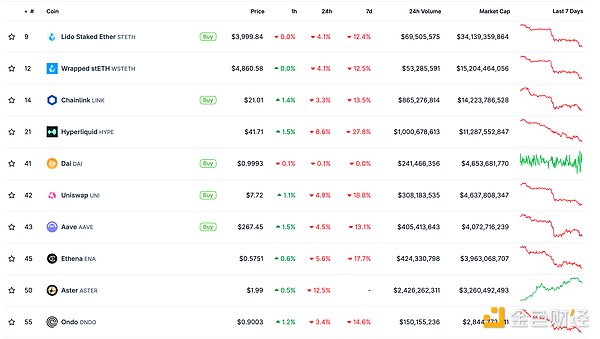

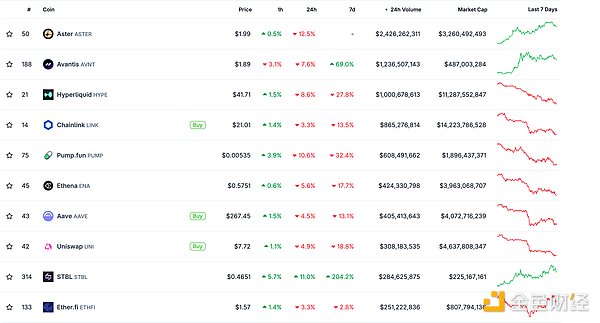

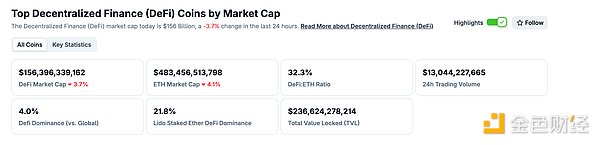

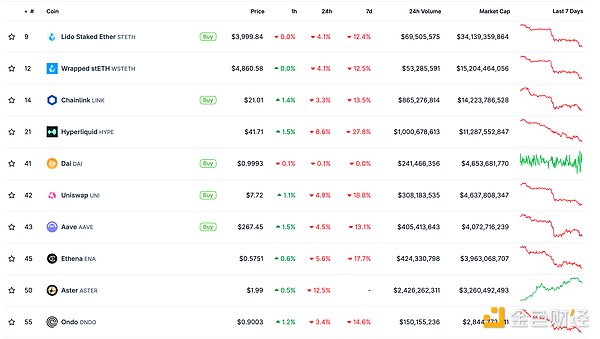

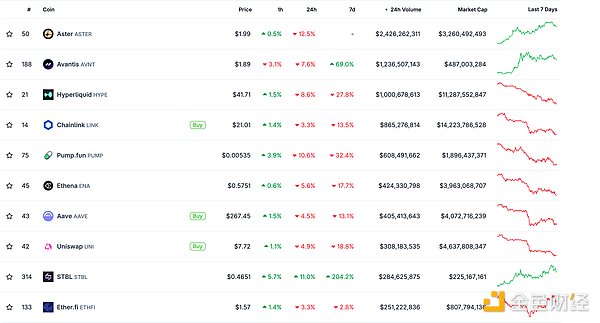

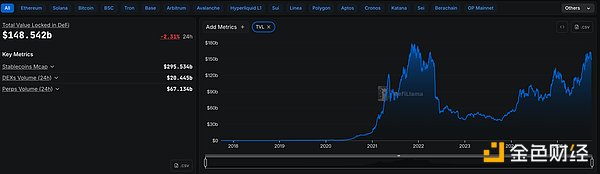

1. Total market value of DeFi tokens: 156.396 billion US dollars

2. The trading volume of decentralized exchanges in the past 24 hours was US$130.44

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

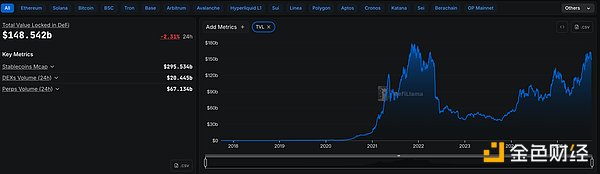

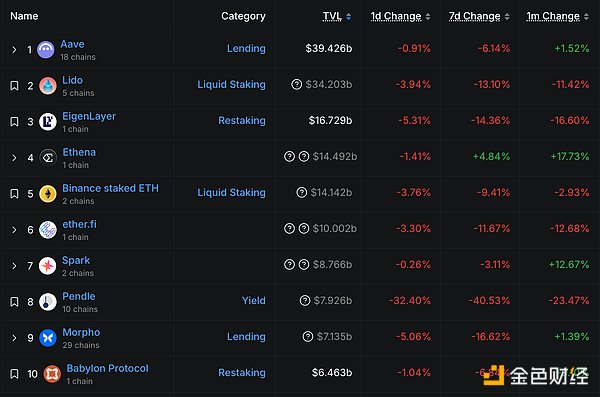

3. Assets locked in DeFi: US$14.854 billion

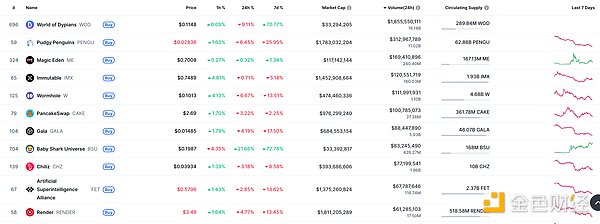

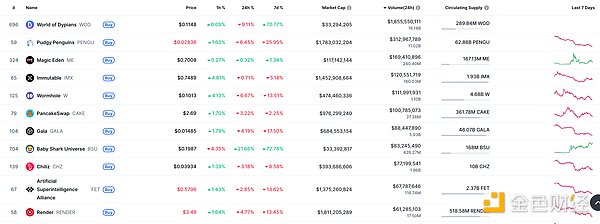

NFT total market value, top ten projects by market value Data source: Coinmarketcap

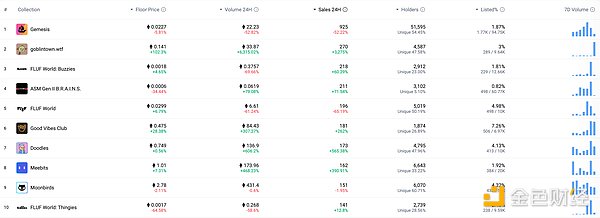

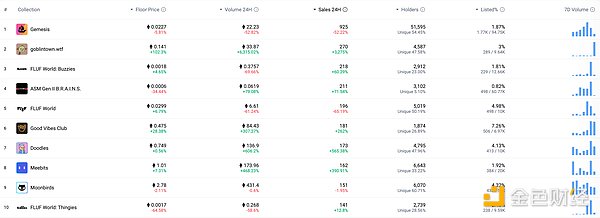

3. Top NFTs in 24 hours

The top ten NFTs with the highest sales in 24 hours. Data source: NFTGO

Headlines

Polymarket officially hinted at issuing a token with the code PM

Golden Finance reported that an official tweet from Polymarket hinted at issuing a token with the code PM, “PM stands for Polymarket, btw” (incidentally, “PM” refers to Polymarket). Previous reports have indicated that the possibility of Polymarket issuing a token has increased, and the latest financing includes “other warrants.”

MEME Hot Topics

1. Robinhood US will list WLFI

Golden Finance reports that Robinhood US will list WLFI.

2. Maji's Big Brother's ETH and PUMP Long Positions on Hyperliquid Reach $18.68 Million in Floating Losses

Golden Finance reports that according to on-chain analyst Yu Jin, Maji's Big Brother Huang Licheng currently has $149 million worth of ETH and PUMP long positions on Hyperliquid, resulting in a current floating loss of $18.68 million.

A long position of 30,000 ETH ($122 million) at $4,399 currently has a floating loss of $9.92 million, with a liquidation price of $3,694.

A long position of 4.85 billion PUMP ($26.7 million) at $0.0073 currently has a floating loss of $8.76 million, with a liquidation price of $0.003.

DeFi Hotspot

1. CoreWeave and OpenAI reached a $6.5 billion expansion agreement

Golden Finance reported that the US AI cloud computing company CoreWeave today announced an expanded agreement with OpenAI to power OpenAI's most advanced next-generation model training. The contract value of the transaction is up to $6.5 billion. In March 2025, CoreWeave announced a preliminary agreement with OpenAI with a contract value of up to $11.9 billion, and then signed an expansion agreement worth up to $4 billion in May. The agreement announced today brings the total contract value with OpenAI to approximately $22.4 billion. 2. Hyperion DeFi announced that it spent $10 million to increase its holdings of 176,400 HYPE tokens. Golden Finance reported that Nasdaq-listed Hyperion DeFi announced that it has spent $10 million to increase its holdings of 176,422 HYPE tokens. As of now, its digital asset treasury holds a total of 1,712,195 HYPE tokens, with an average purchase price of $38.25. It is reported that this is the company's fourth investment in HYPE tokens, and it is expected that the new holdings will be used for revenue-generating opportunities on HyperCore and HyperEVM. 3. FalconX Launches First Ethereum Staking Yield Forward Rate Agreement Golden Finance reports that San Mateo, California-based FalconX said Thursday it has executed the first forward rate agreement tied to Ethereum staking yields, introducing a new class of interest rate-based derivatives to the digital asset market.

These contracts reference the Treehouse Ethereum Staking Rate (TESR), a benchmark published daily by infrastructure provider Treehouse. The metric is part of Treehouse's "Decentralized Offered Rates" framework, which aims to create crypto-native versions of widely used benchmarks like Libor or the Secured Overnight Financing Rate.

Its launch comes amid a surge in staking demand. With billions of dollars flowing into ETFs and corporate treasuries, Ethereum's validator enrollment recently reached a two-year high.

4. Star: The future of on-chain finance will be built on the X Layer

On September 25th, OKX CEO Star retweeted the news that "AAVE will be deployed on the X Layer" and posted on the X platform, saying: "DeFi lending on the X Layer has ushered in a new upgrade. With the official addition of AAVE, we are unlocking more real-world application scenarios, institutional-grade security, and large-scale liquidity. The future of on-chain finance is being built here. As for the FUD against the X Layer and OKB, it will not stop us in the slightest - every step forward will only make us stronger and more resilient."

5. Vitalik: Fusaka is developing the core function PeerDAS, which aims to achieve real-time blockchain without downloading full data

According to Golden Finance, Ethereum founder Vitalik Buterin stated in a post on the X platform that security is paramount for Fusaka. Its core feature, PeerDAS, attempts something unprecedented: creating a live blockchain that doesn't require any single node to download all the data.

PeerDAS works by having each node request only a small number of "chunks" of data, probabilistically verifying that more than 50% of the chunks are available. If more than 50% of the chunks are available, then the node can theoretically download those chunks and use erasure coding to recover the remaining data.

In the first version, the complete block data still needs to exist in one place, in two cases:

(i) Initial broadcasting: when the data is first published;

(ii) Data reconstruction: when the publisher has published between 50% and 100% of the chunk data.

But these roles are trustless: only one honest participant is required to perform these tasks; even if there are 100 dishonest participants, the protocol will bypass them. Furthermore, different nodes can perform these tasks for different blocks. In the future, cell-level messaging and distributed block building will allow both of these features to be distributed as well.

These are new technologies, and the core developers are wise to be extremely cautious in testing, even though they've been working on them for years. This is why the number of blobs will be increased conservatively initially, then more aggressively over time. But this is key to L2 scaling (and ultimately L1 scaling, too, once the L1 gas limit becomes so high that we must move L1 execution data into blobs). Disclaimer: As a blockchain information platform, Golden Finance publishes articles for informational purposes only and does not constitute actual investment advice. We encourage you to cultivate sound investment practices and maintain a high level of risk awareness.

Anais

Anais