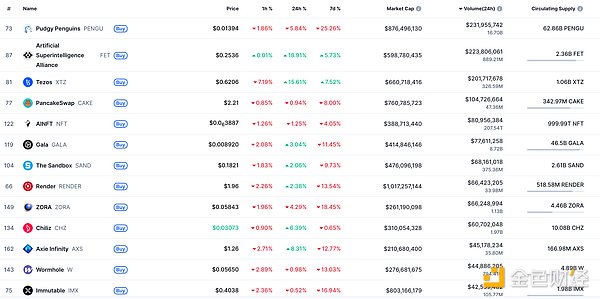

DeFi data

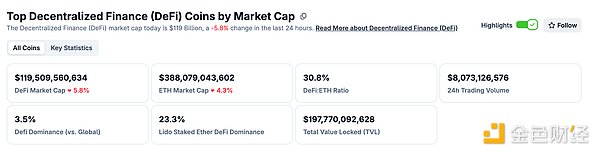

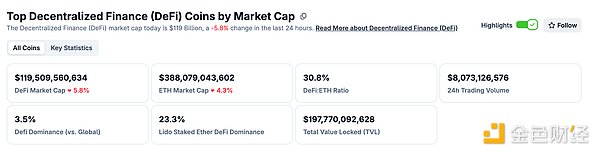

1. Total market value of DeFi tokens: US$119.509 billion

DeFi Total Market Cap Data Source: coingecko

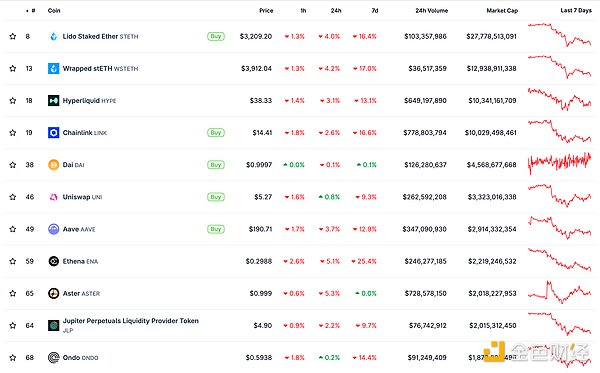

2. Trading volume of decentralized exchanges in the past 24 hours: $80.73

![3l07oob012XZr38yINPKeBAAUmDnSZ2zHQfHDClX.png]()

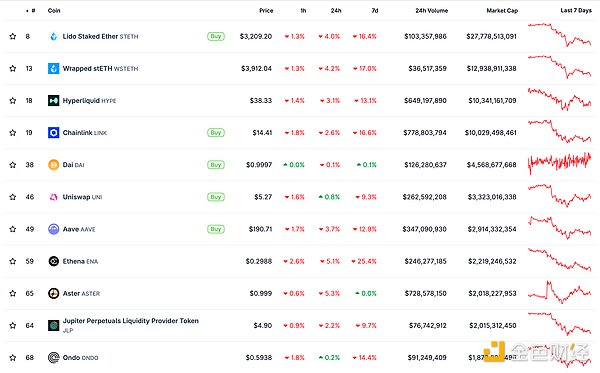

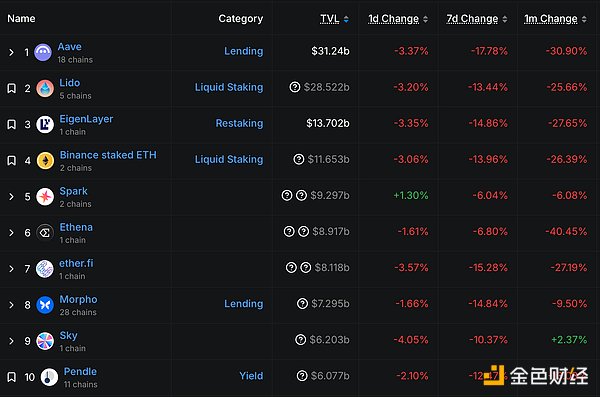

Top 10 DeFi Projects by Locked Assets and Total Value Locked. Data Source: defillama

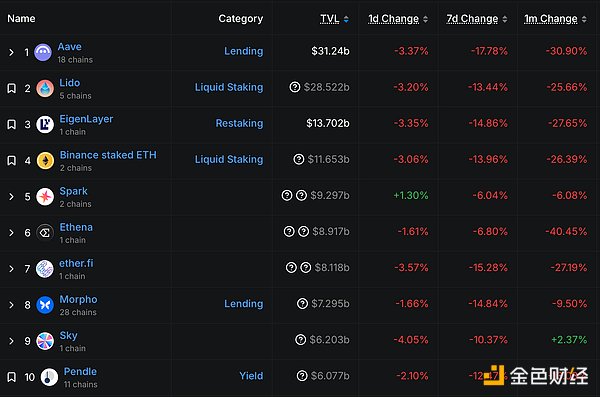

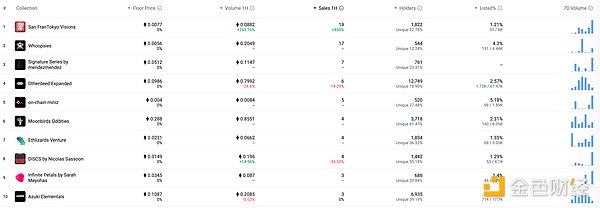

NFT Data

1. Total Market Value of NFTs: $13.255 billion

![]() 2.24-hour NFT transaction volume: $2.196 billionUSD

2.24-hour NFT transaction volume: $2.196 billionUSD

Total NFT market capitalization, top ten projects by market capitalization

Data Source: Coinmarketcap

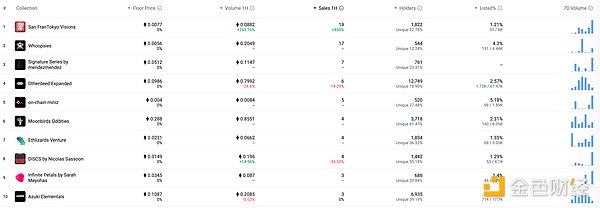

Top NFTs in 24 Hours

Top 10 NFTs by Sales Growth in 24 Hours

Headlines

Bitcoin Market Cap Falls Below $2 Trillion

According to Jinse Finance, Coingecko data shows that Bitcoin's market capitalization has fallen below $2 trillion.

DeFi Hot Topics

1. Lista DAO: Smart Lending Lista Lending 2.0 Officially Launched

On November 7th, Lista DAO officially launched Lista Lending 2.0, introducing the new Smart Lending feature, marking the official start of its 2025 year-end sprint plan.

Smart lending deeply integrates lending and liquidity, enabling dual returns on collateralized assets: While users obtain loan amounts by pledging their assets, the collateral is automatically injected into the liquidity pool of a decentralized exchange (DEX) that delists, continuously earning transaction fees and liquidity incentives. This achieves "collateralization as market making, lending as interest generation," further improving capital efficiency and profit potential. According to Jinse Finance, Binance Alpha 2.0 has completed the ai16z (AI16Z) token swap, incremental issuance, and brand upgrade to elizaOS (ELIZAOS).

The tokens have been distributed at a ratio of 1 old AI16Z: 6 new ELIZAOS. Deposits for the new ELIZAOS token are now open.

Binance Alpha 2.0 opened trading of elizaOS (ELIZAOS) on November 7, 2025 at 14:30 (UTC+8).

3. Polygon Co-founder: Stablecoins Will Drive the Dollar Stronger in the Short to Medium Term

According to Jinse Finance, Polygon co-founder Sandeep Nailwal stated on the X platform that the dollar will be stronger than ever in the short to medium term—contrary to the prediction of Bridgewater Associates founder Ray Dalio.

The reason is stablecoins, which not only continue to create demand for US Treasury bonds—but are also reshaping the relationship between the dollar and the world, shifting from B2B (between Treasury bonds and Treasury bonds/corporations) to B2C (from Treasury bonds to end users).

Dollarization 2.0 is happening in real time—from Latin America to Africa, the entire economic system is being restructured around the digital dollar.

4. Data: Ethereum network stablecoin supply reaches $184.1 billion, a record high

Jinse Finance reports that the Ethereum network stablecoin supply has reached $184.1 billion, a record high.

5. Binance officially becomes a Sei Network validator

Jinse Finance reports that, according to official news, Binance has officially joined the Sei Network as a validator.

Binance's joining signifies its deep involvement in blockchain security and ecosystem collaboration. Meanwhile, the institutional ecosystem of the Sei Network continues to expand. Both parties will continue to cooperate to promote the application of blockchain technology in the financial field.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and should not be considered actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.

Anais

Anais