DeFi data

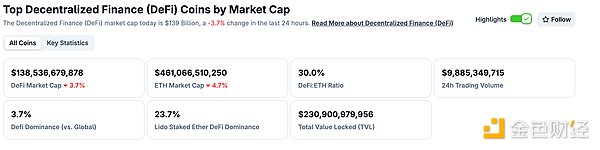

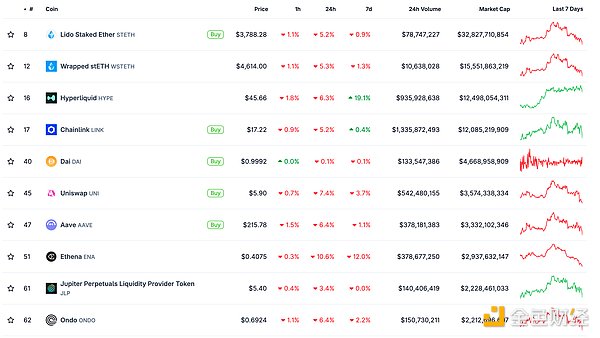

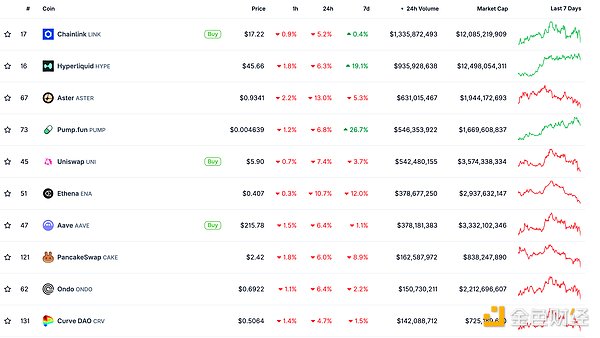

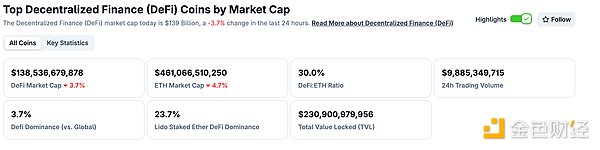

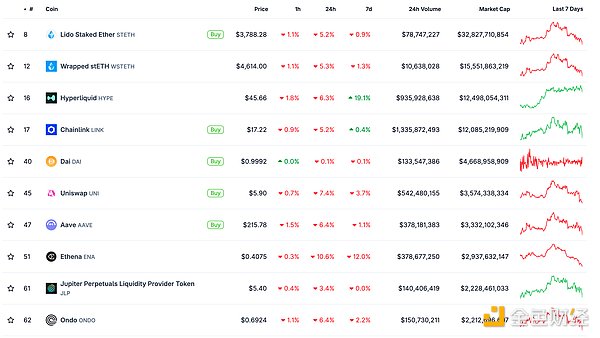

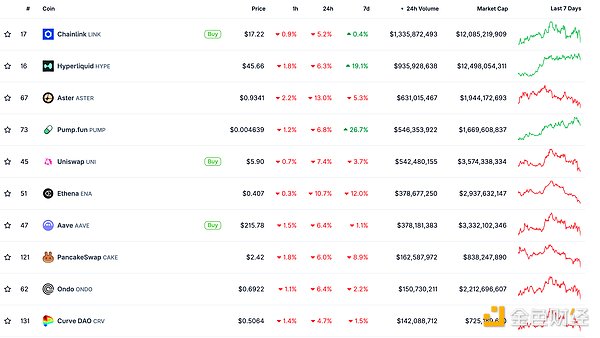

1. Total market value of DeFi tokens: 138.536 billion US dollars

DeFi Total Market Cap Data Source: coingecko

2. Trading volume of decentralized exchanges in the past 24 hours: $98.85

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

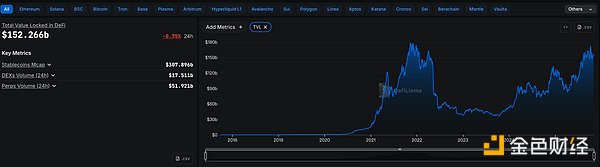

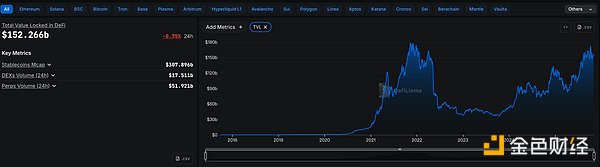

3. Assets locked in DeFi: $152.266 billionbillion

![]() Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

Top 10 DeFi Projects by Locked Assets and Total Value Locked (Data Source: defillama)

NFT Data

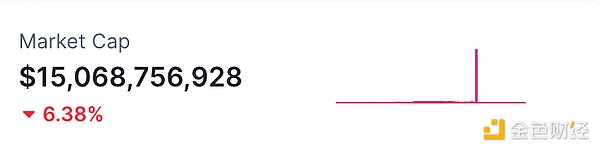

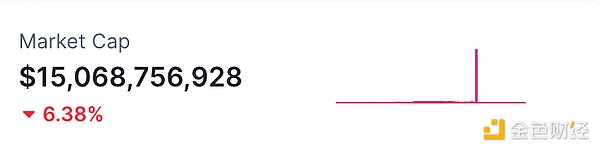

1. Total Market Cap of NFTs: $15.068 billion

alt="uQNRulsNeemItEV20qsW2II7A4RMcSVjvGCJBvw8.png">

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

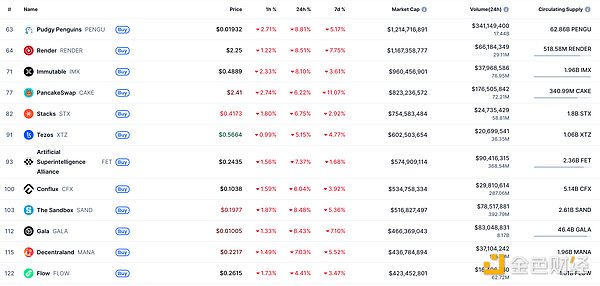

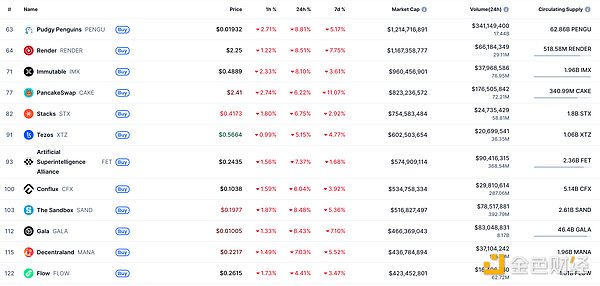

2.24-hour NFT Transaction Volume: $2.895 billionUSD

![]()

NFT Total Market Capitalization, Top Ten Projects by Market Capitalization Data Source: Coinmarketcap

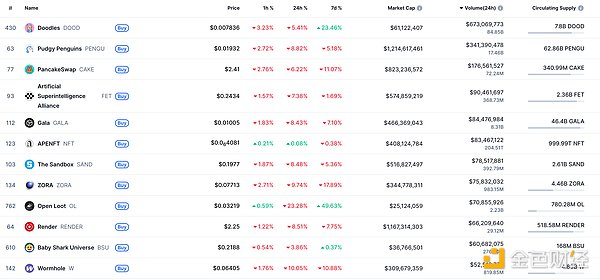

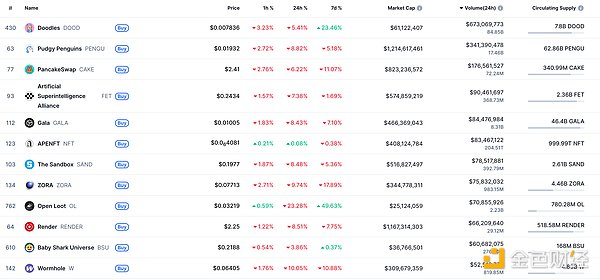

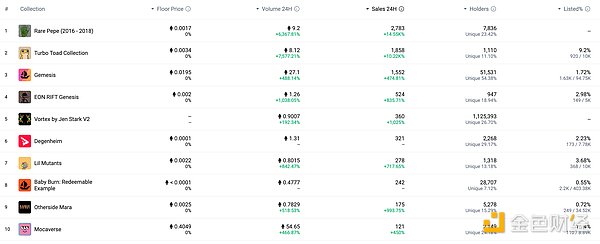

Top NFTs in 24 Hours

3.24 Hours

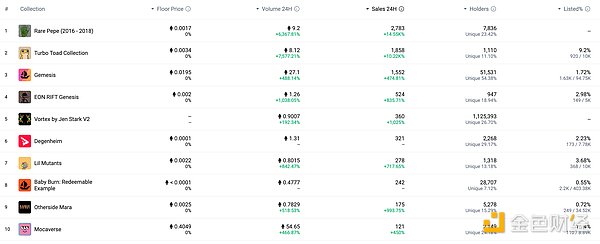

Top 10 NFTs by Sales Growth in the Last 24 Hours. Data Source: NFTGO

Toutiao

Consensys Plans US IPO, Hires JPMorgan Chase and Goldman Sachs as Lead Underwriters

According to Jinse Finance, Consensys, the developer of the MetaMask wallet and an Ethereum infrastructure company, plans to go public in the United States and has hired JPMorgan Chase and Goldman Sachs as lead underwriters for its IPO.

Jinse Finance reports that Consensys, the developer of the MetaMask wallet and an Ethereum infrastructure company, plans to go public in the United States and has hired JPMorgan Chase and Goldman Sachs as lead underwriters for its IPO.

Stablecoin Hot Topics

1. Deputy Governor of the Reserve Bank of India: Launching stablecoins will bring a lot of avoidable policy problems

According to Jinse Finance, the Deputy Governor of the Reserve Bank of India stated that launching stablecoins will bring a lot of avoidable policy problems.

DeFi Hot Topics

1. Cosmos Labs Announces New Development Strategy for Cosmos Hub and ATOM

According to Jinse Finance, Cosmos Labs announced its future development strategy for Cosmos Hub and ATOM at the CosmoverseHQ conference. The plan revolves around three core pillars:

Expanding a dedicated Hub team to support its technology roadmap, led by RoboMcGobo with technical support from HyphaCoop

Updated delegation and Hub initiatives to promote ecosystem health and validator stability

Re-evaluated the token economics design with the community

Cosmos Labs stated that as global finance transitions to on-chain, Cosmos Hub has the opportunity to provide key functionalities such as asset issuance, RPC services, and neutral interoperability, but first, a more robust ATOM infrastructure needs to be built.

2. JPMorgan Chase Completes Tokenization of Private Equity Fund on Its Own Blockchain

According to a report by Jinse Finance, citing the Wall Street Journal, JPMorgan Chase has completed a pilot tokenization of a private equity fund on its own blockchain network, marking a significant step in the bank's advancement of blockchain financial infrastructure. The project aims to achieve on-chain representation and settlement of fund units to improve liquidity and transparency.

JPMorgan Chase stated that it plans to officially launch its "Alternative Investment Fund Tokenization Platform" in 2026, providing institutional clients with on-chain issuance and trading services for private equity, credit, and other non-public market assets.

3. dYdX Proposes Three-Month Trial to Use 100% of Transaction Fees for Token Buybacks

On October 30th, a new proposed proposal appeared on the dYdX community forum, which includes using 100% of dYdX's net transaction fees for DYDX token buybacks to enhance token value accumulation. The plan is to conduct a three-month experimental trial.

Currently, dYdX Chain allocates net transaction fees as follows: 25% for DYDX buybacks, 40% for staking rewards for validators and stakers, 25% for Megavault liquidity, and 10% to the treasury. The proposal will be formally submitted on November 3rd.

Anais

Anais