DeFi data

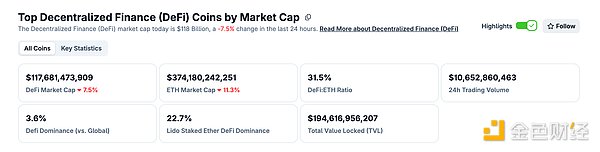

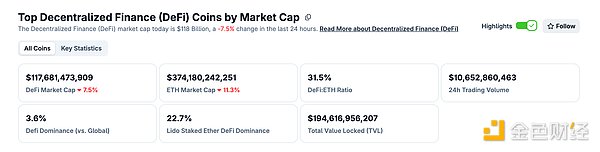

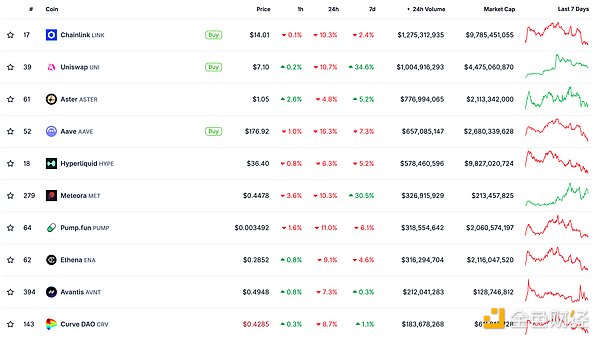

1. Total market value of DeFi tokens: 117.681 billion US dollars

DeFi Total Market Cap Data Source: coingecko

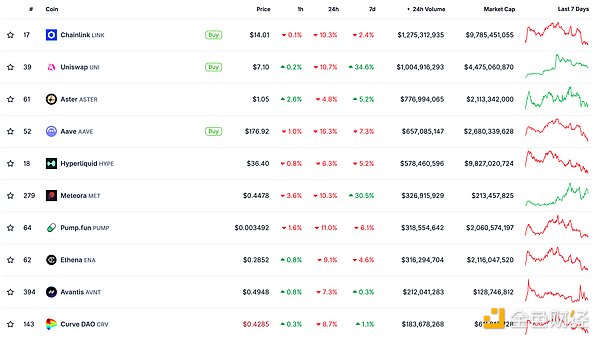

2. Trading volume of decentralized exchanges in the past 24 hours: $106.52

Trading volume of decentralized exchanges in the past 24 hours. Data source: coingecko

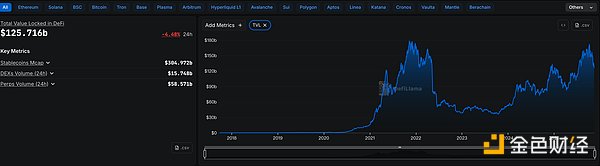

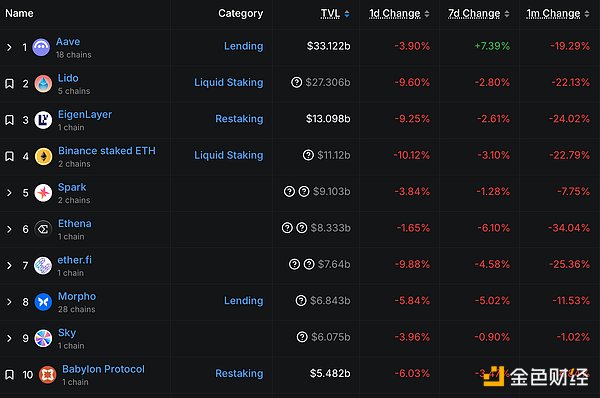

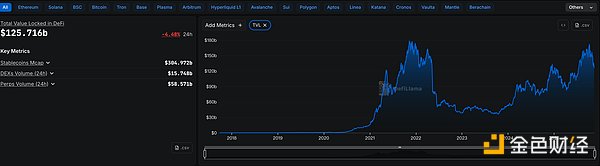

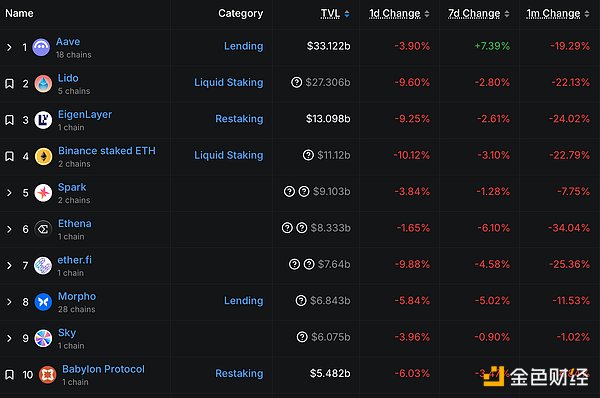

3. Assets locked in DeFi: $125.716 billion$125.716 billion

Top 10 DeFi Projects by Locked Assets and Total Value Locked. Data Source: defillama

NFT Data

1. Total Market Value of NFTs: $13.122 Billion

![]()

Top NFTs in 24 Hours

Top 10 NFTs by Sales Growth in 24 Hours Data Source: NFTGO

Headlines

EU Plans to Centralize Regulation of Cryptocurrency Businesses within the Region

MEME Hot Topics

1. DeFiance Capital CEO: PUMP has repurchased 11% of its circulating supply

According to Jinse Finance, DeFiance Capital CEO Arthur Cheong stated on the X platform that since PumpFun launched its repurchase program, PUMP's repurchase scale has reached a cumulative 11% of the circulating supply, with the total repurchase amount estimated at between $400 million and $500 million on an annualized basis.

2. DOGE Treasury Company CleanCore Discloses Holding 733 Million DOGE, Equivalent to Approximately $120 Million

According to Jinse Finance, CleanCore, the DOGE treasury company, saw its stock price fall 7% on Thursday to $0.43, a new low since 2025. In late August, before the transition to the Dogecoin (DOGE) treasury, the company's stock price once reached approximately $7 per share.

Last month, CleanCore stated it held 710 million Dogecoins, then worth approximately $188 million. As of Thursday, the value had shrunk to nearly $123 million.

CleanCore also stated that it has completed a $175 million private placement to fund its "strategy for developing an official Dogecoin treasury in partnership with the House of Doge."

2. DOGE Treasury Company CleanCore Discloses Holding 733 Million DOGE, Equivalent to Approximately $120 Million

DeFi Hot Topics

1. Analysis: US SEC Issues Guidance on Post-Shutdown Document Processing, Multiple Crypto ETFs May Expedited Activation

November 14th news, according to Bloomberg analyst Eric Balchunas citing the latest guidance from the SEC, the US Securities and Exchange Commission (SEC) received over 900 registration documents during the government shutdown and is now accelerating the clearing of the backlog. The guidance document shows that if the registration statement submitted by the issuer during the shutdown does not include a delay-effectiveness clause (path 8(a)), it will automatically become effective after 20 days, and the issuer can apply for expedited activation by supplementing the delay clause.

DeFi Hot Topics

1. Analysis: US SEC Issues Guidance on Post-Shutdown Document Processing, Multiple Crypto ETFs May Expedited Activation

Analysts suggest this could prompt some crypto ETF issuers that haven't yet completed the 8(a) process to accelerate their listing plans, with Bitwise's XRP ETF considered a potential next mover.

2. Ethereum treasury company BitMine appoints new CEO, Tom Lee remains chairman of the board

According to Jinse Finance, Ethereum treasury company BitMine announced the appointment of Chi Tsang as CEO and a member of the company's board of directors. It also appointed three independent directors: Robert Sechan, Olivia Howe, and Jason Edgeworth. Tom Lee remains chairman of the board.

3. Ethereum Whale Sells 2,404 ETH Purchased 4 Years Ago, Breaks Even

According to Jinse Finance, Lookonchain monitoring shows that a whale investor has just sold all 2,404 ETH he held for over four years, for a total value of approximately $7.7 million. This investor initially purchased these ETH on August 25, 2021, at approximately $3,190 per ETH, and the current ETH price has fallen to the break-even point of his initial investment.

4. MinionLab Announces Social Insight Beta Launch, New Users Will Receive Free Points

According to Jinse Finance, MinionLab has announced the launch of the beta version of Social Insight.

According to official news, MinionLab has announced the launch of the beta version of Social Insight.

5.Cosmos Ecosystem Liquidity Staking Protocol Drop Announces Cessation of Operations, Cancellation of Token Issuance and Airdrops

According to Jinse Finance, the Cosmos ecosystem liquidity staking protocol Drop announced its orderly cessation of operations. The protocol was launched in 2024.

Drop stated that given the current development direction of the ecosystem and broader market conditions, the protocol could no longer find a sustainable development path. Simultaneously, the DROP token issuance will not proceed, and airdrops related to the Droplets program will be cancelled. Drop is exploring the possibility of distributing protocol revenue to Droplets program participants as a way to return value to contributors.

Regarding asset management, dTIA and deINIT will begin to be gradually delisted, while withdrawal functionality will remain open; dATOM and dNTRN will continue to receive support, and Drop is discussing the possibility of keeping these two assets operational with potential partners.

Weatherly

Weatherly